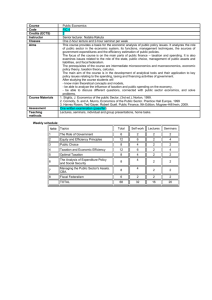

Taxation of Natural Resources and Land Tax (Rajaraman)

advertisement

Resource and Land Taxation Indira Rajaraman Tax Aspects of Domestic Resource Mobilisation – A Discussion of Enduring and Emerging Issues Rome 4-5 September 2007 Resource Taxation Non-renewable: Mining, Petroleum, Timber Renewable (within sustainability limits): Water, Fishing Fiscal Resources from Natural Resources • With natural resources, it is non-tax revenue in the form of royalty and other compensation, rather than taxation, which poses issues to be resolved. • Taxation of resources, whether within a VAT framework or not, is on par with indirect taxes on other inputs (conceptual parity, if not rate parity); exports are usually exempted, with or without a VAT. • Non-tax royalties do not figure in double-taxation agreements and are therefore not compensated in any way. 3 Are Resource Royalties an Emerging Issue? • Resources are not uniformly distributed spatially, so there is the issue of whether non-tax revenue should accrue to producer jurisdictions, and why. • In the future, with buoyant commodity demand from China and India, mineral prices are projected to be buoyant, therefore this is a very live issue. • Demand-side players will lobby for royalty design that will keep mineral prices less buoyant, and producer jurisdictions will lobby for royalty design that will keep up fiscal buoyancy. 4 Rationale for Non-tax Compensation • Economic: – Land pre-empted from other use during extraction – Depletion (inter-temporal fairness) – Externalities (market failure to factor in concurrent and inter-generational costs) – Costs of restoration of land for other uses – Permanent loss of livelihoods (river storage for hydro power) • Legal: Local jurisdictional rights in terms of – Ownership – Control 5 Compensation Design • Royalty rates: – Specific rates ($ per unit quantum) low on buoyancy but stable – Ad valorem (% value) high on buoyancy, but can be volatile – Mixed systems are sometimes prescribed (Specific plus % value) that strive for the virtues of both. – Where resource prices on a steady upward trend, producer jurisdictions benefit from fully ad valorem design • Hydro power not formula driven, designed case by case, which introduces scope for corruption. 6 New Approaches • New approaches: profit/income-based royalty • Competitive bidding processes to determine royalty rather than pre-determined formula: – suits the variability of mineral deposits – but can be defeated by collusive bidding • Competitive bidding for each component of royalty makes collusion difficult across all elements of a vector of bids – Environmental – Design (fully ad valorem or hybrid with specific component) – Depletion (separate for current local and intergenerational) 7 Land Taxation In situ Transfer of property Which Level of Government? • Immoveable property (housing and land) is the universally assigned tax base for local government. • Immoveable property as a tax base is administratively suitable for local government: – relatively easy to observe and assess, – and relatively difficult to conceal. • Thus, effective land taxation holds the key to provision of the local public goods which are critically underprovided in the developing world – Water, sanitation, law and order, primary education 9 Effective Land Taxation in Developing Countries • Requires three operational properties: – parsimonious information requirements for assessment; – assessee acceptance. • The critical need is for an incentive structure for local revenue collection. 10 Problems in Developing Countries • Valuation distortions: Land markets are frequently distorted as a result of taxation of transfer of ownership (called “stamp duty” in India), and taxation of capital gains, both of which encourage under-reporting of the true market value of land and property. • Valuation basis: Not enough transfer transactions for a robust estimate of capital value. 11 Common Solutions to the Valuation Problem • Urban property taxation is typically based on rental value rather than capital value, since the market for rental might be deeper than the market for transfer of ownership. • However, even rental value can be distorted by rent control legislation. • Being sought to be overcome by presumptive zone-specific area-based taxation. 12 Presumptive Parameters • Parameters going into determination of the presumptive rental value: – – – – – Type of usage (commercial/residential/other) Type of construction Zone (the zones need not be contiguous) Age of building Resident type 13 Revenue Yield of Presumptive Levies • Buoyant only if rates periodically revised. • This calls for recalibration of the various parameters underlying the determination of the area-based rental value. • Thus, area-based assessment will lead to sustained revenue improvement only if it is not a once-over change. 14 Local Government Collection Incentives • Require three properties to work in practice: – Minimal costs of assessment and enforcement (of the incentive). – Cross-sectional fairness in assessment of revenue potential across local jurisdictions. – Distinction between revenue effort and underlying revenue potential (matching grants do not do this). 15 Cost-effective Incentives • The most cost-effective design for own resource collection incentives: – Norm-based closed-ended grants from higher governments, where allocations are made after deducting baseline calculations of local revenue potential. – Thus, the revenue potential is deemed to have been collected (upto some stipulated percentage less than hundred if need be), at specified floor rates. – This calls for a minimal-cost method of estimating jurisdiction-specific revenue potential. 16 Other Incentives Commonly Found • Grants from higher-level governments must not be so structured as to carry adverse policy incentives. – Example: A grant system inversely calibrated to local facilities will generate adverse incentives for keeping these under-supplied. • Other types of direct incentives commonly recommended (based on performance indicators like primary enrolments, small family norms) call for monitoring and verification by State governments and are liable to lapse over time. 17 Compliance • Compliance can be encouraged by linking property tax payment to ownership rights • Urban property taxation is a “benefit tax” and there is non-compliance when no commensurate services are delivered by urban authorities 18 Rural Land • In rural areas: – selective, not universal, coverage confined to crops yielding returns above a specified floor – systematic, as distinct from discretionary, catastrophe exemption provision for rural land, given the absence of perfect risk markets • New issues arising with the conversion of rural land into Special Economic Zones – explosion in land value with no commensurate gain for original owners of the land. 19 References • The Energy and Resources Institute, 2007, Study on Compensation to Resource Bearing States (Interstate Council, mimeo) • June 2007 conference of Lincoln Institute • Rao, U.A. Vasanth, 2006 “Is Area-Based Assessment an Alternative, an Intermediate Step, or an Impediment to Value-Based Taxation in India”, Georgia State University • Rajaraman, Indira, 2003, A Fiscal Domain for Panchayats (Oxford University Press). 20