Supervision of Groups: Key Principles and Tools

advertisement

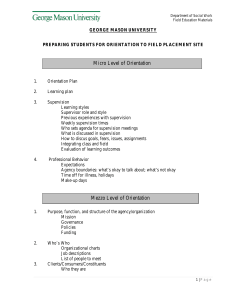

Supervision of Groups: Key Principles and Tools Keith Pooley Workshop on Cross-Border Supervision and Consolidated Supervision June 2-4, 2015 Beirut, Lebanon Objectives of this session • To understand: – the nature and purpose of consolidated supervision – how it differs from and adds value to solo supervision – the main tools and techniques of consolidated supervision • To cover: – concepts of consolidated supervision – challenges in carrying out consolidated supervision in practice – capital and liquidity in consolidated supervision – intra-group exposures 2 2 Basel Committee Basel Concordat, 1983: – “The principle of consolidated supervision is that parent banks and parent supervisory authorities monitor the risk exposure including a perspective of concentrations of risk and of the quality of assets - of the banks or banking groups for which they are responsible, as well as the adequacy of their capital, on the basis of the totality of their business wherever conducted” International Standards - BIS Core Principles Principle 12 – Consolidated supervision: “An essential element of banking supervision is that the supervisor supervises the banking group on a consolidated basis, adequately monitoring and, as appropriate, applying prudential standards to all aspects of the business conducted by the banking group worldwide.” So it is necessary to: – be clear what is a “banking group” – define what it means to supervise a group on a consolidated basis – define how to apply prudential standards to the group What is Consolidated Supervision? • The overall evaluation - both quantitative and qualitative - of the strength of a group to which a bank belongs, to assess the potential impact of other group companies on the bank. • The assessment is both: – Quantitative - based on a number of sources of information, including consolidated financial returns – Qualitative - of the whole group (including the activities of group companies not incorporated in the consolidated returns), including consideration of the Group-wide systems and controls Why Consolidated Supervision? • Consolidated supervision is desirable because there are risks to a bank, which may pose a threat to it, arising as a result of its membership of a wider group. • These risks include: – the risk that risks taken by other group companies might undermine the group as a whole; – the financial risks taken on by a bank in its links with other group companies, such as intra-group lending; and – the reputational risk to a bank if there are losses or other problems elsewhere in the group. • Reputational risk is of particular concern to supervisors. Even if a bank were entirely ring-fenced from the rest of its group and had no intra-group lending, problems elsewhere in the group might pose a risk to the bank. But the focus of Banking Supervision For banks, membership of a group can be a source of strength: • advantages of scale and potential benefits from diversification of risk • access to resources (financial and others) of the group in case of need But for the supervisor the main focus is on the risks to the bank: • losses from direct exposure to problems elsewhere in the group, e.g., through bank funding of other group companies • contagion: indirect impacts on the bank, e.g. from reputational damage • source of financial weakness, e.g., holding company not wellcapitalised • access to group resources is not available in practice, when required Consolidated supervision is not a panacea • A complement to, not a substitute for, solo supervision, which is needed as well, and the importance of which is stressed in international standards. • Consolidated supervision alone cannot detect all events within a Group that can pose a threat to the bank: - how transparent are the risks in the group? - what could go wrong in the group that would harm the bank – and how would a problem affect the bank in practice? - who is really running the bank and group, do I have access to them and do they really understand and control the group’s risks anyhow? - how can I be sure that capital and liquidity are adequate on a group basis? - are there opportunities for regulatory arbitrage that may obscure risk? - how do I interpret consolidated accounts of banking groups? - are the numbers on bank performance reliable or distorted by group policies? - can I rely on other supervisors (at home and abroad, as applicable) to help put together the full picture of risk? Consolidated Supervision in practice Three key steps: – identify the scope of the group that is “supervisable” in practice and ensure that (where there are multiple supervisors) there is one supervisor accepting responsibility for consolidated supervision – apply bank prudential standards to the banking group (capital, liquidity, large exposures, corporate governance etc.) with appropriate modifications (e.g., if insurance companies are included in the group) – carry out supervision of the banking group, including offsite monitoring (with appropriate reporting), onsite work (including foreign operations) under risk-based approach Determining group structure First key step is to identify the scope of the group... - include bank and its subsidiaries and affiliates on appropriate basis - include holding companies (top company and intermediate holdcos) - include sister companies, where financial - also funding and service companies - and unregulated entities, where financial - include foreign companies on the same basis (i.e. including holding companies etc.) ...and ensure there is a supervisor clearly responsible for and best-placed to carry out consolidated supervision: - usually the supervisor of the top company, if a bank - or the supervisor of the main bank in the group Techniques Of Consolidation Full consolidation Line by line consolidation Balance sheets added together. Intra group balances netted. Total positions risk weighted in the required way The consolidation of balance sheets according to conventional accounting rules (including the netting of balances between companies included in the consolidation). Pro Rata (or Proportional) Consolidation Balance sheets combined. Proportion of risks added, determined by holding. Total positions risk weighted in the required way Deduction No consolidation Consolidated supervision: prudential regulation Second key step: apply prudential standards to the banking group: – capital requirements, using Basel standards (including Pillar 2) – liquidity requirements: Basel requirements (when implemented) – large exposures: limits should apply to aggregate group wide exposures – governance etc: requirements for an effective board of directors, sound internal controls and risk management should apply group wide Other requirements still apply at solo/national level – market conduct/AML etc, but scope to examine group wide controls Consolidated supervision: group capital adequacy Two overall approaches to the calculation of group capital adequacy: - Consolidation/“line-by-line”: starts with one balance sheet for the whole group (as for audited financial statements); investments in group companies net out as do intragroup balances; only capital raised outside the group is recognised; capital requirements calculated on basis of group consolidated risks (credit, market etc.) - Aggregation: starts with calculation of group capital (top company and any other externally-raised capital); capital requirements aggregated across group, including notional requirements for unregulated entities Consolidation/“line-by-line” preferred for banking groups (alignment with audited group accounts an advantage), although supervisors need to be sure capital is available across the group, as the approach requires. But aggregation useful for some entities (e.g. insurance companies, regulated foreign companies) and risks (e.g. market risk calculated with internal model) Consolidated supervision: liquidity Basel III approach – Liquidity Coverage Ratio (LCR) to be applied on a consolidated basis using the consolidating supervisor’s rules For cross-border groups, Basel also recognizes the need to take account of conditions in national markets, reflected in national regulators’ rules: – so national standards should be used by banks, for example, for assumptions on retail deposit outflows expected in stressed conditions As with capital adequacy, excess liquidity must not be recognised by a crossborder group in its consolidated LCR if there are restrictions on its transfer: – e.g., ring-fencing measures, non-convertibility of local currency, foreign exchange controls etc) Liquidity risk management standards also apply on a consolidated basis Consolidated supervision: Supervision Third key step: carry out supervision on a group basis – require regular reports on group capital, liquidity, large exposures etc – hold group management to account for meeting standards on group wide basis – assess risks across the banking group (and in wider group, if there is one) and intra-group transactions/exposures – carry out onsite work on group issues, e.g., examinations of companies within the group (including foreign operations), and adequacy of group governance, risk management, internal audit etc To emphasize, consolidated supervision is about more than consolidated capital adequacy. It involves understanding the risks in the group and how they may adversely affect the bank - i.e., supervision. Consolidated Supervision - information requirements Information requirements • In order to carry out the qualitative part of the risk assessment, information is required both on the overall structure of the group and the individual significant business units. Group legal structure and management structure • A bank should provide a chart that shows: - every company included in its consolidated prudential returns: including any subsidiary or associated company included by virtue of a deduction from capital, as well as companies included on a line-by-line basis or by aggregation plus. - the extent of outside shareholders’ interests in group companies. - the group management structure. This should focus on units that carry on revenueearning activities and should indicate clearly the way in which group senior management responsibilities are allocated. Consolidated Supervision: Key areas of focus Questions to ask: - what is the group business model (or models) and strategy? - how is the group managed, centrally or on a devolved basis? - what are the key risk concentrations and how are they managed at group level? - what are the obstacles to movement of capital and other resources within the group, if required (is capital “fungible” in practice”?) - what is the overall level of risk in the group: are there diversification benefits or is the group complex and hard to manage? - what information on the group do I need in addition to regular reporting? - what do I need to do to be ready for a crisis affecting the group as a whole? Consolidated supervision: group governance What is adequate group wide governance and risk management? - management and control covers whole group (no “black holes”) - respects separate governance requirements applying to individual companies, especially in different jurisdictions - group wide control functions: risk management, internal audit etc, in addition to local functions (may also – e.g., internal audit – do the work of local function) - supported by group wide management information (MI) Different degrees of centralisation of management in practice Consolidated supervision: group governance Senior management set the tone and cascade accountability for risk management throughout the firm Accountability for ensuring risk is managed consistently with the Risk Framework approved by the Board The maximum amount of particular risks to which the Group wish to be exposed Role of the Board and senior management Confirmation of the effectiveness of the Risk Framework and underlying risk and control Risk appetite, tolerance and limits Provides succinct guidance to all levels of staff on the way the Group manage specific risks Risk framework and policy Ensures line 1 and line 2 are aware of their separate risk management duties to the firm Categorization and definition of the risks Makes risk management a core element of the Group’s culture by considering actions and behaviours Segregation of duties Risk identification and measurement Culture Mandate of the risk function Risk monitoring and reporting Resources The role of RMF including ownership at Board level A suite of risk metrics and information to support effective decision making at all levels Appropriately skilled resources able to support a growing business and risk management function 1 9 Consolidated supervision: intra-group transactions Supervisors need to oversee intra-group transactions and exposures: - - can be efficient and low risk, e.g., group funding via central treasury can also be source of risk to bank – likelihood of less disciplined approach to credit on intra-group (and related party) lending, including less monitoring of how funds are used can be used to transfer risk or value to and from other parts of the group can obscure the bank’s real performance transactions with unregulated entities potentially high risk Basel standards on large exposures do not cover intra-group: - but should be monitored and transactions/exposures reported to supervisor on a regular basis - supervisor should understand group’s approach Consolidated supervision: good practices • An effective banking supervisory system should consist of some form of both on-site and off-site supervision. • Banking supervisors must have regular contact with bank management and thorough understanding of the bank's operations and their interactions with the rest of the Group. • Banking supervisors must have a means of collecting, reviewing and analysing prudential reports and statistical returns from banks on a solo and consolidated basis. • Banking supervisors must have a means of independent validation of supervisory information either through on-site examinations or use of external auditors. • An essential element of banking supervision is the ability of the supervisors to supervise the banking group on a consolidated basis. Consolidated supervision: cross border practices Cross-border Banking – key components • Monitoring and applying appropriate prudential norms to all aspects of the business conducted worldwide through foreign branches, joint ventures and subsidiaries. • Establishing contact and information exchange with the various other supervisors involved, primarily host country supervisory authorities. • Requiring local operations of foreign banks to be conducted to the same high standards as are required of domestic institutions and having powers to share information needed by the home country supervisors of those banks for the purpose of carrying out consolidated supervision. Consolidated supervision: simple groups with and without holding company MEB Holdings Middle East Bank MEB Consumer loans MEB mortgages AB Bank Consolidated supervision: a complex group multiple activities and countries MEB Holdings Middle East Bank MEB Capital Ltd Middle East Bank (Singapore) Ltd MEB Trustees Jordan Ltd Middle East Bank (UK) Ltd MEB Securities Ltd MEB Leasing (UK) Ltd Dubai Funds Ltd ME Bank Mortgages Ltd MEB Life Assurance Ltd MEB Insurance Brokers Ltd MEB Microfinance Bank Ltd Consolidated supervision: sources of group financial weakness MEB Holdings Middle East Bank MEB Consumer loans MEB mortgages Middle East Bank AB Bank Bank capital 100 Investment in subsidiaries 80 Capital available to bank: 20 not 100 MEB Consumer loans MEB mortgages AB Bank Holdco Capital : 10 Debt : 90 Investment in subsidiaries: 100 How much real capital is available to the banks? Recap: Steps in consolidation 1. Determine the Group structure (Participation levels, majority of votes, concept of control, type of business of each group member) B 2. Determine the scope of consolidation (i.e., the relevant units for regulatory consolidation) 3. Determine the type of consolidation (full, pro rata, deduction etc.) for any relevant unit X Full X Y Y B Pro rata Y Y 4. Add capital positions according to type of consolidation in the sequence Tier I, deductions from Tier I, Tier II, deductions from Tiers I & II, 5. Add risk positions according to type of consolidation separately for Risk weighted assets and market risks 6. Calculate prudential ratios in a similar way to ratios on a solo basis 26 Capital >= 8% Risk Summary • Consolidated supervision enables supervisors to take necessary action to protect banks from the adverse effects of being part of a group • It is not about supervising all aspects of the group directly and it supplements rather than replaces solo bank supervision • Defining the group’s scope (requiring restructuring, if necessary) is the key first step • The tools of consolidated supervision are the same as for solo supervision (especially application of prudential standards and supervision), adapted and extended as necessary, e.g., for non-bank risks, intra-group transactions • Consolidated supervision covers cross-border business too – with a key role for host as well as home supervisors, e.g., in identifying group wide risks and contributing to coordinated supervision