Chapter 5 The Time Value of Money - it

advertisement

Chapter 5

The Time Value

of Money

Laurence Booth, Sean Cleary

and Pamela Peterson Drake

Outline of the chapter

5.1 Time is money

5.2 Annuities and

perpetuities

•Simple versus

compound

interest

•Future value of

an amount

•Present value of

an amount

•Ordinary

annuities

•Annuity due

•Deferred

annuities

•Perpetuities

5.3 Nominal and

effective rates

•APR

•EAR

•Solving for the

rate

5.4 Applications

•Savings plans

•Loans and

mortgages

•Saving for

retirement

5.1 Time value of money

Simple interest

Simple interest is interest that is paid only

on the principal amount.

Interest = rate × principal amount of loan

Simple interest: example

A 2-year loan of $1,000 at 6% simple interest

At the end of the first year,

interest = 6% × $1,000 = $60

At the end of the second year,

interest = 6% × $1,000 = $60

and loan repayment of $1,000

Compound interest

Compound interest is interest paid on both

the principal and any accumulated interest.

accumulated

Interest = rate × principal +

interest

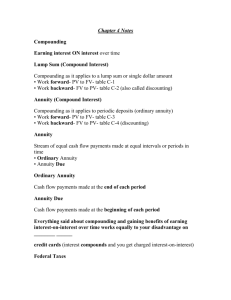

Compounding

Compounding

is translating a present

value into a future value, using compound

interest.

Future Present

Future value

=

×

value

value

interest factor

Future

value interest factor is also referred

to as the compound factor.

Terminology and notation

Term

Notation

Meaning

Future value

FV

Value at some specified

future point in time

Present value

PV

Value today

Interest

i

Compensation for the use

of funds

Number of periods

n

Number of periods

between the present value

and the future value

Compound factor

(1 + i)n

Translates a present value

into a future value

Compare:

simple versus compound

Suppose you deposit $5,000 in an account

that pays 5% interest per year. What is the

balance in the account at the end of four

years if interest is:

1. Simple interest?

2. Compound interest?

Simple interest

Year

Beginning

Add interest

Ending

1

$5,000.00

+ (5% × $5,000) =

$5,250.00

2

$5,250.00

+ (5% × $5,000) =

$5,500.00

3

$5,500.00

+ (5% × $5,000) =

$5,750.00

4

$5,750.00

+ (5% × $5,000) =

$6,000.00

Compound interest

Year

Beginning

Compounding

Ending

1

$5,000.00

× 1.05 =

$5,250.00

2

$5,250.00

× 1.05 =

$5,512.50

3

$5,512.50

× 1.05 =

$5,788.13

4

$5,788.13

× 1.05 =

$6,077.53

Interest on interest

How much interest on interest?

Interest on interest = FVcompound – FVsimple

Interest on interest = $6,077.53 – 6,000.00 = $77.53

Comparison

0

$5,000.00

$5,000.00

1

$5,250.00

$5,250.00

2

$5,500.00

$5,512.50

3

$5,750.00

$5,788.13

4

$6,000.00

$6,077.53

$5,000

$6,000

$6,078

$5,750

$5,788

$5,500

$5,513

$6,000

Compound interest

$5,250

$5,250

$7,000

Balance in the account

Year

End of year balance

Simple

Compound

interest

interest

$5,000

$5,000

Simple interest

$4,000

$3,000

$2,000

$1,000

$0

0

1

2

3

Year in the future

4

Try it: Simple v. compound

Suppose you are comparing two accounts:

The Bank A account pays 5.5% simple

interest.

The Bank B account pays 5.4% compound

interest.

If you were to deposit $10,000 in each, what

balance would you have in each bank at the

end of five years?

Try it: Answer

1.

2.

Bank A: $12,750.00

Bank B: $13,007.78

A note about interest

Because compound interest is so common,

assume that interest is compounded unless

otherwise indicated.

Short-cuts

Example:

Consider $1,000 deposited for three years

at 6% per year.

The long way

FV1 = $1,000.00 × (1.06) = $1,060.00

FV2 = $1,060.00 × (1.06) = $1,123.60

FV3 = $1,123.60 × (1.06) = $1,191.02

or

FV3 = $1,000 × (1.06)3 = $1,191.02

or

FV3 = $1,000 × 1.191016 = $1,191.02

Future value factor

Short-cut: Calculator

Known values:

PV = 1,000

n=3

i = 6%

Solve for: FV

Input three known values,

solve for the one unknown

Known:

Unknown:

PV, i , n

FV

HP10B

BAIIPlus

HP12C

TI83/84

1000 +/PV

3N

6 I/YR

FV

1000 +/PV

3N

6 I/YR

FV

1000 CHS PV

3n

6i

FV

[APPS] [Finance]

[TVM Solver]

N =3

I%=6

PV = -1000

FV [Alpha] [Solve}

Short-cut: spreadsheet

Microsoft Excel or Google Docs

=FV(RATE,NPER,PMT,PV,TYPE)

TYPE default is 0, end of period

=FV(.06,3,0,-1000)

or

A

1

6%

2

3

3

-1000

4

=FV(A1,A2,0,A3)

Problems Set 1

Problem 1.1

Suppose you deposit $2,000 in an account

that pays 3.5% interest annually.

1. How much will be in the account at the

end of three years?

2. How much of the account balance is

interest on interest?

23

Problem 1.2

If you invest $100 today in an account that

pays 7% each year for four years and 3%

each year for five years, how much will you

have in the account at the end of the nine

years?

24

Discounting

Discounting

Discounting

is translating a future value

into a present value.

The discount factor is the inverse of the

1

compound factor:

𝑛

1+𝑖

To translate a

value, PV=

future value into a present

FV

1+𝑖 𝑛

Example

Suppose you have a goal of saving $100,000

three years from today. If your funds earn

4% per year, what lump-sum would you have

to deposit today to meet your goal?

Example, continued

Known values:

FV = $100,000

n=3

i = 4%

Unknown: PV

Example, continued

$100,000

1

PV =

=$100,000 ×

3

1+0.04

1+0.04 3

PV = $100,000 × 0.8889964

PV = $88,899.64

Check:

FV3 = $88,899.64 × (1 + 0.04)3 = $100,000

Short-cut: Calculator

HP10B

BAIIPlus

HP12C

TI83/84

100000 +/PV

3N

4 I/YR

PV

100000

+/- PV

3N

4 I/YR

PV

100000 CHS PV

3n

4i

PV

[APPS] [Finance] [TVM

Solver]

N =3

I%=4

FV = 100000

PV [Alpha] [Solve]

Short-cut: spreadsheet

Microsoft Excel or Google Docs

=PV(RATE,NPER,PMT,PV,TYPE)

TYPE default: end of period

=PV(.06,3,0,-1000)

or

A

1

6%

2

3

3

100000

4

=PV(A1,A2,0,A3)

Try it: Present value

What is the today’s value of $10,000

promised ten years from now if the discount

rate is 3.5%?

Try it: Answer

Given:

FV = $10,000

N = 10

I = 3.5%

Solve for PV

PV = $10,00010 = $7,089.19

1+0.035

Frequency of compounding

If interest

is compounded more than once

per year, we need to make an adjustment

in our calculation.

The stated rate or nominal rate of interest

is the annual percentage rate (APR).

The rate per period depends on the

frequency of compounding.

Discrete compounding:

Adjustments

Adjust

the number of periods and the rate

per period.

Suppose the nominal rate is 10% and

compounding is quarterly:

rate per period is 10% 4 = 2.5%

The number of periods is

number of years × 4

The

Continuous compounding:

Adjustments

The compound

The discount

Suppose

factor is eAPR x n.

factor is

1

eAPR x n

.

the nominal rate is 10%.

For five years, the continuous compounding

factor is e0.10 x 5 = 1.6487

The continuous compounding discount factor

for five years is 1 ÷ e0.10 x 5 = 0.60653

Try it: Frequency of

compounding

If you invest $1,000 in an investment that

pays a nominal 5% per year, with interest

compounded semi-annually, how much will

you have at the end of 5 years?

Try it: Answer

Given:

PV = $1,000

n = 5 × 2 = 10

i = 0.05 2 = 0.25

Solve for FV

FV = $1,000 × (1 + 0.025)10 = $1,280.08

Problem Set 2

Problem 2.1

Suppose you set aside an amount today in an

account that pays 5% interest per year, for

five years. If your goal is to have $1,000 at

the end of five years, what would you need

to set aside today?

40

Problem 2.2

Suppose you set aside an amount today in an

account that pays 5% interest per year,

compounded quarterly, for five years. If your

goal is to have $1,000 at the end of five

years, what would you need to set aside

today?

41

Problem 2.3

Suppose you set aside an amount today in an

account that pays 5% interest per year,

compounded continuously, for five years. If

your goal is to have $1,000 at the end of five

years, what would you need to set aside

today?

42

0

|

1

2

3

4

5

CF

CF

CF

CF

CF

|

|

|

PV?

5.2 Annuities and

Perpetuities

|

|

FV?

What is an annuity?

An

annuity is a periodic cash flow.

Same amount each period

Regular intervals of time

The different

types depend on the timing

of the first cash flow.

Type of annuities

Type

First cash flow

Examples

Ordinary

One period from

today

Mortgage

Annuity due

Immediately

Lottery payments

Rent

Deferred annuity

Beyond one period

from today

Retirement savings

Time lines: 4-payment annuity

Ordinary

Annuity due

Deferred annuity

0

1

2

3

4

5

|

|

|

|

|

|

CF

CF

CF

CF

FV

CF

CF

CF

CF

CF

PV

CF

PV

PV

FV

CF

CF

FV

Key to valuing annuities

The key to valuing

annuities is to get the

timing of the cash flows correct.

When in doubt, draw a time line.

Example: PV of an annuity

What is the present value of a series of three

cash flows of $4,000 each if the discount rate

is 6%, with the first cash flow one year from

today?

0

1

2

3

|

|

|

|

$4,000

$4,000

$4,000

4

Example: PV of an annuity

The long way

0

1

2

3

|

|

|

|

$4,000

$4,000

$4,000

$3,773.58

3,559.99

3,358.48

$10,692.05

4

Example: PV of an annuity

In table form

Year

1

2

3

Discount Present

Cash flow

factor

value

$4,000.00

0.94340 $3,773.58

$4,000.00

0.89000

3,559.99

$4,000.00

0.83962

3,358.48

2.67301 $10,692.05

PV = $4,000.00 × 2.67301 = $10,692.05

Example: PV of an annuity

Formula short-cuts

1−

PV = $4,000 ×

1

3

1+0.06

0.06

PV = $4,000 × 2.67301

PV = $10,692.05

Example: PV of an annuity

Calculator short cuts

Given:

PMT = $4,000

i = 6%

N=3

Solve for PV

Example: PV of an annuity

Spreadsheet short-cuts

=PV(RATE,NPER,PMT,FV,TYPE)

=PV(.06,3,4000,0)

Note: Type is important for annuities

• If Type is left out, it is assumed a 0

• 0 is for an ordinary annuity

• 1 is for an annuity due

Example: FV of an annuity

What is the future value of a series of three

cash flows of $4,000 each if the discount rate

is 6%, with the first cash flow one year from

today?

0

1

2

3

|

|

|

|

$4,000

$4,000

$4,000

4

Example: FV of an annuity

The long way

0

1

2

3

|

|

|

|

$4,000.00

$4,000.00

$4,000.00

4,240.00

4,494.40

$12,734.40

4

Example: FV of an annuity

In table form

Year

1

2

3

Compound

Cash flow

factor

Future value

$4,000.00

1.1236

$4,494.40

$4,000.00

1.0600

4,240.00

$4,000.00

1.0000

4,000.00

3.1836

$12,734.40

PV = $4,000.00 × 3.1836 = $12,734.40

Example: FV of an annuity

Calculator short cuts

CALCULATOR

Given:

PMT = $4,000

i = 6%

N=3

Solve for FV

Example: FV of an annuity

Spreadsheet short-cuts

=FV(RATE,NPER,PMT,PV,type)

=FV(.06,3,4000,0)

Annuity due

Consider a series of three cash flows of

$4,000 each if the discount rate is 6%, with

the first cash flow today.

1. What is the present value of this annuity?

2. What is the future value of this annuity?

The time line

0

1

2

3

|

|

|

|

$4,000.00

$4,000.00

$4,000.00

PV?

This is an annuity due

FV?

Valuing an annuity due

Present value

End of year Compoun Present value of

Year cash flow d factor

cash flow

0

$4,000.00

1.00000

$4,000.00

1

$4,000.00

0.94340

3,773.58

2

$4,000.00

0.89000

3,559.99

2.83339

$11,333.57

Future value

End of year

Year cash flow

0

$4,000.00

1

$4,000.00

2

$4,000.00

Factor Future value

1.19102

$4,764.06

1.12360

4,494.40

1.06000

4,240.00

3.37462 $13,498.46

Valuing an annuity due:

Using calculators

Present value

Future value

PMT = 4000

N=3

I = 6%

BEG mode

Solve for PV

PMT = 4000

N=3

I = 6%

BEG mode

Solve for FV

Valuing an annuity due:

Using spreadsheets

Present value

=PV(RATE,NPER,PMT,FV,TYPE)

=PV(0.06,3,4000,0,1)

Future value

=PV(RATE,NPER,PMT,FV,TYPE)

=PV(0.06,3,4000,0,1)

Any other way?

There is one period difference between an

ordinary annuity and an annuity due.

Therefore:

PVannuity due = PVordinary annuity × (1 + i)

and

FVannuity due = FVordinary annuity × (1 + i)

Valuing a deferred annuity

A

deferred annuity is an annuity that

begins beyond one year from today.

That

means that it could begin 2, 3, 4, … years

from today, so each problem is unique.

Valuing a deferred annuity

0

4-payment

ordinary annuity,

then discount

value one period

PV0

4-payment annuity

due, then discount

value two periods

PV0

1

2

3

4

5

|

|

|

|

CF

CF

CF

CF

←PV1

←PV2

Example: Deferred annuity

What is the value today of a series of five

cash flows of $6,000 each, with the first cash

flow received four years from today, if the

discount rate is 8%?

0

PV?

1

2

3

4

5

6

7

8

|

|

|

|

|

CF

CF

CF

CF

CF

9

10

Example, cont.

Using an ordinary annuity:

PV3 = $23,956.26

Discount 3 periods at 8%

PV0 = $19,017.25

Using an annuity due:

PV4 = $25,872.76

Discount 4 periods at 8%

PV0 = $19,017.25

Example: Deferred annuity

Calculator solutions

HP10B

BAIIPlus

TI83/84

0 CF

0 CF

0 CF

0 CF

6000 CF

6000 CF

6000 CF

6000 CF

6000 CF

8i

NPV

0 CF ↑ 1

0 CF ↑ 1 F1

0 CF ↑ 1 F2

0 CF ↑ 1 F3

6000 CF ↑ 1 F4

6000 CF ↑ 1 F5

6000 CF ↑ 1 F6

6000 CF ↑ 1 F7

6000 CF ↑ 1 F8

8i

NPV

[2nd] {

0 0 0 6000 6000

6000 6000 6000}

STO [2nd] L1

[APPS] [Finance]

[ENTER] 7

NPV(.08,0,L1)

[ENTER]

Example: Deferred annuity

Spreadsheet solutions

A

B

Year Cash flow

1

1

$0

2

2

$0

3

3

$0

4

4

$6000

5

5

$6000

6

6

$6000

7

7

$6000

8

8

$6000

1. =PV(0.08,3,0,PV(0.08,5,6000,0))

2. =PV(0.08,4,0,PV(0.08,5,6000,0,1))

3. =NPV(0.08,A1:A9)

Perpetuities

A perpetuity is an even cash flows that

occurs at regular intervals of time, forever.

The valuation of a perpetuity is simple:

PV =

𝐶𝐹

𝐶𝐹

𝐶𝐹

𝐶𝐹

+

+

+…

1

2

3

1+𝑖

1+𝑖

1+𝑖

1+𝑖 ∞

𝐶𝐹

PV =

𝑖

Problem Set 3

Problem 3.1

Which do you prefer if the appropriate

discount rate is 6% per year:

1. An annuity of $4,000 for four annual

payments starting today.

2. An annuity of $4,100 for four annual

payments, starting one year from today.

3. An annuity of $4,200 for four annual

payments, starting two years from today.

73

5.3 Nominal and effective

rates

APR & EAR

The

annual percentage rate (APR) is the

nominal or stated annual rate.

The

APR ignores compounding within a year.

The APR understates the true, effective rate.

The effective

annual rate (EAR)

incorporates the effect of compounding

within a year.

APR EAR

EAR = 1 +

𝐴𝑃𝑅 𝑚

𝑚

−1

Suppose interest is stated as 10% per years,

compounded quarterly.

EAR = 1 +

0.10 4

4

EAR = 10.3813%

− 1 = 1.0254 − 1

EAR with continuous

compounding

EAR = 𝑒 𝐴𝑃𝑅 − 1

Suppose interest is stated as 10% per years,

compounded continuously.

EAR = e0.1 −1=1.05171−1

EAR = 10.5171%

77

Frequency of compounding

If interest

is compounded more frequently

than annually, then this is considered in

compounding and discounting.

There are two approaches

1. Adjust the i and n; or

2. Calculate the EAR and use this

Example: EAR &

compounding

Suppose you invest $2,000 in an investment

that pays 5% per year, compounded

quarterly. How much will you have at the

end of 4 years?

Example: EAR &

compounding

Method 1:

FV = $2,000 (1 + 0.0125)16 = $2,439.78

Method 2:

EAR = (1 + 0.05 4)4 – 1 = 5.0945%

FV = $2,000 (1 + 0.050945)4 = $2,439.78

Try it: APR & EAR

Suppose a loan has a stated rate of 9%, with

interest compounded monthly. What is the

effective annual rate of interest on this loan?

Try it: Answer

EAR =

0.09 12

1+

−1

12

1.007512 − 1

EAR =

EAR = 9.3807%

Problem Set 4

Problem 4.1

What is the effective interest rate that

corresponds to a 6% APR when interest is

compounded monthly?

84

Problem 4.2

What is the effective interest rate that

corresponds to a 6% APR when interest is

compounded continuously?

85

5.4 Applications

Saving for retirement

Suppose you estimate that you will need $60,000

per year in retirement. You plan to make your first

retirement withdrawal in 40 years, and figure that

you will need 30 years of cash flow in retirement.

You plan to deposit funds for your retirement

starting next year, depositing until the year before

retirement. You estimate that you will earn 3% on

your funds.

How much do you need to deposit each year to

satisfy your plans?

Deferred annuity time line

0

1

2

3

4

5

6

7

8

|

|

|

|

|

|

|

|

D

D

D

D

D

D

D

D

D = Deposit (39 in total)

W = Withdrawal (30 in total)

…

39

40

41

42

43

|

|

|

|

|

W W W W W

…

79

|

W

Deferred annuity time line

0

1

2

3

4

5

6

7

8

|

|

|

|

|

|

|

|

…

39

40

41

42

43

|

|

|

|

|

|

W

W

W

W

W

←

Ordinary annuity

PV

↓

Ordinary annuity

D

D

D

D

D

D

D

→

FV

D …

D

…

79

Two steps

Step 1: Present value of ordinary annuity

N = 30; i = 3%; PMT = $60,000

PV39 = $1,176,026.48

Step 2: Solve for payment in an ordinary

annuity

N = 39; i = 3%; FV = $1,176,026.48

PMT = $16,280.74

What does this mean?

If there are 39 annual deposits of $16,280.74

each and the account earns 3%, there will be

enough to allow for 30 withdrawals of

$60,000 each, starting 40 years from today.

Balance in retirement account

$1,400,000

$1,200,000

Balance in

the

retirement

account

$1,000,000

$800,000

$600,000

$400,000

$200,000

$0

1 5 9 13 17 21 25 29 33 37 41 45 49 53 57 61 65 69

Year into the future

Practice problems

Problem 1

What is the future value of $2,000 invested

for five years at 7% per year, with interest

compounded annually?

Problem 2

What is the value today of €10,000 promised

in four years if the discount rate is 4%?

Problem 3

What is the present value of a series of five

end-of-year cash flows of $1,000 each if the

discount rate is 4%?

Problem 4

Suppose you plan to save $3,000 each year

for ten years. If you earn 5% annual interest

on your savings, how much more will you

have at the end of ten years if you make your

payments at the beginning of the year

instead of the end of the year?

Problem 5

Sue plans to deposit $5,000 in a savings

account each year for thirty years, starting

ten years from today. Yan plans to deposit

$3,500 in a savings account each year for

forty years, starting at the end of this year. If

both Sue and Yan earn 3% on their savings,

who will have the most saved at the end of

forty years?

Problem 6

Suppose you have two investment

opportunities:

Opportunity 1: APR of 12%, compounded

monthly

Opportunity 2: APR of 11.9%, compounded

continuously

Which opportunity provides the better

return?

Problem 7

If you can earn 5% per year, what would you

have to deposit in an account today so that

you have enough saved to allow withdrawals

of $40,000 each year for twenty years,

beginning thirty years from today?

Problem 8

Suppose you deposit ¥50000 in an account

that pays 4% interest, compounded

continuously. How much will you have in the

account at the end of ten years if you make

no withdrawals?

The end