S17b_Celia Reyes_ADB_China_April23_final

advertisement

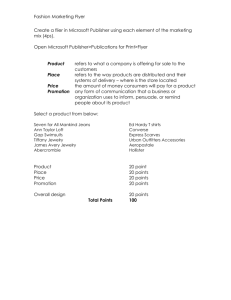

Celia M. Reyes Senior Research Fellow Philippine Institute for Development Studies Regional Forum: Journey to and From the Middle Income Status- The Challenges for Public Sector Managers April 22-25, 2015, Shanghai, PRC Challenges for middle income countries Avoiding middle income trap Achieving inclusive growth – all benefit from and participate in the growth process Track record of the Philippines Relatively higher economic growth in recent years Slow reduction in poverty Lower inequality in urban areas but small increase in inequality in the rural areas “Jobless” growth Recent economic growth has been remarkable Gross Domestic Product, Growth Rates, 1990-2013 (at constant 2000 prices) 8.0 7.6 6.7 5.2 4.4 In Percent 6.6 5.8 6.0 4.0 6.8 3.0 5.0 4.4 4.7 5.2 4.8 4.2 3.6 3.1 3.6 2.9 2.1 2.0 0.0 1.1 0.3 -0.6 -2.0 Source of basic data: NIA, NSCB -0.6 7.2 Yet slow progress in poverty reduction 40 Poverty incidence among population (%), 1991-2012 35 30 34.4 25 26.6 26.3 25.2 2006 2009 2012 20 15 10 5 0 1991 Source: NSCB GINI Coefficient, Philippines, by Areas, 1985-2009 0.55 0.5183 0.53 0.5045 0.51 0.49 0.4803 0.47 0.45 0.4871 0.4735 0.4850 0.4736 0.43 0.39 0.4190 0.3941 0.3942 1991 1994 0.4743 0.4782 0.4602 0.41 0.4837 0.4255 0.4513 0.4496 0.4462 0.4288 0.4296 0.4278 2006 2009 0.37 0.35 1997 All Areas 2000 Urban 2003 Rural Source: Celia M. Reyes, Aubrey D. Tabuga, Ronina D. Asis and Maria Blesila G. Datu, 2012, Poverty and Agriculture in the Philippines: Trends in Income Poverty and Distribution (PIDS DP 2012-09) Unemployment Rate, 2005-2012 9 8 7 6 5 4 3 2 1 0 7.8 2005 8.0 2006 7.3 7.4 7.5 7.4 2007 2008 2009 2010 7.0 7.0 2011 2012 Note: Data refers to average of January, April, July and October rates except for 2005 which is the average of April, July and October rates. Source: Yearbook of Labor and Statistics: http://www.bles.dole.gov.ph/ (downloaded 13June2013) Underemployment rate, 2005-2012 25.0 21.0 22.6 20.0 20.1 19.3 19.1 18.8 19.3 19.3 2007 2008 2009 2010 2011 2012 15.0 10.0 5.0 0.0 2005 2006 Note: Data refers to average of January, April, July and October rates except for 2005 which is the average of April, July and October rates. Source: Yearbook of Labor and Statistics: http://www.bles.dole.gov.ph/ (downloaded 13June2013) Constraints to inclusive growth include Weak investment Inadequate infrastructure Governance issues Human capital Investment to GDP Ratio ( in percent) 30.0 25.0 20.0 15.0 10.0 Source of basic data: National Income Accounts, NSCB 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 0.0 1990 5.0 Infrastructure Ranking of Selected Countries (out of 144), 2012-2013 Philippines Indonesia Malaysia Thailand Viet Nam Overall 98 92 29 49 119 Road 87 90 27 39 120 Source: World Competitiveness Report 2012-2013. Railway 94 51 17 65 68 Port 120 104 21 56 113 Air 112 89 24 33 94 Electricity Rates for General and Business Use in Selected ASEAN Cities (2012) City Manila Cebu Singapore Phnom Penh Yangon Bangkok Kuala Lumpur Danang Ho Chi Minh Hanoi Jakarta Vientiane Batam Country Philippines Philippines Singapore Cambodia Myanmar Thailand Malaysia Vietnam Vietnam Vietnam Indonesia Lao PDR Indonesia Electricity Rate for General Use (US$/kWh) * 0.25 0.24 0.23 0.16 0.12 0.11 0.11 0.08 0.08 0.08 0.08 0.07 0.06 Average Electricity Rate for Business Use (US$/kWh) ** 0.15 0.23 0.2176 0.216 0.12 0.14 0.09 0.085 0.085 0.085 0.08 0.0685 0.11 Table taken from: Navarro, A. (2013) Finding solutions to the problem of high electricity rates in the Philippines. Philippine Institute for Development Studies Discussion Paper (forthcoming) Proportion of children attending school, by income quintile and by age group, 2011 100 90 85.1 98.8 97.7 97.1 94.9 90.5 92.6 96.1 99.2 98.7 85.9 80 67.3 70 60 50 6 to 11 55.3 12 to 15 47.9 16 to 18 42.6 40 30 20 10 0 Poorest 2 Basic source of data: APIS 2011, NSO. 3 4 Richest In Percent Percentage distribution of workers by highest educational attainment and by income quintile, 2009 50 45 40 35 30 25 20 15 10 5 0 Poorest Second Third Fourth Richest No formal schooling Some elementary graduate Elementary graduate Some high school High school graduate Some College At least college graduate Basic source of data: Family Income and Expenditure Survey 2009, NSO. Distribution of workers who have elementary education by sector of employment, 2011 Public Education Health & Other community, social & personal administration & 0.1% social service activities defense work 1.7% 1.7% Real estate, renting 0.1% & business activities Financial 0.5% intermediation 0.0% Transport, storage & communications 5.5% Hotels & restaurants 1.1% Agriculture, hunting & forestry 50.5% Wholesale & retail trade 13.5% Construction 5.9% Electricity, gas & water supply 0.1% Manufacturing 5.7% Mining & quarrying 0.8% Private household activities 5.5% Fishing 7.3% Source of basic data: LFS (July 2011), NSO Average daily wage of wage/salary workers by educational attainment, 2011 Php 1200 1,137 1000 800 598 600 400 200 335 141 169 186 202 246 0 No grade Elementary Elementary High school High school College completed undergraduate graduate undergraduate graduate undergraduate College graduate Postgraduate Source: Celia Reyes, Aubrey Tabuga, Christian Mina and Ronina Asis, 2013. Regional Integration, Inclusive Growth and Poverty: Enhancing Employment Opportunities for the Poor (PIDS DP 2013-10) What can be done to promote inclusive growth? Poor to Benefit from growth Redistributive policies and programs Poor to Participate in the growth process Social Protection programs such as Conditional cash transfer program or the Pantawid Pamilya Pilipino Program (4Ps) Features of the 4Ps Objectives: Social Assistance – provide cash assistance to alleviate immediate needs (short-term poverty alleviation) Social Development – to break the intergenerational cycle of poverty through investments in human capital Features of the 4Ps Target families: Extremely poor families with children aged 0 to 14 Components: Health and Education Health: P6,000 annually (P500 per month)/family Education: P3,000/child/school year (P300/child/month for 10 months); up to a max. of 3 children in each family Features of the 4Ps Conditionalities: o Pregnant women must avail of pre- and post-natal care and be attended during childbirth by a trained health professional o Parents must attend family development sessions o 0-5 year old children must receive regular preventive health check-ups and vaccines o 3-5 year old children must attend day care or preschool classes at least 85% of the time o 6-14 year old children must enrol in elementary or high school and must attend at least 85% of the time o 6-14 years old children must receive de-worming pills twice a year Features of the 4Ps: Targeting Scheme Criteria for selection of beneficiaries: Residents of poorest municipalities; Households whose economic condition is equal to or below the provincial poverty threshold; Households that have children 0-14 years old and/or have a pregnant woman at the time of assessment; and Households that agree to meet conditions specified in the program. Features of the 4Ps: Targeting Scheme The DSWD selects the beneficiaries through the National Household Targeting System for Poverty Reduction (NHTS-PR). The benificiaries are selected from the poorest municipalities based on the 2003 Small Area Estimates of poverty incidence generated by the NSCB. Municipalities with poverty incidence higher than or equal to 50% are saturated – all families are interviewed and assessed for eligibility. In municipalities where the poverty incidence is less that 50%, “pockets of poverty” are identifies by the municipal social welfare and development officer and then families in these pockets are interviewed and assessed for eligibility. Families residing outside these pockets of poverty are excluded in the assessment. This leads to significant exclusion. The poorest households in the selected municipalities are identified through a Proxy-Means Test. 4Ps has been scaled up too rapidly 6.000 5.2 5.000 3.8 4.000 3.1 3.000 2.3 2.000 1.000 0.000 0.006 2007 0.34 2008 Source of basic data: Reyes, et al (2013) 0.63 2009 1.0 2010 2011 2012 2013 2014 4Ps Targeting: Leakage Based on the APIS 2011, 4Ps beneficiaries comprise 6.4% of the total number of families. Over 82% of all 4Ps beneficiaries are rural families. Only 70.81% of the 4Ps beneficiaries in 2011 are income poor (after taking out the cash grant). Among the 4Ps beneficiaries who are poor, only 7.2% became non-poor when given cash transfers. NHTS-PR identified 5.2 million poor families, way above the estimated 3.9 million poor families in 2009. Including all these families will lead to even higher leakage rate. Leakage rate Proportion of 4Ps beneficiaries who are nonpoor Source Leakage rates APIS 2011(less cash grant) 29.2 4Ps Targeting: Exclusion Issue As of 2011, the 4Ps has reached 20.3% of the country’s total poor families On-demand system (families who claim eligibility but are not selected have to go through the ondemand system); they are entered into the database of eligible beneficiaries in the NHTS-PR; there is a lag before they can be accommodated into the 4Ps database of beneficiaries Administrative cost of the program is substantial Share of Cash Transfer to Total Budget Budget category Total Cash transfer/grant to beneficiaries 2011 2012 21,194 17,138 39,450 35,453 4,056 1,625 716 3,997 703 1,877 Bank service fee 171 346 Information, education and advocacy materials; printing of manuals and booklets Capital outlay 649 218 252 133 677 80.9% 686 89.9% Implementation support* Trainings Salaries and allowances for 1,800 new personnel Monitoring, evaluation and administration support Share of cash transfer to total budget Source: DSWD, available online http://pantawid.dswd.gov.ph/index.php/pantawid-pamilya-financials Percent (%) School Attendance falls below 90% after age 13 100 90 80 70 60 50 40 30 20 10 0 92.6 98.0 98.4 98.9 98.8 98.3 96.4 93.6 89.7 77.5 60.0 43.6 33.8 6 7 8 9 10 11 12 Age Source of basic data: APIS 2011, NSO 13 14 15 16 17 18 Proportion of children attending school, by income group and by age group, 2011 120.0 100.0 80.0 94.1 97.2 95.9 86.1 91.2 92.4 93.2 60.0 48.5 75.4 71.0 64.9 61.9 58.9 56.7 53.9 99.3 98.7 99.1 98.9 97.9 99.5 98.5 98.1 96.3 96.9 93.4 93.0 84.8 97.6 97.0 40.0 20.0 0.0 Poorest 2 3 4 6 to 11 Source of basic data: APIS 2011, NSO 5 12 to 14 6 7 15 to 18 8 9 Richest % 100 92.1 90 80 70 60 50 40 30 20 10 0.00 0 6 96.9 96.5 95.7 94.4 92.6 88.7 84.8 75.2 63.1 48.4 46.10 38.29 26.15 33.6 14.88 0.00 0.00 0.00 0.10 0.54 0.91 2.52 5.39 7 8 9 10 11 12 13 14 15 16 Age out-of-school, working studying, not working Source of basic data: Matched files of APIS 2011 and LFS July 2011, NSO 24.3 17 18 4Ps Non-4Ps Difference Significance (α=0.05) Aged 6-14 96.3 92.8 3.5 significant Aged 6-11 97.8 95.0 2.8 significant Aged 12-14 93.1 89.0 4.1 significant Aged 15-18 57.1 54.3 2.8 not significant Age group Note: Figures are estimates from the Nearest Neighbor (1), or One-to-one, matching with replacement. Source of basic data: Matched files of APIS 2011 and LFS July 2011, NSO Php 1,200 1,137 1,000 800 598 600 400 200 0 335 141 No grade completed 169 186 202 Elementary undergraduate Elementary graduate High school undergraduate Source of basic data: LFS (July 2011), NSO 246 High school graduate College undergraduate College graduate Postgraduate Recommendations of the study To extend the 4Ps to cover high school education - children up to 18 years Improve targeting scheme to reduce leakages and exclusion Government response: Extended it to high school and increased the budget allocation for 4Ps Updating the targeting scheme Revenue and Tax Effort (GDP base year 2000) 20 18 16 14 12 10 8 6 4 2 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Q1-Q3 Revenue Effort *Using the 2000 rebased/revised GDP by NSCB Tax Effort Distribution of total public expenditures, by Sector, 2013 Economic Services 34% General Public Services 24% Defense 5% Other Social Services 7% Social Security, Welfare and Employment 9% Health 3% Source: Department of Budget and Management (DBM) Education, Culture and Manpower Development 18% Concluding remarks The Philippines is in a higher growth trajectory. However, inclusive growth still has to be achieved. To address constraints, investments in infrastructure and human capital, among others, are necessary. Raising government revenues to finance these investments are critical. “Sin” tax on alcohol and tobacco (2013) to finance higher health care programs