Sales tax payment

advertisement

TROUBLESHOOTING BEST PRACTICE

Sales tax payment

Monika Kowalka

Escalation Engineer

Contents

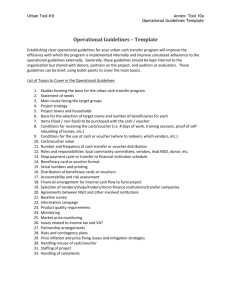

Possible issues with sales tax payment......................................................................................................... 2

Pre-research .................................................................................................................................................. 2

Troubleshooting example 1: User get error message during sales tax payment run: “Account number for

transaction type Sales tax does not exist” .................................................................................................... 3

Step 0: Pre-requirements.......................................................................................................................... 3

Step 1: Checking setup .............................................................................................................................. 3

Step 2: Identify the transaction(s) ............................................................................................................ 3

Step 3: Identify the scenario ..................................................................................................................... 9

Step 4: Reproduce on customize environment ...................................................................................... 11

Step 5: Reproduce on standard environment ........................................................................................ 11

Example 2: Sales tax payment voucher is not equal to the posted sales tax transactions ........................ 12

Step 0: Pre-requirements........................................................................................................................ 13

Step 1: Checking setup ............................................................................................................................ 13

Step 2: Identify the transaction(s) .......................................................................................................... 13

Step 3: Identify the scenario ................................................................................................................... 21

Step 4: Reproduce on customize environment ...................................................................................... 23

Step 5: Reproduce on standard environment ........................................................................................ 23

Step 6: Not able to repro on customer application ................................................................................ 23

Example 3: User receive an error: ”Error message: The combination 3800---- is not valid for the account

structure Account structure – cee” ............................................................................................................ 24

Useful scripts and jobs ................................................................................................................................ 24

SQL Script 1: Identify all tax transactions that does not have corresponding

TaxTransGeneralJournalAccountEntry.................................................................................................... 24

SQL Script 2: Identify all tax transactions with source document line recID, but this source document

line does not exist. .................................................................................................................................. 25

AX JOB: Change the TaxPeriod for specific tax transactions................................................................... 25

Possible issues with sales tax payment

a. Error message: “Account number for transaction type Sales tax does not exist”

b. Difference between sales tax payment voucher and report and in connection in account balance

Pre-research

Existing fixes for similar problems or issues that can effect on the Sales tax payment feature

KB

article

Version

Title

2731462

AX 2012 RTM

Sales Tax Payment voucher displays wrong values when purchase order amounts and invoice amounts are different

2779549

AX 2012 R2

Voucher posted in the Sales tax payment process is not complete

2779549

AX 2012 RTM

2839138

AX 2012 RTM

2839138

AX 2012 R2

Voucher posted in Sales tax payment process is incorrect, but the report generated is correct

VAT payment transaction is posted incorrectly when sales tax code is set with a currency that is different than the

company currency

VAT payment transaction is posted incorrectly when sales tax code is set with a currency that is different than the

company currency

2861718

AX 2012 R2

2861650

AX 2012 RTM

2861650

AX 2012 R2

Payment journal cannot be posted due to error, "Account number for transaction type Sales tax does not exist"

Sales tax payment voucher is generated with incorrect amount when purchase order line price is changed after

product receipt and cash discount is obtained with payment

Sales tax payment voucher is generated with incorrect amount when purchase order line price is changed after

product receipt and cash discount is obtained with payment

2705859

AX 2012 RTM

Printing the Sales tax payment report, receive error “Account number for transaction type Sales tax does not exist”

2963585

AX 2012 R2

Tax payment and account structure modification

2963585

AX 2012 R3

2949604

AX 2012 R2

2949604

AX 2012 R3

Tax payment and account structure modification

Sales tax payment voucher is not generated when tax code field ‘Pct. Exempt from sales tax’ is set 100 and use tax

is posted

Sales tax payment voucher is not generated when tax code field ‘Pct. Exempt from sales tax’ is set 100 and use tax

is posted

2954023

AX 2012 R2

Sales tax payment in reporting currency

2954023

AX 2012 R3

Sales tax payment in reporting currency

2940211

AX 2012 R2

Sales tax payment report shows updated transactions also in following periods

3008738

AX 2012 R2

3008738

AX 2012 R2

2986812

AX 2012 RTM

2986812

AX 2012 R2

2986812

AX 2012 R3

Not able to post sales tax payment due to error: Account number for transaction type Sales tax does not exist.

Sales tax payment voucher does not create the settlement tax transactions if vendor invoice is tax free and invoice

is posted in journal

If Vendor invoice is deleted in purchase history source document header is deleted and the link with

AccountingDistribution is lost

If Vendor invoice is deleted in purchase history source document header is deleted and the link with

AccountingDistribution is lost

If Vendor invoice is deleted in purchase history source document header is deleted and the link with

AccountingDistribution is lost

2878451

AX 2012 R2

2852396

AX 2012 RTM

2852396

AX 2012 R2

Able to delete posted free text invoice

Purchase order with sales tax code = 0% have no connection between tables TaxTrans and

TaxTransGeneralJournalAccountEntry’

Purchase order with sales tax code = 0% have no connection between tables TaxTrans and

TaxTransGeneralJournalAccountEntry’

Troubleshooting example 1: User get error message during sales tax

payment run: “Account number for transaction type Sales tax does not

exist”

Step 0: Pre-requirements

1.

2.

3.

4.

5.

Full compilation

Full CIL generation

Database synchronization

Re-indexing (optional)

Reset usage data and restart AOS

Step 1: Checking setup

1. Posting profile setup

2. Ledger account and posting type

3. All accounts need to be in account structure

Step 2: Identify the transaction(s)

During settlement period, Customer is posting thousands of transactions and identifying which one is

causing the problem during debugging or analyzing the data is difficult or even impossible.

To minimize the number of records, please follow such procedure on TEST application:

1. GL > Setup > Sales tax > Sales tax settlement periods >

1.1. If current settlement periods have period interval set to Months and number of unit is set to

more than 1, change it to 1 and create periods for each month.

1.1.1.Now, run the report and identify the month where the issue occurs.

1.2. If current settlement periods have period interval set to Months and number of unit is set to 1,

change the period interval to Days and select number of units: 5 and create periods for each 5

days for specific month where the issue occurs:

1.2.1 Run the report for each 5 days period and locate the first period where the issue occurs.

1.3 If current settlement periods have period interval set to Days and number of unit is set to 5,

change the number of units to 1 and create periods for each 1 day for specific month where the

issue occurs:

1.3.1 Next run the sales tax payment for each day and locate days where the issue occurs.

1.4 Review the transaction for the days that has been identified in previous steps.

1.4.1 Check posted sales tax transaction in General Ledger > Inquires > Tax > Posted sales tax

1.5 Create new settlement period i.e. TEST for the same period interval (Days) and Number of units

(1).

1.6 For the transactions posted in the first identified day, change the tax period.

1.6.1 Option 1: Manually

1.6.1.1 Open developer workspace go to AOT> Data Dictionary >Tables > select TaxTrans > field:

TaxPeriod - change the properties: AllowEdit and AllowEditOnCreate to YES and save

changes

1.6.1.2 Open table TaxTrans > search for all transactions posted on identified day (field

TransDate) and change the TaxPeriod to “TEST” but just for few, i.e. on all with specific

Tax Code or where the source is the same (sales order, voucher, purchase order, free text

invoice, …) or tax origin (sales tax, cash discount)

1.6.2 Option 2: Tax period modified by script

1.6.2.1 Open developer workspace > AOT > Jobs > create new and write code

1.6.2.2 Run it and check the results

Result can be checked in TaxTrans table

1.7 Run again the sales tax payment for the “old” settlement period for the same day and check if the

issue still exist.

1.8 If issue occurs, repeat step 1.6 (1 or 2) for next part of transactions posted on the identified day

1.9 If the issue disappear, proceed with below:

1.9.1 Export the transactions to excel just to remember them

1.9.2 Change back the setup and set “TEST” tax period for first one and run the sales tax payment

for “Test” period

Hint: To do not create new settlement period each time when it will be posted, we can just modify data

in Table > TaxReportPeriod

Change on the field ”Closed” and “VersionNum” the properties “AllowEdit” and “AllowEditOnCreate” to

YES

Open the TaxReportPeriod table and unmark checkbox in Closed column and change version form 1 to 0

On “TEST” TaxPeriod

After change:

Step 3: Identify the scenario

After identifying transaction, we have to find out how this transaction has been created.

In my example, the issue is coming from the voucher 140000003_042 where taxOrigin is set to cash

discount

1. Open General ledger > Inquires > Voucher transaction > filter by the voucher number

1.1. Check the transaction origin

1.2. Check vendor transaction and history on voucher

Offset voucher for invoice

Offset voucher for second is connected with credit note

Conclusion: Voucher for tax cash discount was created after settling invoice with credit note.

1.3. Review the invoice and credit note and find out how it was created

Invoice:

Credit note

Conclusion: It’s a purchase order invoice and credit note

Step 4: Reproduce on customize environment

Try to create the same transactions, invoice and credit note and settle them. Cash discount voucher

should be created.

Run the sales tax payment

Step 5: Reproduce on standard environment

If we can reproduce the issue on customer database, we can try to do it in the same way on standard.

Note: Make sure to check the most important parameters

Note: Make sure that we test it on the same build number at first

Example 2: Sales tax payment voucher is not equal to the posted sales

tax transactions

Trial Balance before sales tax payment:

Sales tax payment voucher > Totals on voucher are not equal posted sales tax transactions

VAT19

inVat19

EUS

EU19

Account posting

-89.44

-290.55

0.00

-54.95

3800

233.55

3805

89.44

3803

54.95

Difference is 290.55 – 233.55 = 57.00

Trial Balance after sales tax payment > Balance on account 3800 is 57.00

Step 0: Pre-requirements

1.

2.

3.

4.

5.

Full compilation

Full CIL generation

Database synchronization

Re-indexing (optional)

Reset usage data and restart AOS

Step 1: Checking setup

1. Posting profile setup

2. Ledger account and posting type

3. All accounts need to be in account structure

Step 2: Identify the transaction(s)

During settlement period, Customer is posting thousands of transactions and identifying which one is

causing the problem is difficult or even impossible during debugging or analyzing the data.

To minimize the number of records, please follow such procedure on TEST application:

1. Developer workspace > AOT > Tables > TaxReportPeriod >

1.1 Change on fields ”Closed” and “VersionNum” the properties “AllowEdit” and “AllowEditOnCreate”

from NO to YES

Save changes

1.2 Open table and find the period where the issue occurs

1.2.1

1.2.2

Change the Closed from TRUE to FALSE

Change VersionNum from 1 to 0

Save it and close the table

2. GL > Setup > Sales tax > Sales tax settlement periods >

2.1. If current settlement periods have period interval set to Months and number of unit is set to

more than 1, change it to 1 and create periods for each month.

2.1.1.Now, run the report and identify the month where the issue occurs.

2.2. If current settlement periods have period interval set to Months and number of unit is set to 1,

change the period interval to Days and select number of units: 5 and create periods for each 5

days for specific month where the issue occurs:

Current:

After change:

1.2.3

Run the report for each 5 days period and locate the first period where the issue occurs.

In out example, the issue occurs in period 10/11 till 10/15

1.3 If current settlement periods have period interval set to Days and number of unit is set to 5, change

the number of units to 1 and create periods for each 1 day for specific month where the issue

occurs.

Note: In our example we have transaction posted on 15th of October, so no need to run this step.

1.3.1 Next run the sales tax payment for each day and locate days where the issue occurs.

1.4 Review the transaction for the days that has been identified in previous steps.

We have just two transactions, so it’s easy to identify which one is causing wrong ledger transaction

1.4.1 Check posted sales tax transaction in General Ledger > Inquires > Tax > Posted sales tax

1.5 Create new settlement period i.e. TEST for the same period interval (Days) and Number of units (1).

1.6 For the transactions posted in the first identified day, change the tax period.

1.6.1 Option 1: Manually

1.6.1.1 Open developer workspace go to AOT> Data Dictionary >Tables > select TaxTrans > field:

TaxPeriod - change the properties: AllowEdit and AllowEditOnCreate to YES and save changes

1.6.1.2 Open table TaxTrans > search for all transactions posted on identified day (field TransDate) and

change the TaxPeriod to “TEST” but just for few, i.e. on all with specific Tax Code or where the

source is the same (sales order, voucher, purchase order, free text invoice, …) or tax origin (sales

tax, cash discount)

1.6.2 Option 2: Tax period modified by script

1.6.2.1 Open developer workspace > AOT > Jobs > create new and write code

1.6.2.2 Run it and check the results

Result can be checked in TaxTrans table

1.7 Run again the sales tax payment for the “old” settlement period and check if the issue still exist.

Note: Need to repeat step 1.2

Note 2: Need to reset the period interval on “old” settlement period

Sales tax payment voucher for ALL other transaction:

Result: Voucher is equal to posted sales tax transactions:

VAT19

inVat19

EUS

EU19

Account posting

3800

3805

3803

-89.44

-233.55

0.00

-54.95

233.55

89.44

54.95

1.8 If issue occurs, repeat step 1.6 (1 or 2) for next part of transactions posted on the identified day

1.9 If the issue disappear, proceed with below:

1.9.1 Export the transactions to excel just to remember them – transaction with TaxPeriod set to TEST

1.9.2 Change back the setup on all other transactions ad leave “TEST” tax period for first one and run

the sales tax payment for “Test” period

1.9.3 Repeat above step till we identify first transactions that is causing the issue for transactions that

we saved in Excel

Hint: To do not create new settlement period each time when it will be posted, we can just modify data

in Table > TaxReportPeriod (Step 1.2)

Step 3: Identify the scenario

After identifying transaction, we have to find out how this transaction has been created.

In our example, the issue is coming from the voucher 110000007_061 where source is set to Purchase

order

2. Open General ledger > Inquires > Voucher transaction > filter by the voucher number

2.1. Check the transaction origin

2.2. Check the invoice journal

AP > Inquires > Journals > Invoice journal > find our voucher

Result: The view distribution and subledger entries is disabled

2.3. Click on posted sales tax and subledger entries

Result: Stack trance error

Conclusion: There are missing accounting distribution records for sales tax transaction

Step 4: Reproduce on customize environment

Try to create the same Purchase order and run the sales tax payment, but just for this transaction.

This can be done by changing the TaxPeriod

Step 5: Reproduce on standard environment

If we can reproduce the issue on customer database, we can try to do it in the same way on standard.

Note: Make sure to check the most important parameters

Note: Make sure that we test it on the same build number at first

Step 6: Not able to repro on customer application

In our example, the issue could not be repro because the accounting distribution exist.

Research in VKB and TFS and find KB 2986812 “If Vendor invoice is deleted in purchase history source

document header is deleted and the link with AccountingDistribution is lost”

Similar issue has been found for Free text invoice -> KB 2878451 “Able to delete posted free text invoice”

Review AP > Inquires > History > Invoice history and matching details and confirm that the PO has been

deleted from this form:

Missing voucher: 110000007_061

With this information we can try to reproduce the scenario:

1. Create PO

2. Delete PO from Invoice history and matching details (before fix KB 2986812)

3. Run the sales tax payment

Example 3: User receive an error: ”Error message: The combination

3800---- is not valid for the account structure Account structure – cee”

With the same procedure, we identify that the issue was coming from the voucher where tax amount

was equal to 0,00.

The root cause was connected with missing TaxTransGeneralJournalAccount entries to this TaxTrans.

This has been fixed under KB 2852396

Useful scripts and jobs

SQL Script 1: Identify all tax transactions that does not have corresponding

TaxTransGeneralJournalAccountEntry

select distinct

voucher,TRANSDATE,source,taxtrans.DATAAREAID,TAXTRANSGENERALJOURNALACCOUNTENTRY.TAXTR

ANS from TAXTRANS

left outer join TAXTRANSGENERALJOURNALACCOUNTENTRY

on taxtrans.RECID = TAXTRANSGENERALJOURNALACCOUNTENTRY.taxtrans

where TAXTRANSGENERALJOURNALACCOUNTENTRY.TAXTRANS is null

and TAXTRANS.TAXAMOUNT != '0'

order by taxtrans.DATAAREAID

Note: Highlighted lines can be change for amount that is equal to 0,00 KB 2852396

Note 2: In case of KB 2852396, in above script we can add “and TAXTRANS.Source = 1” or “and

TAXTRANS.Source = 5” because it applies to free text invoices and purchases orders

SQL Script 2: Identify all tax transactions with source document line recID, but this source

document line does not exist.

select TAXTRANS.VOUCHER,TRANSDATE,TAXTRANS.TAXAMOUNT, TAXTRANS.TAXCODE,

TAXTRANS.SOURCEDOCUMENTLINE, TAXTRANS.RECID, TaxTRans.SOURCE from TAXTRANS

left outer join SOURCEDOCUMENTLINE

on TAXTRANS.SOURCEDOCUMENTLINE = SOURCEDOCUMENTLINE.RECID

WHERE SOURCEDOCUMENTLINE.RECID IS NULL

AND TAXTRANS.SOURCEDOCUMENTLINE != 0

and TaxTRans.TAXAMOUNT != 0

AND TAXTRANS.TRANSDATE between '10/01/2013' and '10/05/2013'

order by taxtrans.RECID

Note: Highlighted lines can be change for specific period

AX JOB: Change the TaxPeriod for specific tax transactions

static void TaxPeriod(Args _args)

{

TaxTrans

TaxTrans;

;

ttsBegin;

while select forUpdate TaxTrans

where TaxTrans.TaxCode == "InVAT19" &&

TaxTrans.TaxOrigin == TaxOrigin::CashDisc &&

TaxTrans.TransDate == mkDate(08,10,2014)

{

TaxTrans.TaxPeriod = "TEST";

TaxTrans.update();

}

Box::info("Done");

ttsCommit;

}

“Microsoft provides programming examples for illustration only, without warranty either

expressed or implied, including, but not limited to, the implied warranties of merchantability

or fitness for a particular purpose. This mail message assumes that you are familiar with the

programming language that is being demonstrated and the tools that are used to create and

debug procedures."