Institute of International Bankers

advertisement

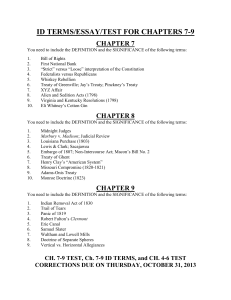

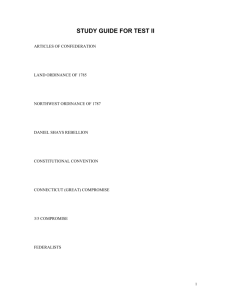

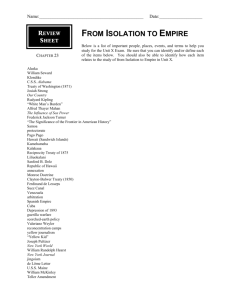

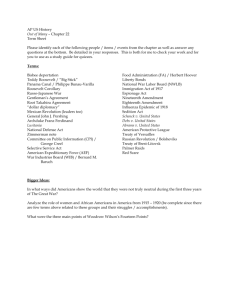

Institute of International Bankers Tax Treaty Developments & The New U.S. Model Income Tax Treaty Tuesday - June 19, 2007 10:45 - 11:45 AM Daniel J. Raimondo HSBC Securities (USA) Inc. Benedetta Kissel Internal Revenue Service Peter Connors Orrick, Herrington & Sutcliffe LLP Willard Taylor Sullivan & Cromwell LLP Recent treaty developments • Issuance of new Model treaty in November of 2006, together with technical explanation • Replaces the 1996 Model, which in turn had been preceded by Models going back to 1977 2 Recent treaty developments • Pending – protocols with Denmark, Finland, and Germany – Treaty with Belgium • Announced agreements with Iceland, Bulgaria • Protocol to the Canadian treaty 3 Recent treaty developments • Protocols with Denmark, Finland, and Germany, and new treaty with Belgium provide – A zero rate on parent-subsidiary dividends, on dividends paid to pension plans and of branch profits – New limitation on benefits articles • Agreements with Germany and Belgium also provide – Authorized OECD approach for attribution of profits to a permanent establishment – Binding arbitration 4 Specific Issues under 2006 Model Treaty – “Consistency” • The “consistency” doctrine – i.e., that a foreign taxpayer may not choose to apply the business profits article of the treaty to some US operations and the “effectively connected” rules in the Code to others 5 Specific Issues under 2006 Model Treaty – “Consistency” • For example, suppose that a foreign corporation has – activities that amount to a trade or business in the US but not a permanent establishment and – separately, employees and an office in New York that actively trade stocks and securities and commodities • May the foreign corporation use the treaty to avoid US tax on the activities but Section 864(b)(2 ) to avoid US tax on the trading income? • What’s the legal basis for requiring “consistency”? – Is there something more than Rev. Rul. 84-17? 6 Specific Issues under 2006 Model Treaty – Attribution of Profits • How do the Model’s rules for attributing profits to a permanent establishment differ from the determination of “effectively connected” income under the Code? – Suppose a foreign bank has employees in a New York branch who, working hand and glove with employees in a foreign branch enter into notional principal contracts with customers • Under the “material factor” rules in the Section 864 regulations, all of the income would be “effectively connected”, absent an APA (or the adoption of the global dealing regulations) 7 Specific Issues under 2006 Model Treaty – Attribution of Profits • Under the OECD guidelines, which seem to be incorporated in the Model treaty, attribution would assume that the branch was functionally a separate entity and determine the income on the basis of an arm’s length allocation – Is this self-executing? – Is there any need in such a case for an APA or for the global dealing regulations? 8 Specific Issues under 2006 Model Treaty – “Risk weighting” • The Model treaty contemplates that banks and other financial institutions may elect to use “riskweighting” to determine US assets and thus deductible interest expense and branch profits – In a number of treaties today (e.g., UK, Japan) and also in the German protocol – Not in others – e.g., Switzerland, the Netherlands – Is risk-weighting self-executing? Will there be guidance? 9 Specific Issues under 2006 Model Treaty-Payments to Hybrids •Section 894 – Reduced rate of any withholding tax imposed will not be available “on an item of income derived through an entity which is treated as a partnership (or is otherwise treated as fiscally transparent) for purposes of this title if….such item is not treated for purposes of the taxation laws of such foreign country as an item of income of such person” •Article 1(6) – An item of income, profit or gain derived through an entity that is fiscally transparent under the laws of either Contracting State shall be considered to be derived by a resident of a State to the extent that the item is treated for purposes of the taxation law of such Contracting State as the income, profit or gain of a resident. 10 Specific Issues under 2006 Model Treaty-Payments to Hybrids Country A Co Transparent for US purposes, but not for Country A purposes LLC USCO Treaty benefits will not be available since LLC is not transparent for Country A purposes 11 Specific Issues under 2006 Model Treaty-Payments to Hybrids Country A Co Transparent for US purposes, but not for Country A purposes LLC USCO Assume LLC is engaged in a trade or business but has no PE, does the Article 1(6) limit application to nonFDAP Income? 12 Specific Issues under 2006 Model Treaty-Dividends to Hybrids • Article 10: If the dividends are beneficially owned by a resident of the other Contracting State, except as otherwise provided, the tax so charged shall not exceed: • a) 5 percent of the gross amount of the dividends if the beneficial owner is a company that owns directly at least 10 percent of the voting stock of the company paying the dividends • How do you determine application of beneficial owner and direct test? – See LTR 200712007 (application of direct ownership test under UK treaty) 13 Specific Issues under 2006 Model Treaty-Dividends to Hybrids Country A (treaty) Transparent for Country A and US purposes Country B Dividends USCO •Alternative: What if transparent for US purposes, but not for Country A purposes? 14 Specific Issues under 2006 Model Treaty-Article 10-Reverse Hybrid Country A (treaty) Country B (Non-treaty) USCO •Article 10 not satisfied •Article 1(6) satisfied 15 Specific Issues under 2006 Model Treaty • Other items – Model does not offer a zero rate on parentsubsidiary dividends – TE lists guarantee fees as a type of income constituting “Other Income” – Model does not contemplate binding arbitration 16