Chapter 9 - Productivity Commission

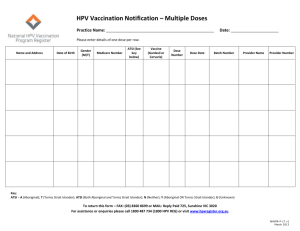

advertisement