Ch13_MoneyBanking

advertisement

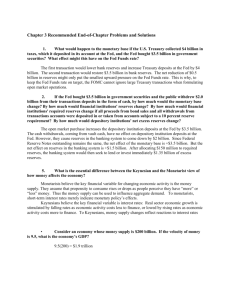

Ch 13 Recite the three functions of money and recognize which function is being illustrated List the and describe the items included in M1 and M2 Outline the structure of the Fed Solve answers to mathematical problems about banks’ creation of money List the tools used by the Fed to control the economy Money is whatever is generally accepted in exchange for goods and services – accepted not as an object to be consumed but as an object that represents a temporary abode of purchasing power to be used for buying still other goods and services. --Milton Friedman You can buy something with it You can save it You can compare values and cost These are the three functions of money Medium of exchange – an asset that is used to buy and sell goods or services Without a medium of exchange, barter When you use $5 cash to pay for a foot-long Commodities are often inconvenient mediums of exchange ◦ Examples: gold, silver, cigarettes ◦ Heavy, dangerous, uncertain purity levels Store of Value – an item people can use to transfer purchasing power from the present to the future When you put money aside each month to save for spring break Liquid Asset – can be easily converted into money w/o loss of value Houses are a store of value, not liquid Bonds are liquid, not mediums of exchange Currency and checking accounts are liquid and mediums of exchange Inflation reduces money value Causes money to cease being a store of value Unit of account – the unit of measurement people use to post prices and keep track of revenues and costs When you use dollar prices to compare costs $5 $5 Money that has neither intrinsic value nor the backing of a commodity with intrinsic value Paper currency of most countries Fiat money has value because of ◦ We trust that it’s valuable ◦ It is scarce M1 – the sum of currency, checkable deposits, travelers checks Demand deposits – non-interest earning checking deposits that depositors can access by writing a check (or using debit card) M2 – includes M1 plus savings deposits, time deposits less than $100,000, and money market mutual fund shares Money market mutual funds – interest earning accounts that pool depositors funds and invest them in highly liquid short-term securities. Because these securities can be quickly converted to cash, depositors are permitted to write checks (which reduce their shareholdings) against their accounts Credit ◦ Funds acquired by borrowing ◦ A liability Money is an asset Match borrowers with savers Profitable projects promote economic growth Banking system includes savings and loan associations, credit unions, commercial banks Institution designed to oversee the banking system and regulate the amount of money in the economy. U.S. central bank is the Federal Reserve System (The Fed) Liabilities: deposits, borrowings Assets: vault cash, securities, loans Liabilities are payable on demand! Bank reserves – vault cash plus deposits of banks with Federal Reserve banks Fractional reserve banking – allows banks to hold reserves of less than 100% against deposits Required reserves – the minimum amount that a bank is required to keep on had to back up deposits Fractional reserve banking increases the money supply Guarantees deposits up to $250,000 Failures ◦ 10,000 during Great Depression ◦ 200 during most recent recession Pros: no more bank runs Cons: no incentive for depositors to monitor Required reserve ratio – the ratio of reserves that banks are required to maintain in their vaults Excess reserves – actual reserves that exceed the legal requirement Deposit expansion multiplier ◦ maximum potential increase in the money supply as new reserves are injected 1 𝑝𝑜𝑡𝑒𝑛𝑡𝑖𝑎𝑙 𝑑𝑒𝑝𝑜𝑠𝑖𝑡 𝑒𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛 𝑚𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟 = 𝑟𝑒𝑞𝑢𝑖𝑟𝑒𝑑 𝑟𝑒𝑠𝑒𝑟𝑣𝑒 𝑟𝑎𝑡𝑖𝑜 Actual deposit multiplier will be smaller than the potential because ◦ Some people hold currency. ◦ Banks hold excess reserves. Monetary policy – control of the money supply by the Fed Expansionary monetary policy – increasing the money supply Restrictive monetary policy – decreasing the money supply 1. Change reserve requirements 2. *Open market operations* (buying and selling gov’t securities and other financial assets) 3. Extend loans to banks and other institutions 4. Change interest rate on funds held as reserves Lowering the reserve requirement increases the money supply Increasing the reserve requirement decreases the money supply Crisis of 2008 ◦ Before: most banks held very little excess reserves ◦ After: banks hold excess reserves Open market operations – buying and selling of U.S. securities (bonds) and other financial assets ◦ Buying bonds increases the money supply ◦ Selling bonds decreases the money supply Crisis of 2008 ◦ Before: Only U.S. treasury securities ◦ After: Corporate bonds, commercial paper, mortgage-backed securities Discount rate Federal funds rate ◦ The interest rate the Fed charges banks for loans ◦ Usually short term – days /weeks ◦ The interest rate that banks charge banks for loans ◦ Usually short term – days /weeks Lowering these interest rates increases the money supply Increasing these interest rates decreases the money supply Crisis of 2008 ◦ Before: Only short-term discount rate loans to member banks ◦ After: longer-term loans to other companies (insurance, brokerage) Lowering the interest payments on reserves held at the Fed increases the money supply Increasing the interest payments on reserves held at the Fed decreases the money supply Crisis of 2008 ◦ Before: Fed did not pay interest on reserves ◦ After: Fed has been paying rate about equal to federal funds rate Policy Expansionary Monetary Policy Restrictive Monetary Policy Reserve requirements Lower Increase Open market operations Buy bonds and other assets Sell bonds and other assets Extend loans More loans, Lower discount rate Fewer loans, Increase discount rate Pay interest on excess bank reserves Lower interest payments Increase interest payments 2008: QE1 ◦ Assets rise from $923 billion to $2.1 trillion ◦ Fed buys mortgage-backed securities ◦ Extends loans 2010: QE2 ◦ Assets rise to $2.9 trillion ◦ Fed buys treasury securities 2012: QE3 ◦ Assets rise to $3.4 trillion ◦ Fed buys treasury and mortgage-backed securities Monetary base = currency + bank reserves 1990 – 2007 ◦ Monetary base approximately equal currency + required reserves ◦ Excess reserves are near zero 2008 and beyond ◦ Monetary base grows rapidly ◦ Money supply grows more slowly than monetary base ◦ Because banks increase excess reserves Banks don’t want to give risky loans Demand for low-risk loans is weak If banks reduce excess reserves and Fed does not reduce monetary base, high inflation will occur The Fed The Treasury Issue Bonds? No Yes Buy/sell bonds? Buys and sells bonds to control the money supply Sells bonds to finance government budget deficits Control the money Yes supply? No Objective? Controlling the money supply Financing government deficits Create money? Creates money out of thin air by writing a check on itself No Recite the three functions of money and recognize which function is being illustrated List the and describe the items included in M1 and M2 Outline the structure of the Fed Solve answers to mathematical problems about banks’ creation of money List the tools used by the Fed to control the economy