GLOBAL MARKET ENTRY STRATEGIES Chapter Nine

advertisement

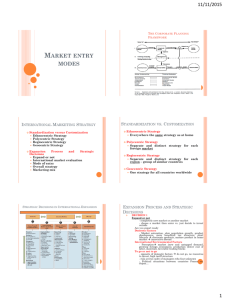

International Marketing Management Foreign Market Entry Strategies 1 Overview 1. Target Market Selection 2. Choosing the Mode of Entry 3. Exporting 4. Licensing 5. Franchising 6. Contract Manufacturing 7. Joint Ventures 8. Wholly Owned Subsidiaries 9. Strategic Alliances 10. Timing of Entry 11. Exit Strategies 2 Introduction The need for a solid market entry decision is an integral part of a global market entry strategy. Entry decisions will heavily influence the firm’s other marketing-mix decisions. Global marketers have to make a multitude of decisions regarding the entry mode which may include: – (1) the target product/market – (2) the goals of the target markets – (3) the mode of entry – (4) The time of entry – (5) A marketing-mix plan – (6) A control system to check the performance markets in the entered 3 1. Selecting the Target Market A crucial step in developing a global expansion strategy is the selection of potential target markets (see Exhibit 9-1 for the entry decision process). A four-step procedure for the initial screening process: 1. Select indicators and collect data 2. Determine importance of country indicators 3. Rate the countries in the pool on each indicator 4. Compute overall score for each country 4 1. Selecting the Target Market Chapter 9 Copyright (c) 2007 John Wiley & Sons, Inc. 5 2. Choosing the Mode of Entry Decision Criteria for Mode of Entry: – Market Size and Growth – Risk – Government Regulations – Competitive Environment/Cultural Distance – Local Infrastructure . 6 2. Choosing the Mode of Entry 7 2. Choosing the Mode of Entry 8 2. Choosing the Mode of Entry – – – – Classification of Markets: – Platform Countries (Singapore & Hong Kong) – Emerging Countries (Vietnam & the Philippines) – Growth Countries (China & India) – Maturing and established countries (examples: South Korea, Taiwan & Japan) Company Objectives Need for Control Internal Resources, Assets and Capabilities Flexibility 9 2. Choosing the Mode of Entry Mode of Entry Choice: A Transaction Cost Explanation – Regarding entry modes, companies normally face a tradeoff between the benefits of increased control and the costs of resource commitment and risk. – Transaction Cost Analysis (TCA) perspective – Transaction-Specific Assets (assets valuable for a very narrow range of applications) 10 3. Exporting Indirect Exporting – Export merchants – Export agents – Export management companies (EMC) Cooperative Exporting – Piggyback Exporting Direct Exporting – Firms set up their own exporting departments 11 4. Licensing Licensor and the licensee Benefits: – Appealing to small companies that lack resources – Faster access to the market – Rapid penetration of the global markets Caveats: – Other entry mode choices may be affected – Licensee may not be committed – Lack of enthusiasm on the part of a licensee – Biggest danger is the risk of opportunism – Licensee may become a future competitor 12 5. Franchising Franchisor and the franchisee Master franchising Benefits: – Overseas expansion with a minimum investment – Franchisees’ profits tied to their efforts – Availability of local franchisees’ knowledge Caveats: – Revenues may not be adequate – Availability of a master franchisee – Limited franchising opportunities overseas – Lack of control over the franchisees’ operations – Problem in performance standards – Cultural problems – Physical proximity 13 5. Franchising Chapter 9 Copyright (c) 2007 John Wiley & Sons, Inc. 14 6. Contract Manufacturing (Outsourcing) Benefits: – Labor cost advantages – Savings via taxation, lower energy costs, raw materials, and overheads – Lower political and economic risk – Quicker access to markets Caveats: – Contract manufacturer may become a future competitor – Lower productivity standards – Backlash from the company’s home-market employees regarding HR and labor issues – Issues of quality and production standards 15 6. Contract Manufacturing (Outsourcing) Qualities of an ideal subcontractor: – Flexible/geared toward just-in-time delivery – Able to meet quality standards – Solid financial footings – Able to integrate with company’s business – Must have contingency plans 16 7. Expanding through Joint Ventures Cooperative joint venture Equity joint venture Benefits: – Higher rate of return and more control over the operations – Creation of synergy – Sharing of resources – Access to distribution network – Contact with local suppliers and government officials 17 7. Expanding through Joint Ventures Caveats: – Lack of control – Lack of trust – Conflicts arising over matters such as strategies, resource allocation, transfer pricing, ownership of critical assets like technologies and brand names 18 7. Expanding through Joint Ventures Drivers Behind Successful International Joint Ventures : – Pick the right partner – Establish clear objectives from the beginning – Bridge cultural gaps – Gain top managerial commitment and respect – Use incremental approach – Create a launch team during the launch phase: – (1) Build and maintain strategic alignment – (2) Create a governance system – (3) Manage the economic interdependencies – (4) Build the organization for the joint venture . 19 8. Entering New Markets through Wholly Owned Subsidiaries Acquisitions Greenfield Operations Benefits: – Greater control and higher profits – Strong commitment to the local market on the part of companies – Allows the investor to manage and control marketing, production, and sourcing decisions 20 8. Entering New Markets through Wholly Owned Subsidiaries Caveats: – Risks of full ownership – Developing a foreign presence without the support of a third part – Risk of nationalization – Issues of cultural and economic sovereignty of the host country . 21 8. Entering New Markets through Wholly Owned Subsidiaries Acquisitions and Mergers – Quick access to the local market – Good way to get access to the local brands Greenfield Operations – Offer the company more flexibility than acquisitions in the areas of human resources, suppliers, logistics, plant layout, and manufacturing technology. . 22 9. Creating Strategic Alliances Types of Strategic Alliances – Simple licensing agreements between two partners – Market-based alliances – Operations and logistics alliances – Operations-based alliances 23 9. Creating Strategic Alliances The Logic Behind Strategic Alliances – Defend – Catch-Up – Remain – Restructure 24 9. Creating Strategic Alliances . 25 9. Creating Strategic Alliances Cross-Border Alliances that Succeed: – Alliances between strong and weak partners seldom work. – Autonomy and flexibility – Equal ownership 26 9. Creating Strategic Alliances – Other factors: Commitment and support of the top of the partners’ organizations Strong alliance managers are the key Alliances between partners that are related in terms of products, technologies, and markets Have similar cultures, assets sizes and venturing experience Tend to start on a narrow basis and broaden over time A shared vision on goals and mutual benefits . 27 10. Timing of Entry International market entry decisions should also cover the following timing-of-entry issues: – When should the firm enter a foreign market? – Other important factors include: level of international experience, firm size – Also, the broader the scope of products and services – Mode of entry issues, market knowledge, various economic attractiveness variables, etc. 28 10. Timing of Entry Reasons for exit: – Sustained losses – Volatility – Premature entry – Ethical reasons – Intense competition – Resource reallocation 29 11. Exit Strategies Risks of exit: – Fixed costs of exit – Disposition of assets – Signal to other markets – Long-term opportunities Guidelines: – Contemplate and assess all options to salvage the foreign business – Incremental exit – Migrate customers . 30