theory of distribution of incomes

advertisement

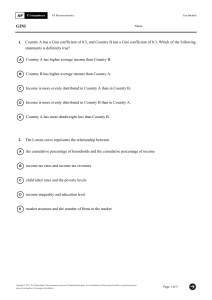

THEORY OF DISTRIBUTION OF INCOMES INCOME AND WEALTH INCOME – total amount of WEALTH – consists of the net money received by a person or household during a given time period (usually a year). Consists of: wages or labor earnings (about two-thirds of personal income), property income such as rents, interest, and dividends (particularly important for highincome groups), transfer payments or receipts from the government, such as social security or unemployment insurance. euro/crown value of assets owned at a point in time In a household’s wealth is included: tangible items (like houses, cars and other consumer durable goods, and land), financial assets (like cash, savings accounts, bonds, and stocks). INCOME COMPONENTS The total income of households can be divided into: labor income (YL), income from ownership of land and capital (YA, YK), income in the form of transfer payment (YT). Y = YL + YA + YK + YT Sources of Inequality in Labor Income abilities and skills intensity of work differences among occupations differences in education other factors – f. e. discrimination and exclusion from certain occupations, good/bad luck Inequalities in property income inheritance – many wealthy people inherited a great deal of their property from their parents or grandparents, savings – a recent study suggests that only a small fraction of personal wealth, perhaps 20 %, can be explained by lifecycle savings, risk taking (doing business) – entrepreneurship seems to be the surest route to great wealth. MEASUREMENT OF INEQUALITY how substantial is the dispersion of disposable incomes, and how the degree of inequality of income distribution can be measured explain diagram known as the LORENZ CURVE Lorenz curve depicts relationship between: complete equality, absolute inequality and actual inequality. Lorenz curve Percentage share of national income (cumulative) 100 80 Line of complete equality 60 40 Lorenz curve 20 O O 20 40 fig 60 Percentage of population 80 100 GINI COEFFICIENT further tool for measuring of inequality is so called Gini coefficient, which compares actual Lorenz curve with the ideal curve. Measures the difference between the area below the ideal Lorenz curve and the area below the actual Lorenz curve: G = A /A+B Gini coefficient can vary from 0 to 1. G = 1 – corresponds to extreme case of absolute inequality in incomes G = 0 – case of absolute equality in income distribution Lorenz curve and Gini coefficient 100 Percentage share of national income (cumulative) Gini coefficient = A / (A + B) 80 Line of complete equality 60 A 40 B Lorenz curve 20 O O 20 40 fig 60 Percentage of population 80 100 REDISTRIBUTION PROCESSES IN ECONOMY primary distribution - the income distribution (wages, interests, profits and rent) among the households that is result of market mechanism result of income redistribution is final distribution of income – income was increased by transfer payments (social security, unemployment insurance, pensions for elderly ..) and decreased by taxes, fines and other payments to state budget and other funds. THE EFFECT OF REDISTRIBUTION ON ECONOMIC ACTIVITY Administrative costs – there are always associated direct nonproductive (especially administrative) costs with redistribution The impact on working effort and entrepreneurship – redistribution processes often weaken the motives to work and taking risk by entrepreneurship Impact on savings and investment