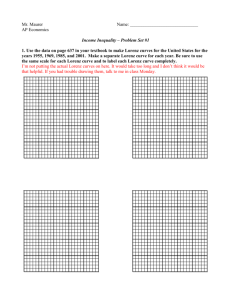

Mr. Maurer Name: ______________________________ AP Economics

advertisement

Mr. Maurer AP Economics Name: ______________________________ Income Inequality – Problem Set #1 1. Use the data on page 471 in your textbook to make Lorenz curves for the United States for the years 1995, 2000, 2005, and 2011. Make a separate Lorenz curve for each year. Be sure to use the same scale for each Lorenz curve and to label each Lorenz curve completely. Questions 2 – 8 refer to the Lorenz curve at left. Countries A and B are represented by the two curves. Letters X, Y, and Z represent enclosed areas. 2. What can you say about the relative distribution of income in Country A and Country B? 3. Which country has the higher Gini coefficient? 4. What does the straight diagonal line represent? 5. Represent Country A’s Gini coefficient in terms of X, Y, and Z. 6. Represent Country B’s Gini coefficient in terms of X, Y, and Z. 7. What is the Gini coefficient for the straight diagonal line? 8. Identify two tax policies that Country B could take to move its Lorenz curve more in line with Country A’s. Questions 9 - 11 refer to the income data below: Quintile Percentage of income Percentage of income before taxes and transfers income after taxes and transfers Lowest 20% 1.1 5.1 Second 20% 7.9 11.1 Third 20% 15.5 16.5 Fourth 20% 24.7 23.8 Highest 20% 50.7 43.5 9. This government’s tax and transfer policies generally shifted income away from which quintile(s) and to which quintile(s)? 10. What type of income tax system does this country probably have? Explain. 11. Would the Gini Coefficient for the country above be greater with or without this system taxes and transfers? Questions 12 – 15 are based on the Lorenz curve to the left, which represents the country of Jakeland. The letters X and Y represent enclosed areas. 12. If the area of X + Y is 100 square units and the area of X is 28 square units, what is the Gini coefficient for Jakeland? 13. If the area of X + Y is 100, and the Gini coefficient of Jakeland is .40, what is the area of X? 14. If Jakeland adopted a regressive income tax system, which significantly increased income inequality, what would happen to the area of Y? 15. Instead, assume that Jakeland adopts a very progressive income tax system, indicate on the diagram the likely change this would cause in the distribution of income in Jakeland (draw a new curve). 16. Plot the following income distribution data for both countries carefully on the same Lorenz curve below. Country X Country Y Quintile Percentage of income Percentage of income Lowest 20% Second 20% Third 20% Fourth 20% Highest 20% 5.0 11.8 17.0 23.1 43.0 4.1 9.2 14.1 20.9 51.7 Assume that the Gini coefficients for the two countries are .35 and .4. What is the Gini coefficient for each country?