options for raising capital - Rural Finance and Investment Learning

advertisement

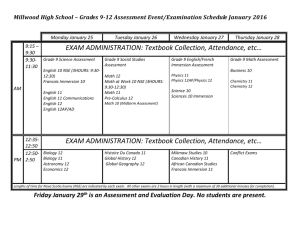

Commodities Exchange and Risk Mitigation: Options for Raising Capital A presentation by Mr. Jimnah Mbaru Chairman, Nairobi Stock Exchange Chairman, Dyer & Blair Investment Bank 17 October 2007 STRUCTURE OF PRESENTATION 1. Introduction 2. Structure of Nairobi Stock Exchange 3. NSE Performance 4. Drivers of NSE 5. Role of Commodities Exchange 6. Options for Raising Capital 7. Conclusion 8. Q&A (NSE) STRUCTURE OF THE NAIROBI STOCK EXCHANGE (NSE) • • • • • Established in 1954 as an overseas stock exchange through the London Stock Exchange NSE 20-share index established in 1966 & was managed by Dyer and Blair Ltd. Regulated by the Capital Markets Authority (CMA), which was established in 1989 Primary (IPOS) & Secondary (Trading) markets Part of the African Securities Exchange Association (ASEA), which aims to: Establish systematic corporation, Enhance sharing of information Development of harmonized market standards. STRUCTURE OF THE NSE Cont’d • • • • • • 74 government bonds 53 listed companies 6 corporate bonds 7 Licensed Investment Banks 11 Licensed Stockbrokers Market trading done through: 1954 – 1991: 1991 – Aug 2006: Since Sept 2006 : Callover System Open Outcry System Automated Trading System • Shares are traded in lots of 100 NSE Market Performance (A) Equities Primary Market (Kshs Million) Year Amount Raised Rights Issue Private Sector Privatization/IP O 1992 496.10 - 358.00 1993 62.48 - 62.48 1994 2,600.04 61.90 2,138.14 400.00 1995 124.00 - 102.00 22.00 1996 5,108.00 1,200.00 66.00 3,842.00 1997 1,944.60 1,500.00 276.6 168.00 1998 1,800.00 - 1,800.00 1999 - - - 2000 997.63 619.63 378.00 2001 1,155.00 30.00 1,125.00 2002 331.21 - 331.21 2003 - - - 2004 2,450.00 2,450.00 - 2005 2,011.00 2,011.00 - 2006 15,225.00 776.00 Sept 2007 3,080 1,319.55 13,129.45 800.00 2,280.00 NSE Market Performance B) Equities Secondary Market 94 95 96 97 98 99 00 01 02 03 04 05 06 07 Turnover (Kshs Bn) 3.08 3.33 3.9 6.15 4.58 5.15 3.63 3.09 2.92 15.25 22.3 36.5 95 57.6 Volume (Mn) 43 62 114 144 112 101 142 115 149 381 625 847 1,455 1,139 Market Cap. (Kshs Bn) 137 105.5 98.9 114.3 129 107 101.4 86.1 112 318 306 463 792 739 NSE Index 4,559 3,468 3,114 3,115 2,962 2,303 1,913 1,355 1,363 2,738 2,95 3,97 5,646 5,069 Liquidity (%) 2.76 3.43 3.85 5.73 3.74 5.12 3.71 2.9 3.6 8.52 7.3 7.9 12 13 20 00 20 01 20 02 20 03 20 04 20 05 20 0 M 6 ar -0 Ap 7 r-0 M 7 ay -0 Ju 7 n0 Ju 7 l-0 Au 7 gSe 07 p07 NSE Index Movement (2000-2007) NSE Index 2000-2007 6000 5000 4000 3000 2000 1000 0 NSE Performance (C) Bonds Primary/Secondary Market Bonds Issued/Trades (Kshs Bn) Primary Secondary 1996 0.86 0.86 1997 38.6 11.5 1998 47.3 8.22 1999 47.4 6.92 2000 25.1 5.88 2001 72.5 14.1 2002 71.2 33.6 2003 76.4 42.0 2004 91.4 34.1 2005 74.4 13.6 2006 76.7 48.6 2007 66.3 68.0 (A) Drivers of NSE: The Economy Vision 2030 geared towards growth GDP Growth 1st Qtr 2007 Expected Growth 2006 2005 2004 2003 2002 2001 2000 1999 7.00 6.00 5.00 4.00 3.00 2.00 1.00 0.00 (B) Drivers of NSE: Economic Monetary Cycle (C) Drivers of NSE - Technology Effects 800.0000 600.0000 400.0000 200.0000 Open Outcry 1991- Switch from Callover ATS SetUp CDS Activation 0.0000 Year 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 2.0% 0.0% % Liquidity 1,000.0000 De c De -91 cDe 9 2 c De -93 cDe 9 4 c De -95 c De -96 c De -97 c De -98 c De -99 c De -00 c De -01 c De -02 c De -03 c De -04 c De -05 c Au -06 g07 Capitalization (KES Billion) Market Capitalization and liquidity 1991-2007 (D) Drivers of NSE – Low Interest Rates •Low stable interest rates •Low cost of funding hence high corporate profitability n- 0 Ju 1 l-0 Ja 1 n0 Ju 2 l-0 Ja 2 n0 Ju 3 l-0 Ja 3 n0 Ju 4 l-0 Ja 4 n0 Ju 5 l-0 Ja 5 n0 Ju 6 l-0 Ja 6 n0 Ju 7 l-0 7 18.000 16.000 14.000 12.000 10.000 8.000 6.000 4.000 2.000 - Ja % Interest Rates Interest Rates 2001 -2007 Explanation to the low interest rates Kshs Billion Government Revenue and Deficit 2001-2006 800 700 600 500 400 300 200 100 0 1999 2000 2001 Domestic Debt Kshs 2002 2003 2004 GOVT REVENUE •Deficit financing through privatization 2005 Deficit 2006 (E) Other Factors influencing NSE Performance • • • • • • Increased corporate profitability Increased foreign exchange earnings – FDI Diaspora remittances estimated at Kshs 75Bn per annum ($1.2Bn) Increase in amounts held by institutions e.g. pension funds assets of Kshs 224Bn Increase in investment vehicles – unit trusts, mutual funds assets of 20Bn Increase in market participants to over 750,000 investors – KENGEN Role of Commodities Exchange Facilitates offsetting commodity transactions without impacting on physical goods until the expiry of a contract • Offers – Price transparency – Effective price discovery – Efficient risk management • Types – Commodities Futures Exchange – Spot Exchange • Market players – Producers, processors, warehouses – Buyers, speculators – Government, marketing agencies, banks Benefits to; • Farmers – Price discovery – Warehousing services – Warehouse receipts as collateral for loans • Traders – Access to bigger markets – Elimination of counterparty risks through guarantees – Better pricing because of high number of participants • Exporters – Quality products through a secured platform – Elimination of physical market procurement problems – Elimination of procurement agents fees Benefits to; • End Users – Ability to buy direct at competitive prices – Operational comfort - easy to access information – The exchange I s a single window system for procurement of various materials • The Exchange – Fair transparent prices for settlement of contracts – Arbitrage opportunities for investors – Long-term investors can buy physical commodities stored at warehouses and take advantage of offseason price rises Challenges for Multiple Commodities Exchange in Kenya (MCE) • • • Commodities controlled by Boards - heavily regulated Many small-scale producers- challenge on stability of client base In an environment of struggling institutions – cooperatives – Inefficiencies and mismanagement – Internal bureaucracies on elective posts and decision making process • • Conservative approach Partial liberalization of some commodities sectors (coffee) Options for Raising Capital (Players) • Private Equity/Capital – Private equity fund – Syndicated • Initial public offer - IPO • Demutualized commodities exchange – Nairobi Stock Exchange (NSE) – Over The Counter (OTC) • Listing Requirements • Corporate bonds – Plain vanilla bonds Options for Raising Capital (Players) • • Securitization – Commodities receipts backed bonds – Fees receivables backed bonds Syndicated loans – backed by physical commodities (Coffee exchange practice) Role Of Government In Setting Up The Exchange • • • • • One-off grant to start (Kshs 1 billion) Reforms in the producer sector Exchange income tax exempt until demutualized Provide warehousing (Subsidized) Plan a regulatory body for commodities Conclusion • • • • Possible to raise funds through NSE Reforms essential for successful MCE in Kenya MCE way forward Government cooperation and support essential Q&A THANK YOU 10th Floor, Loita House, Loita Street P.O. Box 45396-00100 Nairobi, Kenya Tel: +254-2-3240000 Fax: +254-20-3240114 Website: www.dyerandblair.com