Pradeep Jethi

advertisement

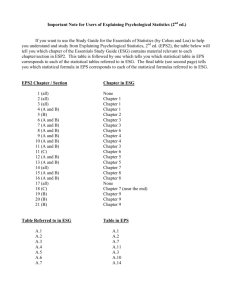

Innovative financing for social enterprises The Social Stock Exchange 1 Disclaimer This Presentation is provided for information purposes only by the Social Stock Exchange (“SSE”) which is not authorised by the FCA or operating as a Recognised Investment Exchange (RIE) and does not constitute an offer to sell or an invitation or solicitation of an offer to buy any security. SSE makes no representation or warranty as to the accuracy, reliability, or completeness of any of the information contained in this Presentation, and said information may not be relied upon in connection with any investment or listing decision. This Presentation is provided on a confidential basis and may not be copied, reproduced, distributed, disclosed or published, in whole or in part, to any person for any purpose whatsoever without the prior written consent of SSE. 2 Impact Investing Defined an investment approach seeking regulated securities whether private or public intentionally seeking to create both financial return and positive social or environmental impact impact is actively measured typical sectors: health, education, social housing, charity finance, sustainable agriculture, sustainable transport, renewable energy, clean-tech, waste/water/recycling an investment style, not an asset class, that accentuates positive impact www.socialstockexchange.com 3 About the Social Stock Exchange PM Launch at G8 Social Impact Investment Forum platform that aggregates impact investment opportunities (not a transaction venue) raise the global visibility of businesses that generate social and environmental impact* connect social impact businesses with global impact investors (lower cost-of-search) validation and articulation of social or environmental impact grow the number of publicly-listed social impact businesses retail primarily invests in publicly-traded securities *We describe these as ‘Social Impact Businesses’ www.socialstockexchange.com 4 SSE Member Companies Accsys Technologies Plc Ashley House Plc Assura Group Places for People Group Plc Primary Health Properties Plc Scope Good Energy Group Plc Straight Plc Halosource Inc V22 Plc ITM Power Plc ValiRx Plc 5 Entrepreneurs’ Needs improved access to finance visibility amongst aligned investors input, assistance, know-how from experienced investors mission lock and control through corporate form, authenticated impact reporting or social objects enabling environment: commissioning, tax incentives, pension fund stimuli, technical assistance www.socialstockexchange.com 6 Investors’ Needs fair returns: market rates on a risk-adjusted basis evidence of impact: engaged investor relationship impact outcomes are actively measured good business plans, good management teams, good market opportunities exit potential product and portfolio www.socialstockexchange.com 7 The SSE Proposition increased visibility and improved access to capital public securities with a yield or growth profile on-going brand awareness with global impact investors validation and articulation of social or environmental impact opportunities universe from which to create retail products www.socialstockexchange.com 8 SSE Impact Investment Social Impact Business Traditional Responsible Sustainable Thematic Impact-First Philanthropy Impact only Competitive Returns ESG Risk Management ESG Opportunities High-Impact Solutions Limited or no focus on ESG factors of underlying investments Focus on ESG risks ranging from a wide consideration of ESG factors to negative screening of harmful products Focus on ESG opportunities through investment selection, portfolio management and shareholder advocacy Focus on one or a cluster of issue areas where social or environmental need creates a commercial growth opportunity for market-rate or market-beating returns Focus on one or a cluster of issue areas where social or environmental need requires some financial trade-off No regard for societal impact Operational practices (ESG) do not create negative societal impact Operational practices (ESG) create some or significant positive societal impact Core business model (product or service) generates positive outcomes for the population at large Core business model (product or service) generates positive outcomes for underserved groups No evidence Disclosure in selfprepared CSR report Disclosure against ESG standards: FTSE4Good, GRI For SSE: mandatory impact report using expert providers. Impact is measured; intentionality is sought through articulation of problem to be solved For SSE: mandatory impact report using expert providers. Impact is measured; intentional model to solve market failure problem for underserved Clean energy company; Emerging markets healthcare fund; Micro-finance structured debt fund Accsys, PHP, Good Energy, Straight (SSE current or targets) Fund providing debt or equity to social enterprises and/or trading charities. Impact Evidence Impact Intensity Focus Finance only Examples UNPRI Global Compact BAT, William Hill PE firm integrating ESG risks into investment analysis; Negatively-screened ‘ethical’ investment fund Nestle McDonalds For SSE: impact report on a/the business unit creating societal value “Best-in-Class” SRI or ESG funds; Longonly public equity fund using deep integration of ESG to create additional value Unilever Kingfisher Focus on one or a cluster of issue areas where social or environmental need requires 100% financial trade-off FSE Fund, SCOPE bond 9 Get in Touch We invite you to join us as we work together to help demonstrate that public markets can deliver both financial and social value. Please get in touch with SSE’s experienced team members to find out more. Contact Pradeep Jethi pradeep@socialstockexchange.com Tomas Carruthers tomas@socialstockexchange.com Alison Fort alison@socialstockexchange.com Jon Grayson jon@socialstockexchange.com Serena Vento serena@socialstockexchange.com Diana Robinson diana@socialstockexchange.com www.socialstockexchange.com 10