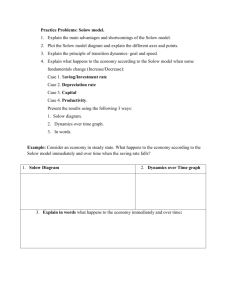

The Solow Growth Model

MACROECONOMICS

Charles I. Jones

© 2008 by W. W. Norton & Company. All rights reserved

5.1 Introduction

In this chapter, we learn:

how capital accumulates over time, helping us understand

economic growth.

© 2008 by W. W. Norton & Company. All rights reserved

the role of the diminishing marginal product of capital in

explaining differences in growth rates across countries.

the principle of transition dynamics: the farther below its

steady state a country is, the faster the country will grow.

the limitations of capital accumulation, and how it leaves a

significant part of economic growth unexplained.

CHAPTER 5 The Solow Growth Model

2

The Solow growth model is the starting point to

determine why growth differs across similar

countries

it builds on the production model by adding a

theory of capital accumulation

© 2008 by W. W. Norton & Company. All rights reserved

developed in the mid-1950s by Robert Solow of

MIT

the basis for the Nobel Prize he received in 1987

CHAPTER 5 The Solow Growth Model

3

The Solow growth model

capital stock is no longer exogenous

capital stock is “endogenized”: converted from an

exogenous to an endogenous variable.

© 2008 by W. W. Norton & Company. All rights reserved

the accumulation of capital as a possible engine of

long-run economic growth

CHAPTER 5 The Solow Growth Model

4

5.2 Setting Up the Model

Start with the production model from chapter 4 and add an

equation describing the accumulation of capital over time.

© 2008 by W. W. Norton & Company. All rights reserved

Production

The production function:

is Cobb-Douglas

has constant returns to scale in capital and labor

has an exponent of one-third on capital

Variables are time subscripted as they may potentially

change over time

CHAPTER 5 The Solow Growth Model

5

Output can be used for either consumption (Ct) or

investment (It)

A resource constraint describes how an economy can

use its resources

© 2008 by W. W. Norton & Company. All rights reserved

Capital Accumulation

capital accumulation equation: the capital stock next

year equals the sum of the capital started with this

year plus the amount of investment undertaken this

year minus depreciation

CHAPTER 5 The Solow Growth Model

6

Depreciation is the amount of capital that wears

out each period

the depreciation rate is viewed as approximately

10 percent

© 2008 by W. W. Norton & Company. All rights reserved

Thus the change in the capital stock is investment

less depreciation

represents the change in the capital stock between

today, period t, and next year, period t+1

CHAPTER 5 The Solow Growth Model

7

© 2008 by W. W. Norton & Company. All rights reserved

Labor

the amount of labor in the economy is given

exogenously at a constant level

Investment

the amount of investment in the economy is

equal to a constant investment rate times total

output

remember that total output is used for either

consumption or investment

therefore, consumption equals output times the

quantity one minus the investment rate

CHAPTER 5 The Solow Growth Model

8

© 2008 by W. W. Norton & Company. All rights reserved

The Model Summarized

CHAPTER 5 The Solow Growth Model

9

© 2008 by W. W. Norton & Company. All rights reserved

5.3 Prices and the Real Interest Rate

If we added equations for the wage and rental price,

the MPL and the MPK would pin them down,

respectively -- omitting them changes nothing.

the real interest rate is the amount a person can earn

by saving one unit of output for a year

or equivalently, the amount a person must pay to

borrow one unit of output for a year

measured in constant dollars, not in nominal dollars

CHAPTER 5 The Solow Growth Model

10

saving is the difference between income and

consumption

© 2008 by W. W. Norton & Company. All rights reserved

Saving equals investment:

a unit of saving is a unit of investment, which

becomes a unit of capital: therefore the return on

saving must equal the rental price of capital

the real interest rate in an economy is equal to the

rental price of capital, which is equal to the

marginal product of capital

CHAPTER 5 The Solow Growth Model

11

5.4 Solving the Solow Model

To solve the model, write the endogenous variables as

functions of the parameters of the model and graphically

show what the solution looks like and solve the model in

the long run.

© 2008 by W. W. Norton & Company. All rights reserved

combine the investment allocation equation with the

capital accumulation equation

(change in capital)

(net investment)

net investment is investment minus depreciation

substitute the supply of labor into the production function:

CHAPTER 5 The Solow Growth Model

12

We now have reduced our system of five

equations and five unknowns to two equations and

two unknowns:

© 2008 by W. W. Norton & Company. All rights reserved

The key equations of the Solow Model are these:

The production function

And the capital accumulation equation

How do we solve this model?

We graph it, separating the two parts of the capital

accumulation equation into two graph elements:

saving = investment and depreciation

CHAPTER 5 The Solow Growth Model

13

The Solow Diagram graphs these two

pieces together, with Kt on the x-axis:

© 2008 by W. W. Norton & Company. All rights reserved

Investment,

Depreciation

At this point,

dKt = sYt, so

Capital, Kt

CHAPTER 5 The Solow Growth Model

14

Figure 5.1: The Solow Diagram

Investment, depreciation

Depreciation: d K

© 2008 by W. W. Norton & Company. All rights reserved

Investment: s Y

Net investment

K0

CHAPTER 5 The Solow Growth Model

K*

Capital, K

15

Using the Solow Diagram

© 2008 by W. W. Norton & Company. All rights reserved

the amount of investment is greater than the amount

of depreciation, the capital stock will increase

the capital stock will rise until investment equals

depreciation: this point, the change in capital is equal

to 0, and absent any shocks, the capital stock will

stay at this value of capital forever

the point where investment equals depreciation is

called the steady state

CHAPTER 5 The Solow Growth Model

16

Suppose the economy starts at this K0:

•We see that the red line is above

Investment,

Depreciation

the green at K0:

•Saving = investment is greater

than depreciation

•So ∆Kt > 0 because

•Then since ∆Kt > 0,

© 2008 by W. W. Norton & Company. All rights reserved

Kt increases from K0 to K1 > K0

K0

CHAPTER 5 The Solow Growth Model

K1

Capital, Kt

17

Now imagine if we start at a K0 here:

Investment,

Depreciation

•At K0, the green line is above the

red line

•Saving = investment is now less

than depreciation

•So ∆Kt < 0 because

•Then since ∆Kt < 0,

© 2008 by W. W. Norton & Company. All rights reserved

Kt decreases from K0 to K1 < K0

Capital, Kt

K1 K0

CHAPTER 5 The Solow Growth Model

18

We call this the process of transition dynamics:

Transitioning from any Kt toward the economy’s

steady-state K*, where ∆Kt = 0

Investment,

Depreciation

© 2008 by W. W. Norton & Company. All rights reserved

No matter where

we start, we’ll

transition to K*!

At this value of K,

dKt = sYt, so

CHAPTER 5 The Solow Growth Model

K*

Capital, Kt

19

when not in steady state, the economy obeys

transition dynamics or in other words, the

movement of capital toward a steady state

notice that when depreciation is greater than

investment, the economy converges to the same

steady state as above

© 2008 by W. W. Norton & Company. All rights reserved

at the rest point of the economy, all endogenous

variables are steady

transition dynamics take the economy from its

initial level of capital to the steady state

CHAPTER 5 The Solow Growth Model

20

Output and Consumption in the

Solow Diagram

© 2008 by W. W. Norton & Company. All rights reserved

using the production function, it is evident that as K

moves to its steady state by transition dynamics,

output will also move to its corresponding steady

state by transition dynamics

note that consumption is the difference between

output and investment

CHAPTER 5 The Solow Growth Model

21

We can see what happens to output, Y, and

thus to growth if we rescale the vertical axis:

• Saving = investment and

Investment,

Depreciation, Income

depreciation now appear

here

• Now output can be

Y*

graphed in the space

above in the graph

• We still have transition

dynamics toward K*

© 2008 by W. W. Norton & Company. All rights reserved

• So we also have

dynamics toward a

steady-state level of

income, Y*

K*

CHAPTER 5 The Solow Growth Model

Capital, Kt

22

Figure 5.2: The Solow Diagram with

Output

Investment, depreciation,

and output

Output: Y

Y*

Consumption

Depreciation: d K

© 2008 by W. W. Norton & Company. All rights reserved

Y0

Investment: s Y

K0

CHAPTER 5 The Solow Growth Model

K*

Capital, K

23

© 2008 by W. W. Norton & Company. All rights reserved

Solving Mathematically for the Steady

State

in the steady state, investment equals depreciation. If

we evaluate this equation at the steady-state level of

capital, we can solve mathematically for it

the steady-state level of capital is positively related

with the investment rate, the size of the workforce

and the productivity of the economy

the steady-state level of capital is negatively

correlated with the depreciation rate

CHAPTER 5 The Solow Growth Model

24

What determines the steady state?

We can solve mathematically for K* and Y* in the

steady state, and doing so will help us understand the

model better

© 2008 by W. W. Norton & Company. All rights reserved

In the steady state:

CHAPTER 5 The Solow Growth Model

25

© 2008 by W. W. Norton & Company. All rights reserved

If we know K*, then we can find Y* using the

production function:

CHAPTER 5 The Solow Growth Model

26

© 2008 by W. W. Norton & Company. All rights reserved

This equation also tells us about income per

capita, y, in the steady state:

CHAPTER 5 The Solow Growth Model

27

© 2008 by W. W. Norton & Company. All rights reserved

notice that the exponent on the productivity

parameter is greater than in the chapter 4 model:

this results because a higher productivity

parameter raises output as in the production

model.

however, higher productivity also implies the

economy accumulates additional capital.

the level of the capital stock itself depends on

productivity

CHAPTER 5 The Solow Growth Model

28

5.5 Looking at Data through the Lens of

the Solow Model

The Capital-Output Ratio

© 2008 by W. W. Norton & Company. All rights reserved

the capital to output ratio is given by the ratio of the

investment rate to the depreciation rate:

while investment rates vary across countries, it is assumed

that the depreciation rate is relatively constant

CHAPTER 5 The Solow Growth Model

29

© 2008 by W. W. Norton & Company. All rights reserved

Empirically, countries with higher investment

rates have higher capital to output ratios:

CHAPTER 5 The Solow Growth Model

30

Differences in Y/L

the Solow model gives more weight to TFP in explaining

per capita output than the production model does

© 2008 by W. W. Norton & Company. All rights reserved

Just like we did before with the simple model of

production, we can use this formula to understand why

some countries are so much richer

take the ratio of y* for a rich country to y* for a poor

country, and assume the depreciation rate is the same

across countries:

45 =

CHAPTER 5 The Solow Growth Model

18

x

2.5

31

© 2008 by W. W. Norton & Company. All rights reserved

45 =

18

x

2.5

Now we find that the factor of 45 that separates

rich and poor country’s income per capita is

decomposable into:

A 103/2 = 18-fold difference in this productivity

ratio term

A (30/5)1/2 = 61/2 = 2.5-fold difference in this

investment rate ratio

In the Solow Model, productivity accounts for

18/20 = 90% of differences!

CHAPTER 5 The Solow Growth Model

32

© 2008 by W. W. Norton & Company. All rights reserved

5.6 Understanding the Steady State

the economy will settle in a steady state because the

investment curve

has diminishing returns

however, the rate at which production and

investment rise is smaller as the capital stock is larger

a constant fraction of the capital stock depreciates

every period, which implies depreciation is not

diminishing as capital increases

CHAPTER 5 The Solow Growth Model

33

© 2008 by W. W. Norton & Company. All rights reserved

In summary, as capital increases, diminishing returns

implies that production and investment increase by

less and less, but depreciation increases by the same

amount .

Eventually, net investment is zero and the economy

rests in steady state.

There are diminishing returns to capital: less Yt per

additional Kt

That means new investment is also diminishing: less

sYt = It

But depreciation is NOT diminishing; it’s a constant

share of Kt

CHAPTER 5 The Solow Growth Model

34

5.7 Economic Growth in the Solow

Model

there is no long-run economic growth in the Solow

model

© 2008 by W. W. Norton & Company. All rights reserved

in the steady state: output, capital, output per person,

and consumption per person are all constant and

growth stops

both constant

CHAPTER 5 The Solow Growth Model

35

© 2008 by W. W. Norton & Company. All rights reserved

empirically, economies appear to continue to

grow over time

thus capital accumulation is not the engine of

long-run economic growth

saving and investment are beneficial in the shortrun, but diminishing returns to capital do not

sustain long-run growth

in other words, after we reach the steady state,

there is no long-run growth in Yt (unless Lt or A

increases)

CHAPTER 5 The Solow Growth Model

36

5.8 Some Economic Experiments

while the Solow model does not explain long-run economic

growth, it does help to explain some differences across

countries

economists can experiment with the model by changing

parameter values

© 2008 by W. W. Norton & Company. All rights reserved

An Increase in the Investment Rate

the investment rate increases permanently for exogenous

reasons

the investment curve rotates upward, but the deprecation

line remains unchanged

CHAPTER 5 The Solow Growth Model

37

Figure 5.4: An Increase in the

Investment Rate

Investment, depreciation

Depreciation: d K

New investment

exceeds depreciation

© 2008 by W. W. Norton & Company. All rights reserved

Old investment: s Y

K*

CHAPTER 5 The Solow Growth Model

K**

Capital, K

38

the economy is now below its new steady state and

the capital stock and output will increase over time by

transition dynamics

© 2008 by W. W. Norton & Company. All rights reserved

the long run, steady-state capital and steady-state

output are higher

What happens to output in response to this increase in

the investment rate?

the rise in investment leads capital to accumulate over

time

this higher capital causes output to rise as well

output increases from its initial steady-state level Y*

to the new steady state Y**

CHAPTER 5 The Solow Growth Model

39

Figure 5.5: The Behavior of Output

Following an Increase in s

Investment, depreciation, and output

Depreciation: d K

Output: Y

Y**

© 2008 by W. W. Norton & Company. All rights reserved

Y*

New

investment:

s ‘Y

Old

investment:

s Y

K*

K**

(a) The Solow diagram with output.

CHAPTER 5 The Solow Growth Model

Capital, K

40

Figure 5.5: The Behavior of Output

Following an Increase in s (cont.)

Output, Y

(ratio scale)

© 2008 by W. W. Norton & Company. All rights reserved

Y**

Y*

2000

2020

2040

2060

2080

2100

Time, t

(b) Output over time.

CHAPTER 5 The Solow Growth Model

41

A Rise in the Depreciation Rate

the depreciation rate is exogenously shocked to a higher

rate

the depreciation curve rotates upward and the investment

curve remains unchanged

© 2008 by W. W. Norton & Company. All rights reserved

the new steady state is located to the left: this means that

depreciation exceeds investment

the capital stock declines by transition dynamics until it

reaches the new steady state

note that output declines rapidly at first but less rapidly as it

converges to the new steady state

CHAPTER 5 The Solow Growth Model

42

Figure 5.6: A Rise in the Depreciation

Rate

Investment, depreciation

New

depreciation:

d ‘K

Old

depreciation:

dK

Depreciation

exceeds

investment

© 2008 by W. W. Norton & Company. All rights reserved

Investment: s Y

K**

CHAPTER 5 The Solow Growth Model

K*

Capital, K

43

© 2008 by W. W. Norton & Company. All rights reserved

What happens to output in response to this increase

in the depreciation rate?

the decline in capital reduces output

output declines rapidly at first, and then gradually

settles down at its new, lower steady-state level Y**

CHAPTER 5 The Solow Growth Model

44

Figure 5.7: The Behavior of Output

Following an Increase in d

Investment, depreciation,

and output

New depreciation: d‘K

Output: Y

Y*

© 2008 by W. W. Norton & Company. All rights reserved

Y**

Investment:

s Y

Old depreciation: d K

K**

K*

Capital, K

(a) The Solow diagram with output.

CHAPTER 5 The Solow Growth Model

45

Figure 5.7: The Behavior of Output

Following an Increase in d (cont.)

Output, Y

(ratio scale)

Y*

© 2008 by W. W. Norton & Company. All rights reserved

Y**

2000

2020

2040

2060

(b) Output over time.

CHAPTER 5 The Solow Growth Model

2080

2100

Time, t

46

Experiments on Your Own

© 2008 by W. W. Norton & Company. All rights reserved

Try experimenting with all the parameters in the

model:

1. Figure out which curve (if either) shifts.

2. Follow the transition dynamics of the Solow model.

3. Analyze the steady-state values of capital, output,

and output per person.

CHAPTER 5 The Solow Growth Model

47

© 2008 by W. W. Norton & Company. All rights reserved

5.9 The Principle of Transition

Dynamics

when the depreciation rate and the investment rate

were shocked, output was plotted over time on a ratio

scale

ratio scale allows us to see that output changes more

rapidly the further we are from the steady state

as the steady state is approached, growth shrinks to

zero

CHAPTER 5 The Solow Growth Model

48

the principle of transition dynamics says that the

farther below its steady state an economy is, in

percentage terms, the faster the economy will grow

similarly, the farther above its steady state, in

percentage terms, the slower the economy will grow

© 2008 by W. W. Norton & Company. All rights reserved

this principle allows us to understand why economies

may grow at different rates at the same time

CHAPTER 5 The Solow Growth Model

49

Understanding Differences in Growth

Rates

empirically, OECD countries that were relatively poor in

1960 grew quickly while countries that were relatively rich

grew slower

if the OECD countries have the same steady state, then the

principle of transition dynamics predicts this

© 2008 by W. W. Norton & Company. All rights reserved

looking at the world as whole, on average, rich and poor

countries grow at the same rate

two implications: (1) most countries have already reached

their steady states; and (2) countries are poor not because

of a bad shock, but because they have parameters that yield

a lower steady state

CHAPTER 5 The Solow Growth Model

50

© 2008 by W. W. Norton & Company. All rights reserved

CHAPTER 5 The Solow Growth Model

51

© 2008 by W. W. Norton & Company. All rights reserved

CHAPTER 5 The Solow Growth Model

52

5.10 Strengths and Weaknesses of

the Solow Model

The strengths of the Solow model are:

1. It provides a theory that determines how rich a country is

in the long run.

2. The principle of transition dynamics allows for an

understanding of differences in growth rates across

countries.

© 2008 by W. W. Norton & Company. All rights reserved

The weaknesses of the Solow model are:

1. It focuses on investment and capital, while the much more

important factor of TFP is still unexplained.

2. It does not explain why different countries have different

investment and productivity rates.

3. The model does not provide a theory of sustained long-run

economic growth.

CHAPTER 5 The Solow Growth Model

53

Summary

© 2008 by W. W. Norton & Company. All rights reserved

1. The starting point for the Solow model is the

production model of Chapter 4. To that framework,

the Solow model adds a theory of capital

accumulation. That is, it makes the capital stock an

endogenous variable.

2. The capital stock is the sum of past investments.

The capital stock today consists of machines and

buildings that were bought over the last several

decades.

CHAPTER 5 The Solow Growth Model

54

© 2008 by W. W. Norton & Company. All rights reserved

3. The goal of the Solow model is to deepen our

understanding of economic growth, but in this it’s

only partially successful. The fact that capital runs

into diminishing returns means that the model does

not lead to sustained economic growth. As the

economy accumulates more capital, depreciation

rises one-for-one, but output and therefore

investment rise less than one-for- one because of the

diminishing marginal product of capital. Eventually,

the new investment is only just sufficient to offset

depreciation, and the capital stock ceases to grow.

Output stops growing as well, and the economy

settles down to a steady state.

CHAPTER 5 The Solow Growth Model

55

© 2008 by W. W. Norton & Company. All rights reserved

4. There are two major accomplishments of the Solow

model. First, it provides a successful theory of the

determination of capital, by predicting that the

capital-output ratio is equal to the investmentdepreciation ratio. Countries with high investment

rates should thus have high capital-output ratios,

and this prediction holds up well in the data.

CHAPTER 5 The Solow Growth Model

56

© 2008 by W. W. Norton & Company. All rights reserved

5. The second major accomplishment of the Solow

model is the principle of transition dynamics, which

states that the farther below its steady state an

economy is, the faster it will grow. While the model

cannot explain long-run growth, the principle of

transition dynamics provides a nice theory of

differences in growth rates across countries.

Increases in the investment rate or total factor

productivity can increase a country’s steady-state

position and therefore increase growth, at least for a

number of years. These changes can be analyzed

with the help of the Solow diagram.

CHAPTER 5 The Solow Growth Model

57

© 2008 by W. W. Norton & Company. All rights reserved

6. In general, most poor countries have low TFP levels

and low investment rates, the two key determinants

of steady-state incomes. If a country maintained

good fundamentals but was poor because it had

received a bad shock, we would see it grow rapidly,

according to the principle of transition dynamics.

CHAPTER 5 The Solow Growth Model

58

Figure 5.10: Investment in South Korea

and the Philippines, 1950-2000

Investment rate (percent)

South Korea

© 2008 by W. W. Norton & Company. All rights reserved

U.S.

Philippines

Year

CHAPTER 5 The Solow Growth Model

59

Figure 5.11: The Solow Diagram

Investment, depreciation,

and output

Output: Y

Y*

Depreciation: d K

© 2008 by W. W. Norton & Company. All rights reserved

Y0

Investment: s Y

K0

CHAPTER 5 The Solow Growth Model

K*

Capital, K

60

Figure 5.12: Output Over Time, 2000-2100

Output, Y

(ratio scale)

© 2008 by W. W. Norton & Company. All rights reserved

Y*

Y0

2000

2020

2040

2060

2080

2100

Time, t

CHAPTER 5 The Solow Growth Model

61