Adjusting Accounts For Financial

Statements

Chapter 3

Wild, Shaw, and Chiappetta

Financial & Managerial Accounting

6th Edition

Copyright © 2016 McGraw-Hill Education. All rights reserved. No

reproduction or distribution without the prior written consent of

McGraw-Hill Education.

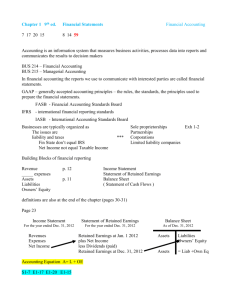

03-C1:

Explain the importance of

periodic reporting and the role

of accrual accounting

2

The Accounting Period

C1

3

Accrual Basis versus Cash Basis

C1

Accrual Basis

Cash Basis

Revenues are

recognized when

earned and expenses

are recognized when

incurred.

Revenues are

recognized when cash

is received and

expenses are recorded

when cash is paid.

4

Accrual Basis versus Cash Basis

Accrual Basis

Cash Basis

Revenues are

recognized when

earned and expenses

are recognized when

incurred.

Revenues are

recognized when cash

is received and

expenses are recorded

when cash is paid.

Non-GAAP

C1

5

Accrual Basis versus Cash Basis

On December 1, 2015, FastForward paid $2,400

cash for a twenty-four month business insurance

policy.

C1

Using the cash basis, the entire $2,400 would be

recognized as insurance expense in 2015. No

insurance expense from this policy would be

recognized in 2016 or 2017, periods covered by

the policy.

6

Accrual Basis versus Cash Basis

On the accrual basis, $100 of insurance

expense is recognized in 2015, $1,200 in

2016, and $1,100 in 2017. The expense is

matched with the periods benefited by the

insurance coverage.

C1

7

Recognizing Revenues

The revenue recognition principle states

that we recognize revenue when the

product or service is delivered to our

customer.

C1

8

Recognizing Expenses

The expense recognition (or matching)

principle aims to record expenses in the

same accounting period as the revenues

that are earned as a result of those

expenses. This matching of expenses with

the revenue benefits is a major part of the

adjusting process.

C1

9

03-P1:

Prepare and explain adjusting

entries

10

Framework for Adjustments

An adjusting entry is made at the end of an accounting

period to reflect a transaction or event that is not yet

recorded.

P1

11

Prepaid (Deferred) Expenses

(ex. Prepaid Insurance, Prepaid Rent, Supplies, etc.

Resources paid for

prior to receiving the

actual benefits.

P1

12

PREPAID INSURANCE

On December 1, 2015, FastForward paid $2,400 to cover

insurance for 24 months that began on December 1 of

2015. Scott recorded the expenditure as Prepaid

Insurance on December 1.

PREPAID INSURANCE

24-month policy

Beginning 12/01

P1

$2,400

13

PREPAID INSURANCE

PREPAID INSURANCE

$2,400

INSURANCE EXPENSE

$100

$100

$2,400/24 months = $100

Insurance Expense is debited

$100 to recognize the amount

of insurance coverage for Dec. and

Prepaid Insurance is credited for $100

to reduce it’s balance.

P1

14

PREPAID INSURANCE

(Balance Sheet)

PREPAID INSURANCE

$2,400

(Income Statement)

INSURANCE EXPENSE

adj $100

$100 adj

Bal.

$2,300

The Balance Sheet will show

$2,300 (23 months) of

Prepaid Insurance remaining!

P1

The Income Statement will

show $100 (1 month) of

insurance expired!

15

Adjusting Journal entry for Insurance

expired:

We’ve seen the adjustment in the T-accounts but we

need to record the adjustment on Dec. 31, in the

General Journal. . .

Insurance Expense

Dec. 1

2,400 Dec. 31

Bal.

2,300

637

100

Prepaid Insurance

Dec. 31

100

Dec. 31 Insurance Expense

Prepaid Insurance

128

100

100

To record first month's expired insurance

P1

16

Another adjusting entry which needs to be

made is for Depreciation

Instead of expensing the cost of a plant asset

(equipment, building, cars, etc.) in the year it is

purchased we allocate or spread out the cost over

their expected useful lives.

The formula for straight-line depreciation is:

Straight-Line

Asset Cost - Salvage Value

Depreciation =

Useful Life

Expense

P1

17

USEFUL LIFE

The period of time that an asset is expected

to help produce revenues.

Useful life expires as a result of wear and

tear, or because it no longer satisfies the

needs of the business.

P1

18

SALVAGE VALUE

• The expected market value or selling price

of an asset at the end of its useful life

• Also called:

– Scrap Value or

– Residual Value

P1

19

DEPRECIATION EXAMPLE

FastForward purchased equipment on Dec 1 for

$26,000. It has an estimated useful live of 60 months.

The equipment is expected to be worth about $8,000 at

the end of five years. They purchased the equipment

on Dec 1 but it is now Dec 31.

Because FastForward expects the equipment

to be worth $8,000 when the five years

are over, only $18,000 of the cost needs

to be spread over the next 60 months.

P1

20

STRAIGHT-LINE METHOD

1st step: Calculate Net Cost (the amount to

depreciate).

FORMULA:

Original

Cost

$26,000

P1

Salvage

Value

=

$8,000

=

Net Cost

$18,000

21

Calculating Depreciation Expense

2nd step: Determine depreciation expense

for this accounting period (one month).

FORMULA:

Net Cost

Estimated

Useful Life

P1

$18,000

60 mos.

$300 per

month

Now that we know depreciation for

the month is $300, let’s figure out the

adjusting entry. . .

22

Depreciation adjustment reflected in

our T-accounts looks like this:

Depreciation Expense

Equipment

12/1 26,000

12/31 300

Accumulated Depreciation

12/31 300

The depreciation amount of

$300 is credited to this

account instead of the

asset account.

23

Let’ look at the journal entry for the

adjustment for Depreciation..

Equipment

12/1 26,000

Depreciation Expense

12/31 300

Accumulated Depreciation-Equipment

12/31 300

Dec. 31 Depreciation Expense

Accumulated Depreciation - Equipment

P1

300

300

To record monthly equipment depreciation

24

Depreciation would show up on our

balance sheet like this:

FastForward

Partial Balance Sheet

At February 28, 2016

$

Assets

Cash

.

Equipment

Less: accumulated deprec.

.

.

Total Assets

P1

$ 26,000

(900)

25,100

After three

months of

depreciation

have been

taken, the

Equipment is

shown net of

accumulated

depreciation.

25

NEED-TO-KNOW

For each separate case below, follow the three-step process for adjusting the prepaid asset account.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record an adjusting entry to get from step 1 to step 2.

Assume no other adjusting entries are made during the year.

Prepaid Insurance.The Prepaid Insurance account has a $5,000 debit balance to start the year. A

review of insurance policies and payments shows that $1,000 of unexpired insurance remains at yearend.

Prepaid Rent. On October 1 of the current year, the company prepaid $12,000 for one year of rent for

facilities being occupied from that day forward. The company debited Prepaid Rent and credited Cash

for $12,000. December 31 year-end statements must be prepared.

Supplies. The Supplies account has an $1,000 debit balance to start the year. Supplies of $2,000

were purchased during the current year and debited to the Supplies account. A December 31 physical

count shows $500 of supplies remaining.

Accumulated Depreciation. The company has only one fixed asset (equipment) that it purchased at

the start of this year. That asset had cost $38,000, had an estimated life of 10 years, and is expected

to be valued at $8,000 at the end of the 10-year life.

P1

26

NEED-TO-KNOW

Prepaid Insurance. The Prepaid Insurance account has a $5,000 debit balance to start the year. A

review of insurance policies and payments shows that $1,000 of unexpired insurance remains at yearend.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Unadj.

Adj.

Prepaid Insurance

5,000

Adjustment

1,000

$5,000

$1,000

4,000

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Insurance expense

Prepaid Insurance

Income Statement

Revenue

Debit Expense

P1

Debit

4,000

Credit

4,000

Balance Sheet

Credit Asset

Liability

27

NEED-TO-KNOW

Prepaid Rent. On October 1 of the current year, the company prepaid $12,000 for one year of rent for

facilities being occupied from that day forward. The company debited Prepaid Rent and credited Cash

for $12,000. December 31 year-end statements must be prepared.

Step 1: Determine what the current account balance equals.

$12,000

Step 2: Determine what the current account balance should equal. $9,000

Oct. 1

Dec. 31

Prepaid Rent

12,000

Adjustment

9,000

3,000

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Rent Expense

Prepaid Rent

Income Statement

Revenue

Debit Expense

P1

Debit

3,000

Credit

3,000

Balance Sheet

Credit Asset

Liability

28

NEED-TO-KNOW

Supplies. The Supplies account has a $1,000 debit balance to start the year. Supplies of $2,000

were purchased during the current year and debited to the Supplies account. A December 31 physical

count shows $500 of supplies remaining.

Step 1: Determine what the current account balance equals.

$3,000

Step 2: Determine what the current account balance should equal.

$500

Unadj.

Dec. 31

Supplies

3,000

Adjustment

500

2,500

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Supplies Expense

Supplies

Income Statement

Revenue

Debit Expense

P1

Debit

2,500

Credit

2,500

Balance Sheet

Credit Asset

Liability

29

NEED-TO-KNOW

Accumulated Depreciation. The company has only one fixed asset (equipment) that it purchased at

the start of this year. That asset had cost $38,000, had an estimated life of 10 years, and is expected

to be valued at $8,000 at the end of the 10-year life.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

$0

$3,000

Accumulated Depreciation

Unadj.

Adjustment

Dec. 31

0

3,000

3,000 ($38,000 - $8,000)

10 years

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Depreciation Expense

Accumulated Depreciation

Income Statement

Revenue

Debit Expense

P1

Debit

3,000

Credit

3,000

Balance Sheet

Credit Contra-Asset

Liability

30

Unearned (Deferred)

Revenues

Cash received in

advance of providing

products or services.

P1

31

NEED-TO-KNOW

For each separate case below, follow the three-step process for adjusting the unearned revenue liability account.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record an adjusting entry to get from step 1 to step 2.

Assume no other adjusting entries are made during the year.

Unearned Rent Revenue. The company collected $24,000 rent in advance on September 1,

debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months rent in

advance and occupancy began September 1.

Unearned Services Revenue. The company charges $100 per month to spray a house for insects.

A customer paid $600 on November 1 in advance for six treatments, which was recorded with a debit

to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied two

treatments for the customer.

P1

32

NEED-TO-KNOW

Unearned Rent Revenue. The company collected $24,000 rent in advance on September 1,

debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months rent in

advance and occupancy began September 1.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Unearned Rent Revenue

Sept. 1

Adjustment

8,000

Dec. 31

$24,000

$16,000

24,000

16,000 (8 mos. @ $2,000)

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Unearned Rent Revenue

Rent Revenue

Income Statement

Credit Revenue

Expense

P1

Debit

8,000

Credit

8,000

Balance Sheet

Asset

Debit Liability

33

NEED-TO-KNOW

Unearned Services Revenue. The company charges $100 per month to spray a house for insects.

A customer paid $600 on November 1 in advance for six treatments, which was recorded with a debit

to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied two

treatments for the customer.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Unearned Services Revenue

Nov. 1

Adjustment

200

Dec. 31

$600

$400

600

400

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Unearned Services Revenue

Services Revenue

Income Statement

Credit Revenue

Expense

P1

Debit

200

Credit

200

Balance Sheet

Asset

Debit Liability

34

Accrued Expenses

Costs incurred in a

period that are

both unpaid and

unrecorded.

P1

35

NEED-TO-KNOW

For each separate case below, follow the three-step process for adjusting the accrued expense account.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record an adjusting entry to get from step 1 to step 2.

Assume no other adjusting entries are made during the year.

Salaries Payable. At year-end, salaries expense of $5,000 has been incurred by the company, but is

not yet paid to employees.

Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has

incurred $1,000 in annual interest that is neither recorded nor paid. The company intends to pay the

interest on January 3 of the next year.

P1

36

NEED-TO-KNOW

Salaries Payable. At year-end, salaries expense of $5,000 has been incurred by the company, but is

not yet paid to employees.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Salaries Payable

Unadj.

Adjustment

Dec. 31

$0

$5,000

0

5,000

5,000

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Salaries Expense

Salaries Payable

Income Statement

Revenue

Debit Expense

P1

Debit

5,000

Credit

5,000

Balance Sheet

Asset

Credit Liability

37

NEED-TO-KNOW

Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has

incurred $1,000 in annual interest that is neither recorded nor paid. The company intends to pay the

interest on January 3 of the next year.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Interest Payable

Unadj.

Adjustment

Dec. 31

$0

$1,000

0

1,000

1,000

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Interest Expense

Interest Payable

Income Statement

Revenue

Debit Expense

P1

Debit

1,000

Credit

1,000

Balance Sheet

Asset

Credit Liability

38

Accrued Revenues

Revenues earned in a

period that

are both unrecorded

and not yet received.

P1

39

NEED-TO-KNOW

For each separate case below, follow the three-step process for adjusting the accrued revenue account.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record an adjusting entry to get from step 1 to step 2.

Assume no other adjusting entries are made during the year.

Accounts Receivable. At year-end, the company has completed services of $1,000 for a client, but

the client has not yet been billed for those services.

Interest Receivable. At year-end, the company has earned, but not yet recorded, $500 of interest

earned from its investments in government bonds.

P1

40

NEED-TO-KNOW

Accounts Receivable. At year-end, the company has completed services of $1,000 for a client, but

the client has not yet been billed for those services.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

$0

$1,000

Accounts Receivable

Unadj.

0

Adjustment

1,000

Dec. 31

1,000

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Accounts Receivable

Services Revenue

Income Statement

Credit Revenue

Expense

P1

Debit

1,000

Credit

1,000

Balance Sheet

Debit Asset

Liability

41

NEED-TO-KNOW

Interest Receivable. At year-end, the company has earned, but not yet recorded, $500 of interest

earned from its investments in government bonds.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Unadj.

Adjustment

Dec. 31

$0

$500

Interest Receivable

0

500

500

Step 3: Record an adjusting entry to get from step 1 to step 2.

Date

Dec. 31

General Journal

Interest Receivable

Interest Revenue

Income Statement

Credit Revenue

Expense

P1

Debit

500

Credit

500

Balance Sheet

Debit Asset

Liability

42

Links to Financial Statements

P1

43

03-P2: Adjusted Trial Balance

44

Adjusted Trial Balance

P2

45

03-P3: Prepare financial

statements from an adjusted

trial balance

46

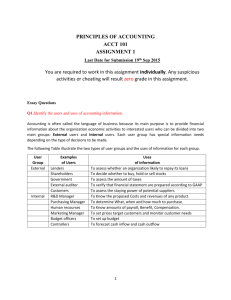

Preparing Financial Statements

from an Adjusted Trial Balance

Step 1— Prepare income statement using revenue and expense

accounts from trial balance.

Step 2—Prepare statement of retained earnings using retained

earnings and dividends from trial balance; and pull

net income from step 1.

Step 3—Prepare balance sheet using asset and liability account

from trial balance; and pull updated retained earnings

balance from step 2.

Step 4—Prepare statement of cash flows from changes in cash

flows for the period (illustrated later in the book).

P3

47

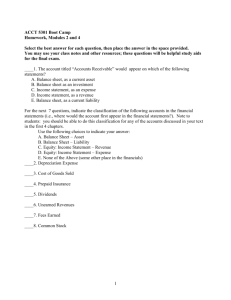

NEED-TO-KNOW

Use the following adjusted trial balance of Magic Company to prepare its (1) income statement, (2) statement of

Retained earnings, and (3) balance sheet (unclassified), for the year ended, or date of, December 31, 2015. The

Retained Earnings account balance is $45,000 at December 31, 2014.

Magic Company

Adjusted Trial Balance

December 31, 2015

Debit

Credit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

$12,000

Long-term notes payable

33,000

30,000

Common Stock

Retained Earnings

45,000

Dividends

20,000

Fees earned

79,000

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000 $199,000

P3

48

Debit

Credit

Magic Company

Adjusted Trial Balance

December 31, 2015

Debit

Credit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

$12,000

Long-term notes payable

33,000

30,000

Common Stock

Retained Earnings

45,000

Dividends

20,000

Fees earned

79,000

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000 $199,000

P3

The Income

Statement

Magic Company

Income Statement

For Year Ended December 31, 2015

Fees earned

$79,000

Expenses

Salaries expense

$56,000

Office supplies expense 8,000

64,000

Net income

$15,000

49

Debit

Credit

Magic Company

Adjusted Trial Balance

December 31, 2015

Debit

Credit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

$12,000

Long-term notes payable

33,000

30,000

Common Stock

Retained Earnings

45,000

Dividends

20,000

Fees earned

79,000

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000 $199,000

P3

Magic Company

Income Statement

For Year Ended December 31, 2015

Fees earned

$79,000

Expenses

Salaries expense

$56,000

Office supplies expense 8,000

64,000

Net income

$15,000

Magic Company

Statement of Retained Earnings

For Year Ended December 31, 2015

Retained Earnings, Dec. 31 2014

$45,000

Plus: Net income

15,000

Less: Dividends

(20,000)

Retained Earnings, Dec. 31 2015

$40,000

The Statement of

Retained Earnings

50

Debit

Credit

Magic Company

Adjusted Trial Balance

December 31, 2015

Debit

Credit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

$12,000

Long-term notes payable

33,000

30,000

Common Stock

Retained Earnings

45,000

Dividends

20,000

Fees earned

79,000

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000 $199,000

Magic Company

Income Statement

For Year Ended December 31, 2015

Fees earned

$79,000

Expenses

Salaries expense

$56,000

Office supplies expense 8,000

64,000

Net income

$15,000

Magic Company

Statement of Owner’s Equity

For Year Ended December 31, 2015

Retained Earnings, Dec. 31 2014

$45,000

Plus: Net income

15,000

Less: Dividends

(20,000)

Retained Earnings, Dec. 31 2015

$40,000

Magic Company

Balance Sheet

December 31, 2015

Assets

Cash

Accounts receivable

Land

P3

Total assets

$13,000

17,000

85,000

$115,000

Liabilities

Accounts payable

Long-term notes payable

Total liabilities

Equity

Common Stock

Retained Earnings

Total Equity

Total liabilities and equity

$12,000

33,000

45,000

Balance

Sheet

30,000

40,000

70,000

115,000

51

03-P4:

Describe and prepare closing

entries

52

Recording Closing Entries

Close Credit Balances in

Revenue Accounts to Income

Summary.

Close Debit Balances in

Expense accounts to Income

Summary.

Close Income Summary

account to Retained Earnings.

Close Dividends to Retained

Earnings.

P4

53

NEED-TO-KNOW

Use the adjusted trial balance of Magic Company to prepare its closing entries.

Magic Company

Trial Balance

Magic

Company

December

31,Balance

20X2

Adjusted

Trial

December 31, 2015Debit

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Common Stock

Retained Earnings

Dividends

Fees earned

Salaries expense

Office supplies expense

Totals

P4

Debit

$13,000

17,000

85,000

Credit

Credit

$12,000

33,000

30,000

45,000

20,000

79,000

56,000

8,000

$199,000 $199,000

54

Debit

$13,000

17,000

85,000

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Common stock

Retained earnings

Dividends

20,000

Fees earned

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000

Date

Dec. 31

Dec. 31

Dec. 31

Dec. 31

P4

Credit

Expenses

Closing

$12,000

33,000

30,000

45,000

Income summary

64,000

Revenues

Net income

15,000

79,000

15,000

0

Retained earnings

12/31/2014

20,000 Net income

12/31/2015

Dividends

79,000

45,000

15,000

40,000

$199,000

General Journal

Fees earned

Income summary

Debit

79,000

Credit

79,000

Income summary

Salaries expense

Office supplies expense

64,000

Income summary

Retained earnings

15,000

Retained earnings

Dividends

20,000

56,000

8,000

15,000

20,000

55

Debit

$13,000

17,000

85,000

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Common Stock

Retained earnings

Totals

$115,000

Credit

Expenses

Closing

$12,000

33,000

30,000

40,000

$115,000

Income Summary

64,000

Revenues

Net income

15,000

79,000

15,000

0

Dividends

Retained Earnings

12/31/2014

20,000 Net income

12/31/2015

45,000

15,000

40,000

Magic Company

Balance Sheet

December 31, 2015

Assets

Cash

Accounts receivable

Land

Total assets

P4

$13,000

17,000

85,000

$115,000

Liabilities

Accounts payable

Long-term notes payable

Total liabilities

Equity

$12,000

33,000

45,000

Common stock

Retained earnings

Total equity

Total liabilities and equity

30,000

40,000

75,000

115,000

56

03-P5:

Explain and prepare a postclosing trial balance

57

Post-Closing Trial Balance

List of permanent

accounts and their

balances after posting

closing entries.

Total debits and credits

must be equal.

P5

58

Post-Closing Trial Balance

P5

59

03-C2:

Identify steps in the accounting

cycle.

60

Accounting Cycle

C2

61

03-C3: Explain and prepare a

classified balance sheet

62

Classified Balance Sheet

Current items are those expected to come due (both

collected and owed) within the longer of one year or

the company’s normal operating cycle.

C3

63

Current Assets

Current assets are expected to be sold,

collected, or used within one year or the

company’s operating cycle.

C3

64

Long-Term Investments

Long-term investments are expected to be held for

more than one year or the operating cycle.

C3

65

Plant Assets

Plant assets are tangible long-lived assets used to

produce or sell products and services.

C3

66

Intangible Assets

Intangible assets are long-term resources used to

produce or sell products and services and that

lack physical form.

C3

67

Current Liabilities

Current liabilities are obligations due within the longer of

one year or the company’s operating cycle.

C3

68

Long-Term Liabilities

Long-term liabilities are obligations not due within

the longer of one year or the company’s operating

cycle.

C3

69

Equity

Equity is the owner’s claim on the assets.

C3

70

NEED-TO-KNOW

Use the adjusted trial balance of Magic Company to prepare its classified

balance sheet as of December 31, 2015.

Magic Company

Magic

Company

Adjusted

Trial Balance

Adjusted

Trial

December Balance

31, 20X2

December 31, 2015

Debit

Credit

Debit

Credit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

$12,000

Long-term notes payable

33,000

30,000

Common Stock

Retained Earnings

45,000

Dividends

20,000

Fees earned

79,000

Salaries expense

56,000

Trial Balance

Office supplies expense

8,000

Totals

$199,000

$199,000

Debit

Credit

C3

71

NEED-TO-KNOW

Use the adjusted trial balance of Magic Company to prepare its classified balance sheet as of

December 31, 2015.

Magic

Company

Magic

Company

Adjusted

Trial Balance

Adjusted

Trial

Adjusted

Trial Balance

Balance

December

31, 20X2

December

31,

December 31, 20X2

2015

Debit

Credit

DebitDebit Credit

Credit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

$12,000

Long-term notes payable

33,000

30,000

Common Stock

Retained Earnings

Dividends

Fees earned

45,000

20,000

79,000

Salaries expense

Trial Balance 56,000

Office supplies expense

8,000

Totals

C3

$199,000

Debit $199,000

Credit

Magic Company

Balance Sheet

December 31, 2015

Assets

Current assets

Cash

Accounts receivable

Total current assets

Plant assets

Land

Total plant assets

Total assets

Liabilities

Current liabilities

Accounts payable

Total current liabilities

Long-term liabilities

Long-term notes payable

Total liabilities

Equity

Common Stock

Retained Earnings

Total equity

Total liabilities and equity

$13,000

17,000

30,000

85,000

85,000

$115,000

$12,000

12,000

33,000

$45,000

30,000

40,000

70,000

$115,000

72

Global View

The definition of an asset is similar under U.S. GAAP and IFRS and

involves three basic criteria:

(1) the company owns or controls the right to use the item,

(2) the right arises from a past transaction or event, and

(3) the item can be reliably measured.

Both systems define the initial asset value as historical cost for

nearly all assets.

The definition of a liability is similar under U.S. GAAP and IFRS and

involves three basic criteria:

(1) the item is a present obligation requiring a probable future resource

outlay,

(2) the obligation arises from a past transaction or event, and

(3) the obligation can be reliably measured.

73

Global View

Both U.S. GAAP and IFRS include similar guidance for adjusting accounts. Although

some variations exist in revenue and expense recognition.

74

03-A1:

Compute profit margin and

describe its use in analyzing

company performance.

75

Profit Margin

The profit margin ratio measures the company’s net

income to net sales.

Profit

Net Income

=

Margin

Net Sales

Limited Brands, Inc.

A1

76

03-A2:

Compute the current ratio and

describe what it reveals about

a company’s financial

condition.

77

Current Ratio

Helps assess the company’s ability to pay its

debts in the near future

Current ratio =

Current assets

Current liabilities

Limited Brands, Inc.

A2

78

03-P6: Appendix 3A

Alternative Accounting for

Prepayments

79

Appendix 3A: Alternative

Accounting for Prepayments

An alternative method is to record all prepaid expenses

with debits to expense accounts.

The adjusting entry depends on how the original payment

was recorded.

P6

80

Appendix 3A: Alternative

Accounting for Prepayments

P6

81

Appendix 3A: Alternative Accounting for Revenues

An alternative method is to record all revenues to a liability account or

a revenue account.

The adjusting entry depends on how the original receipt

was recorded.

P6

82

Appendix 3A: Alternative

Accounting for Revenues

P6

83

03-P7: Appendix 2C

Prepare a work sheet and

explain its usefulness.

84

Benefits of a Work Sheet

Aids the

preparation of

financial

statements.

Reduces

possibility of

errors.

Links accounts

and their

adjustments.

P7

Assists in

planning and

organizing an

audit.

Not a

required

report.

Helps in

preparing

interim financial

statements.

Shows the

effects of

proposed

transactions.

85

NEED-TO-KNOW

The following 10-column work sheet contains the year-end unadjusted trial balance for Sampson Company

as of December 31, 2016. Complete the work sheet by entering the necessary adjustments, computing the adjusted

account balances, extending the adjusted balances into the appropriate financial statement columns, and entering

the amount of net income for the period. Note: The common stock account balance was $32,000 at December 31, 2015.

Unadjusted

Trial Balance

No.

Dr.

Cr.

101 Cash

23,000

106 Accounts receivable

8,000

183 Land

52,000

201 Accounts payable

10,000

251 Long-term notes payable

43,000

301 Common Stock

32,000

302 Dividends

10,000

401 Fees earned

70,000

622 Salaries expense

54,000

650 Office supplies expense

8,000

Totals

155,000 155,000

Adjustments

Dr.

Cr.

Adjusted

Trial Balance

Dr.

Cr.

Income

Statement

Dr.

Cr.

Balance Sheet

and Statement of

Ret. Earnings

1. Prepare and complete the work sheet, starting with the unadjusted trial balance and including adjustments

based on the following.

a. The company has earned $9,000 in fees that were not yet recorded at year-end.

b. The company incurred $2,000 in salary expense that was not yet recorded at year-end.

(Hint: For simplicity, assume it records any salary not yet paid as part of accounts payable.)

c. The long-term note payable was issued on December 31 this year. Thus, no interest has yet accrued

on this loan.

P7

Dr.

Cr.

86

Unadjusted

Adjusted

Trial Balance

Trial Balance

Adjustments

No.

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

101 Cash

23,000

23,000

106 Accounts receivable

8,000

(a) 9,000

17,000

183 Land

52,000

52,000

201 Accounts payable

10,000

(b) 2,000

12,000

251 Long-term notes payable

43,000

43,000

301 Common Stock

32,000

32,000

302 Dividends

10,000

10,000

401 Fees earned

70,000

(a) 9,000

79,000

622 Salaries expense

54,000

(b) 2,000

56,000

650 Office supplies expense

8,000

8,000

Totals

155,000 155,000

11,000

11,000 166,000 166,000

Net income

Totals

Income

Statement

Dr.

Cr.

Balance Sheet

and Statement of

Owner's Equity

Dr.

Cr.

23,000

17,000

52,000

12,000

43,000

32,000

10,000

79,000

56,000

8,000

64,000

15,000

79,000

79,000 102,000

87,000

15,000

79,000 102,000 102,000

a. The company has earned $9,000 in fees that were not yet recorded at year-end.

b. The company incurred $2,000 in salary expense that was not yet recorded at year-end.

(Hint: For simplicity, assume it records any salary not yet paid as part of accounts payable.)

c. The long-term note payable was issued on December 31 this year. Thus, no interest has yet accrued

on this loan.

P7

87

Unadjusted

Adjusted

Trial Balance

Trial Balance

Adjustments

No.

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

101 Cash

23,000

23,000

106 Accounts receivable

8,000

(a) 9,000

17,000

183 Land

52,000

52,000

201 Accounts payable

10,000

(b) 2,000

12,000

251 Long-term notes payable

43,000

43,000

301 Common Stock

32,000

32,000

302 Dividends

10,000

10,000

401 Fees earned

70,000

(a) 9,000

79,000

622 Salaries expense

54,000

(b) 2,000

56,000

650 Office supplies expense

8,000

8,000

Totals

155,000 155,000

11,000

11,000 166,000 166,000

Net income

Totals

Income

Statement

Dr.

Cr.

Balance Sheet

and Statement of

Ret. Earnings

Dr.

Cr.

23,000

17,000

52,000

12,000

43,000

32,000

10,000

79,000

56,000

8,000

64,000

15,000

79,000

79,000 102,000

87,000

15,000

79,000 102,000 102,000

2. Use information from the completed work sheet in part 1 to prepare adjusting entries.

Date

General Journal

Dec. 31 Accounts Receivable

Debit

9,000

Fees earned

Dec. 31 Salaries expense

Accounts payable

Credit

9,000

2,000

2,000

Dec. 31 No journal entry required

P7

88

3. Prepare the income statement and the statement of retained earnings for the year ended December 31 and

the unclassified balance sheet at December 31.

Debit

$23,000

17,000

52,000

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Common Stock

Dividends

10,000

Fees earned

Salaries expense

56,000

Office supplies expense

8,000

Totals

$166,000

Credit

$12,000

43,000

32,000

79,000

$166,000

Sampson Company

Income Statement

For Year Ended December 31, 2016

Fees earned

$79,000

Expenses

Salaries expense

$56,000

Office supplies expense 8,000

64,000

Net income

$15,000

Sampson Company

Statement of Retained Earnings

For Year Ended December 31, 2016

Retained Earnings, Dec. 31 2015

$

00

Plus: Net income

15,000

Less: Dividends

(10,000)

Retained Earnings, Dec. 31 2016

$ 5,000

Sampson Company

Balance Sheet

December 31, 2016

Assets

Cash

Accounts receivable

Land

P7

Total assets

$23,000

17,000

52,000

$92,000

Liabilities

Accounts payable

Long-term notes payable

Total liabilities

Equity

Common Stock

Retained Earnings

Total liabilities and equity

$12,000

43,000

55,000

32,000

5,000

92,000

89

03-P8: Appendix 3C

Reversing Entries

90

Appendix 4A – Reversing Entries

Reversing entries are optional. They are recorded in

response to accrued assets and accrued liabilities that

were created by adjusting entries at the end of a

reporting period. The purpose of reversing entries is to

simplify a company’s recordkeeping.

Let’s see how the accounting for our payroll

accrual will be handled with and without

reversing entries.

P8

91

P8

92

Without Reversing Entries

P8

With Reversing Entries

93

End of Chapter 3

94