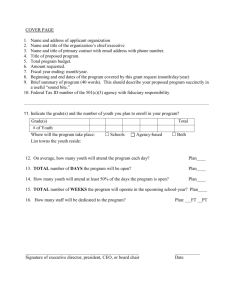

report title (28 pt, arial, all caps, bold)

advertisement

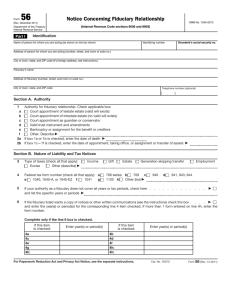

FIDUCIARY LIABILITY—PUBLIC SECTOR Hard Choices, Real Protection October 10, 2009 Daniel Aronowitz Ullico Casualty President Christine A. Dart Chubb & Son Vice President Robert D. Klausner Klausner & Kaufman, P.A. Esquire Brian L. Smith The Segal Company Senior Vice President Agenda Indemnity protection Common misconceptions v. reality Fiduciary “Standard of Care” Fiduciary liability exposures Operational Statutory Other Claim Examples Fiduciary liability insurance Is it permitted? What does it cover? Common Misconceptions Trustees are not bound to fiduciary rules Plans are exempt from ERISA Trustees are exempt from liability Sovereign immunity Statutory indemnification Governmental policy 2 The Reality Trustees are subject to significant fiduciary obligations Existing protections may be Very limited Non-existent 3 Possible “Gaps” in Your Liability Protection “Good faith” standard Who determines? – The attorney general, the board of trustees, or the courts Indemnity contingent upon an evaluation of the underlying conduct Liable for bad faith, willful, wanton or grossly negligent conduct “Ultra virus” standard Indemnity not available for actions taken outside “the scope of employment” Conduct must be consistent with “statutory duties” or “applicable standard of care” – “Breaches of fiduciary duty” may not be covered 4 Potential “Gaps” continued No uniformity Statues vary by state for indemnification of defense costs, judgments, penalties, and other expenses “Triggers” also vary No indemnity At least eleven appear to limit indemnification to trustees No indemnity is available to other officers, agents or employees 5 Immunity State “agent” immunity may be qualified Acts involving skill or judgment (Discretionary Acts) may not be eligible for immunity Non-qualifying acts may include: – Acts “inconsistent” with statutory duty – “Ultra Virus” acts – “Willful and wanton” negligence The “independence” of Public Sector plans may void sovereign immunity protection 6 Indemnity/Immunity Other Observations State statutory law may mirror ERISA’s section 412 [or 410?] Any indemnity agreement for a breach of fiduciary duty is void State statutory law may specifically grant immunity BE AWARE OF THE CAVEAT “That do not involve malicious or wanton misconduct…” 7 Critical Questions Do you know your state’s statutory and other applicable laws that define your responsibilities and liabilities? Do you have written opinions from legal counsel identifying the scope of any indemnification or immunity protections? Do you understand the caveat language that may exist within these protections? For example, is indemnity available for: “Gross negligence” or “willful or wanton failure?” Any alleged criminal activity? Are you protected if the Plan or a regulatory agency (e.g., the state attorney general) sues you for an alleged wrongdoing? Will the indemnity or immunity be provided if the alleged wrongdoing has become a political “hot potato” or “public scandal”? 8 Fiduciary Standard of Care The fiduciary standard adopted in most states is the ERISA standard applicable to most private sector plans. Federal Standard = Expert Prudent Man State Standard = or ~ Expert Prudent Man 9 Fiduciary Standard of Care continued The fiduciary…may owe affirmative duties…beyond those found in an ordinary case of fraud. See Jersey City v. Hague, 18 N.J. 584, 589-90 (1995) A fiduciary agent is presumed to be acting with “absolute devotion”… See Jaclyn, Inc. v. Edison Bros. Stores, Inc., 1970 N.J. Super. 334, 369 (1979) The public official may be considered a “constructive trustee” of assets gained through misconduct…or impose an “equitable lien”… The public employer may demand not only what was lost, but also gains… – See Dobbs, Law of Remedies RICO provisions and remedies may also be available 10 Public versus Private Sector Plans ERISA preempts state law and creates a uniform statutory standard Public sector plans are not so protected Numerous statutory and common law standards may apply ERISA = Uniform Statutory Standard Public Sector = No Uniform Statutory Standard 11 Delegation of Fiduciary Duty ERISA permits the avoidance of fiduciary liability by delegation Trustees’ exposure is essentially limited to monitoring Government plan fiduciaries do not transfer their liability by delegation of their duties to service providers ERISA Delegation Permitted Public Sector Delegation Permitted Liability Transferred Liability Not Transferred Trustees’ exposure includes investment decision, performance, and monitoring 12 Trustee and Administrative (Operational) Exposures 13 Trustee and Administrative (Operational) Exposures Asset/Liability Valuations Actuarial assumptions – Investment return assumption – Liability valuation » LTM or level-cost vs. MVL GASB and OPEB Asset/allocation choices Traditional v. non-traditional – Complexity of non-traditional » Research, evaluating, explaining, and monitoring Statutory constraints or mandates – Green, “politically correct,” “community development” “Prudent investor” rule Benchmarking By whom, how and what comparatives Investment monitoring arrangements Benefits Formulas – 1 – 3 – X final year salaries – Overtime impact – “Cash balance” type formula Statutory anti-cutback provisions Alternatives/Supplemental – Lump sum – DROP – LTD Corporate governance Sophistication or non-sophistication Agenda Expectations Participants Contributing employer 14 Trustee and Administrative (Operational) Exposures continued Fees Reasonableness Transparency Funding levels Long term Short term – Cash flows Knowledge/Experience Trustees Investment committee members Staff, especially investment staff Market issues Access, especially private sector Volatility Rate of return Public bond funding Contributing employer implications Scandals Ponzi schemes – Madoff and Stanford Financial Group LTD percentages Sponsor contributions Budget/tax implications Staffing Expertise Retention Resources Strategic partnerships Investment consultants Investment managers 15 DOL 401(K) Enforcement Actions—A Partial List Labor Department Sues to Appoint Independent Fiduciary for 401k Plan Abandoned by Employer DOL Sues Health Care Provider to Recover 401k Assets Company Agrees to Restore 401k Funds Following DOL Investigation DOL Sues Defunct Company for Abandoning 401k Plan DOL Sues to Restore Losses to Tampa 401k Plan DOL Sues Company President to Recover 401k Assets DOL Sues Company to Protect 401k Plan Participants DOL Sues Company and Owners Over Delinquent 401k Contributions DOL Sues Fiduciary to Recover 401k Assets Owner Pleads Guilty to Embezzlement of 401k Assets Labor Sues to Recover 401k Assets from California Company Labor Appoints Independent Fiduciary for Abandoned Georgia 401k 401Khelpcenter.com Labor Department Recovers $8.6 Million Involving Agway 401k Plan Labor Department Obtains Judgment Over Misuse of 401k Assets Company and Officers Ordered to Restore Misused 401k Funds DOL Takes Legal Action Against 401k Plan Trustee Labor Department Sues Fiduciary to Recover 401k Assets Labor Department Obtains Settlement with Business Owner to Restore 401k Funds DOL Sues Defunct Company Over Abandoned Retirement Plan Labor Department Sues to Appoint Independent Fiduciary for Abandoned 401k Labor Department Seeks to Recover Employee Contributions to 401k Plan Labor Sues to Protect Retirement Assets of Reno, Nevada, Workers 16 Specific Examples Asset allocation choices Mostly debt Statutory limitations Debt to Equity Shift Statutory limitations eliminated Heavy equity and Alternative investments Possibly ALM ~1950’s ~1970’s – 1990’s Today Future Funding Issues NJ—Considers bill deferring ½ of municipalities annual pension funding requirements. PA—Employer contributions may increase from 4% of payroll to 28% in 2012. MI—Employer contributions for Detroit’s police and fire pension plans may increase to 50% of payroll in 2011. Source: Pension Bills to Surge Nationwide (WSJ, March 16, 2009) 17 Specific Examples continued Favorable benefit provisions For example, in at least one municipal plan – The minimum retirement age = 50 – 100% benefits after 25 years of service Performance disclosure 13 states have secrecy laws Real estate investments—risk adjusted performance In 2007, one large fund held $213 billion in commercial real estate equity, leveraged 70% on average. – Rarely do internal rates of return account for leverage. – In a down market, leverage turns average performance into a disaster. Source: The Next Meltdown, Forbes, July 21, 2008 18 Other Statutory Exposures Federal ERISA’s “exclusive benefit” rule Tax exempt status is subject to plan assets not being used for or diverted to nonparticipants – Does this indirectly impose ERISA’s “fiduciary standards”? » See H.R. Conf. Rep. No. 93-1280 ADEA, PPA’06, and WRERA Crediting interest in cash balance plans – What is a market rate? Non-spousal rollovers Temporary waiver of required minimum distributions Self-funded plans eligible for special tax exclusion See Segal’s April, 2009 Bulletin for details IRS 19 Other Statutory Exposures continued State and local laws “Mirror” ERISA’s fiduciary standards Statutory “prudent investor” rules Investment analysis “per investment” versus “overall portfolio” Trust law Common law Duty of loyalty and “prudent investment” rule may create additional liability 20 Claim Examples and Allegations Pay to Play Theft Churning Investment Protocols Pension Benefits Cuts Portfolio Allocations 21 Allegations versus Final Impact ALLEGATION FINAL IMPACT Fee increases for poor performance Reduced benefits Churning—unusually high number of transactions New benefit “tiers” Inappropriate investments— insufficient liquidity Theft of funds Increased taxes Greater contributions Insolvency Pay to play 22 Public Scandals are Not New History repeats itself Ancient Roman writing tablets suggest public officials were involved in expenses scandals 2,000 years ago. 23 Fiduciary Liability Insurance At least one state mandates its purchase Approximately twenty states expressly authorize its purchase 24 Fiduciary Liability Insurance Protection Coverage Defense costs, settlements and judgments Named insured The plan, its trustees and employees Wrongful act Any actual or alleged breach of fiduciary duty or administrative error or omission even if it is proven frivolous or without merit Exclusions Willful, deliberate and dishonest acts – Defense coverage may be available until a final adjudication is established Severability Each insured individually protected This is an extremely limited “oversight” description. Consult legal counsel. 25 Fiduciary Liability Insurance Protection continued It is a legal, insurance contract with a third party, professional insurance company The insurance carrier will either provide or pay for independent legal counsel A qualified insurance carrier knows public sector claims The insurance carrier has an objective, financial rather than emotional investment The insurance carrier has been paid to be on your side 26 Conclusion Recent economic events: Spotlight trustees’ actions and responsibilities Are potentially redefining trustees’ standard of care Historical experience is not an indicator of future experience Relying on indemnification and immunity may be a false security Fiduciary liability insurance is an established, proven “safety net” 27 Contacts 1625 Eye Street, NW Washington, DC 20006 Bus: 202-682-4992 Mobile: (415) 254-4031 Bus Fax: 202-962-8853 Daniel Aronowitz President daronowitz@ullico.com 10059 Northwest 1st Court Plantation, Florida 33324 Robert D. Klausner Esquire bob@robertklausner.com100 82 Hopmeadow Street Simsbury, CT 06070-7683 Phone: 203-222-9625 Mobile: 203-451-3431 Christine Dart Vice President cdart@chubb.com Bus: 954-916-1202 Bus Fax: 954-916-1232 One Park Avenue New York, NY 10016-5895 www.segalco.com Bus: (212) 251-5333 Mobile: (347) 423-3452 Bus Fax: (212) 726-5518 Brian L. Smith Senior Vice President email: bsmith@segalco.com 28