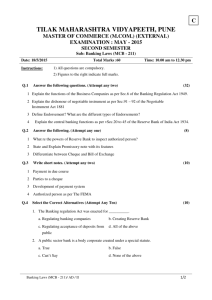

I Co-operative Banking

advertisement

Nature of Cooperative Bank Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world. Cooperative banking, as discussed here, includes retail banking carried out by credit unions, mutual savings banks, building societiesand cooperatives, as well as commercial banking services provided by mutual organizations (such as cooperative federations) to cooperative businesses. 2 Types of Co-operative Banks The co-operative banks are small-sized units which operate both in urban and non-urban centers. They finance small borrowers in industrial and trade sectors besides professional and salary classes. Regulated by the Reserve Bank of India, they are governed by the Banking Regulations Act 1949 and banking laws (cooperative societies) act, 1965. The co-operative banking structure in India is divided into following 5 categories: 3 State Co-operative Banks The state co-operative bank is a federation of central co-operative bank and acts as a watchdog of the cooperative banking structure in the state. Its funds are obtained from share capital, deposits, loans and overdrafts from the Reserve Bank of India. The state co-operative banks lend money to central co-operative banks and primary societies and not directly to the farmers. 4 Central Co-operative Banks These are the federations of primary credit societies in a district and are of two types-those having a membership of primary societies only and those having a membership of societies as well as individuals. The funds of the bank consist of share capital, deposits, loans and overdrafts from state cooperative banks and joint stocks. These banks provide finance to member societies within the limits of the borrowing capacity of societies. They also conduct all the business of a joint stock bank. 5 Urban Co-operative Banks The term Urban Co-operative Banks (UCBs), though not formally defined, refers to primary co-operative banks located in urban and semi-urban areas. These banks, till 1996, were allowed to lend money only for non-agricultural purposes. This distinction does not hold today. These banks were traditionally centered on communities, localities, work place groups. They essentially lend to small borrowers and businesses. Today, their scope of operations has widened considerably. 6 Land Development Banks The Land development banks are organized in 3 tiers namely; state, central, and primary level and they meet the long term credit requirements of the farmers for developmental purposes. The state land development banks oversee, the primary land development banks situated in the districts and tehsil areas in the state. They are governed both by the state government and Reserve Bank of India. Recently, the supervision of land development banks has been assumed by National Bank for Agriculture and Rural development (NABARD). The sources of funds for these banks are the debentures subscribed by both central and state government. These banks do not accept deposits from the general public 7 Primary Co-operative Credit Society The primary co-operative credit society is an association of borrowers and non-borrowers residing in a particular locality. The funds of the society are derived from the share capital and deposits of members and loans from central co-operative banks. The borrowing powers of the members as well as of the society are fixed. The loans are given to members for the purchase of cattle, fodder, fertilizers, pesticides, etc. 8 The origins of the urban co-operative banking movement in India can be traced to the close of nineteenth century. Inspired by the success of the experiments related to the co-operative movement in Britain and the co-operative credit movement in Germany, such societies were set up in India. Co-operative societies are based on the principles of cooperation, mutual help, democratic decision making, and open membership. Co-operatives represented a new and alternative approach to organization as against proprietary firms, partnership firms, and joint stock companies which represent the dominant form of commercial organization. They mainly rely upon deposits from members and non-members and in case of need, they get finance from either the district central co-operative bank to which they are affiliated or from the apex co-operative bank if they work in big cities where the apex bank has its Head Office. They provide credit to small scale industrialists, salaried employees, and other urban and semi-urban residents. 9 Prudential Norms applicable to Co-operative Banks & Co-operative Credit Societies General : Non Performing Assets (NPA) Asset Classification Income Recognition Diversion in Asset Classification 10 Non Performing Assets : 1) Interest & / or Installment remain overdue for a period of 90 days 2) Account remains out of order for a period more than 90 days in respect of ODCC 3) Bill remains overdue for a period more than 90 days 4) In case of Direct Agriculture Advances remains overdue for two crop seasons (for long duration crop overdue for one crop season) 5) Any amount to be received remain overdue for a period of more than 90 days 11 Prudential Norms applicable to Co-operative Banks & Cooperative Credit Societies NPA - An asset becomes non performing when it ceases to generate income for the bank. - 90 Days overdue norms to identification of NPA’s have been made applicable from 31.03.2004 - Tier I banks were permitted to classify loan accounts as NPA based on 180 days delinquency norm instead of 90 days norm. This relaxation as in force up to 31.03.2009. - Accordingly w. e. f 01.04.2009 all banks would classify NPA on 90 days delinquency norm. 12 Identification of Assets as NPA should be done on an on-going basis. Charging of Interest at monthly rest. Record of Recovery Treatment of NPA is borrower wise & not facility wise Agriculture Advance - Default in repayment due to natural calamites Housing loan to Staff Credit facilities guaranteed by Central/State Govt. Project Finance Prudential guidelines on restructuring of advances Other Advances 13 Recognition of income on investment treated as NPA. NPA reporting to RBI 14 Assets Classification - Bank should classify their assets into following broad groups: (i) Standard Assets (ii) Sub-Standard Assets (iii) Doubtful Assets (iv) Loss Assets Income Recognition has to be based on record of recovery Reversal of Income on accounts becoming NPA’s Partial recovery of NPA’s 15 Provisioning Norms Standard Assets Category of Standard Assets Rate of Provisioning Tier II Tier I Direct Advances to Agriculture & SME Sectors 0.25% 0.25% Commercial Real Estate (CRE) sector 1.00 % 1.00 % Commercial Real Estate Residential Housing sector (CRE-RH) 0.75 % 0.75 % All other loans and advances not included 0.40 % 0.25% 16 Provisioning on NPA’s Category of NPA Rate of Provisioning Sub Standard 10% Doubtful up to 1 Year 20% Doubtful 1 to 3 Year 30% Doubtful above 3 years (w. e. f. 01.04.2010) 100% Loss Assets 100% 17 Prudential norms on Capital Adequacy Statutory Requirements Share linking to Borrowings Capital Adequacy Norms Tier - I Capital Tier - II Capital Risk Weight for Computation of CRAR Issue of Preference Shares Issuance of Long Term (Subordinated) Deposits 18 Laws applicable to Cooperative Banks The Banking Regulation Act 1949 The Reserve Bank of India Act 1934 Prevention of Money Laundering Act 2002 Other Acts Applicable 19 Banking Regulation Act 1949 Section 6 :- Forms of Business in which banking companies may engage Now as per notification of GoI, Hire Purchase & Equipment Leasing is allowed. Also Insurance Business may be undertaken by UCB’s. Section 8 :- Prohibition of Trading No Banking Company shall directly or indirectly deal in buying or selling of goods except in connection with the realization of security. 20 Section 9 Disposal of Non Banking Asset No banking company shall hold any immovable property except those required for it’s a own use for any period exceeding 7 years Section 10A: Board of Directors to include persons with professional or other experience. Section 11 :- No co-operative bank shall commence or carry on the business of banking in India unless the aggregate value of its paid up capital and reserves is not less than Rupees One Lac. 21 Section 14 A:- No co-operative bank shall create a floating charge on the under taking or any of it’s a property. (Unless the creation of such charge is certified in writing by RBI as not being detrimental to the interest of depositors of such bank.) Section 18:- Cash Reserve Every co-operative bank shall maintain in India by way of Cash Reserve, a sum equivalent to at least 4% of total of it’s time & demand liabilities as on last Friday of Second preceding forth night & submit to RBI before 15th day of every month a return showing the particulars. 22 Section 20:- Restrictions on Loans & Advances to Directors. (with effect from 01.10.2003) Exemption a) Employee related loan to staff director b) Loan to directors against Fixed deposit and LIP Section 20A:- Restriction of Power to remit Debts Co-operative banks would have to obtain prior approval of RBI to remit any debt due to it by any of it’s past or present directors. Section 21 :- Power of RBI to control advances (Purpose / Margin / Limit / Rate of interest) 23 Section 24:- Every co-operative bank shall maintain in India by way of Assets, a sum equivalent to at least 21.50% (Not exceeding 40%) of total of it’s time & demand liabilities as on last Friday of Second preceding forth night & submit to RBI before 20th day of every month showing the particulars. Section 26:- Return of Unclaimed Deposits Every Co-operative bank within 30 days from the close of each calendar year submit a return of all accounts which have not been operated upon for 10 years. (As per amended provision, every bank has to transfer the Unclaimed deposit of more than 10 years to RBI as Depositors Education & Awareness Fund every month) 24 Section 27 :- Every bank is required to submit to RBI a return showing it’s a Assets and Liabilities as at last Friday of every month, within next month. Section 29 & 31 :- Banks are required to prepare their P&L account and B/S before 30th Sept. of each year. Also required to submit 3 copies along with Statutory Audit Reports, signed by principal officer of the bank and at least 3 directors. Such financial statements should be published in local news paper within a period of 9 months from the end of the period to which they relate. (i.e. before 31st Dec.) 25 Section 35:- Inspection Section 35A:- Power of RBI to give directions Section 45:- Power of RBI to apply to Central Govt. for suspension of business of co-operative bank or to order moratorium. Section 46: Penalties 26 The Reserve Bank of India Act 1934 22. Right to issue bank notes. (1) The Bank shall have the sole right to issue bank notes in [India], and may, for a period which shall be fixed by the [Central Government] on the recommendation of the Central Board, issue currency notes of the Government of India supplied to it by the [Central Government], and the provisions of this Act applicable to bank notes shall, unless a contrary intention appears, apply to all currency notes of the Government of India issued either by the [Central Government] or by the Bank in like manner as if such currency notes were bank notes, and references in this Act to bank notes shall be construed accordingly. 27 (2) On and from the date on which this Chapter comes into force the [Central Government] shall not issue any currency notes. 24. Denominations of notes. (1) Subject to the provisions of sub-section (2), bank notes shall be of the denominational values of two rupees, five rupees, ten rupees, twenty rupees, fifty rupees, one hundred rupees, five hundred rupees, one thousand rupees, five thousand rupees and ten thousand rupees or of such other denominational values, not exceeding ten thousand rupees, as the Central Government may, on the recommendation of the Central Board, specify in this behalf. 28 (2) The Central Government may, on the recommendation of the Central Board, direct the nonissue or the discontinuance of issue of bank notes of such denominational values as it may specify in this behalf.] 26. Legal tender character of notes. (1) Subject to the provisions of sub-section (2), every bank note shall be legal tender at any place in [India] in payment or on account for the amount expressed therein, and shall be guaranteed by the [Central Government]. 29 (2) On recommendation of the Central Board the [Central Government] may, by notification in the Gazette of India, declare that, with effect from such date as may be specified in the notification, any series of bank notes of any denomination shall cease to be legal tender [save at such office or agency of the Bank and to such extent as may be specified in the notification]. 30 42. Cash reserves of scheduled banks to be kept with the Bank. [(1) Every bank included in the Second Schedule shall maintain with the Bank an average daily balance the amount of which shall not be less than [such per cent. of the total of the demand and time liabilities in India of such bank as shown in the return referred to in subsection (2), as the Bank may from time to time, having regard to the needs of securing the monetary stability in the country, notify in the Gazette of India]: 31 (1A) Notwithstanding anything contained in sub-section (1), the Bank may, by notification in the Gazette of India, direct that every scheduled bank shall, with effect from such date as may be specified in the notification, maintain with the Bank, in addition to the balance prescribed by or under sub-section (1), an additional average daily balance the amount of which shall not be less than the 1[rate specified in the notification, such additional balance being calculated with reference to the excess of the total of the demand and time liabilities of the bank as shown in the return referred to in sub-section (2) over the total of its demand and time liabilities] at the close of business on the date specified in the notification as shown by such return so however, that the additional balance shall, in no case, be more than such excess 32 (2A) Where the last Friday of a month is not an alternate Friday for the purpose of sub-section (2), every scheduled bank shall send to the Bank, a special return giving the details specified in sub-section (2) as at the close of business on such last Friday or where such last Friday is a public holiday under the Negotiable Instruments Act, 1881 as at the close of business on the preceding working day and such return shall be sent not later than seven days after the date to which it relates. 33 (3) If the average daily balance held at the Bank by a scheduled bank during any [fortnight] is below the minimum prescribed by or under sub-section (1) or subsection (1A), such Scheduled bank shall be liable to pay to the Bank in respect of that [fortnight] penal interest at a rate of three per cent, above the bank rate on the amount by which such balance with the Bank falls short of the prescribed minimum, and if during the next succeeding [fortnight], such average daily balance is still below the prescribed minimum the rates of penal interest shall be increased to a rate of five per cent, above the bank rate in respect of that [fortnight) and each subsequent [fortnight) during which the default continues on the amount by which such balance at the Bank falls short of the prescribed minimum.] 34 (3A) When under the provisions of sub-section (3) penal interest at the increased rate of five per cent, above the bank rate has become payable by a scheduled bank, 1[if thereafter the average daily balance held at the Bank during the next succeeding [fortnight] is still below the prescribed minimum. (a) every director, manager or secretary of the scheduled bank, who is knowingly and willfully a party to the default, shall be punishable with fine which may extend to five hundred rupees and with a further fine which may extend to five hundred rupees for each subsequent [fortnight] during which the default continues, and (b) the Bank may prohibit the scheduled bank from receiving after the said [fortnight] any fresh deposit,] 35 and, if default is made by the scheduled bank in complying with the prohibition referred to in clause (b), every director and officer of the scheduled bank who is knowingly and willfully a party to such default or who through negligence or otherwise contributes to such default shall in respect of each such default be punishable with fine which may extend to five hundred rupees and with a further fine which may extend to five hundred rupees for each day after the first on which a deposit received in contravention of such prohibition is retained by the scheduled bank. Explanation.– In this sub-section ‘‘officer’’ includes a manager, secretary, branch manager, and branch secretary. 36 (4) Any scheduled bank failing to comply with the provisions of subsection (2) [shall be liable to pay to the Bank] a penalty of one hundred rupees for each day during which the failure continues. (5) (a) The penalties imposed by sub-sections (3) and (4) shall be payable within a period of fourteen days from the date on which a notice issued by the Bank demanding the payment of the same is served on the scheduled bank, and in the event of a failure of the scheduled bank to pay the same within such period, may be levied by a direction of the principal civil court having jurisdiction in the area where an office of the defaulting bank is situated, such direction to be made only upon an application made in this behalf to the court by the Bank; 37 (b) when the court makes a direction under clause (a), it shall issue a certificate specifying the sum payable by the scheduled bank and every such certificate shall be enforceable in the same manner as if it were a decree made by the court in a suit; (c) notwithstanding anything contained in this section, if the Bank is satisfied that the defaulting bank had sufficient cause for its failure to comply with the provisions of sub-sections (1), (1A) or (2), it may not demand the payment of the penal interest or the penalty, as the case may be.] 38 (6) The Bank shall, save as hereinafter provided, by notification in the Gazette of India,– (a) direct the inclusion in the Second Schedule of any bank not already so included which carries on the business of banking [in India] and which– (i) has a paid-up capital and reserves of an aggregate value of not less than five lakhs of rupees, and (ii) satisfies the Bank that its affairs are not being conducted in a manner detrimental to the interests of its depositors, and (iii) is a State co-operative bank or a company as defined in [section 3 of the Companies Act, 1956, or an institution notified by the Central Government in this behalf] or a corporation or a company incorporated by or under any law in force in any place [outside India]; 39 (b) direct the exclusion from that Schedule of any scheduled bank.– (i) the aggregate value of whose paid-up capital and reserves becomes at any time less than five lakhs of rupees, or (ii) which is, in the opinion of the Bank after making an inspection under section 35 of the [Banking Regulation Act, 1949], conducting its affairs to the detriment of the interests of its depositors, or (iii) which goes into liquidation or otherwise ceases to carry on banking business: 40 Provided that the Bank may, on application of the scheduled bank concerned and subject to such conditions, if any, as it may impose, defer the making of a direction under sub-clause (i) or sub-clause (ii) of clause (b) for such period as the Bank considers reasonable to give the scheduled bank an opportunity of increasing the aggregate value of its paid-up capital and reserves to not less than five lakhs of rupees or, as the case may be, of removing the defects in the conduct of its affairs: 41 (c) alter the description in that Schedule whenever any scheduled bank changes its name. Explanation.– In this sub-section the expression ‘‘value’’ means the real or exchangeable value and not the nominal value which may be shown in the books of the bank concerned; and if any dispute arises in computing the aggregate value of the paid-up capital and reserves of a bank, a determination thereof by the Bank shall be final for the purposes of this subsection.] 42 (6A) In considering whether a State co-operative bank or a regional rural bank should be included in or excluded from the Second Schedule, it shall be competent for the Bank to act on a certificate from the National Bank on the question whether or not a State co-operative bank or a regional rural bank, as the case may be, satisfies the requirements as to paid-up capital and reserves or whether its affairs are not being conducted in a manner detrimental to the interests of its depositors. (7) The Bank may, for such period and subject to such conditions as may be specified, grant to any scheduled bank such exemptions from the provisions of this section as it thinks fit with reference to all or any of its offices or with reference to the whole or any part of its assets and liabilities. 43 45E. Disclosure of information prohibited. 1) Any credit information contained in any statement submitted by a banking company under section 45C or furnished by the Bank to any banking company under section 45D, shall be treated as confidential and shall not, except for the purposes of this Chapter, be published or otherwise disclosed. (2) Nothing in this section shall apply to – (a) the disclosure by any banking company, with the previous permission of the Bank, of any information furnished to the Bank under section 45C: 44 (b) the publication by the Bank, if it considers necessary in the public interest so to do, of any information collected by it under section 45C, in such consolidated form as it may think fit without disclosing the name of any banking company or its borrowers: (c) the disclosure or publication by the banking company or by the Bank of any credit information to any other banking company or in accordance with the practice and usage customary among bankers or as permitted or required under any other law: Provided that any credit information received by a banking company under this clause shall not be published except in accordance with the practice and usage customary among bankers or as permitted or required under any other law.] 45 (d) the disclosures of any credit information under the Credit Information Companies (Regulation) Act, 2005.] (3) Notwithstanding anything contained in any law for the time being in force, no court, tribunal or other authority shall compel the Bank or any banking company to produce or to give inspection of any statement submitted by that banking company under section 45C or to disclose any credit information furnished by the Bank to that banking company under section 45D. 46 Prevention of Money Laundering Act, 2002 Section 3 - Offence of money-laundering.— Whosoever directly or indirectly Attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming it as untainted property shall be guilty of offence of money-laundering. 47 4. Punishment for money-laundering.—Whoever commits the offence of money-laundering shall be punishable with rigorous imprisonment for a term which shall not be less than three years but which may extend to seven years and shall also be liable to fine. 12. Reporting entity to maintain records.— (1) Every reporting entity Shall—(a) maintain a record of all transactions, including information relating to transactions covered under clause (b), in such manner as to enable it to reconstruct individual transactions. 48 (b) furnish to the Director within such time as may be prescribed, information relating to such transactions, whether attempted or executed, the nature and value of which may be prescribed; (c) verify the identity of its clients in such manner and subject to such conditions, as may be prescribed; (d) identify the beneficial owner, if any, of such of its clients, as may be prescribed; (e) maintain record of documents evidencing identity of its clients and beneficial owners as well as account files and business correspondence relating to its clients. 49 (2) Every information maintained, furnished or verified, save as otherwise provided under any law for the time being in force, shall be kept confidential. (3) The records referred to in clause (a) of sub-section (1) shall be maintained for a period of five years from the date of transaction between a client and the reporting entity. (4) The records referred to in clause (e) of sub-section (1) shall be maintained for a period of five years after the business relationship between a client and the reporting entity has ended or the account has been closed, whichever is later. (5) The Central Government may, by notification, exempt any reporting entity or class of reporting entities from any obligation under this Chapter.] 50 15. Procedure and manner of furnishing information by reporting entities.—The Central Government may, in consultation with the Reserve Bank of India, prescribe the procedure and the manner of maintaining and furnishing information by a reporting entity under sub-section (1) of section 12 for the purpose of implementing the provisions of this Act.] 63. Punishment for false information or failure to give information, etc.— (1) Any person willfully and maliciously giving false information and so causing an arrest or a search to be made under this Act shall on conviction be liable for imprisonment for a term which may extend to two years or with fine which may extend to fifty thousand rupees or both 51 (2) If any person,— (a) being legally bound to state the truth of any matter relating to an offence under section 3, refuses to answer any question put to him by an authority in the exercise of its powers under this Act; or (b) refuses to sign any statement made by him in the course of any proceedings under this Act, which an authority may legally require to sign; or (c) to whom a summon is issued under section 50 either to attend to give evidence or produce books of account or other documents at a certain place and time, omits to attend or produce books of account or documents at the place or time, he shall pay, by way of penalty, a sum which shall not be less than five hundred rupees but which may extend to ten thousand rupees for each such default or failure. 52 Prevention of Money Laundering Rules 2. Definitions.—(1) In these rules, unless the context otherwise requires,— (d) “officially valid document” means the passport, the driving licence, the Permanent Account Number (PAN) Card, the Voter’s Identity Card issued by Election Commission of India, job card issued by NREGA duly signed by an officer of the State Government, the letter issued by the Unique Identification Authority of India containing details of name, address and Aadhaar number or any other document as notified by the Central Government in consultation with the in consultation with the [Regulator] 53 Provided that where simplified measures are applied for verifying the identity of the clients the following documents shall be deemed to be officially valid documents:— (a) identity card with applicant’s Photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks, and Public Financial Institutions; (b) letter issued by a gazetted officer, with a duly attested photograph of the person. 54 (fb) “small account” means a savings account in a banking company where— (i) the aggregate of all credits in a financial year does not exceed rupees one lakh, (ii) the aggregate of all withdrawals and transfers in a month does not exceed rupees ten thousand, and (iii) the balance at any point of time does not exceed rupees fifty thousand. 55 (g) “suspicious transaction” means a transaction referred to in clause (h), including an attempted transaction, whether or not made in cash, which to a person acting in good faith— (a) gives rise to a reasonable ground of suspicion that it may involve proceeds of an offence specified in the Schedule to the Act, regardless of the value involved; or b) appears to be made in circumstances of unusual or unjustified complexity; or (c) appears to have no economic rationale or bona fide purpose; or(d) gives rise to a reasonable ground of suspicion that it may involve financing of the activities relating to terrorism 56 3. Maintenance of records of transactions (nature and value).—(1) Every reporting entity shall maintain the record of all transactions including, the record of— (A) all cash transactions of the value of more than ten lakh rupees or its equivalent in foreign currency; (B) all series of cash transactions integrally connected to each other which have been individually valued below rupees ten lakh or its equivalent in foreign currency where such series of transactions have taken place within a month and the monthly aggregate exceeds an amount of ten lakh rupees or its equivalent in foreign currency 57 1[(BA) all transactions involving receipts by non-profit organisations of value more than rupees ten lakh, or its equivalent in foreign currency;] 2[(C) all cash transactions where forged or counterfeit currency notes or bank notes have been used as genuine or where any forgery of a valuable security or a document has taken place facilitating the transactions;] (D) all suspicious transactions whether or not made in cash and by way of— (i) deposits and credits, withdrawals into or from any accounts in whatsoever name they are referred to in any currency maintained by way of— 58 (a) cheques including third party cheques, pay orders, demand drafts, cashiers cheques or any other instrument of payment of money including electronic receipts or credits and electronic payments or debits, or (b) travellers cheques, or (c) transfer from one account within the same banking company, financial institution and intermediary, as the case may be, including from or to Nostro and Vostro accounts, or (d) any other mode in whatsoever name it is referred to; 59 Other Laws applicable to Cooperative Banks The Negotiable Instrument Act 1881 State Stamp Acts State Co-operative Societies Act Multistate Co-operative Societies Act 2002 Income Tax Act 1961 Employees Provident Fund Act 1952 Gratuity Act Payment of Bonus Act 1956 Indian Contract Act 1872 The Foreign Exchange Management Act, 1999 The Service Tax Act and Rules 60 Thank You! CA Sunil Nagaonkar, Kolhapur M: 9823124333 61