AFT Presentation - Preservation Kentucky

advertisement

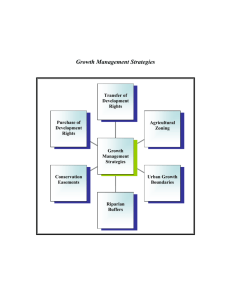

Farms and Historic Preservation: Planning for an Agricultural Future Gerry Cohn American Farmland Trust Organic Valley © American Farmland Trust American Farmland Trust National non-profit organization, founded in 1980. 50,000 members nationwide Protecting working lands, planning for agriculture, and keeping the land healthy Education, policy advocacy, and land projects Farm Bill © American Farmland Trust Farming on the Edge © American Farmland Trust Why are we losing farmland? Farm Economy is changing Greater competition for land Prices rising Fewer Acres Fewer Farmers More residents, more taxes New residents, new conflicts © American Farmland Trust Farmland Protection Toolbox • • • • • • • • • • Differential Taxation Right to Farm Laws Land Use Planning Agricultural Protection Zoning Conservation Easements Purchase of Development Rights Transfer of Development Rights Agricultural Economic Development Estate Planning / Farm Transition Agricultural Districts © American Farmland Trust Planning for Agriculture, not just around it! Planning for Agriculture Land use policies Economic development programs FARMING IS A BUSINESS © American Farmland Trust Profitability is Key Local foods Grains and biofuels Grass-fed meat Recreation: hunting, meetings Ecosystem services New farmers: Farm Credit survey Taking care of family needs © American Farmland Trust Local Government Tools Comprehensive and Local FP Plans Zoning and Subdivision Ordinances Taxation Right-to-Farm Laws Agricultural Districts © American Farmland Trust Farm Transfer and Estate Planning Transfer ownership and management of the agricultural operation, land and other assets Avoid unnecessary transfer taxes (income, gift and estate) Ensure financial security and peace of mind for all generations Develop the next generation’s management capacity © American Farmland Trust Planning for Conservation Federal Leveraging $ into your community Farm Bill opportunities Alphabet Soup: Access thru local Soil and Water Conservation District office Local foods, community food security, rural development, etc. State NC: Ag Conservation cost share, CREP, CWMTF Your State: ?? © American Farmland Trust Buncombe County, NC Cooperative Extension Sustainable Ag Agent Blue Ridge Food Ventures $2M annually for PACE Appalachian Sustainable Agriculture Project Agricultural Development and Farmland Preservation Plan City Market Foodtopia Farm Prosperity and Farmland Values Project © American Farmland Trust Carroll County, GA Broad based partnership, led by Rolling Hills RC&D Active participation in Comp Plan Update Cotton Mill Farmers Market Farmers Fresh Food Network SPLOST referendum (3M for farmland) Georgia Agricultural Land Trust New growers school © American Farmland Trust Purchase of Development Rights or Purchase of Agricultural Conservation Easements Land protection, liquidity, cash in-flow 27 state programs 56 local programs Farmland Protection Program (federal) © American Farmland Trust Farmland Protection Program (FPP) • Leveraging federal dollars for farmland protection • USDA pays 50% of value. Landowner can donate 25% of value. 25% cash match required. • Funding increase from 97M in 2008 to 200M in 2012. © American Farmland Trust FPP Eligibile Lands The farmland or ranch land must contain at least 50 percent of prime, unique, or locally important soil or contain historic or archaeological sites. Historic sites: must be listed in historic register or formally be declared eligible. © American Farmland Trust Possible sources of funding • General obligation and special purpose bonds • Annual appropriations • Real estate transfer taxes • Impact Fees • Present Use Value Program Rollback Taxes • Transportation Enhancement Funds © American Farmland Trust Creative Funding Sources • Dedicated local sales tax • Farmland conversion mitigation fees • Cellular phone tax • Lottery proceeds • Motel/restaurant tax • Transfer of Development Rights © American Farmland Trust CT Trust for Historic Preservation Barns Grant Program 75 percent cost-share, up to 8K Conditions Assessment, feasibility study, or historic registration Funded by General Assembly © American Farmland Trust MA Community Preservation Act Allows communities to collect a 1-3% property tax surcharge Matched with state funds collected through deed recording fee Can be used for historic preservation, land protection or affordable housing © American Farmland Trust CT Community Investment Act Statewide Deed Recording Fee Funds state agency programs for farmland preservation, historic preservation, affordable housing, and open space Up to $20 M annually Building new coalitions © American Farmland Trust KY Rural Heritage Development Initiative Multi-year regional collaboration Farmland protection, historic preservation, agricultural economic development 2006 Rural Resource Team – land use planning, farm viability, reuse of old buildings Building new coalitions and putting the pieces together © American Farmland Trust CROPP Cooperative - Organic Valley National farmer cooperative - 1200 members All certified organic dairy, eggs, meat, juice, animal feed, and vegetables All-farmer board and elected committees Farmer-determined stable pay price Organic transition and technical assistance © American Farmland Trust Sign up for AFT’s E-news and Farm Policy News www.farmland.org © American Farmland Trust FARMLAND INFORMATION CENTER www.farmlandinfo.org (800) 370 - 4879 © American Farmland Trust Gerry Cohn 919-537-8447 gcohn@farmland.org © American Farmland Trust