Korean Mobile Market Overview

advertisement

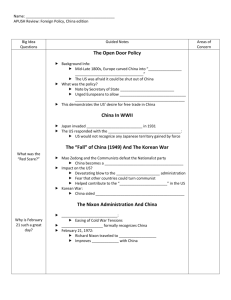

Index 1. Korean Mobile market Overview 2. Korean Mobile Trend 3. Penetration Strategy for Korean market 4. NEOWIZ as Mobile Publisher in Korea Q&A 1. Korean Mobile market Overview Korean Mobile Market Overview Numbers million US CHINA ENG KOREA JPN GER FRA CAN SPAIN Korean Mobile Market Overview Korean Mobile Market Overview Smartphone Penetration Rate (%) US KOREA As of JUL 2012 ENG FRA GER JPN … AVG of World Korean Mobile Market Overview Korean Mobile Market Overview Korean Mobile Market Overview Korean Mobile Market Overview Korean Mobile Market Overview Korean Mobile Market Overview Smart phone Internet access Web Smart phone Access Network Mobile web Wifi Mobile app Korean mobile users are more ‘MOBILE’ dedicated Korea has good network infrastructure with ‘Unlimited data service’ * Source : KISA 2012.8 Korean Mobile Market Overview Number of Installed APP Number of Frequently used APP Down loaded mobile apps (multi select, %) Game Comm Music Utility * Source : KISA 2012.8 Map Weather News Video Shopping Stock Life TV Education eBook office Korean Mobile Market Overview 2012.2Q Game contents usage survey Mobile game Online game (client + web) Online game (client only) Online game (web only) Arcade game Console game Board game Web hard/P2P game Software buying Never * Source : Korea Creative Contents Agency 2012.8 Have ever played! Korean Mobile Market Overview 2012.2Q Game playing time (min) Online game (client) Software Online game (web) Board game Video Console game Web hard / P2P game Mobile game Arcade game Others * Source : Korea Creative Contents Agency 2012.8 Korean Mobile Market Overview 2012.2Q Game contents Buying rate Mobile game Online game (client + web) Online game (client) Online game (web) Arcade game Video Console game Software buying Board game Web hard / P2P game Never * Source : Korea Creative Contents Agency 2012.8 Have ever bought! Korean Mobile Market Overview Major Application Usage Time (Min/Day) etc entertainment news SNS game Insight 1 Game + SNS 48% Social Game Korean Mobile Market Overview Global Game Growth Expectation per Genre Arcade PC Console Mobile Insight 2 ‘Mobile + Web‘ Cross platform 2. Korean Mobile Trend Korean Mobile Trend KAKAO TALK 36,000,000 registered users in Korea 63,000,000 registered users worldwide Each users’ average KAKAO friends number 93.5 Korean Mobile Trend KAKAO TALK iOS Top 30 Download Rank in Game category (2012.10.30) Korean Mobile Trend KAKAO TALK Android Top Daily Active User Rank in Game category (2012.10.31) 1. Dragon Flight 2. Any pang 3. Candy pang 4. I love coffee 5. Korean draw something 7. Puzzle zoozoo Casual Killing time Friendly Korean Mobile Trend KAKAO TALK Simple & Easy & Playing together & Competition Any pang • 1heart after 8min • Heart for gift • Ranking among friends • 1min/PLAY Dragon Flight • Dragon item with strong force • 5mil RMB/DAY (peak) Korean Mobile Trend T STORE T store, bigger market share over Apple and Google market Monthly Revenue Share of Korean App Market ※ Source: SK estimation Korean Mobile Trend T STORE Business performance as of October 8, 2012: Accumulated subscribers Accumulated Downloads Developers 17.3M 988M 33K Registered Apps & Contents Monthly Active Users Monthly Transactions 0.37M 9M US$ 12M Korean Major Mobile platform T STORE Paid Downloads : Game > VOD > Utilities > Music … Free Downloads : Utilities > Game > Fun > Education … Game (w/ In-Game Purchases) is the most profitable category, whereas utility (w/ In-App Ads) records the most downloads Paid Downloads E-book Free Downloads Game 8% 29% VOD Education Music 3% VOD E-book 0% 1% 2% Game 31% 26% Education 4% Music Utilities 14% 12% Fun Utilities Fun 6% 45% 18% Korean Major Mobile platform T STORE Game is the most preferred and profitable application. ※ Source: SK Data (Oct 2011) Korean Mobile Trend T STORE Examples of Global Games (Sep 18, 2012) 2011 Achievement 348,064 D/L 3,000 KRW (U$3) March 18, 2011 RealNetworks AP 97,111 D/L 1,200 KRW (U$1) Stand-alone Nov 11, 2010 - D/L: 183,842 Strastar - Revenue: U$ 568K 649,890 D/L Free Carrier-billing July 14, 2011 RealNetworks AP In-App Purchase - D/L: 278,090 - Revenue: U$ 483K 97,369 D/L 5,000 KRW (U$4) July 28, 2011 Joymoa 141,132 D/L 43,608 D/L 165,837 D/L 2,200 KRW (U$2) 5,000 KRW (U$4) 1,000 KRW (U$1) July 12, 2011 May 24, 2012 May 22, 2012 GREE Gameloft Gameloft 1,131,684 D/L 36,341 D/L 14,658 D/L Free 5,000 KRW (U$4) 1,100 KRW (U$1) July 25, 2011 Dec 7 2010 July 11, 2012 GREE Gameloft Rovio 3. Penetration Strategy for Korean market Penetration Strategy for Korean market 1. Localization Good brand Easy to memorize English is acceptable Cultural translation Ordinary expression Natural feeling Easy tutorial User friendly Detail explain Local SNS KAKAO Facebook Simple UI 3D or qualified graphic design Good network infra No concern of file size Penetration Strategy for Korean market 2. Multi Channeling Android Apple store Telecom market T store Olleh store U+ store Google play KAKAO TALK iOS Penetration Strategy for Korean market 3. Partnership Local payment Different SDKs Minimized version Unified payment SDK Fast update Frequent communication with users Cross border issue Local account tax Income transfer Local Operation SNS Promotion / Target marketing PR CS Synergy User pool Cross selling 4. NEOWIZ as mobile publisher in Korea NEOWIZ as Mobile publisher in Korea NEOWIZ as Mobile publisher in Korea Online Game lineup: Develop and publish 45+ titles Expanding both locally and internationally Game portal Pmang.com : 6 million monthly UV, 25 million RU #1 Korean game publisher: presence in 49 countries 2011 revenue: $660 million RPG NEOWIZ as Mobile publisher in Korea Representing Products Mobile Social Platform High Quality Applications 10mil registered users Covering all major platforms NEOWIZ as Mobile publisher in Korea Mobile Game lineup: Develop and publish 20+ titles globally 欢乐王国 逆转三国 NEOWIZ as Mobile publisher in Korea TOGETHER WE CAN MAKE GREAT SUCCESS STORY THANK YOU eliot@neowiz.com