Finish Line, Inc.

advertisement

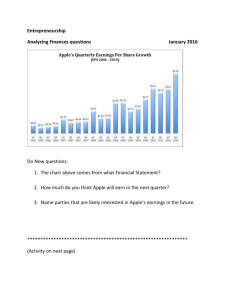

FINISH LINE NASDAQ: FINL Shreyas Garg Sudhamsh Tippireddy STOCK OVERVIEW Price: 24.42 Market Cap: 1.2B Beta: 1.57 P/E: 18.35 INDUSTRY/BUSINESS OVERVIEW Finish Line sells shoes and other sportswear Competitors include Foot Locker, Nike, Adidas, Dick’s Sporting Goods, Sports Authority, and Amazon (somewhat) Advantages in the industry include: variety and price of the products A major problem with most companies in the industry is that they don’t sell many products to women FINISH LINE OVERVIEW The typical customer is male and between the ages of 18 and 29 For the Running Specialty Stores it is a typical performance runner Sells mostly premium products The current leader in the running shoes category Sacrificed some revenue this year for long term growth Something you always want to see in a smaller company THESIS The exclusive partnership with Macy’s gives FINL a major advantage over its competition Finish Line has 651 stores which provides ample opportunity for growth (there are about 1000 class A malls in the USA) Could also expand internationally FINL is intelligently integrating technology into its stores which provides for a better customer experience PARTNERSHIP WITH MACY’S Finish Line announced an with Macy’s to become the exclusive provider of athletic shoes. Finish Line will manage the athletic footwear assortment and inventory for all Macy’s locations and online. This will include shops in more than 450 Macy’s department stores in the U.S. The majority of Macy’s Customers are women This allows FINL to reach a customer base (women) which few other companies are able to sell too. FINL STORE WITHIN MACY’S STORE INTEGRATION OF TECHNOLOGY The employees have handheld scanners which allows them to check out customers at any place in the store (convenience) Constantly upgrading software and their website Omni channel customer experience SOME STATS Q2 FY 2014 financial results (period ended August 31, 2013). The Company reported net sales of $436.0 million, a 13.3% YoY increase. Its diluted EPS for the quarter totaled $0.54, a 10.2% YoY increase. Chairman and CEO Glenn Lyon commented, "The combination of positive comparable sales and good expense control drove a 10% increase in earnings per share over last year. VALUATION FINL Industry PE 18.35 29.40 P/TBV 2.31 5.57 5 yr growth rate 3.60% -.05% Gross Margin 35.00% 32.50% Pre Tax Margin 6.80% 4.30% Net Profit Margin 4.20% .02% SUMMARY Many opportunities for growth Exclusive partnership will be highly advantageous Growing while the industry is stagnant