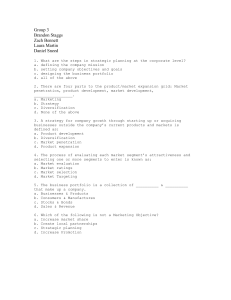

REITS_4

advertisement

REITs and Portfolio Diversification Capital Asset Pricing Models (CAPM) A. Risk compensation 1. unique vs. systematic risk 2. idiosyncratic vs. nondiversifiable B. Appropriate market portfolio 1. stock and/or bond markets typically used 2. real estate estimated to comprise 50% of US stock of wealth vs 20% for stocks stock market risk may be diversifiable C. market risk and beta 1. Rf = risk-free return 2. Rm = market return 3. Rre = real estate return Rre R f Rm R f Definitions • Expected Portfolio Return (2 stocks): – Weighted average of each stock’s expected return. ~ ~ ~ E RP x1 E R1 x 2 E R2 Definitions • Portfolio Variance: – sum of share-weighted averages of the variances of stock returns plus the covariances among stock returns. x x 2 x1 x2 COV R1 , R2 2 P 2 1 2 1 2 2 2 2 Definitions • Covariance: – absolute measure of the extent to which 2 stocks move together over time. • Positive Covariance - 2 assets move together • Negative Covariance - 2 assets move apart • Gives contribution of stock to overall portfolio risk ~ ~ COV R1 , R2 E R1 E R1 R2 E R2 12 Definitions • Correlation: – relative measure of the extent to which 2 stocks move together. • Perfectly Positive = +1 • Perfectly Negative = -1 COV R1 , R2 1 2 Definitions • Portfolio Variance – reprise P2 x12 12 x22 22 2 x1 x2 COV R1 , R2 x x 2 x1 x2 1 2 2 P 2 1 2 1 2 2 2 2 Portfolio Diversification • Now consider the “market” portfolio. – How many stocks are in the market? • Assume market composed of “N” stocks. N ~ Rm xi E ( Ri ) i 1 Portfolio Diversification • Out of the “N” stocks in the market, let’s assume that #2 represents the return on REITs. • How do you measure the REIT contribution to the overall portfolio risk? – Answer: Covariance Portfolio Diversification • Let’s look at the “N” stock market variance/covariance matrix – Gives contribution of each stock to portfolio risk. 1 1 x12 12 2 x 2 x1 21 N x N x1 N 1 2 N x1 x 2 12 x1 x N 1N x 2 2 2 2 x 2 x N 1N x N2 N2 N x 2 xi 2 i i 1 Portfolio Diversification • The Marginal Risk of REITs = – Covariance of REIT and market divided by overall market risk. N N x2 xi 2i x2 xi 2i x2 cov R2 , xi Ri i 1 i 1 i 1 N m2 m2 m2 Portfolio Diversification • Note that: Rm n xi Ri i 1 Portfolio Diversification • Thus: cov R2 , Rm 2m 2 m 2 x2 x2 x 2 2 m 2 2 m m m Note: 2 2m m Portfolio Diversification • So what’s the point? – Compound Annual Returns (1981-2001): • • • • REITs S&P 500 Russell 2000 NASDAQ 10.79% 11.59% 11.44% 11.18% Portfolio Diversification • So what’s the point? – 20-year Standard Deviation of Annual Returns (1981-2001) • REITs • S&P • NASDAQ 16.5% 19% 29% Portfolio Diversification • So, what’s the point? – Correlation: • REIT & S&P500 • REIT & NASDAQ • REIT & Russell 2000 0.25 0.13 0.40 Portfolio Diversification • So, what’s the point? 1. REIT m 2. REIT , M 1.0 3. REIT 1.0 • REITs provide diversification benefits to portfolios.