David Walker - Deposit Insurance Corporation

advertisement

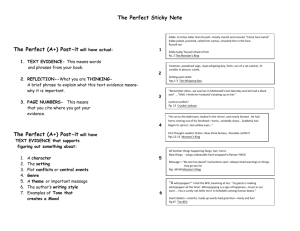

STRENGTHENING FINANCIAL STABILITY: THE REVISED IADI CORE PRINCIPLES AND FSB KEY ATTRIBUTES DAV I D W A L K E R C A N A DA D E P O S I T I N S U R A N C E C O R P O R AT I O N IADI Annual Conference Port-of-Spain: 22-23 October 2014 PRESENTATION OUTLINE I. Background and objectives: Core Principles and Key Attributes II. Key comparisons III. Special considerations I. II. Moral hazard and bail-in Depositor preference IV. Next steps 3 3 I. BACKGROUND AND OBJECTIVES: IADI CORE PRINCIPLES • The Core Principles for Effective Deposit Insurance Systems were approved by IADI and the BCBS in June 2009 and Methodology completed in December 2010. • IADI and its international partners have prepared a set of revised Core Principles (issued for public consultation on Sept 1st 2014). Key objectives: improve the effectiveness of deposit insurance systems in protecting depositors and contributing to financial system stability... ensure the CPs are adaptable to a wide range of country circumstances, settings and structures… mitigate moral hazard. 4 4 REVISING THE CORE PRINCIPLES: KEY OBJECTIVES • Strengthen the CPs (e.g. governance, depositor reimbursements, coverage, funding) and improve safeguards for the use of deposit insurance funds. • Incorporate IADI-FSB enhanced guidance on reimbursements, public awareness, coverage, moral hazard, and funding. • Update to reflect the greater role played by deposit insurers in resolution regimes and ensure consistency with the FSB Key Attributes. 5 • Address moral hazard concerns within all relevant CPs instead of restricting moral hazard guidance to a single principle. • Add more guidance on deposit insurer’s role in crisis preparedness and management as well as cross-border issues. 5 BACKGROUND AND OBJECTIVES: FSB KEY ATTRIBUTES • The Financial Stability Board Key Attributes of Effective Resolution Regimes (Key Attributes) were approved in November 2011 and their supporting Methodology under development. −Key Attributes a new umbrella standard designed to strengthen resolution regimes. −Key Attributes influenced the development of the revised Core Principles (e.g. resolution powers, funding, crisis preparedness). • Main objectives: …to resolve financial institutions in an orderly manner …without taxpayer exposure to loss from solvency support …while maintaining continuity of their vital economic functions 6 6 II. TOPIC COMPARISONS Core Principles 1. Public policy objectives 2. Mitigating and powers 3. Governance 4. Relationships 5. Cross-border issues 6. Crisis preparedness & management 7. Membership 8. Coverage 9. Funding 10. Public awareness 11. Legal protection 12. Dealing with parties at fault 13. Early detection and timely intervention 14. Effective resolution processes 15. Reimbursing depositors 16. Recoveries 7 7 Key Attributes 1. Scope 2. Resolution authority 3. Resolution powers 4. Set-off/netting, collateralization… 5. Safeguards 6. Funding 7. Cross-border cooperation 8. Crisis management groups 9. Institution-specific cross-border COAGs 10. Recovery and resolution planning 11. Resolvability assessments 12. Access to information and info sharing CONNECTING THE KEY ATTRIBUTES & CORE PRINCIPLES KA1. Scope •Regime for any financial institution that could be systemic – main focus G-SIFIs. KA2. Resolution authority (RA) •Single or multiple RAs. •Operationally independent, accountable authority with a mandate to pursue financial stability. KA3. Resolution powers •Broad range of powers to intervene and resolve institutions, including through transfers of business, bridge bank and bail-in within resolution and timely payout or transfer of insured deposits. Scope and operating environment • Adaptable to a wide range of circumstances, settings and systems. CP2/3. Mandates , Powers and Governance • DI mandates vary from “paybox” to “risk minimizers”. Many insurers have resolution powers and are RAs. • Mandate clarifies roles and responsibilities of deposit insurer and is aligned with the mandates of the other safety-net participants. • Deposit insurer is operationally independent and accountable. • Powers support its mandate. 8 8 CONNECTING THE KEY ATTRIBUTES & CORE PRINCIPLES KA4 /5. Set-off, netting… Safeguards •Legal certainty, effectiveness & enforceability. •No creditor worse off than in liquidation principle. KA6. Funding • Privately financed sources of funds in resolution (e.g. DI or resolution funds). • Ex post recoveries from industry, if necessary. • Reference to IADI CPs on deposit insurer funds & safeguards CP9: Funding •Banks pay for deposit insurance. •Deposit insurer must have ex-ante funding and assured access to emergency liquidity. •Sound fund investment and management. •Start-up funding from government or international donors permitted under conditions. •Deposit insurer must authorize use of its funds. •Taxation and remittance limits. 9 9 SAFEGUARDS IN MORE DETAIL IADI funding Safeguards •Decision-making: the deposit insurer is informed and involved in the decisionmaking process. •Transparency: the use of the deposit insurer’s funds is transparent and documented and is clearly and formally specified. •Exposure limits: where a bank is resolved through a resolution process other than liquidation, the resolution results in a viable, solvent and restructured bank, which limits the exposure of the deposit insurer to contribute additional funding in respect of the same obligation. •Contributions are restricted: to the costs the deposit insurer would otherwise have incurred in a payout/liquidation net of expected recoveries. 10 10 Continued… •No recapitalization: Contributions are not used for the recapitalisation of resolved institutions unless shareholder’s interests are reduced to zero and uninsured, unsecured creditors are subject to parri passu losses in accordance with the legal claim priority. •Independent audit: the use of the deposit insurer’s funds is subject to an independent audit and the results reported back to the deposit insurer. •Ex-post review: all resolution actions and decisions using the deposit insurer’s funds are subject to ex-post review. 11 11 CONNECTIONS KA7. Cross-border Cooperation CP5. Cross-border issues •Statutory mandate to cooperate and legal capacity to share information and to give effect to foreign resolution measures. •No discrimination against creditors based on nationality. •Formal information sharing and coordination in place among deposit insurers. •No discrimination against depositors based on nationality. KA8-10. Crisis Management Groups, Resolvabilty Assessment & COAGs CP6 . Crisis preparedness & management •Home, key hosts, central banks, supervisors, resolution authorities and finance ministries of GSIFIs to maintain CMGs. •Information sharing among home & key host authorities in recovery and resolution planning as well as in crisis. •Resolvability assessments for all G-SIFIs to evaluate feasibility/credibility of RRPs. •Institution-specific cross-border cooperation agreements. •The deposit insurer has effective contingency planning/crisis management policies/procedures. •The insurer should be a member of any institutional framework for coordination involving system-wide crisis preparedness & management. CP14. Failure resolution •Resolution regime should enable the deposit insurer to provide for protection of depositors and contribute to financial stability. •Legal framework includes special resolution regime. 12 12 CONNECTIONS KA11. Recovery and resolution planning (RRPs) •Set out recovery and resolution plans to be undertaken by all G-SIFIs. •To be informed by resolvability assessments. •Regularly updated and reviewed. 12. Access to information and information sharing •Robust management information systems •No impediments to cross-border sharing of information among authorities subject to confidentiality. CP14. Failure Resolution •Resolution regime enables the deposit insurer to provide for the protection of depositors and contribute to financial stability. •All banks resolvable through a broad range of powers and tools which include: powers to preserve critical bank functions (bridge bank), transfers of deposits and assets, write-down and/or debt to equity conversion. CP15. Reimbursing depositors •Most insured depositors to be reimbursed within seven working days utilizing a variety of reimbursement options. •Provisions to be made for making advance, interim or partial payments. •Access to depositor records at all times; authority to undertake advance or preparatory exams. •Scenario planning and simulations mandated. 13 13 III. SPECIAL CONSIDERATIONS Moral hazard/ and bail-in issues − FSB discussions indicate covered (insured) deposits to be excluded from the scope of bail-inable liabilities. − Some jurisdictions intend to exclude all uninsured depositors from bail-in. − G-SIB resolution would likely also involve use of funding from resolution funds and possibly deposit insurers. No depositor preference in KAs or CPs − But, various forms of depositor preference being increasingly adopted in many jurisdictions. 14 14 IV. NEXT STEPS IADI: Finalization of revised CPs and development of assessment framework tools (e.g. Handbook for Assessors). Key areas many jurisdictions will need to focus on: − − − − − − 15 15 Governance; Coverage; Fund adequacy and safeguards; Crisis preparedness/management ; Cross-border agreements; and Payout timeliness. NEXT STEPS FSB: Emphasizing the acceleration of reform initiatives to ensure progress in adopting resolution regimes consistent with the KAs because: − Few resolution regimes are fully aligned with the KAs. − Many barriers to resolvability remain (e.g. operational, structural and financial). − Need to build-up adequate loss absorbency across G-SIBs. − Address cross-border close-out-risks and cross-border resolution cooperation. IADI and FSB: Continue development of supporting guidance both individually and together where common areas of interest (e.g. funding). 16 16 17 13th IADI Annual Conference “Updated Core Principles to Strengthen the Financial Stability Architecture” ESTABLISHING A RESOLUTION AUTHORITY Governance and resolution mandates Anna Trzecińska Bank Guarantee Fund, Poland Port-of-Spain, Trinidad, 22-23 October 2014 Evolution of BFG mandates February 1995 The Bank Guarantee Fund was established on the basis of the Act of 14 December 1994 on the Bank Guarantee Fund as a response to Directive 94/19/EC on deposit guarantee schemes of 30 May 1994. Hybrid funding: mainly ex-ante with an ex-post component From the very beginning the mandate of BFG wider than pure pay-box Apart from reimbursement of covered deposits required by the directive BFG’s powers included: • Collection and analysis of information on institutions covered by the guarantee system: access to data collected by the Central Bank (assigned with supervisory functions), • Provision of assistance to entities covered by the guarantee system provided from the Assistance Fund: loans, guarantees and endorsements for entities at risk or as support for acquirers in merger and acquisition processes; 20 Evolution of BFG mandates January 2001 Enhanced powers to provide support to cooperative banks. • Returnable financial assistance on preferential conditions, • Addressed to entities in which the threat of insolvency is absent, • To finance needs relating to mergers of cooperative banks, • Granted from separate Cooperative Bank Restructuring Fund. November 2008 • Coverage limit raised to 50 000 EUR, • No 10% co-insurance. December 2010 • Coverage limit raised to 100 000 EUR, • Payout period reduced to 20 working days. Directive 2009/14/EU on deposit-guarantee schemes as regards the coverage level and the payout delay 21 Evolution of BFG mandates December 2010 Enhanced control powers in entities covered by the guarantee system. • BFG assigned with the power to carry out audits with respect to the accuracy of data contained in calculating systems of all banks covered by the system. • On-site and off-site inspections. • Accuracy data audits supplemented by the power of review with respect to entities receiving BFG financial assistance, assigned to BFG since its inception, where it: ─ verifies the correctness of assistance funds allocation, ─ audits the implementation of a reorganization program, ─ monitors the economic and financial situation of the bank as well as its management. • Independently of its auditing powers, BFG may assume the role of a trustee, overseeing the implementation of a reorganization program with respect to a bank receiving BFG financial assistance. 22 Evolution of BFG mandates May 2013 BFG assigned with new powers in relation to credit unions, including some resolution tools (bridge bank, support to an acquirer in P&A) and providing financial assistance to entities at risk (guarantees, loans classified as own funds) from the Cooperative Savings and Credit Union Guarantee Fund. September 2013 New power to provide capital support to banks. • Guarantees to increase the bank's own funds level, • Guarantee executed in the event of insufficient demand by purchase or assumption of stock, bonds or bank-issued securities, • Provided upon a request submitted by the Minister of Finance, • Financed from the newly created Stabilization Fund. November 2013 Deposits collected by credit unions covered by BFG guarantee. Evolution of BFG mandates COOPERATIVE CREDIT BANKS BANKS UNIONS PREVIOUSLY COMMERCIAL Credit Union Mutual Insurance Society AFTER THE REFORM Bank Guarantee Fund 43 572 55 COMMERCIAL COOPERATIVE CREDIT BANKS BANKS UNIONS Bank Guarantee Fund Under the new legislation credit unions are covered by BFG guarantee only. Evolution of BFG mandates Ongoing developments The following changes to BFG mandate and powers are a result of two EU regulations: • Directive 2014/49/EU on deposit guarantee schemes (DGSD), and • Directive 2014/59/EU establishing a framework for recovery and resolution (BRRD). DGSD imposes obligations, inter alia, to: • Reimburse covered deposits within 7 working days, • Reach a minimum target level of 0.8% of covered deposits by 3rd July 2024, • Ex-ante funding based on risk-based premiums, • Use of DGS funds for resolution purposes. 25 Pay-out in failure of credit union „Wspólnota” Pay-out trigger conditions met: 20 working days for reimbursement 19.08.2013 General Preparedness Program of data accuracy audits launched 30.08.2013 First meeting with the receiver 29.11.2013 Credit unions covered by BFG guarantee system Stage I Before pay-out trigger 18.07.2014 Activity of the credit union suspended by the PFSA 23.07.2014 Depositors’ list prepared by the credit union and forwarded to BFG 24.07.2014 Reimbursement list prepared by BFG and delivered to the agent-bank Stage II Reimbursement list preparation 28.07.2014 Pay-out of covered deposits by the agent-bank starts Stage III Pay-out handled by agent-bank 20.09.2014 Pay-out of covered deposits by BFG’s office starts Stage IV Pay-out handled by BFG Helpdesk for depositors of the credit union: helpline, BFG website etc. 26 Evolution of BFG mandates Deterioration of cooperative savings and credit unions’ financial situation Failing or likely to… Viable Prevention Early supervisory intervention Financial support granted by BFG to a credit union at risk of insolvency Restructuring measures If the Polish National Association of Credit Unions refuses to grant support Restructuring decisions Upon application of a credit union at risk, Available only to entities being subject to reorganization proceedings conducted according to the requirements of the PFSA, Insolvent Purchase and assumption: partial or whole credit union by other credit union or a bank Positive decision of the PFSA required, BFG’s claims fully collateralized, Forms of support: • Guarantee, BFG may acquire or assume shares of a bank to participate in credit union restructuring measures as an acquirer, BFG may provide to the acquirer, financial assistance in the form of: • Endorsement, • Purchase of shares, • Loan (can be classified as own funds) • Guarantee, • Loan, • Loss-sharing agreement, • Subsidy. BFG assistance in the restructuring of credit unions 1. BFG may provide assistance in the form of: • total or partial guarantees to cover losses arising from risks associated with acquired property rights or liabilities • subsidies to cover the difference between the value of acquired property rights and liabilities • loans • guarantees • subscription of shares of the acquiring bank 2. In providing support BFG has the right to participate in profits relating to acquired property rights 3. Detailed conditions for support are defined in individual agreements Subsidy 1 A subsidy is granted to cover the difference between the value of acquired property rights and liabilities arising from guaranteed funds Guarantee of loss coverage A guarantee of loss coverage may be given up to 100% of the balance sheet value of the acquired property rights or obligations, in particular: 1) loans to households for consumption; 2 The value of the acquired property rights arising from guaranteed funds is determined based on cash accounting records as at the date of acquisition 2) mortgage loans to households; 3) shares 4) debt securities 3 The subsidy is paid under the terms of an individual agreement 5) units of investment funds on the money market 4 The obligations of the transferee are specified in the subsidy agreement 6) investment certificates of closed investment funds PFSA decisions on restructuring credit union Receiver Sequence of events 29.07.2013: PFSA established a receiver for the duration of the reorganization program to strengthen financial situation of the entity through increase of capital and operational efficiency • Trigger condition met (ratio of own funds to total assets below 1%), • Polish National Association of Credit Unions refused to provide assistance, • Lack of potential among credit unions. acquirers Tasks of the receiver: • Draws up and agrees a reorganization program with the PFSA, • Coordinates implementation of the program, • Informs the PFSA, the Polish National Association of Credit Unions and supervisory board of the credit union about the effects of corrective measures. 17.07.2014: PFSA designated 7-day period to submit offers by domestic banks interested in P&A transaction 14 August 2014: – decision of the PFSA to take over the credit union by the bank Takeover of the credit union by the bank • Credit union taken over by the bank on 01.09.2014, • Before that date asset management of the credit union goes to the bank-acquirer, credit union operates and provides services to its members on the current basis, • Financial statements at the acquisition date should be issued by the acquirer within 15 days from the date of the acquisition, • Acquirer will order the auditor to examine the financial statements of the credit union and shall provide a report and the auditor's opinion immediately after being prepared. 29 BFG assistance in the restructuring of credit unions Initial work Preparation of internal regulations in the field of providing financial support to credit unions or acquirers in P&A transactions Audit on the accuracy of data contained in calculating systems of the credit union - value of covered deposits at the day of takeover Draft standard form contracts on subsidy to acquirer and loss-sharing agreements Operational preparations in the field of IT solutions Contract fulfillment Process within BFG Conditions Financial Assistance Dept. The requirements to grant support: 1. Recognition by BFG of the results of an audit of the financial statements 2. Positive opinion of the PFSA and no risk to safety of depositors' funds 30 days Draws up an application for assistance for the acquirer Committee for the Assessment of Requests for Assistance Opinion Council of the Bank Guarantee Fund 3. The amount of BFG funds granted for support must not be higher than the amount of a potential pay-out Opinion Management Board 4. Use of the equity of the entity for covering losses Decision on financial assistance Agreement with the acquirer BFG monitors the fulfillment of obligations arising from contracts, especially contracts of loss coverage: • settlement of the guarantee on a semiannual basis • control of the exercise of the beneficiary obligations under the agreements Resolution framework development in Poland International experiences in crisis management Global and EU recommendations and initiatives Lack of adequate resolution regime 01/2011 Bank Guarantee Fund indicated as a leading institution by the Ministry of Finance October 2011 Establishment of a special Working Group by the Financial Stability Committee BFG Ministry of Finance Chaired by the President of BFG Technical Details of a Possible BRR Framework 10/2011 Key Attributes… Cooperation with the World Bank in the field of a bank resolution framework within technical support (upon request from the Ministry of Finance) National Bank of Poland Polish FSA Project coordinated by BFG 31 Resolution framework development in Poland Adopted work plan Ministry of Finance FSC Working Group on Bank Resolution Establishment of an FSC special Working Group Stage I Conceptual work Schedule built in compliance with FSB recommendations Stage II Stage III Study visits Design of draft legislation Know the practice, benefit from experience Legislative process External legal experts support in terms of congruence with internal and European law Lex 32 Resolution framework development in Poland April 2012 • Financial Stability Committee approved technical details for bank resolution framework in Poland proposed by the Working Group, • Bank Guarantee Fund as a resolution authority with full scope of resolution powers. December 2012 • Draft legislation forwarded to the Minister of Finance for further legislative process. 2013 / 2014 Legislative process: • Impact assessment, • Intradepartmental consultations, • Public consultations (including consensus conferences). 2014 Full adjustment to the final BRRD provisions. 33 Resolution framework development in Poland BFG as a resolution authority • Strong position in the financial safety net and active role in crisis management, • Appropriate ex-ante funds available, • Advanced analysis including Early Warning System, • Experience in restructuring measures, • Governance in line with international standards → Core Principles. 34 BFG as formal member of safety net The Financial Stability Committee was established by force of law in 2008 and consists of four member entities, whose representatives meet on a regular basis MINISTRY OF FINANCE NATIONAL BANK OF POLAND FINANCIAL SUPERVISION AUTHORITY BANK GUARANTEE FUND* THE FSC’S TASKS INCLUDE * FROM OCTOBER 2013 Crisis management and coordinating the activities of members in situations that constitute a threat to the stability of the financial system Ensuring a proper flow of information with respect to major events and trends that may pose a threat to financial stability The development and adoption of procedures in case of the emergence of a threat to financial stability On-going assessment of the situation in the domestic financial system Preventing crisis escalation in the domestic financial system. Funds available to BFG in billion PLN BFG is already compliant with the new European DGS directive and has one of the highest fund to deposit ratios in the EU Remarks: For the purpose of comparability between the year 2013 and previous years, the 2013 data does not consider funds collected for allocation to the Stabilization Fund and the Cooperative Savings and Credit Union Guarantee Fund. Source: BFG data 36 BFG funding mechanism Agreements with several banks • BFG agreement with banks on transactions with debt securities on the secondary market. These transactions contain repo and sellbuy back transactions. IN CASE OF A NEED FOR EMERGENCY FUNDING: Agreement between the National Bank of Poland and the Bank Guarantee Fund • • Aim is to create an institutional framework which, in the case of pay-outs, would facilitate obtaining fast, short-term liquidity from NBP. The agreement is one of a number of actions taken to reinforce the stability of the financial system and safety-net in Poland. Loans granted from the state budget 37 Early Warning System One of the statutory tasks assigned to BFG (from its establishment in 1995) is collecting and analyzing information on entities covered by the guarantee system. 2009/2010 Analytical toolkit supplemented by Early Warning System Complex Considers wide range of areas Detailed Sufficient set of indicators for each area Efficiency CI Core indicator Capital adequacy Credit risk SI1 SI2 SI3 Supplementary indicators Dynamic Considers changes in the financial and economic situation of banks in 3- and 6-month trends Flexible Qualitative indicators amended with qualitative assessments based on non-financial data Credit Risk Experience in restructuring measures Loans disbursed from the Assistance Fund The financial assistance extended by BFG has yielded measurable financial results, has raised confidence in the banking sector, has assured broad access to banking services and has contributed to increasing banking sector stability. thousands of PLN number of loans 28 800,000 30 Amount in thousands of PLN left scale 700,000 600,000 Number of loans - right scale 20 17 500,000 14 11 400,000 15 9 6 6 10 5 200,000 1 100,000 2 1 0 5 1 0 0 0 0 0 In the years 1996-2013 financial assistance extended by BFG was used for: independent bank reorganization program proceedings bank takeovers purchase of shares of banks facing the threat of insolvency by new shareholders 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 0 1996 0 Source: BFG data 300,000 25 PLN 3,790,342.4 thousand PLN 2,249,050.0 thousand PLN 1,306,292.4 thousand PLN 235,000.0 thousand 39 BFG compliance with the Core Principles Core Principles for Effective Deposit Insurance Systems BFG was compliant with IADI – BCBS Core Principles since their implementation in 2009 • In 2013 a detailed assessment of observance was conducted by a team of experts from the World Bank and the International Monetary Fund, • It was found that BFG is Compliant or Largely Compliant with 16 out of 17 applicable Core Principles and Materially Non-Compliant with only one Core Principle, • The only one deficiency will be mitigated by the new resolution law. 40 BFG compliance with the revised CPs CPS NO. CRITERIA ASSESSMENT CP1 Public Policy Objectives CP2 Mandate and Powers CP3 Governance CP4 Relationships with Other Safety-Net Participants CP5 Cross-border Issues CP6 Deposit Insurer’s Role in Contingency Planning and Crisis Management CP7 Membership CP8 Coverage CP9 Sources and Uses of Funds CP10 Public Awareness CP11 Legal Protection CP12 Dealing with Parties at Fault in a Bank Failure CP13 Early Detection and Timely Intervention CP14 CP15 Failure Resolution Reimbursing Depositors pending CP16 Recoveries pending • BFG is compliant with most of the IADI – BCBS Revised Core Principles for Effective Deposit Insurance Systems, • The deficiencies will be mitigated by the new resolution law which will be introduced in Poland. THANK YOU www.bfg.pl 42 EXPANDING ROLE FOR DEPOSIT INSURER WITHIN CRISIS MANAGEMENT AND CROSS BORDER RESOLUTIONS David S. Hoelscher I. Function of Deposit Insurance II. Expanded Role of Deposit Insurance III. Resolution Mandate in the Revised Core Principles IV. Preparing for an Expanded Mandate V. Conclusions 45 FUNCTION OF DEPOSIT INSURANCE 47 Institutional framework varies widely Authorities design safety nets given local conditions Role of deposit insurer varies widely across jurisdictions Narrow mandate, paybox systems Only responsible for the reimbursement of insured deposits A “paybox plus” mandate Reimbursement plus a limited role in resolution (funding) A “loss minimizer” mandate Responsible for selection/funding of resolution strategies A “risk minimizer” mandate A full suite of resolution powers and prudential oversight 48 Number of Deposit Insurance Systems 49 Clearer focus on financial stability Less concern about only protecting unsophisticated depositors Less concern about moral hazard from high coverage Expanding role in risk analysis and diagnosis Analysis of banking conditions to complement supervisors Even a paybox needs an independent evaluation ability Detailed and early information sharing Participation in crisis management committees Expanding role in resolution activities (mandates) Information sharing and coordination Responsibility for protecting DIA funds Scenario testing/simulation exercises 51 DIAs with Broad Mandates (In percent of all DIAs) 90 80 70 60 50 2004 40 2013 30 20 10 0 total Africa America Asia Europe Middle East 52 DIA Role In Bank Resolution (End 2012) Payout Argentina Australia Brazil Canada France Germany Hong Kong India Indonesia Italy Japan Korea Mexico Netherlands Russia Singapore Spain Switzerland Turkey UK USA Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes yes Yes yes Supervision Resolution No No No No No Yes No No No No Yes Yes No No Yes No No No No No Yes 1/ Mainly provides financing for restructuring/mergers. 2/ A new Act will give DIA role in funding resolution Yes 1/ Yes Yes 1/ Yes Yes No No Yes 1/ Yes 1/ Yes 1/ Yes Yes Yes No 2/ Yes No Yes No Yes Yes 1/ Yes 53 Total 16.3 36.3 Paybox Paybox plus 13.8 Loss minizer Risk minimizer 33.8 54 DIAs by Mandate: 2013 Africa 20.0 40.0 (In percent of total in each region) America Paybox 17.4 21.7 Paybox Paybox plus Loss minizer 40.0 Paybox plus 13.0 Loss minizer Risk minimizer 47.8 Risk minimizer 0.0 Asia 23.5 Europe 6.1 Paybox 41.2 Paybox plus 48.5 Loss minizer 11.8 Risk minimizer 23.5 Paybox 18.2 Paybox plus Loss minizer 27.3 Risk minimizer 55 Current Revisions of Core Principles 2014 More prescriptive: ◦ Strengthened guidance on adequacy of coverage ◦ Mandatory ex-ante funding ◦ Seven day payout target Strengthening governance frameworks New Crisis Management Core Principle ◦ Emphasize establishment of coordinating framework More safeguards ◦ ◦ ◦ ◦ Safeguards on use of DI funding in resolution Strengthened governance standards Strengthened rule on information sharing Post mortem review following failures 57 Principle 6 – DEPOSIT INSURER’S ROLE IN CONTINGENCY PLANNING AND CRISIS MANAGEMENT The deposit insurer should have in place effective contingency planning and crisis management policies and procedures to ensure it is able to effectively respond to the risk of bank failures and other events. The development of system-wide crisis preparedness strategies and management policies should be the joint responsibility of all safety-net participants. Elements of compliance Contingency planning and crisis management procedures Regular testing of plans Member of any interagency coordination agency participates in the development of pre- and post-crisis management communication plans 58 Principle 5 – CROSS-BORDER ISSUES Where there is a material presence of foreign banks in a jurisdiction, formal information sharing and coordination arrangements should be in place. Elements of compliance Formal information sharing, coordination arrangements exist Agreements determine how responsibilities shared 59 Principle 14 – FAILURE RESOLUTION An effective failure-resolution regime should enable the deposit insurer to provide for protection of depositors and contribute to financial stability. The legal framework should include a special resolution regime. Elements of compliance The DIA has operational independence and sufficient resources The resolution regime has a broad range of powers, options Objectives, mandates, and powers among agencies are clear Resolution decisions cannot be reversed by legal action 60 Preparing for an Expanded Mandate Essential Reforms for Expanded Mandate Political consensus on strengthening deposit insurance systems Strengthen coordination within safety net ◦ Develop information sharing protocols ◦ Engage with other safety net players on a regular basis Strengthen diagnostic capacity (even paybox) ◦ Develop systematic analysis of banking system ◦ Develop early warning systems ◦ Coordinate diagnosis and viability assessment with other agencies Strengthening funding structures ◦ Must protect depositor funding ◦ Government support may be needed Staffing to meet expanded skills 62 Conclusions The changing role of deposit insurance • • • • Financial stability a major policy objective for deposit insurance The deposit insurer has a growing role in maintaining stability Safety net participants will coordinate more closely Funding is at risk (even for paybox) With changing role, come changing responsibilities ◦ Need for a strong analytic capacity ◦ Need to understand resolution tools (even paybox) 64