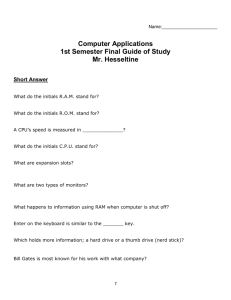

Teaching post-Keynesian economics in a

advertisement

Teaching postKeynesian economics in a mainstream department Marc Lavoie Preliminary • This topic was imposed to me by Jesper Jespersen ! • • • • A bit of autobiography A bit of history of economic thought Descriptions of courses Some analysis ? Click View then Header and Footer to change this text Outline • Background information • Strategies for teaching heterodox stuff • Actual experiments with various courses with PK content: – Honours Macroeconomics – Graduate course in the theory of growth – Two courses in post-Keynesian economics – Graduate course in monetary economics – First-year principles of economics Click View then Header and Footer to change this text Background information Click View then Header and Footer to change this text My first introduction to PKE • Undergraduate at Carleton University, Ottawa • Tutorial 1975 by G. Paquet: Sraffa’s E.J. 1926 article and G.L.S. Shackle • Honours Seminar in Modern Classics given in 1975-76 by T.K. Rymes (editor of Keynes’s lectures 1932-33): – Consumer theory, Theory of the firm: Coase, Demsetz, Alchian, Jensen and Meckling (principal and agent) – GET: Walras, Arrow, Hahn, Meade, Newman, H.G. Johnson, Jones, B. Hansen, Solow – Keynes (GT, ch. 17, QJE 1937), Friedman, Patinkin, Clower, Leijonhufvud – Harrod (Towards a Dynamic Economics), Robinson (1956, 1962), Kaldor (1956), Pasinetti (1962), capital controversies Click View then Header and Footer to change this text Three years in Paris 1976-1979… • A course on disequilibrium theory: Barro-Grossman, Clower, Leijonhufvud, Ostroy-Starr, Bénassy, Hénin. • A course on macroeconomic theory with some classes with Alain Parguez, with critiques of disequilibrium theory and an introduction to the theory of the monetary circuit. • A course on international finance (the cambist view). • A course on input-output and flow of funds. • Lots of new important PK books at the time: Harcourt (1972), Kregel (1973), Minsky (1975), Eichner (1976), Wood (1975), Davidson (1972),Weintraub (1978). Click View then Header and Footer to change this text University of Ottawa (and Carleton) • • • • • • • Initially there were 7 heterodox economists out of 16 A Marxist (Chossudovsky) An econometrician , critical of neoclassical economics (Dagum) A Keynesian (Bodkin, student of Sidney Weintraub) A follower of Perroux A Sraffian (Jacques Henry) Two post-Keynesians (Mario Seccareccia, Marc Lavoie) • However we also had a joint PhD program with Carleton University, which denied tenure to both Stanley Wong and Robert Dimand, and later refused to hire Ian Steedman (on the claim that he had not enough international visibility!) Click View then Header and Footer to change this text The initial atmosphere at the Department • Initially there was no problem, except for one member. • We were able to teach what we wanted, and create new PK courses. • But then senior members of the department, including some of the heterodox members, decided to cleanse the department. • Getting tenure, in 1984 for me and in 1985 for Seccareccia, was a hard-fought battle. • Gradually the atmosphere changed, as new members were hired, who were much more ideological. • They were getting annoyed of being teased in conferences, as UofO was being called a PK department. • Click View then Header and Footer to change this text The current atmosphere at the Department • We have lost any say on recruitment. • Younger members are less ideological than members in midcarreer. • Now we are only two heterodox out of 20 staff members, through attrition (retirements, deaths). • There are also a couple of heterodox-friendly economists in neighbouring departments (international affairs, public affairs). • We are free to do « our thing » within the existing courses. • We have been unable to create a new program (MA in political economy) or a new course that would cover « Currents in modern economic thought ». Click View then Header and Footer to change this text Strategies in teaching heterodox economics Click View then Header and Footer to change this text Three strategies for teaching heterodoxy (Mearman 2007) • Introducing elements of heterodoxy in orthodox modules or courses: First-year introduction courses. • Creating an entire course devoted to an alternative approach : Four courses in PKE. • Teaching orthodox and heterodox economics in parallel: Honours course in macroeconomics. • In some way, I can say that we have tried all three strategies at different stages. • There are also courses in history of economic thought and methodology (which were shrunk from 3 to 1 at the graduate level) Click View then Header and Footer to change this text Teaching in parallel I • “A series of topics of interest or theoretical concerns are taught first from one perspective, then from the other, allowing comparison” (Mearman 2007, 8). • “Pedagogically, this option “is the most beneficial, because it is based on comparative, critical treatments of both orthodox and heterodox. Also, by committing to comparative treatment, the parallel perspectives approach can prevent the confusion which can occur when students are faced with different perspectives only occasionally” (Mearman). Click View then Header and Footer to change this text Teaching in parallel II • Mario and I did this in the Honours Macro course, for about fifteen years, then the course was given to someone else. • Personally, I did not find that this was most successful: fewer topics are covered in a module, students don’t seem to learn much about heterodox economics. • There is a first-year textbook that precisely follows the teaching in parallel method: Microeconomics in Context: Goodwin, Nelson, Ackerman and Weisskopf (M.E. Sharpe) Click View then Header and Footer to change this text Creating an entire alternative course • “This option means that justice can be done to heterodox ideas, but is often restricted to specialist, optional ‘ghetto’ modules, where the development of a critical understanding may be limited” (Mearman 2007). • It was our favourite option. • This option was particularly successful in times of economic recessions, in particular during the subprime financial crisis, as students showed great interest in alternative views, with some even questioning our colleagues as to why alternative theories were not being discussed in other courses Click View then Header and Footer to change this text Creating an entire alternative course: three strategies • Strategy 1: Use an existing course, and transform it into a heterodox course. • One can do so with a course with a generic name, such as Macroeconomic Theory or Theory of Growth, only presenting heterodox content. • This tactic is also useful if your chair asks you to teach a largeenrollment compulsory course that you don’t wish to take: you then threaten to only teach heterodox stuff, invoking academic freedom. • Strategy 2: Create an explicit heterodox course • Strategy 3: Create a new course, with some ambiguous title: Explorations in Monetary Economics. Click View then Header and Footer to change this text Creating alternative courses Srategy 1 Click View then Header and Footer to change this text Alternative course: Strategy 1 • When I arrived in Summer 1979, I was given the option of teaching a grad course Theory of Growth. The contents included: • Keynesian growth theories (Harrod-Domar) • Neoclassical growth theories (Solow) • Technical progress (Robinson, Kaldor 1957, Rymes 1971, Näslund and Sellstedt 1978) • Post-Keynesian growth theory (Shapiro 1977, Kaldor 1956, Pasinetti 1962) • The Capital Cambridge controversies (Harcourt, Robinson, Samuelson and Modigliani, and then Solow, Pasinetti, Garegnani, Petri, Eatwell, Hahn 1975, Spaventa 1970, Harris 1978). • Growth and Finance: Kaldor 1966, Moore 1975, Eichner 1973, Harcourt and Kenyon 1976, Wood 1975. Click View then Header and Footer to change this text Alternative course: Strategy 1 • The unofficial subtitle of the course became: – Growth, income distribution and capital. • The course gradually evolved into a manuscript called: – Macroéconomie: Théorie et controverses postkeynésiennes (1987, Dunod). The referee was Abraham-Frois. • Ironically, as I was finishing the book, a colleague asked me, around 1986, why I did bother writing about growth theory when obviously growth theory was dead, with business cycle theory being the in-thing, just when Lucas and Romer were publishing their famous articles! Click View then Header and Footer to change this text Normal rates of capacity utilization? • • • • • The 1987 book contained a chapter discussing what happens when production or growth speeds up. What if profit margins or shares, as described by the Cambridgians, did not rise? It was argued that rates of utilization in the Kaldor-Robinson growth model were assumed to remain at their normal levels. It was also argued that in reality rates of utilization would first rise over their normal levels in the short run, and that this would bring about a higher share of profits, because of fixed labour costs associated with supervisory work (Kaldor 1964, Asimakopulos 1970, Harris 1974). It was claimed that, in the long run, prices would rise relative to wages, to finance faster growth, and that rates of utilization would return to normal, but without a mechanism. At that time, I did not know of the neo-Kaleckian model (Rowthorn 1981, Dutt 1984, Taylor 1983). I discovered this literature when I read Dutt ‘s CJE 1987 critique of Marglin (1984), and it was introduced in the course outline of Fall 1987. Click View then Header and Footer to change this text Creating alternative courses Srategy 2 Click View then Header and Footer to change this text Strategy 2: Create a new course • In October 1978, a neoclassical-turned Sraffian tenured colleague, Jacques Henry, proposed in a memo to create a new course that would be called: Elements of neo-Ricardian economics. • In the Summer of 1978, Mario Seccareccia, a graduate of McGill University where he had taken courses in particular from Tom Asimakopulos, joined the department. • I joined the department in the Summer of 1979. • Sometime in 1981, as we organized a small conference on postKeynesian theory (V. Chick, Eichner, Asimakopulos, Dostaler), we decided to move on and create two courses. Click View then Header and Footer to change this text The new courses • Both courses were to be called Post-Keynesian Theory, but initially the first one was to cover a flexprice system in the long period, while the second one was to over a fixprice system in the short period. • Then, following a suggestion by Edward Nell, we decided to create two courses: • An undergrad course: PK Theory: Money and Effective Demand • A graduate course: PK Theory: Value and Production • These two courses still exist, but while the undergrad course is being taught every year, the graduate course is more rarely taught. Click View then Header and Footer to change this text PK theory: value and production • This course was at first offered by Jacques Henry • It was essentially the Sraffian course • The course description was: – Historical perspective on the theory of the surplus. Characteristics of the post-Keynesian approach. Sraffa's contribution. Price and value theory. Theory of production and capital. Rent. Joint production. Analysis of the traverse. Applications and policy implications: international trade and public finance. Click View then Header and Footer to change this text PK theory: prices and production • • • • • • • • • • • The last time I gave the course, I followed this outline: General intro to PKE; the neoclassical parables; prices of production in a stationary state, in a growing economy; direct, indirect and hyper-indirect labour; consequences for trade theory, for the measure of technical progress, and for empirical production functions; the quantity traverse in the 2-sector Sraffian model; the convergence or gravitation towards prices of production; models with endogenous rates of capacity utilization; the traverse in Kaleckian 2-sector models; traverses towards normal rates of utilization. Click View then Header and Footer to change this text PK theory: Money and effective demand Initial description • This is the course that I gave most of the time – The firm: mark-up theory; degree of monopoly and capacity utilization; the megacorp: power and objectives; managerial theories of the firm: the valuation ratio and financial constraints; growth and investment of the firm as determinants of the mark-up. – The economy: normal prices and wages, endogenous money supply, effective demand; investment, expectations, uncertainty, speculation, financial instability, economic cycles and growth; the aggregate mark-up and income distribution; stagflation and income policies. Click View then Header and Footer to change this text PK theory: Money and effective demand Current description • Key presuppositions of heterodox and post-Keynesian economics; • the firm: managerial vs finance capitalism, objectives and financial constraints of growing firms, empirical studies of cost curves, pricing theories and normal prices. • Theories of employment: effective demand, Keynes's view and Kaleckian models. • The financial system: the monetary circuit, endogenous money supply, stock-flow coherence. • Expectations, fundamental uncertainty, speculation, financial fragility, economic cycles. • Growth, investment, income distribution, capacity utilization, and balance-of-payment constraints. • Policies to deal with economic and financial instabilities. Click View then Header and Footer to change this text PK Theory: money and effective demand • I have lost the course outlines before 1992, so I don’t know the detailed contents in the 1980s. • This course gave rise to a textbook, Foundations of PostKeynesian Economic Analysis, 1992. • Then it gave rise to a second textbook, a simpler and shorter one, Théorie postkeynésienne (2004), translated by L.P. Rochon into Introduction to Post-Keynesian Economics (2006)(and then translated into Japanese by Takashi Ohno). • The course outines then followed relatively closely the contents of these two books. Click View then Header and Footer to change this text Foundations and Introduction to PKE: Contents • • • • • • • Methodology Micro: Consumer theory and agent behaviour Micro: Theory of the firm Macro: Money and credit Macro: Employment, short-run Macro: Growth, long-run (the Kaleckian model) Macro: Inflation • In the course, some years, some additional material would include the Shaikh-McCombie-Godley critique of production functions and labour demand functions, Minsky’s financial fragility hypothesis, balance-of-payments constraint, fiscal policies Click View then Header and Footer to change this text Difficulties with this 4th-year PK course • The main problem is that students have been exposed to three years of intensive brainwashing, having been given no indication whatsoever by my colleagues that there exist economic theories or economic traditions alternative to the neoclassical view. • Some students would get angry at me, because I would criticize, either directly but mostly indirectly, all the models that they had spent so much time to comprehend in earlier years. • Most students act in a schizophrenic way, putting this course in a small box, never to be opened again. • The subprime financial crisis brought some positive feedback from past graduates. For current students, it also brought a lot of credibility to alternative views, which now seem more reasonable and more realistic. Click View then Header and Footer to change this text Creating alternative courses Srategy 3 Click View then Header and Footer to change this text Alternative course: Strategy 3 • In the early 1990s, our joint PhD program was revamped, a new field, Monetary Economics, was created, and Mario Seccareccia and myself were asked to design a new course. • Initially we wanted to call this course Alternative Theories in Monetary Economics, but finally, we adopted a more ambiguous and diplomatic title, Explorations in Monetary Economics. • In 2011, there was another revamping of the PhD program, and some Carleton staff members questioned the existence of the course, but in the end the course was kept as is. Click View then Header and Footer to change this text Less difficulties with Explorations in Monetary Economics graduate course • Graduate students were usually more receptive overall to this heterodox graduate course than were undergraduates. • The reason is that our graduate students mainly come from abroad (a lot of them come from China), and hence are less brainwashed and, ironically, many know less economics than our undergraduates. For them, all theories are created equal ! • The problem, however, when these students write PhD theses, is that their knowledge of the literature, orthodox or heterodox, is rather slim. Click View then Header and Footer to change this text Explorations in Monetary Economics I • The contents of this course changed considerably over the years, even if it did not change that much year by year. • The first course outline covered the following topics: – Features of neoclassical monetary theory, the natural rate of interest and the impact of the Sraffian critique (Colin Rogers 1989) – The finance motive, the monetary circuit (Graziani) – Money supply and its causality (Kaldor, Moore, Dean) – The determination of interest rates (Pasinetti, Davidson, Pivetti) – The instability of velocity (Rousseas) – Monetary policy (Niggle) – Financial instability (Minsky, Dow) – International endogenous money Click View then Header and Footer to change this text Explorations in Monetary Economics II • Various other topics were then introduced: – The horizontalist versus structuralist debate – Credit rationing and creditworthiness – Kaleckian growth models incorporating interest payments – The operating procedures of central bank and the clearing and settlement system – The « New Consensus » – Neo-chartalism and the fiscal-monetary links – The subprime financial crisis • In 2000, for the first time, I introduced several sections devoted to Godley’s stock-flow consistent approach, and this led eventually to our book Monetary Economics (2007). Click View then Header and Footer to change this text Explorations and G&L Monetary Economics • Initially, the students were asked to reproduce on their own and simulate a model of the manuscript. • Then, as the models became available in Eviews on the website of Gennaro Zezza, the students were asked to take any one model, modify it somehow, and perform simulations. Click View then Header and Footer to change this text Introducing elements of heterodoxy in orthodox textbooks! Click View then Header and Footer to change this text Introducing elements of heterodoxy in orthodox courses: Principles course • For a long time, Mario Seccareccia and I had played around with the idea of writing a first-year principles of economics book. • But this is a huge endeavour and it requires a substantial amount of resources, so we never went ahead. • In 2005 however, Nelson Thomson was looking for a new principles of economics textbook on the Canadian market, looking for a more ecclectic textbook than their succesful Mankiw Canadian edition. • We were asked to write that new Canadian edition, based on the US Baumol and Blinder textbook (the creators of the AS/AD model), which was then in its 10th edition. • So our task was to modify the textbook, introducing some heterodox elements, but without antagonizing lecturers. Click View then Header and Footer to change this text The textbook takes a pluralistic and eclectic approach • BBLS make use of analytical tools that are inspired from different traditions in economics: mainstream neoclassical, Keynesian, institutionalist schools. • This is most evident already from the first chapter where economics is defined beyond the study of scarcity, and where the pluralism of ideas and economic policy alternatives are promoted. • BBLS displays more intellectual skepticism (less arrogance) in affirming economic laws or overly broad generalizations. – “The purpose of studying economics is not to acquire a set of ready made answers to economic questions, but to avoid being deceived by economists.” Joan Robinson (1903-1983) Micro textbook: A dose of realism • Less focus on purely competitive markets and more emphasis on oligopolistic market structures (Cf. Grahame Thompson) • Maximizing versus satisficing, profit objectives versus ethical goals • Linear production relations and constant marginal costs, decreasing average costs • Markup pricing, sticky prices, and the overwhelming presence of unused capacity • These features reappear in various chapters, including the ones discussing natural monopolies, taxation, business choices, etc. Macro textbook: paradoxes • Microeconomic behaviour may be fundamentally different from macroeconomic consequences • The paradox of thrift is emphasized • Market mechanisms do not necessarily bring about equilibrium • Keynesian fiscal policies are emphasized • A banking system that relies on confidence • Interest rate targeting, horizontal money supply • No money multiplier mechanism, no crowding out effect • The possible Dutch disease • Falling prices may lead to a fall in aggregate demand, because the debt burden of households and firms rises The perverse effects of declining wages with an upward-sloping AS curve Micro eccleticism versus macro ideological stance • To our surprise, we discovered that it was much easier to introduce ecclectic or heterodox elements in the micro part of the textbook than it was in the macro part. • Each chapter had to be read by about 5 lecturers. • Our micro changes were accepted without much interference • There was a lot of reluctance to accept our changes in the macro book, both of form and content. • We had to back track to the AS/AD model • We had to wage a huge battle to keep the money multiplier out; readers asked to have it at least in an appendix, not realizing that it was contradicted by the described clearing and settlement system. Click View then Header and Footer to change this text Teaching PKE in first year • The story line in Micro is that there are two groups of economists out there: the bad guys and the good guys. The former believe in the laws of supply and demand, because they assume that markets are free and competitive, and power plays no role; the latter don’t believe so. • The story line in Macro is similar: there are bad guys and good guys. The former rely on the market-clearing view; the latter are the Keynesians. They believe markets must be tamed. • As one would suspect, this kind of presentation generates contrasted reactions: most students come from the management school and are rather reluctant to accept a critique of capitalism; however other students are quite happy to be given the two sides of the story. Click View then Header and Footer to change this text Conclusion • As I prepared for this lecture, I realized how closely entertwined has been my teaching and the writing of books. • It is unfortunate that articles in scholarly journals are given so much importance relative to books in the modern evaluation of scholarly activity, as it undermines pedagogical efforts. • I would agree with what was said yesterday by the rector of the University, Ib Poulsen: research and teaching go hand in hand! Click View then Header and Footer to change this text