special economic zones- fiscal benefits

advertisement

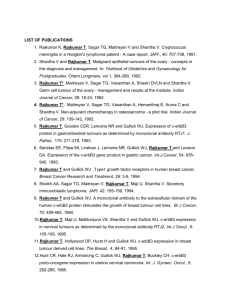

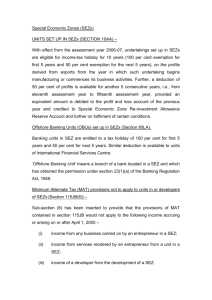

SPECIAL ECONOMIC ZONESFISCAL BENEFITS Rajkumar S. Adukia 09323061049/093221 39642 radukia@vsnl.com rajkumarfca@gmail.com http://www.carajkumarradukia.com ©Rajkumar S.Adukia 1 Agenda Special Fiscal Provisions relating to SEZ Bond cum Legal Undertaking Income Tax Service tax FEMA ©Rajkumar S.Adukia 2 Fiscal Benefits available to SEZ Income Tax Exemptions of tax ,duties or cess in 21 Acts Cenvat Customs VAT Central Sales tax Service Tax Securities Transaction Tax Stamp Duty ©Rajkumar S.Adukia 3 Fiscal Provisions for SEZ Chapter VI of Special Economic Zones Act ,2005 (Section 26 to Section 30) relates to “Special Fiscal Provisions for SEZ” Chapter IV of Special Economic Zones Rules, 2006 (Rule 22 to Rule 46) relates to “Terms and conditions subject to which entrepreneur and developer shall be entitled to exemptions, drawbacks and concessions” Chapter V of Special Economic Zones Rules, 2006 (Rule 47 to Rule 52) relates to “conditions subject to which goods may removed from Special Economic Zones to DTA” ©Rajkumar S.Adukia 4 Exemption available to Sub contractor also – Rule 10 Exemptions, drawbacks and concessions on the goods and services allowed to a Developer or Co-developer will also be available to the contractors appointed by such Developer or Co-developer All the documents in such cases should bear the name of the Developer or Co-developer along with the contractor Documents should be filed jointly in the name of the Developer or Co-developer and the contractor: ©Rajkumar S.Adukia 5 Exemption from taxes,duties or cess- Sec 7 Sec 7 of The Special Economic Zones Act,2005 Any goods or services exported out of, or imported into, or procured from the Domestic Tariff Area by, - (i) a Unit in a Special Economic Zone; or (ii) a Developer; shall, subject to such terms, conditions and limitations, as may be prescribed, be exempt from the payment of taxes, duties or cess under all enactments specified in the First Schedule. ©Rajkumar S.Adukia 6 First Schedule to The Special Economic Zones Act, 2005 1. The Agricultural Produce Cess Act, 1940 2. The Coffee Act, 1942 3. The Mica Mines Labour Welfare Fund Act, 1946 4. The Rubber Act, 1947 5. The Tea Act, 1953 . 6. The Salt Cess Act, 1953 . 7. The Medicinal and Toilet Preparations (Excise Duties) Act, 1955 . ©Rajkumar S.Adukia 7 First Schedule to Special Economic Zones Act, 2005 8. The Additional Duties of Excise (Goods of Special Importance) Act, 1957 9. The Sugar (Regulation of Production) Act, 1961 10. The Textiles Committee Act, 1963 11. The Produce Cess Act, 1966 12. The Marine Products Export Development Authority Act, 1972 13. The Coal Mines (Conservation and Development Act, 1974 . 14. The Oil Industry (Development) Act, 1974 . ©Rajkumar S.Adukia 8 First Schedule to Special Economic Zones Act, 2005 15. The Tobacco Cess Act, 1975 16. The Additional Duties of Excise (Textile and Textile Act, 1978 Articles) 17. The Sugar Cess Act, 1982 18. The Jute Manufactures Cess Act, 1983 19. The Agricultural and Processed Food Products Export Cess Act, 1985 20. The Spices Cess Act, 1986 21. The Research and Development Cess Act, 1986 ©Rajkumar S.Adukia 9 1.The Agricultural Produce Cess Act, 1940 Act to make better financial provision for the Indian Council of Agricultural Research It impose on certain articles a cess by way of customs duty at the rate of .5% on export, the proceeds of which shall be paid to the Council.(Sec 3) It imposes cess on 21 items which are as under Bones,bristles,butter,cereals other than rice and wheat,drugs,fibre for brushes, fish, fruits, ghee, hides, manures,oilcakes,pulses,seeds,skins,spices,tobacco, vegetables,wheat,wheat flour,wool, ©Rajkumar S.Adukia 10 2.The Coffee Act, 1942 A duty of excise is levied at rate not exceeding Rs 6 per 100 weight as may be fixed by the Central Government on all coffee A duty of customs is levied on all code produced in India and exported from India at rate not exceeding Rs 6 per 100weight as may be fixed by the Central Government (sec 11) The proceeds of the duty of customs and of the duty of excise reduced by the cost of collection is paid to the the Indian Coffee Market Expansion Board (Sec 13) ©Rajkumar S.Adukia 11 3. The Mica Mines Labour Welfare Fund Act, 1946 An Act to constitute a fund for the financing of activities to promote the welfare of labour employed in the mica mining industry. A duty of customs is levied on all mica exported at such rate, not exceeding 6.25 % ad valorem, as may from time to time be fixed by the Central Government (Sec 2) Proceeds of the duty of customs recovered is paid to the credit of Mica Mines Labour Welfare Fund (Sec 2) Fund utilise the money to promote the welfare of labour employed in the mica mining industry ©Rajkumar S.Adukia 12 4. The Rubber Act, 1947 Act for the development of the rubber industry A duty of excise is levied on all rubber produced in lndia at such rate not exceeding Rs 2 per kg of rubber as the Central Government may fix.(Section 12(1) The proceeds of the duty of excise collected under this section reduced by the cost of collection is first credited to the Consolidated Fund of lndia Amount collected Paid by the Central Government to the Rubber Board for being utilised for the purpose of this Act (Section 12(7) ©Rajkumar S.Adukia 13 5. The Tea Act, 1953 . An Act to Provide for the control by the Union of the tea industry, including the control, in pursuance of the International Agreement now in force, of the cultivation of tea in, and of the export of tea from, India and for that purpose to establish a Tea Board and levy a customs duty on tea exported from India. Customs duty- on tea exported or taken outside India at such rate not exceeding Rs 2 per 100 pounds as the Central Government may notify in the Official Gazette (Sec 25) The proceeds of the cess levied under is first credited to the Consolidated Fund of India and the Central Government may pay©Rajkumar to the S.Adukia Tea Board (Sec 26) 14 6. The Salt Cess Act, 1953 . A cess in the nature of excise duty is levied on all salt manufactured (a) in the case of salt manufactured in a private salt factory, at the rate of two annas per standard maund (b) in the case of salt manufactured in a salt factory solely owned or solely worked by the Central Government at the rate of three and a half annas per standard maund (Section 3) It is used to meet the expenses incurred on the salt organisation maintained by Government and on the measures taken by Government in connection with the manufacture, supply and distribution of salt. ©Rajkumar S.Adukia 15 7. The Medicinal and Toilet Preparations (Excise Duties) Act, 1955 An Act for the levy and collection of duties of excise on medicinal and toilet preparations containing alcohol, opium, Indian hemp or other narcotic drug or narcotic. Toilet preparation means any preparation which is intended for use in the toilet of the human body or in perfuming apparel of any description, or any substance intended to cleanse, improve or alter the complexion, skin, hair or teeth, and includes deodorants and perfumes (Section 2(k)) ©Rajkumar S.Adukia 16 7. The Medicinal and Toilet Preparations (Excise Duties) Act, 1955 Schedule contd.. Description of dutiable goods Rate of duty Medicinal and toilet reparations, containing alcohol, Rupees seventeen and ann as eight per gallon of the strength of London proof Spirit. Ayurvedic preparations Rupees three per gallon containing self generated Alcohol, which are capable of being consumed as ordinary alcoholic beverages. All other Medicinal and toilet Rupees five per gallon of the reparations not otherwise strength of London proof spirit. specified containing alcohol ©Rajkumar S.Adukia 17 8. The Additional Duties of Excise (Goods of Special Importance) Act, 1957 A duty of excise at the rate or rates specified in the First Schedule to this Act in respect of the following goods,namely, sugar, tobacco, cotton fabrics, rayon or artificial silk fabrics and woolen fabrics produced or manufactured in India The duties of excise shall be in addition to the duties of excise chargeable on such goods under the Central Excises and Salt Act, 1944 (Section 3) ©Rajkumar S.Adukia 18 9. The Sugar (Regulation of Production) Act, 1961 Where the quantity of sugar produced in a factory during any year exceeds the permissible quota fixed for it for that year there shall be levied and collected on the quantity of sugar which is produced in excess of the permissible quota a special duty of excise at the rate at which the duty of excise is chargeable on sugar under the Central Excises Act The special duty of excise shall be in addition to the duty of excise chargeable on sugar under the Central Excises Ac ©Rajkumar S.Adukia 19 10. The Textiles Committee Act, 1963 An Act to provide for the establishment of a Committee for ensuring the quality of textiles and textile machinery and for matters connected therewith. The Committee may levy such fees as may be prescribed-(a) For inspection and examination of textiles, (b) For inspection and examination of textile machinery, (c) for any other service which the Committee may render to the manufacturers of textiles and textile machinery (Section 12) ©Rajkumar S.Adukia 20 11.The Produce Cess Act, 1966 An Act that provides for the imposition of cess on certain produce for the improvement and development of the methods of cultivation and marketing of such produce and for matters connected therewith A cess is levied for the purposes of this Act on every produce specified First Schedule, which is exported from any customs port to any port beyond the limits of India, a duty of customs at such rate, not exceeding the rate specified in the First Schedule A cess is levied for the purposes of this Act, on every produce specified in the Second Schedule, a duty of excise at such rate, not exceeding the rate specified in Second Schedule (Section 3) ©Rajkumar S.Adukia 21 12. The Marine Products Export Development Authority Act, 1972 An Act to provide for the establishment of an Authority for the development of the marine products industry A cess is levied on all marine products which are exported at rate not exceeding 3% as the Central Government decide (Sec 14(1)) The cess levied shall be in addition to any access or duty leviable on marine products under any other law for the time being in force. (Sec 14(2)) The proceeds of the cess is first credited to the Consolidated Fund of India and the Central Government pay to the Marine Products Export Development Authority from out of such proceeds, after deducting the expenses (Sec 15) ©Rajkumar S.Adukia 22 13. The Coal Mines (Conservation and Development Act, 1974 • An Act to provide for the conservation of coal and development of coal mines and for matters connected therewith or incidental thereto. • Excise Duty - on all coal raised and despatched, and on all coke manufactured and despatched, from the collieries in India at the rate not exceeding Rs 10 per tonne (sec 6) • Custom duty - on all coal (including soft and hard coke), imported or brought into India from any place outside India, a duty of customs at the rates equivalent to the rates of duty of excise (sec 7) • Amount collected shall be disbursed by the Central Government to the owners, agents or managers of coal mines (Sec 9) ©Rajkumar S.Adukia 23 14. The Oil Industry (Development) Act, 1974 . An Act to provide for the establishment of a Board for the development of oil industry and for that purpose to levy a duty of excise on crude oil and natural gas and for matters connected therewith. Excise duty- on every item specified in column 2 of the Schedule at such rate not exceeding the rate set forth in the corresponding entry in column 3 of the Schedule (Sec 15) The proceeds of the duties of excise levied under shall first be credited to the Consolidated Fund of India and the Central Government pay to the Oil Industry Development Fund (sec 16) ©Rajkumar S.Adukia 24 15. The Tobacco Cess Act, 1975 An Act to provide for the Levy and collection, by way of cess, of a duty of excise on virginia tobacco and a duty of customs on tobacco, for the development of tobacco industry Excise duty-at the rate of 1 paisa per kg on virginia tobacco which is produced in India and sold at a registered auction platform. (Sec 3) customs duty -at rate not exceeding 1% ad valorem, as the Central Government may specify on all tobacco which is exported.(Sec 4) The proceeds shall first be credited to the Consolidated Fund of India and the Central Government may pay to the Board, for utilised for the purposes of the Tobacco Board ©Rajkumar S.Adukia 25 Act, 1975 (Sec 5) 16. The Additional Duties of Excise (Textile and Textile Articles) Act, 1978 An Act to provide for the levy and collection of additional duties of excise on certain textiles and textile articles Excise duty-Goods of the description mentioned in the Schedule are chargeable to duty equal to 10% of the total amount chargeable on such goods. (Sec 3) Items in schedule are Man-made fibres , Cotton yarn , Woolen and acrylic spun yarn, Non-cellulosic spun yarn,Cotton fabrics, Silk fabrics, Woolen fabrics, Manmade fabrics, Wool tops. ©Rajkumar S.Adukia 26 17. The Sugar Cess Act, 1982 An Act to provide for the imposition of a cess on sugar for the development of sugar industry and for matters connected therewith A cess is levied for the purposes of the Sugar Development Fund Act, 1982, a duty of excise on all sugar produced any sugar factory in India, at such rate not exceeding Rs 15 per quintal of sugar (Sec 3) The proceeds of the duty of excise levied under section 3 shall be credited to the Consolidated Fund of India (Sec 4) ©Rajkumar S.Adukia 27 18. The Jute Manufactures Cess Act, 1983 An Act to provide for the levy and collection, by way of cess, of a duty of excise on jute manufactures for the purpose of carrying out measures for the development of production of jute manufactures Cess is levied on every article of jute manufacture specified in column 2 of the Schedule and produced in India by a duty of excise at such rate not exceeding the rate specified in the corresponding entry in column 3 thereof (Sec 3) The proceeds of the duty of excise levied shall first be credited to the Consolidated Fund of India and the Central Government may pay to the Jute Manufactures Development Council for the purposes of the Jute Manufactures Development Council Act, 1983 (Sec 4) ©Rajkumar S.Adukia 28 19. The Agricultural and Processed Food Products Export Cess Act, 1985 An Act to provide for the levy and collection, by way of a cess, of a duty of customs on the export of certain agricultural and processed food products for the development and promotion of their export Custom duty- at a rate not exceeding 3% by way of a cess on all Scheduled products, which are exported. (Sec 3) The proceeds of the duties of customs levied shall first be credited to the consolidated Fund of India and the Central Government may pay to the Agricultural and Processed Food Products Export Development Authority (Sec 4) ©Rajkumar S.Adukia 29 20. The Spices Cess Act, 1986 An Act to provide for imposition of cess on all spices which are exported for the purposes of carrying out measures for the development of export of spices. customs duy-on spices at such rate not exceeding 5% , ad valorem (Sec 3) proceeds of the duty of customs levied credited to the consolidated Fund of India and the Central Government may pay for the purposes of the Spices Board Act, 1986 (Sec 3) ©Rajkumar S.Adukia 30 21. The Research and Development Cess Act, 1986 An Act to provide for the levy and collection of a cess on all payments made for the import of technology for the purposes of encouraging the commercial application of indigenously developed technology and for adapting imported technology to wider domestic application a cess is levied at such rate not exceeding five per cent, on all payments made towards the import of technology (Sec 3) The proceeds of the cess levied and collected shall first be credited to the Consolidated Fund of India and the Central Government may pay to the Technology Development Board constituted under the Technology Development Board Act, 1995 for the purposes of the Board ©Rajkumar S.Adukia 31 (Sec 4) Terms and conditions for availing exemptions, drawbacks and concessions (Rule 22(1) ) (i) The Unit shall execute a Bond-cum-Legal Undertaking in Form H, with regard to its obligations regarding proper utilization and accountal of goods and regarding achievement of positive net foreign exchange earning; (ii) The Developer and Co-Developer shall execute the Bond-cumLegal Undertaking in Form D with regard to their obligations regarding proper utilization and accountal of goods (iii) The Bond-cum-Legal Undertaking shall be jointly accepted by Development Commissioner and by the Specified Officer: ©Rajkumar S.Adukia 32 Activities covered in Bond-cum-Legal Undertaking (Rule 22(1)(iii) ) (a) the movement of goods between port of import or export and the Special Economic Zone; (b) the authorized operations, as applicable to Unit or Developer; (c) temporary removal of goods or goods manufactured in Unit for the purposes of repairs or testing or calibration or display or processing or sub-contracting of production process or production or other temporary removals into Domestic Tariff Area without payment of duty (d) re-import of exported goods. ©Rajkumar S.Adukia 33 Responsibility for Execution of Bond cum-Legal Undertaking (Rule 22(1)(iv)) Status of entrepreneur or Developer company Responsibility Hindu Undivided Family Managing Director of the company or any other authorized person all the partners or authorized partner(s); Karta proprietorship concern proprietor partnership firm ©Rajkumar S.Adukia 34 Value of Bond-cum-Legal Undertaking Rule 22(1)(iv)) Equal to the amount of effective duties leviable on import or procurement from the Domestic Tariff Area of the projected requirement of capital goods, raw materials, spares, consumables, intermediates, components, parts, packing materials for three months The Bond-cum-Legal Undertaking amount shall be monitored quarterly or yearly on the basis of Quarterly Progress Report or Annual Progress Report ©Rajkumar S.Adukia 35 An Exception- Rule 27(3) Any goods for the personal use of or consumption by officials,workmen, staff, owners or any other person in relation to a Unit or Developer, shall not be eligible for exemptions, drawbacks and concessions or any other benefit ©Rajkumar S.Adukia 36 Income Tax Benefits ©Rajkumar S.Adukia 37 Relevant Sections in Income Tax Act,1961 S.No Section Description 1 10(15)(viii) Interest received on deposit with Offshore Banking Unit is exempt 2 10AA Exemption to newly established Units in SEZ 3 54GA Exemption of Capital gain on transfer of asset in case of shifting of Industrial Undertaking from Urban Area to SEZ 4 80-IAB Deduction is respect of profits and gains in development of SEZ 5 80LA Deduction from income of OBU and IFSC 6 115JB(6) Non applicability of MAT to SEZ ©Rajkumar S.Adukia 38 Relevant Sections in Income Tax Act,1961 S.No Section Description 7 115-O Exemption from dividend distribution tax in respect of income of SEZ 8 197A No TDS on interest on deposits made with OBU by Non-resident or person not ordinary resident in India Changes in the Income Tax Act 1961 relating to SEZ made by Special Economic Zones Act 2005 w.e.f 10/02/2006 ©Rajkumar S.Adukia 39 Exemption to newly established Units in SEZ - Section 10AA ©Rajkumar S.Adukia 40 Exemption to Unit who begins to manufacture or produce articles or things or provide any services during the PY relevant to any AY commencing on or after 01.04.2006 Deduction – Total 15 Years 100% of Profits from export for 5 consecutive years 50% of Profits from exports for further 5 assessment years 50% of Profits for as credited to “Special Economic Zone Reinvestment Reserve Account” for next 5years Absence of restrictive proviso in new Sec. 10AA dealing with Reconstruction, reconstitution of business in existence ©Rajkumar S.Adukia 41 Use of Special Economic Zone Reinvestment Reserve Account ( S 10AA(2(a)) Acquiring machinery or plant Until the acquisition of the machinery or plant for the purposes of the business of the undertaking other than for distribution by way of dividends or profits or for remittance outside India as profits or for the creation of any asset outside India; ©Rajkumar S.Adukia 42 Mis-use of Special Reserve Account ( S 10AA(3)) If the Special Reserve Account is misutilised, then the deduction would be taken back in the year in which the Special Reserve Account is misutilised. If the Special Reserve Account is not utilised for acquiring new plant and machinery within three years as stated above then the deduction would be taken back in the year immediately following the period of three years. ©Rajkumar S.Adukia 43 Consequences for merger and demerger ( S 10AA(5)) Where an undertaking is transferred to another company under a scheme of amalgamation or demerger, the deduction under section 10AA shall be allowable in the hands of the amalgamated or the resulting company. However, no deduction shall be admissible under this section to the amalgamating company or the demerged company for the previous year in which amalgamation or demerger takes place. ©Rajkumar S.Adukia 44 Exemption of Capital Gain on Shifting to SEZ -Sec 54GA ©Rajkumar S.Adukia 45 Exemption of capital gains on transfer of assets in cases of shifting of industrial undertaking from urban area to any Special Economic Zone. The exemption is available to all categories of assesses on capital gain arising on the transfer of certain capital asset of industrial undertaking from urban area to SEZ. (whether developed in an urban area or not) The Asset transferred should be machinery or plant or building or land or any rights in building or land The capital gain should be utilized within one year before or three years after the date of transfer for the specified purpose. ©Rajkumar S.Adukia 46 Specified Purpose- 54GA contd.. (i) purchased machinery or plant (ii) acquired building or land or constructed building (iii) shifted the original asset and transferred the establishment of such undertaking to the Special Economic Zone; and (iv) incurred expenses on such other purposes as may be specified in a scheme framed by the Central Government for the purposes of this section. The amount of capital gain which is not so utilised for the specific purposes should be deposited in an account with any specified bank or institution and utilised in accordance with the scheme notified by the Central Government ©Rajkumar S.Adukia 47 Quantum Of Deduction -Sec 54GA contd.. Situation Result Amount of Capital Gain < = Cost and expenses incurred for specified Purposes Entire Capital Gain exempt Amount of Capital Gain > Cost and Exemption: to the extent of cost expenses incurred for and expenses incurred specified Purposes. ©Rajkumar S.Adukia 48 Definition of Urban area Urban area means any such area within the limits of a municipal corporation or municipality as the Central Government may, having regard to the population, concentration of industries, need for proper planning of the area and other relevant factors, by general or special order, declare to be an urban area for the purposes of this sub-section. ©Rajkumar S.Adukia 49 Deduction in respect of profits by SEZ Developer -Sec 80 IAB ©Rajkumar S.Adukia 50 Deductions in respect of profits and gains from industrial undertakings or enterprises engaged in development of Special Economic Zone. An undertaking which develops a special Economic Zone notified on or after 1.4.2005 will not be eligible to claim deduction under section 80-IA.but will now be claiming deduction under new section 80 – IAB. Available to an assessee , being a Developer whose gross total income, includes any profit and gains derived by an undertaking or an enterprise from any business of developing a special Economic Zone , notified on or after 1.4.2005 under Special Economic Zones Act,2005 ©Rajkumar S.Adukia 51 QUANTUM OF DEDUCTION - Sec 80 IAB contd.. A deduction of an amount equal to 100% of the profits and gains derived from such business for 10 consecutive assessment years. The assessee has the option of claiming the said deduction for any 10 consecutive assessment years out of 15 years beginning from the year in which a SEZ has been notified by the Central Government ©Rajkumar S.Adukia 52 Transfer of Undertaking If a taxpayer who develops a special economic zone on or after April 1, 2005 (“transferor”) transfers the operation/maintenance of such zone to another developer (“transferee”), then deduction shall be allowed to the transferee for the remaining period of 10 years as if the operation and maintenance were not so transferred. Similar rule will be applicable in the case of amalgamation of an Indian company which has developed a special economic zone with another Indian company. ©Rajkumar S.Adukia 53 No Tax on Distributed Profits -Sec 115O(6) ©Rajkumar S.Adukia 54 No tax on dividends would be chargeable in respect of the total income of an undertaking or enterprise engaged in (a) developing a SEZ or (b) developing and operating a SEZ or ( c) developing, operating and maintaining a SEZ IF such dividend (whether interim or otherwise) is declared, distributed or paid by such Developer or enterprise, on or after the 1st day of April, 2005 out of its current income No tax either in the hands of the Developer or enterprise or person receiving such dividend ©Rajkumar S.Adukia 55 OTHER RELATED INCOME TAX PROVISIONS ©Rajkumar S.Adukia 56 Industrial park scheme The Central Government framed the scheme for industrial parks,-Industrial Park Scheme, 2002 in exercise of the powers conferred by clause (iii) of subsection (4) of section 80 IA of the Income-tax Act, 1961 scheme was applicable for any undertaking which develops, develops and operates or maintains and operates an Industrial Park for the period beginning on the 1st day of April, 1997 and ending on the 31st day of March, 2006 this has been extended up to 31.03.2009 by the Finance Act,2006 Eligibility- deduction of 100 % profits derived from such business for ten consecutive years. Assessee can claim deduction for any ten consecutive years out of fifteen years beginning from the year in which the undertaking develops/operates/maintains the Industrial park. ©Rajkumar S.Adukia 57 Investors in SEZ Exemption is provided to investors in special economic Zones under Sec 10 (23G) of the Income Tax Act, 1961. ©Rajkumar S.Adukia 58 Undertaking developing and building housing projects Sec 80- IB (10) - Deduction in respect of profits and gains from certain industrial undertakings other than infrastructure development undertakings Deduction: For projects approved before the 31st day of March, 2007 by a local authority shall be hundred per cent of the profits derived in the previous year relevant to any assessment year from such housing project Conditions: (a) Such undertaking has commenced or commences development and construction of the housing project on or after the 1st day of October, 1998 and completes such construction, (i) In a case where a housing project has been approved by the local authority before the 1st day of April, 2004, on or before the 31st day of March, 2008; ©Rajkumar S.Adukia 59 (ii) in a case where a housing project has been, or, is approved by the local authority on or after the 1st day of April, 2004, within four years from the end of the financial year in which the housing project is approved by the local authority. (b) The project is on the size of a plot of land which has a minimum area of one acre: (c) the residential unit has a maximum built-up area of one thousand square feet where such residential unit is situated within the city of Delhi or Mumbai or within twenty-five kilometres from the municipal limits of these cities and one thousand and five hundred square feet at any other place; and (d) The built-up area of the shops and other commercial establishments included in the housing project does not exceed five per cent of the aggregate built-up area of the housing project or two thousand square feet, whichever is less.] ©Rajkumar S.Adukia 60 Special provisions in respect of certain undertakings or enterprises in certain special category ©Rajkumar S.Adukia 61 Special category states Arunachal Pradesh Assam Manipur Meghalaya Mizoram Nagaland Sikkim Tripura ©Rajkumar S.Adukia 62 Undertaking Sikkim/ Any N.E.States Himachal Pradesh/Uttaranchal • manufactures or produces any article or thing, not being any article or thing specified in the Thirteenth Schedule • manufactures or produces any article or thing, specified in the Fourteenth Schedule one hundred per cent of such profits and gains for ten assessment years commencing with the initial assessment year; one hundred per cent of such profits and gains for five assessment years commencing with the initial assessment year and thereafter, twenty-five per cent (or thirty per cent where the assessee is a company) of the profits and gains. ©Rajkumar S.Adukia 63 Undertaking must manufacture in any Export Processing Zone or Integrated Infrastructure Development Centre or Industrial Growth Centre or Industrial Estate or Industrial Park or Software Technology Park or Industrial Area or Theme Park ©Rajkumar S.Adukia 64 Benefits to OBU ©Rajkumar S.Adukia 65 Interest Income from OBU is exempt In computing the total income of previous year of any person any income by way of interest received by 1. Non resident or 2. a person who is not ordinarily resident in India on a deposit made on or after the 1st day of April, 2005, in an Offshore Banking Unit shall not be included (Section 10(15)(viii)) ©Rajkumar S.Adukia 66 Deductions in respect of certain incomes of Offshore Banking Units and International Financial Services Centre 80LA Assesses covered (i) Scheduled bank, or, any bank incorporated by or under the laws of a country outside India; and having an Offshore Banking Unit in a Special Economic Zone; or (ii) Unit of an International Financial Services Centre, ©Rajkumar S.Adukia 67 Amount of deduction-Sec 80LA(1) (a) 100% of such income for 5 consecutive assessment years beginning with the assessment year relevant to the previous year in which the permission,under 23(1)(a) of the Banking Regulation Act, 1949 or permission or registration under the Securities and Exchange Board of India Act, 1992 (15 of 1992) or any other relevant law was obtained, and thereafter; (b) 50% of such income for next 5 consecutive assessment years. ©Rajkumar S.Adukia 68 Income Exempted-Sec 80LA(2) Income refers to income : (a) from an Offshore Banking Unit in a Special Economic Zone; or (b) from the business referred to in Section 6(1) the Banking Regulation Act, 1949 with an undertaking located in a Special Economic Zone or any other undertaking which develops, develops and operates or develops, operates and maintains a Special Economic Zone; or (c) from any Unit of the International Financial Services Centre from its business for which it has been approved for setting up in such a Centre in a Special Economic Zone. ©Rajkumar S.Adukia 69 80LA…. A report from a Chartered Accountant in Form No. 10CCF certifying that the deduction has been correctly claimed in accordance with the provisions of this section should be submitted along with the return of income. A copy of permission obtained under section 23(1)(a) of Banking Regulation Act should be submitted along with the return of income. ©Rajkumar S.Adukia 70 Case Laws Courts and Tribunals have held that the requirement to file the report along with the return of Income is directory and not mandatory Citation: 251 ITR 693- Commissioner of Income-tax vs. Hemsons Industries (Andhra Pradesh High Court) “ The mere fact that the assessee failed to enclose the audit report along with the return itself would not disentitle him to claim the benefit, and, on the other hand, if he files the audit report before the assessment order is passed, he will be entitled to the deduction “ ©Rajkumar S.Adukia 71 No deduction of Tax –197A(1C) No deduction of tax shall be made by the Offshore Banking Unit from the interest paid (a) on deposit made on or after the 1st day of April, 2005, by a nonresident or a person not ordinarily resident in India; or (b) on borrowing, on or after the 1st day of April, 2005, from a nonresident or a person not ordinarily resident in India. ©Rajkumar S.Adukia 72 Other Benefits ©Rajkumar S.Adukia 73 Exemption from service tax The exemption from payment of service tax on taxable services rendered to a Developer or a Unit (including a Unit under construction) by any service provider shall be available for the authorized operations in a Special Economic Zone. – Section 26(1)(e) and rule 31 ©Rajkumar S.Adukia 74 Exemption from Central Sales tax Every Developer and the entrepreneur is entitled exemption from the levy of taxes on the sale or purchase of goods other than newspapers under the Central Sales Tax Act, 1956 if such goods are meant to carry on the authorized operations by the Developer or entrepreneur. – Sec 26(1)(g) This is subject to the condition that the dealer selling goods in the course of inter state trade or commerce to a registered dealer under the Central Sale Tax Act, 1956 shall furnish a declaration in Form – I prescribed under the Central Sales Tax (Registration and Turnover) Rules, 1957.- Proviso to Rule 32 ©Rajkumar S.Adukia 75 Changes made in Central Sales tax,1956 No CST shall be payable by any dealer in respect of sale of any goods made by such dealer, in the course of inter-State trade or commerce, to a registered dealer( developer of SEZ or SEZ Unit as the case may be) for the purpose of manufacture, production, processing, assembling, repairing, reconditioning, re-engineering, packaging or for use as trading or packing material or packing accessories in an unit located in any special economic zone, if such registered dealer has been authorised to establish such unit by the authority specified by the Central Government in this behalf. (Development Commissioner is of SEZ is authorized to permit a person to set up unit in SEZ) (Section 8(6) of Central Sales Tax Act, 1956) ©Rajkumar S.Adukia 76 Securities Transaction Tax Every Developer and the entrepreneur shall be entitled to exemption from the securities transaction tax leviable under section 98 of the Finance (No. 2) Act, 2004 in case the taxable securities transactions are entered into by a non-resident through the International Financial Services Centre. Sec 26(1)(f) ©Rajkumar S.Adukia 77 Exemption from Stamp Duty under Indian Stamp Act,1899 Exemption from stamp duty on any instrument executed, by, or, on behalf of, or, in favour of the Developer, or Unit or in connection with the carrying out of purposes of the Special Economic Zone.( Section 3 Third Proviso of Indian Stamp Act,1899) Effected by Change in Indian Stamp Act,1899 by Special Economic Zones Act ,2005 Third Schedule ,Part III ©Rajkumar S.Adukia 78 FEMA Provisions relating to SEZ ©Rajkumar S.Adukia 79 Foreign Direct investment 1) 2) 3) 4) FDI is allowed through automatic route for all manufacturing activities in SEZ except Arms and ammunition , Explosives and allied items of defence equipments, Defence aircrafts and warships, Atomic substances, Narcotics and Psychotropic Substances and hazardous Chemicals, Distillation and brewing of Alcoholic drinks and Cigarette/cigars and manufactured tobacco substitutes. Item 20 of Annexure B of Schedule I of Foreign Exchange Management( Transfer or Issue of Security by a person Resident outside India) Regulations, 2000, ©Rajkumar S.Adukia 80 Foreign Direct investment contd.. 100% FDI in trading activity will not be permitted SEZ Unit can manufacture articles reserved for SSI even if foreign equity exceeds 24%.No License is required (Department of Industrial License Press Note No 5 dated 29-03-2000 Notification 7(11)/2000IP dated 04-12-2000) ©Rajkumar S.Adukia 81 Other Provisions for SEZ No Time Limit for export of export proceeds which is normally 6 months for others (Foreign Exchange Management (Export of Goods and Services) Regulation 2000) Branch office may be set up in SEZ to undertake manufacturing and service activities without permission of RBI in those sectors where 100% FDI is permitted (Foreign Exchange Management (Establishment in India of Branch or other place of businesses) Regulation 2000) ©Rajkumar S.Adukia 82 Other Provisions for SEZ DTA units can pay for goods in Foreign Exchange for which goods are supplied by SEZ to DTA – RBI Circular 8/2005-06 dated 01/07/2005 A Unit Located in SEZ can open ,hold and maintain Foreign currency account with authorized dealer in India (Foreign Exchange Management (Foreign currency accounts by a person resident in India),Regulations, 2000 ©Rajkumar S.Adukia 83 Other Provisions for SEZ A Unit in SEZ can enter into contract in commodity exchange or market outside India to hedge the price risk in the commodity on export/import without prior approval of RBI ( Foreign Exchange Derivative Contracts) Regulation ,2000 SEZ can raise ECB for its own requirements and borrowed funds shall not be transferred to its sister concern or any other Unit in DTA (RBI Circular 2/2005-06 dated 01/07/2005) ©Rajkumar S.Adukia 84 Direct Dispatch of documents to Foreign buyer SEZ Units can dispatch export documents direct to consignee outside India. These need not be routed through authorized dealer Remittance should be obtained and GR/SDF form should be submitted to authorized dealer with in 21 days for monitoring RBI Circular 8/2005-06 dated 01/07/2005 ©Rajkumar S.Adukia 85 Job Work abroad and direct dispatch SEZ Units can undertake Job work abroad and export goods from that country itself Exporter has to make satisfactory arrangement for realisation of full exports proceeds (RBI Circular 8/2005-06 dated 01/07/2005) ©Rajkumar S.Adukia 86 QUESTIONS/ SUGGESTIONS/ COMMENTS ??? ©Rajkumar S.Adukia 87