What enabled Adidas to be the Market Leader in

advertisement

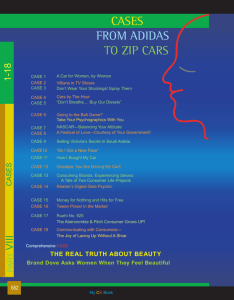

Primary Question for Adidas Does Adidas's corporate strategy, including recent acquisitions and restructuring, stay true to its brand while positioning itself to improve shareholder value and challenge Nike as the leader of the global sporting goods industry? • • • • • • • • Secondary Questions What enabled Adidas to be the market leader in the past? How did Adidas lose its lead to Nike? What has the Adidas brand represented in the past and what does it represent today? How has Adidas's corporate strategy changed over time, specifically before and after the 2005-2006 restructuring? Has Adidas's acquisitions helped position itself against its competitors? What role do developing countries have in Adidas's future success and how is Adidas's position in those countries? Should Adidas be concerned about losing North American market share to Nike? Is there another corporate strategy Adidas should be pursuing? What enabled Adidas to be the Market Leader in the past? Product Innovation Analysis – Adidas was an early entrant into athletic shoe industry. They developed many of the features still present in shoes today. Created a strong brand based on high quality, innovative products that top athletes choose to use in training and competition. Track and Field • 1925:studs and spikes • Arch support • 1949 – molded rubber cleats • 1952 screw in spikes Soccer • 1954 – screw in spikes • 1963- Began producing soccer balls • 1967 – athletic apparel Results • Over 700 patents • Strong reputation among top athletes • 1970 – leading brand in consumer jogging shoes Marketing Innovation •Developed strong following with top track and field athletes. Gave shoes to German athletes in 1928 Olympics •Applied this same model years later with soccer shoes and apparel. 75% of track and field athletes wearing adidas in 1960 Olympics •Successful because adidas was creating innovative, high quality products. •Product innovation enabled marketing innovation. •Different than Nike – marketing is what set them apart from the start. 2 stripe (and later 3 stripe) brand 78% of athletes wearing adidas at 1972 Olympics How did Adidas lose its lead to Nike? What has the Adidas brand represented in the past and what does it represent today? How has Adidas's corporate strategy changed over time, specifically before and after the 2005-2006 restructuring? Adidas’s Evolving Strategy Return to form via restructuring… Loss of focus… Adi’s leadership… Focused on athletic footwear/apparel. Success factors are marketing and product innovation. Focused on Puma, while Nike underestimated. Tries to catch up via acquisitions which yields product breadth instead of specialization. Design and Innovation, differentiated image for brands, improved retail and supply chain Adidas’s Current Strategy Has Adidas's acquisitions helped position itself against its competitors? Salomon Acquisition: Was it Successful? Product Line Before Product Line After Athletic Shoes Athletic Shoes Athletic Apparel Athletic Apparel Ski Equipment Golf Clubs Bicycle equipment Winter Sports Apparel •Analysis:Paid 1.5bn to diversify product line. Surpassed Reebok world’s 2nd largest sporting goods company, however… Adidas’s Stock Price 60 Stock Price (in euros) 50 40 30 Adidas Stock Price 20 10 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Year •Stock price fell soon after acquisition in 1998, Salomon divested except for Taylor-Made Golf line. Adidas overpaid for acquisition. Adidas after Salomon was divested Product Line Before Athletic Shoes Product Line After Athletic Shoes Product Line After Divestiture Athletic Shoes Athletic Apparel Athletic Apparel Athletic Apparel Ski Equipment Golf Clubs* Golf Clubs Bicycle equipment Winter Sports Apparel •Only added Golf Clubs to product line What role do developing countries have in Adidas's future success and how is Adidas's position in those countries? Adidas is a global player •43% of sales from Europe, which is slowest growth market •Encouraging that #1 in developing eastern European market, Russia expected to be most profitable market in Europe by 2010 •2006 acquisition of Reebok not enough to overcome Nike in North America •Growing number of sales in Asia market, fueled by adidas success in China. •Strong demand and large population Net Sales in Emerging Markets Analysis – strong growth trend in sales in two very attractive emerging markets. Growth may be result of Adidas brand strength in soccer, world’s most popular sport. Regional Footwear/Apparel Markets Region Size Market Growth Rate Adidas Sales Adidas Sales Growth Adidas Position North America $42.5 billion 3% $2.9 billion 5% #2 behind Nike Europe N/A 2% (20% Eastern Europe) $4.3 billion 8%, mainly in Russia #1 Asia 3.2 billion people 13% (South and Central) 15% (China) $2.2 billion 17% #1 Latin America N/A N/A $657 million 39% #2 behind Nike Analysis – Adidas is strong in several developing markets (Eastern Europe, China) but its focus and acquisitions have been geared towards overtaking Nike in the large, but slow growth North America market. Should Adidas be concerned about losing North American market share to Nike? Retail Store Strategy 2006 2007 Adidas Retail Locations 875 1003 Reebok Retail Locations 283 430 Adidas AG Geographic Revenue Performance € 5,000 € 4,500 5.0% 31.5% € 4,000 € 3,500 106.4% 3.2% € 3,000 -9.4% Europe North America € 2,500 11.6% € 2,000 32.6% 17.6% € 1,500 Asia Latin America 27.8% € 1,000 1229.2% € 500 56.4% 31.7% €0 2004 2005 2006 2007 Key Growth Potential: Europe – continue focus on soccer (including endorsements) and build brand loyalty Asia/Latin America – increase distribution network and brand awareness - All three regions averaging double-digit growth rates TaylorMade Advantages Shift to International Markets Strength in Metalwoods Revenues from Asia: 1999 – 13% of total 2007 – 35% of total Metalwoods currently hold number one ranking. Decreasing reliance on U.S. Market: 1999 – 69% of total 2007 – 52% of total Irons hold less than half market share of industry leader Strong Apparel Presence Over 70 touring pros lift apparel presence. Golf balls have seen limited success Conclusion – TaylorMade should hold U.S. market share in U.S. given the brand’s strenghts, however, TM is only 8% of Adidas AG global revenues. TM cannot help Adidas overtake Nike in U.S. market TM 8% Reebok 23% Adidas 69% Adidas Global Revenue Sources (2007) 6.4% Remaining regions = 71.3% of revenues 22.1% 42.8% Europe North America Asia Latin America Conclusion – The majority of Adidas’s revenue streams are outside U.S. market and are growing significantly – let Nike lead U.S. market but dominate Europe and emerging markets. N.A. market 28.7% of revenues Reebok Global Revenue Sources (2004) 11.4% 21.4% 12.5% Europe United Kingdom United States Other Countries 54.7% Conclusion – Use Adidas’s control and production efficiencies to enhance Reebok’s distribution network in U.S. to increase U.S. revenues. U.S. market 54.7% of 2004 revenues Is there another corporate strategy Adidas should be pursuing? Alt Strategy Options • Use Adidas as revenue driver outside of U.S. market – restructure Reebok strategy to capitalize on historic revenue performance in U.S. – Decrease number of Adidas retail outlets in U.S. convert to Reebok retail – Increase Reebok U.S. endorsements • Use Adidas global distribution to further increase TaylorMade international revenues Slides that follow still need to be placed or cut. External Environment: PEST Issue Threats/Opportunities Ranking (1-5) Political Operating multi-nationally – awareness of cultures, laws, image, environment, regulations Threat- mistakes can be costly 2 Economic Current state of economy – customers may be less willing to pay for higher priced items Threat – high quality means higher prices 2 Extreme forces in competitor pricing. Opportunity – supply chain efficiencies and multiple distribution channels 4 Category Social Keeping up with the wants of the younger generation Opportunity – Reebok’s strength in this area 4 Technological Product innovation is a key driver in the industry Opportunity – core competency for adidas 4 Porter’s 5 Forces Threat of Substitutes Low Bargaining Power of Suppliers Low Intensity of Competition High Bargaining Power of Buyers High Threat of New Entrants Low Porter’s Five Forces Factor Description Impact •adidas’s strength is product innovation and meeting customer expectations Low •Strong presence of established brands and distribution channels •Customers already loyal to their brand •Huge resources required of new entrants Low Bargaining Power of Buyers •Huge number of buyers means adidas must market products effectively •Must be able to differentiate from the competition •Buyers more conscious of their spending •Buyers have access to more information High Bargaining Power of Suppliers •Multiple sources of materials for shoes and apparel – commodity status •Suppliers are very dependent on adidas and others •Ease in switching suppliers if necessary and can do so globally Low •Recent acquisitions in industry •All competition has global reach – internet and e-commerce •Remaining a leader is expensive – aggressive sales and marketing •Always struggling to get a competitive edge High Threat of Substitute Products Threat of New Entrants Competitive Rivalry SWOT Analysis Strengths •Large event sponsorships •Brand reputation / recognition •Diverse product portfolio •Culture driven by innovation / R&D •Dominant in soccer and hockey •Supply chain management Weaknesses •High quality and innovation are costly •Controlling subcontractor quality – negative effects can be devastating •Wasting resources trying to overtake Nike in the US? Opportunities Threats •Increasing female participation in sports •E-commerce to increase market share •Growth rates for footwear and apparel •Central Asia (13%), •Eastern Europe (20%) •China (15%) •Nike’s reputation and presence; a leader in marketing and advertising •Sponsorships and endorsements may go wrong (Kobe Bryant) How has Adidas evolved since it was founded? Timeline of Adidas • 1920-1925 • • Innovators in Marketing – gave away shoes to German athletes competing in Olympic games. By 1936 most athletes would compete only in Dassler shoes. • Bitter family feud, company dissolved. Rudi established Puma. With his departure Adi renamed company Adidas & registered the trademark 3rd strip to Adidas shoes. • Adi expanded spikes concept in track shoes to soccer shoes. Partial credit was given to the soccer shoes for Germany’s World Cup Championship that year. 1928-1936 1948-1949 1954 Fouded 1920 by Adi Dassler – wanted to design shoes for athletes in soccer, T&F, & tennis. The Dassler brothers (Rudi & Adi) made their first major innovation in athletic shoes, integrating studs & spikes in track & field shoes. Timeline of Adidas • Adidas is the clear favorite among athletes – 75% of T&F athletes wear them in Olympics. ’63 started producing soccer balls, ’67 athletic apparel • Adidas became leader in consumer jogging shoes in the US. Tshirts and apparel bearing the 3 stripes became popular among teens. • Adi Dassler dies, Adidas remains worldwide leader in athletic footwear but they are losing market share fast to Nike in US. Market share loss continues through the 80’s and mid 90’s. • Through cost cutting, new model launches, and endorsement contracts with popular athletes Adidas increased sales by 75% over prior year in US. Becoming 3rd largest athletic footware company in US – trailing only Nike and Reebok. 1960-1967 1970’s 1978 1994 Timeline of Adidas • Acquisition of Salomon SA – diversified beyond shoes & apperal to ski, golf, bicycle, & winter sports. • Stock price takes a hit possibly due to Salomon acquisition. Adidas mgt divested all of Salomon’s winter sports & bicycle equipment. • Acquistion of Reebok, included Rockport footware, Greg Norman apparel, & CCM hockey equipment. 1998 1998-2005 2006