Chapter 17

Liquidity Risk

McGraw-Hill/Irwin

© 2008 The McGraw-Hill Companies, Inc., All Rights Reserved.

Overview

17-2

This chapter explores the problem of

liquidity risk faced to a greater or lesser

extent by all FIs. Methods of measuring

liquidity risk, and its consequences are

discussed. The chapter also discusses the

regulatory mechanisms put in place to

control liquidity risk.

Liquidity Versus Solvency

17-3

Remember, a firm is insolvent if the value of

liabilities exceeds the value of assets

Liquidity is not a solvency issue, but a timing

issue

The “timing issue” can be become

permanent if a liquidity crisis is severe

enough

Here is a new formula to remember:

Illiquid assets + leverage = bankruptcy

FIs and Typical Liquidity Risk Exposure

High exposure

DIs

Highly-leveraged hedge funds

Moderate Exposure

17-4

Life Insurance Companies

Leveraged hedge funds

Low exposure

Mutual funds, hedge funds with minimal , pension funds,

property—casualty insurance companies.

Typically low, does not mean zero:

September 2006, Amaranth Advisors, a hedge fund forced to shut

down

Causes of Liquidity Risk

Asset side

May be forced to liquidate assets too rapidly

Faster sale may require much lower price

May result from OBS loan commitments

Traditional approach: cash and reserves

asset management.

Alternative: liability management.

17-5

Causes of Liquidity Risk for DIs

17-6

Liability side

Reliance on demand deposits

Core deposits

Depository Institutions need to be able to

predict the distribution of net deposit drains.

Seasonality effects in net withdrawal patterns

Early 2000s problem with low rates: finding suitable

investment opportunities for the large inflows

Managed by:

purchased liquidity management

stored liquidity management

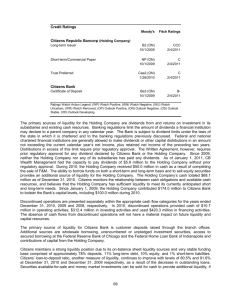

Summary B/S – Commercial Banks

17-7

Borrow to Cover Deposit Outflow

Note that the B/S in the upper right is the “instantaneous effect”.

The B/S must balance.

Also note that equity = 0 in these examples.

17-8

Use Cash to Pay Off Deposit Withdrawal

17-9

Two Ways to Fund Loan Drawdown

17-10

Liquidity Issue Due to Market Risk

17-11

Liquidity Exposure for Two Banks

•What is impact of:

•Variance in reliance on borrowings versus deposits?

•Variance in level of commitments to lend?

17-12

Liability Management

17-13

Purchased liquidity

Federal funds market or repo market.

Managing the liability side preserves asset side

of balance sheet.

Borrowed funds likely at higher rates than

interest paid on deposits.

Deposit insurance allows even distressed

institution to gather deposits

Can be high cost in broker market

Regulatory concerns:

growth of wholesale funds and the potential for

serious problems in credit crunch

Liability Management

Alternative: Stored Liquidity Management

Liquidate assets.

17-14

In absence of reserve requirements, banks tend to

hold reserves. E.g. In U.K. reserves ~ 1% or more.

Downside: opportunity cost of reserves.

Decreases size of balance sheet

Requires holding excess non-interest-bearing

assets

Institutions today typically combine

purchased and stored liquidity management

Asset Side Liquidity Risk

17-15

Risk from loan commitments and other

credit lines:

met either by borrowing funds or

by running down reserves

Current

levels of loan commitments are

dangerously high according to

regulators.

17-16

Investment portfolio & asset side liquidity risk

Interest rate risk and market risk of the

investment portfolio.

Technological improvements have increased

liquidity in financial markets.

Some argue that “herd” behavior may actually

reduce liquidity.

Measuring Liquidity Exposure

17-17

Net liquidity statement: shows sources and

uses of liquidity.

Sources: (i) Cash type assets, (ii) maximum

amount of borrowed funds available, (iii) excess

cash reserves

With liquidity improvements gained via securitization

and loan sales, many banks have added loan assets

to statement of sources

Uses include: borrowed or money market funds

already utilized, and any amounts already

borrowed from the Fed.

Other Measures:

17-18

Peer group comparisons: usual ratios

include borrowed funds/total assets, loan

commitments/assets etc.

Liquidity index:

Weighted sum of “fire sale price” P to fair market

price, P*, where the portfolio weights are the

percent of the portfolio value formed by the

individual assets.

I = S wi(Pi /Pi*)

Liquidity Index Example in Text (p502)

50% T-bills $99 versus $100

50% RE Loans $85 versus $92

Normal RE Market

I= {.50x (99/100)} + {.50x(85/92)} =

.495 + .462 = .957

Slow RE Market

I= {.50x (99/100)} + {.50x(65/92)} =

.495 + .353 = .848

17-19

Measuring Liquidity Risk

17-20

Financing gap and the financing requirement:

Financing gap = Average loans - Average

deposits or,

financing gap + liquid assets

= financing requirement.

The gap can be used in peer group

comparisons or examined for trends within

an individual FI.

Example of excessive financing requirement:

Continental Illinois, 1984.

c

Financing Gap = Loans – Deposits = $25 - $20 = $5

Financing requirements = Financing Gap + Liquid Assets =

$5 + $5 = $10

In other words, beyond the $20 in deposits, the institution

must find another $10 in financing somewhere.

17-21

BIS Approach:

17-22

Maturity ladder/Scenario Analysis

For each maturity, assess all cash inflows

versus outflows

Daily and cumulative net funding requirements

can be determined in this manner

Must also evaluate “what if” scenarios in this

framework

BIS Liquidity Ladder

17-23

Note that, despite the “requirement” terminology, positive

numbers in the last line are really the expected liquidity cushion

Liquidity Planning

17-24

Important to know which types of depositors

are likely to withdraw first in a crisis.

Composition of the depositor base will

affect the severity of funding shortfalls.

Example: mutual funds/pension funds more

likely to withdraw than correspondent banks and

small businesses

Allow for seasonal effects.

Delineate managerial responsibilities clearly.

Sample Analysis of Potential Withdrawals by

Depositor type

17-25

Bank Runs

17-26

Can arise due to concern about bank’s

solvency.

Failure of a related FI.

Sudden changes in investor preferences.

Demand deposits are first come first served.

Depositor’s place in line matters.

Bank panic: systemic or contagious bank

run.

Alleviating Bank Runs:

Regulatory measures to reduce likelihood of

bank runs:

17-27

FDIC

Discount window

Not without economic costs.

FDIC protection can encourage DIs to increase

liquidity risk. (moral hazard)

Mutual Fund with Zero and Max Leverage

No Leverage:

Cash

2

Securities 98

Equity 100

Maximum Leverage (50% net assets):

Cash

3

Securities 147

Borrowings 50

Equity 100

17-28

Investors withdraw $10MM

17-29

No Leverage:

Cash

1

Borrowings 0

Securities

89

Equity

90

Use $1 cash and sell $9 assets to redeem $10, or

Cash

2

Borrowings 10

Securities

98

Equity

90

Borrow $10 to redeem $10

Maximum Leverage (50% net assets):

Cash

Securities

2

133

Borrowings

Equity

45

90

Used up $1 cash and had to sell $14 of securities to pay $10 to redeeming

investors and pay down $5 in borrowings to bring leverage back to 50%

Securities Market Value Falls 10%

17-30

No Leverage:

Cash

Securities

2

88.2

Borrowings

Equity

0

90.2

Note that for the mutual fund with no leverage, there is no

transaction required from a liquidity or leverage limit

standpoint.

The story is quite different with leverage. See the next slide.

Securities Market Value Falls 10%

17-31

Maximum Leverage (50% net assets) Start:

Cash

3

Borrowings 50

Securities

147

Equity

100

First Cut: Securities decline by 14.7 & equity falls the same

Cash

3

Borrowings 50

Securities

132.3

Equity

85.3

But now, the fund is in violation of the SEC leverage limit:

50/85.3 = 58.6% & the limit is 50%

Max borrowings = .5 x 85.3 = 42.65, so need to sell 7.35 of

securities

Cash

3

Borrowings 42.65

Securities

124.95

Equity

85.3

Market Value of Securities Falls 25%

No Leverage:

Cash

Securities

17-32

(note that there is no transaction)

2

73.5

Borrowings

Equity

0

75.5

Maximum Leverage (50% net assets): (start)

Cash

3

Borrowings

50

Securities

147

Equity

100

Loss on securities is 36.75:

Cash

3

Borrowings

50

Securities

110.25

Equity

63.25

But, our equity now only supports borrowings of .5x63.25=31.6

Cash

3

Borrowings

31.6

Securities

91.85

Equity

63.25

Fund must sell $18.4 of securities in a bad market to pay off excess

borrowings.

What About Hedge Funds?

A hedge fund without leverage is in a

similar situation to that of the unlevered

mutual fund

Except that the assets may be less liquid or

more concentrated

Both of these increase liquidity risk

17-33

Hedge Fund With 900% Leverage

17-34

Start:

Cash

50

Borrowings 900

Securities

950

Equity

100

Investors withdraw $30:

Cash

20

Borrowings 630

Securities

680

Equity

70

Manager would use cash to meet the redemption request.

The manager would then very quickly (frantically) try to sell

securities to get the leverage ratio back down. To reach

900% again, would need to sell $270!!! Remember that

unlevered funds would sell none and the mutual fund with

maximum leverage would have to sell only$7.35.

Hedge Fund With 900% Leverage

17-35

Start:

Cash

Securities

50

950

Securities Decline 10%

Cash

50

Securities

855

Borrowings

Equity

900

100

Borrowings

Equity

900

5

Do you think that the lenders might call their loans?

Now, consider that Long Term Capital ran 2000% leverage

routinely and reached 10000% (100:1) at the end.