NC12

advertisement

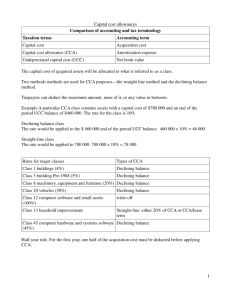

Engineering Economic Analysis Canadian Edition Chapter 12: After-Tax Cash Flows Chapter 12 … Shows how to calculate income taxes. Discusses incremental income taxes. Determines combined federal and provincial income tax rates. Calculates after-tax cash flows. Determines after-tax performance measures, e.g. NPV, EACF, IRR, NFV, PBP, and BCR. Evaluates projects on an after-tax basis with acquisition & disposal of assets. EECE 450 — Engineering Economics 12-2 Income Taxes Taxes have an effect on cash flows and on the investment decisions managers make. Integrating tax considerations into economic analysis requires a thorough understanding of two issues: • how the taxes are imposed; and • how taxes affect economic analysis techniques. EECE 450 — Engineering Economics 12-3 Income Taxes … Federal income taxes are determined from taxable income and income tax rates. • Progressive individual federal income tax structure Gross Income – Deductions = Taxable income. • Gross income: wages, salary, interest income, dividend income, etc. • Deductions: retirement plan contributions, business investment expenses, etc. Personal income tax rates vary across provinces and are progressive; the exception is Alberta which uses a flat rate. EECE 450 — Engineering Economics 12-4 Income Taxes … Average tax rate = Taxes payable/taxable income. Marginal tax rate— the tax rate that applies to the next dollar of income earned. If the next dollar of income does not cause the tax to advance to the next level, i.e. “bracket creep”, the marginal tax rate equals the sum of the federal income tax rate + provincial income tax rate. • An individual at the 26% federal tax level and the 12.29% provincial tax level has a marginal tax rate of 38.29% (about $85,000 taxable income in B.C.). EECE 450 — Engineering Economics 12-5 Corporate Income Taxes More complex than individual income taxes. • Accountants apply Generally Accepted Accounting Principles (GAAP). The Income Tax Act defines specific accounting concepts: • Depreciation/amortization, cost base, book value, salvage value. Combined federal and provincial corporate tax rates for British Columbia in 2009 were: • 14.5% for small business income up to $400,000; • 30% for Canadian-controlled private corporations (CCPCs) with income over $400,000. EECE 450 — Engineering Economics 12-6 Corporate Income Taxes … Income Statement for TMU Corporation for the year ending December 31, 2008 Operating revenues Less: Operating costs Before-tax cash flow (BTCF) CCA Debt interest Taxable income Less: income taxes (rate T) Net Profit (loss) EECE 450 — Engineering Economics OR OC OR OC CCA I OR OC CCA I T(OR OC CCA I) (OROCCCAI)(1T) 12-7 Accounting & Engineering Economy Understand the tax laws affecting the project of interest. Estimate the cash flows without considering the effects of taxes. Adjust the cash flows based on the effects of depreciation and income taxes. Determine the after-tax measure(s) of merit (NPV, IRR, etc.). EECE 450 — Engineering Economics 12-8 Accounting & Eng’g Economy … Principal accounting statements: • Balance sheet: financial position at end of year. • Income statement: earnings during one year. • Cash flow statement: sources and uses of cash. Key amounts from the income statement: • Operating revenue = Operating cost + BTCF (before-tax cash flow) • BTCF = Debt interest + CCA + Taxable income • Taxable income = BTCF Debt interest CCA • Taxable income = Net profit + Income tax • Net profit = Taxable income Income tax • Net profit = (Taxable income)(1 T) EECE 450 — Engineering Economics 12-9 Accounting & Eng’g Economy … After-tax cash flow (ATCF): = Net profit + CCA + Debt interest (I) = (Taxable income)(1T) + CCA + I = (BTCF I CCA)(1 T) + CCA + I = (OR OC)(1 T) + I(T) + CCA(T) Net cash flow from operations: = ATCF – I – Dividends (DIV) = (OR OC)(1T) + I(T) + CCA(T) I DIV = (OR OC I)(1T) + CCA(T) DIV = Net profit + CCA DIV EECE 450 — Engineering Economics 12-10 Accounting & Eng’g Economy … Net cash flow = Net cash flow from operations + New equity issued + New debt issued + Proceeds from asset disposal Repurchase of equity Repayment of debt principal Purchase of assets EECE 450 — Engineering Economics 12-11 Accounting & Eng’g Economy … The CCA (depreciation) expense reduces the taxable income but it increases the cash flow. The CCA increases the cash flow by an amount = TCCA, called the CCA tax shield. The CCA is added to the net income to get the net after-tax cash flow. EECE 450 — Engineering Economics 12-12 Accounting & Eng’g Economy … Acquiring and disposing of assets: • Acquisitions are added to an asset pool and disposals are subtracted from the asset pool. • Reconciliation to the cash flow requires calculation of the net salvage value. • From Canadian tax rules, an asset class remains open as long as there are assets remaining in it. • If there is a loss on disposal or recaptured CCA: if the asset class remains open, the loss or recaptured CCA is allocated on an ongoing basis by the declining balance method at the asset group’s CCA rate; if the asset class must be closed because there are no assets remaining in it, the terminal loss or recaptured CCA is applied to the income. EECE 450 — Engineering Economics 12-13 Accounting & Eng’g Economy … A capital gain is realized when an asset is sold for more than its original cost. 50% of the capital gain (selling price original cost) is taxed at the marginal rate. Net salvage value (NSV): • Asset class open: NSV = S. • Asset class closed: NSV = S + T(BdS). S = Salvage value (before-tax proceeds from disposal) T = marginal tax rate Bd = Book value at disposal (UCC) EECE 450 — Engineering Economics 12-14 CCA and Capital Costs When a capital asset is acquired, the present value of the net capital investment is: dTC 1 i 2 B 1 i d 1 i B capital cost of asset (cost basis) d CCA rate for the specified asset class TC firm’ s marginal tax rate i discount rate Use this formula only if it is valid to assume the full CCA will be taken every year. EECE 450 — Engineering Economics 12-15 CCA and Capital Costs … When we dispose of a capital asset, the present value of the net salvage is: dTC 1 S 1 N i d 1 i S salvage value d, TC , i as defined earlier N lifetime (year of disposal) Use this formula if the CCA class will remain open, i.e. other assets remain in the asset class after the project is complete. EECE 450 — Engineering Economics 12-16 Working Capital Requirements Time lags exist between dispensing cash for expenses and receiving cash from sales. Working capital = injection of cash, or cash equivalents, to cover these time lags. Most investments require an initial investment in working capital. The working capital is recovered entirely at the end of the project. There may be changes in the level of working capital required throughout the project. Working capital does not gain value nor does it depreciate in value during the project. EECE 450 — Engineering Economics 12-17 After-tax Rate of Return It is usually a complex matter to obtain the after-tax MARR and it cannot usually be obtained from the before-tax MARR, however MARRafter-tax MARRbefore-tax(1T) is a reasonable approximation. We will assume, unless it is otherwise clearly stated, that we are using an after-tax MARR when we analyze the economics of a project. EECE 450 — Engineering Economics 12-18 Comprehensive Example Johnston Forwarding Inc. is considering the purchase of twenty new trucks for a special purpose fleet in their freight division. Each truck costs $67,500. They are expected to be in service for eight years, then be salvaged for $5000 each. The trucks will be added to an existing CCA Class 10 asset pool. Each truck is expected to generate $20,750 in annual revenue, net of direct operating costs. Johnston’s maintenance cost centre charges $1550 per truck annually. (Continued …) EECE 450 — Engineering Economics 12-19 Comprehensive Example … There is also a fixed annual cost of $35,000 to cover management and administration of the twenty trucks in the proposed fleet. Each truck will require an immediate investment of $7500 in net working capital. Johnston uses a minimum acceptable rate of return of 14 percent to analyze investments of this type. Johnston’s marginal tax rate is 30 percent. Determine whether Johnston Forwarding Inc. should invest in the new trucks. Use both a value and a rate of return criterion. EECE 450 — Engineering Economics 12-20 Comprehensive Example … Purchase cost per truck : Salvage value per truck : Number of truck s: Annual net revenue per truck : Annual maintenance charge per truck : Fixed costs: Work ing capital per truck : CCA rate: Tax rate: MARR: Planned lifetime (years): $67,500 $5,000 20 $20,750 $1,550 $35,000 $7,500 30% 30% 14% 8 Truck purchase PV(CCA tax shield gained) Investment in work ing capital PV(Salvage) PV(CCA tax shield lost on salvage) PV(recovered work ing capital) PV(net after-tax operating cash flow) -$1,350,000.00 $259,180.62 -$150,000.00 $35,055.91 -$7,170.53 $52,583.86 $1,133,274.45 NPV= IRR= -$27,075.69 13.471% Johnston Forwarding Inc. should not invest in the trucks. EECE 450 — Engineering Economics 12-21 Suggested Problems 12-23 (NPV), 25 (PBP & IRR), 37 (PBP, NPV & IRR), 38 (NPV & IRR), 39 (NPV & IRR), 50, 51. At the time of disposal of an asset, unless it is otherwise explicitly stated, assume: • the CCA asset class continues (has other assets remaining in it) and has greater value before the disposal than the value of the asset being salvaged; • the asset disposal occurs at year-end, after the CCA has been taken for the final year. EECE 450 — Engineering Economics 12-22