powerpoint IP Health and gen insurance

advertisement

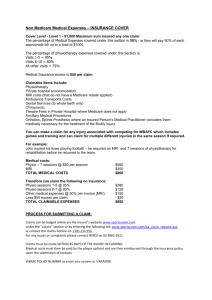

CHAPTER 15 Income Protection, Health and General Insurance OVERVIEW A range of benefits is available to those who become disabled and are unable to earn an income. Full protection needs insurance and a wide variety of policies is available. Business people also need business expenses to be covered if disability strikes unexpectedly. Medical bills can be extremely high and are met from the government or private health insurance. A range of general insurance products provide protection in the areas of homes and contents, personal property, legal liability, motor vehicles, compulsory third party, flood and professional indemnity. Reluctance to Insure • Many people recognise the value of their homes and seek to have them insured. • The home is usually the most valuable possession: should it be destroyed, most people would have great difficulty replacing it. Yet these same people fail to recognise an even more valuable asset, one which they are unlikely to be able to replace, and that is their ability to earn an income. • Additionally an individual’s health is of paramount importance and hence insurance provides a risk management strategy in this area. Risk Identification The range of disabling events that can impair ability to earn income is quite extensive and can extend from a heavy cold that keeps a person from work for several days to a person being totally disabled with a serious illness or accident and unable to work for months or even unable to work ever again. Risk Identification • The period of disablement arising from these events can vary considerably from a short period of time to permanent. • Regardless of the period, the costs arising can be considerable and include: – medical expenses; – equipment and aids to assist in coping with disability, for example motorised wheelchairs, house alterations (ramps, rails, widening doorways) – nursing assistance; and – loss of income. Funding Needs Different levels of disability will impose different funding burdens when income stops, depending on: 1.The duration of the period of disability 2.The cost of medical interventions 3.The availability of sick leave Funding Sources The possible sources of funds are: • • • • sick leave entitlements workers’ compensation benefits compulsory third party benefits social security benefits. Insurance policies There are a number of insurance policies and government assistance that could help meet costs during periods of disablement. These are: • total and permanent disablement (TPD) policies; • trauma policies; • income protection insurance; • business overheads insurance; • Medicare; and • private health insurance. TPD and Trauma Policies • TPD policies pay a lump sum for those whose disabilities are total (cannot work) and permanent (never will work again). • Trauma policies will pay a lump sum amount on the occurrence of a specified event (trauma). • Disabling events will result in medical expenses. • There are different levels of cover that can be effected. Income Protection Insurance • Providing protection for loss of income is a major and essential item and can be achieved with an income protection policy. • Such policies are designed to replace, in part, the insured’s income while the insured is totally disabled (but not necessarily permanently). The payment of the benefit commences following a waiting period and continues until the insured is no longer totally disabled or the benefit period expires. Income Protection Insurance • Policies can be extended to include partial disablement for an additional premium. • There are a range of additional covers available in these policies: some of these are included at no extra charge and others incur an additional premium if nominated. • Policies vary in their definitions of ‘injury’ or ‘sickness’. Some do not define the terms at all and where this is the case the common usage or dictionary definition would be used in interpreting the policy. • Note that the word ‘accidental’ excludes self-inflicted injuries. Income • An income protection policy will also define what constitutes ‘income’, which will vary between employed and self-employed people. • Employed – the total remuneration package: salary, fees, commissions, regular bonuses, regular overtime, superannuation and fringe benefits. (Sometimes only salary sacrifice superannuation is included.) • Self-employed – the income earned by way of ‘personal exertion’, less expenses incurred in earning that income. Benefit • The benefit paid under the policy is usually a stipulated monthly amount which is related to the insured’s ‘income’ (see discussion of ‘income’ below) at the time the policy was effected. • The insurer will usually provide cover for up to 75% of the insured’s pre-disability income. This margin is set to provide an incentive for the insured to return to work. • Some insurers are prepared to provide cover for a further 10–15% of pre-disability income provided the additional amount is used for meeting superannuation contributions. Qualifying Period • The ‘qualifying’ (or ‘waiting’) period is a period at the start of the incapacity, during which the insured has elected that no benefit shall be paid under the income protection policy. • Incapacities of a short duration can occur frequently and if insurers were to provide compensation for incapacities of just a few days the premiums they would need to charge would be very high. Qualifying Period • The length of the qualifying period commonly offered by insurers is 14, 30, 60 or 90 days. • Some insurers will provide qualifying periods of six months and one year or even two years. • Longer waiting periods result in fewer claims and cheaper premiums. There is a dramatic drop in the premium where the waiting period is increased from 14 to 60 days. Benefit Period The insured selects the maximum period of time that a benefit is payable for when effecting the policy. Benefit periods offered by insurers are one, two, five years or to age 65. For some professional occupations, lifetime cover may be offered. Business Overheads Insurance Where a person operates their own business a significant incapacity can seriously impair the business. The business income, in addition to providing an income for the selfemployed person, meets the costs of the business. Business Overheads Insurance A decrease or suspension of business income means that the continuing business expenses cannot be met. Items such as commission will cease to arise where there are no sales made, but fixed costs such as rent, phone rental, lease payments on leased equipment and similar expenses will continue. This gap can be filled by the business overheads policy. Business Overheads Insurance The expenses covered are listed in the policy and an example might include: – ‘Depreciation, land and payroll taxes and rates, interest on business loans and mortgages, electricity, gas, water rates, insurance premiums, cleaning, heating, phone costs, lease payments for equipment and vehicles, professional subscriptions, salaries of employees who do not directly contribute to the earnings of the business, other fixed costs normal to the conduct of the insured’s business.’ Business Overheads Insurance • • • • • • The policy will also contain a list of expenses that are not covered and the following list is typical: goods, merchandise or stock in trade depreciation on real estate remuneration of those who directly contribute to the earnings of the business remuneration paid to family members expenses not regularly paid by the business business taxes. Health Insurance • Hospital and medical insurance in Australia is provided by way of two systems: • Public: Medicare • Private: Private health funds Medicare • Medicare is a federal government scheme. It is available to everyone and is funded partly from government revenue and partly from a levy made on the income of all taxpayers except low income earners. • The current levy is 1.5% on taxable income and is paid along with income tax. • Where a person’s income is over $50,000 (or $100,000 for a couple) and they have no private health insurance the amount of the levy rises to 2.5%. Medicare • Medicare provides treatment in a public hospital at no charge by a doctor appointed by the hospital. You cannot choose your own doctor. • For a private patient, Medicare will pay 75% of the scheduled fee for the treatment provided. Bear in mind that the actual charge may be greater than the scheduled fee. • For medical expenses incurred outside a hospital, Medicare will reimburse 85% of the scheduled fee. Medicare Medical benefits Medicare covers a variety of medical services: – – – – – – – – doctor’s and specialist’s consultations anaesthetics obstetrics radiology X rays, pathology tests and other similar tests optometry surgical procedures approved by dentists certain cleft lip and palate procedure. Medicare Hospital Benefits The cover provided by Medicare applies in both public and private hospitals, but the extent of cover differs as to whether the person is a private or public patient. Public hospital • Medicare allows a public patient to receive treatment, in most cases at no cost, from a doctor or specialist provided by the hospital. • A private patient in a public hospital is treated the same as a private patient in a private hospital. Medicare Private hospital • A private patient must meet the cost of their hospital accommodation, and medical and related expenses, but they have their choice of doctors and specialists. They can insure these costs under private health insurance. Restrictions on Medicare • • • • There are a number of services Medicare does not cover. Briefly the principal items are: Hearing aids and dental care Ambulance services Home nursing Costs incurred as a private patient. These can be incurred in a public hospital where the patient has elected to be admitted as a private patient. In such a case they would be able to choose their own doctor. Restrictions on Medicare • • • • • Physiotherapy, speech and occupational therapy Chiropody, psychology and chiropractic services Osteopathy Prostheses costs Treatment provided as part of a workers’ compensation or compulsory third party insurance • Life insurance or superannuation examination Other Government Assistance In additional to Medicare, the Pharmaceutical Benefits Scheme assists with medical expenses by meeting part of the cost of most prescriptions purchased from pharmacies. Private Health Insurance Private health services allow the patient a greater choice and flexibility Private patients can choose their own doctor and have more control over when they are admitted to hospital. Costs are met by the patient or their insurer for items such as: hospital accommodation, theatre fees, intensive care, drugs, dressings and similar, surgically implanted prostheses, diagnostic tests, pharmaceuticals and doctors services These costs can be substantial and private health insurance is designed to assist with paying them. Government Initiatives In recent years the private health insurance industry has undergone something of a crisis with the number of people privately insured dropping to very low levels, below 30% of the population A number of measures have been introduced in an attempt to address this problem, including: – the Medicare levy surcharge – 30% Rebate on Private Health Insurance – the Lifetime Health Cover Initiative. The Medicare Levy Surcharge The surcharge was aimed at encouraging high income earners to take out private hospital cover. An extra 1% surcharge is applied to the Medicare levy making it a total of 2.5% for high income earners who do not have an appropriate level of hospital insurance. Federal Government 30% Rebate on Private Health Insurance • This initiative was introduced in January 1999 and it provides a rebate of 30% of a person’s health insurance premium. This rebate can be claimed by: • The health fund reducing the premium by 30%. The government reimburses the fund for this amount. • A direct payment from government through the local Medicare office. • Claiming the 30% back on the person’s tax return. The Lifetime Health Cover Initiative • This initiative is aimed at encouraging people to take out cover at a younger age and maintain the cover throughout their lifetime • The initiative increases the premium payable by 2% for each year after 30 a person is when they take out the cover. Membership Categories Not all funds provide all of these categories • Single - Cover for the applicant only • Family - Cover for the applicant, one other adult and all dependent children • Couple - Cover for the applicant and another person who is not a dependent child of the applicant • Single parent family - Cover for the applicant and any dependent children A dependent child is one who is under 18 (or under 25 if a full-time student). Health Insurance Benefits The amount of benefit received will depend on the type of cover purchased and the benefit level paid for within that cover. In some cases the fund may have an agreement with the hospital or the doctor in which case the fund may cover all costs. Types of Cover There are two types of cover provided by private health insurance. These are: • Hospital cover – Reimburses the costs of hospital and medical expenses • Ancillary cover – Reimburses a range of non-hospital charges, such as physiotherapy, podiatry, glasses and contact lenses, and home nursing General Insurance House and contents insurance • Indemnity value – Covers the market value of the property at the time of the loss, and takes into account depreciation. Indemnity value might not provide enough money to replace the property. • Replacement value – ‘new for old’ policies which enable full replacement. General Insurance Contribution, subrogation and co-insurance • Contribution – Where insurance is held with more than one company over the same asset, each is obliged to pay only a part of the claim in proportion to the amount of cover they are sharing. • Subrogation – When the client has a right to recover from a third party as well as to make an insurance claim, the right to sue is transferred, as a contractual term of the policy, to the insurance company. General Insurance Contribution, subrogation and co-insurance Co-insurance – Where an insured person does not insure for the full value, they are deemed to be self-insuring part of the property. Only part of even a small claim will be met by the insurance company. Co-insurance clauses have proven to be very unpopular and many insurance companies either no longer include them or do not enforce them. General Insurance Sums insured When calculating the full sum insured for a house, the following items must be included: – – – – cost to rebuild the house costs of other buildings, sheds, garage cost of fences, swimming pools and other structures architect fees, demolition fees and debris removal. General Insurance Contents insurance It is advisable to list contents with new for old values in advance to avoid disputes in the event of a serious loss. Portable property, such as cameras, watches and jewellery, may have valuation limits and special conditions attached to them. General Insurance Scope of insurance Two main types: 1. Everything covered except items listed as exclusions. 2. Everything excluded except items listed as included. The former provides greater certainty about what is covered for the policy holder. General Insurance Exclusions House and content policies cover fire, explosion, lightning, earthquake, wind, rain, hail and snow. Policies generally do not cover gradual deterioration, water entering the house because of building defects or open windows, flood, landslides, subsidence or erosion. General Insurance Personal Property Insurance Covers accidental loss or damage to personal property anywhere in Australia. Legal Liability Insurance Extent of the cover will vary between policies and may be restricted to the premises or operate Australia wide. General Insurance Personal Property Insurance Covers accidental loss or damage to personal property anywhere in Australia. Legal Liability Insurance Extent of the cover will vary between policies and may be restricted to the premises or operate Australia wide. General Insurance Motor Vehicle Insurance • Compulsory third party – Covers the driver against bodily injury to third parties as a result of his or her use of the vehicle. • Full comprehensive – Covers damage to the vehicle itself and property damage to third parties. • Third party fire and theft – No cover for the vehicle itself unless caused by fire or theft, but cover for property damage to third parties in accidents. General Insurance Other insurances • Flood – A difficult area to underwrite, because only those at high risk are interested. • Professional indemnity – Provides cover for legal liabilities arising from negligent acts, errors or omissions. Required by professionals, including financial planners. Summary • A range of benefits is available to those who become disabled and are unable to earn an income. • Full protection needs insurance and a wide variety of policies is available • Business people also need business expenses to be covered if disability strikes unexpectedly. • Medical bills can be extremely high and are met from the government or private health insurance. • A range of general insurance products provide protection in the areas of homes and contents, personal property, legal liability, motor vehicles, compulsory third party, flood and professional indemnity.