Slide 0 - CII Institute of Logistics

advertisement

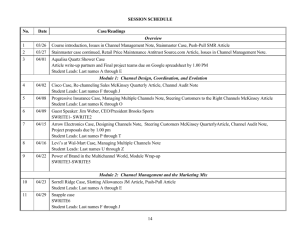

WORKING DRAFT Last Modified 26/08/2012 22:05:51 India Standard Time Printed 24/08/2012 20:24:32 India Standard Time Agility for Success Sumit Dutta Partner – McKinsey & Company Automotive Supply Chain Conference - 27th August, 2012 Organized by CII Institute of Logistics Trends & discontinuities affecting auto supply chain Agility for success Cross functional agility to drive an agile organization Implementing agility McKinsey & Company | 1 Sharpening of megatrends driving industry supply chain NOT EXHAUSTIVE Key trends driving auto supply chain Example 1 Increasing service requirement Increasing need for convenience features, drive towards just in time / sequence delivery 2 Global production and supply networks Toyota has 29 assembly sites across 22 countries, Tier-1 suppliers across 3 continents and 15+ countries 3 Reduced value creation by OEM 4 Increasing complexity SOURCE: McKinsey Evolution of the Automotive OEMs global profit pool by geography $ bn, 2006-15E BRIC Europe North America Japan and Korea 48 Restructuring 53 Partnership 55 39 25 3 9 -10 2006 07 08 09E 2010E Bear case Base case Smart consolidation Declining global profit pools post financial crisis, 2015 base case estimate profit pools to be at <80% of 2007 levels 2015E Number of car variants have increased to 2X over the last 5 years McKinsey & Company | 2 Unforeseeable risks have increased in frequency and intensity ▪ Unexpected changes in demand ▪ ▪ Increased demand for customization As uncertainty rises … ▪ ▪ Price volatility Natural disasters ▪ Political unrest ▪ Adverse weather Non-economic Value stream No. of disruptive events Probability of steel price change Before 2000 2000-2005 After 2005 Supplier insolvency Climatic catastrophes Meteorological events Hydrologic catastrophes Geophysical events 1,100 1,000 900 +3% p.a. 800 700 600 500 400 300 >20 10 5 2 0 -2 -5 <-20 -10 Monthly price change In percent Credit availability Exchange rate fluctuations Macro/regulatory 0 82 84 86 88 90 92 94 96 98 2000 02 Global interconnectedness (1990-2011) Index S&P 500 (1990 to 2011) Index Volatility 500Volatility S&P Toyota assembly sites and suppliers interconnectness Global to disruptive events (3 yrs) exposure 90 04 Final assembly sites 2010 08 1990-2010 <1990 06 of disruptions Examples Disruptive event in the last 3 years Assembly sites, 2010 Assembly sites, 1990 15+ Tier 1 suppliers 80 3-15 Tier 1 suppliers 70 1-2 Tier 1 suppliers 60 50 40 New Normal 30 Average: 18.6 Stdev : 5.9 10 Greater opportunities for agile companies to capitalize on uncertainty SOURCE: McKinsey Agile Operations ▪ 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 0 1993 Trade protectionism Average: 22.0 Stdev : 9.4 Old Normal 20 1992 Euro crises impact 1991 ▪ ▪ 100 1980 1990 ▪ ▪ 200 Global supply and demand networks amplify and transmit changes at unprecedented pace McKinsey & Company | 3 Executives feel unprepared to deal with the risks associated with growing uncertainties Leaders recognize… “Disruptions to supply chains can adversely impact growth and productivity” “…need to be ready to cope with externallyimposed crises…” – Carlos Ghosn However, supply chain BCM is still immature Executives are inadequately prepared to manage risks ▪ Preparedness gap index (10 = unprepared; 0 = well prepared) ▪ ▪ 15% not reviewing their business continuity plan with key suppliers Cost and availability 18% not seeking evidence of credit of BCM arrangements Supplier insolvency 8.5 7.0 50% not validating that key suppliers business continuity plans would actually work in practice Loss of customers 6.5 Currency fluctuations 6.0 Cancelled orders 6.0 How much should I spend on supply chain risk management and on risk mitigation? Regulation 4.5 Trade protectionism Asset price volatility SOURCE: Kevin Hendricks, University of Western Ontario, Vinod Singhal, Georgia Institute of Technology July 2009 Lloyds 3600 Risk Insight and Economist Intelligence Unit 2.0 0.5 McKinsey & Company | 4 Normal / Very Important Survey: Responding quickly to supply chain disruptions is a top priority for organisations Critical Importance Top functional priority / Top organizational priority Organisational priorities in the coming five years N = 22 Responding quickly to supply chain disruptions xx 5% 32% Challenging cost escalations 14% 23% Increasing consumer requirements 9% 32% Driving product development to balance cost and value 14% Managing sales losses and wrong inventory accumulation 23% Optimizing a global manufacturing foot print 2 33% 64% 3.9 64% 3.8 59% 36% 27% 19% Average rating 3.9 50% 3.6 50% 3.5 48% 3.2 1 Rating scale: 1 – Normal Importance -- 2 Very Important -- 3 Critically important - 4 Top priority for the functional leader -- 5 Most important priority for the organization 2 Excludes respondents who did not respond to the question SOURCE: Survey of participants of Automotive Conference, Delhi 2012 McKinsey & Company | 5 Select themes are important for automotive supply chains to respond better to business necessities 1 SCM flexibility and agility for market uncertainties NOT EXHAUSTIVE Main focus of the document Cost innovation for tier 2/3 2 market penetration 3 Cracking the code on outsourcing 4 Managing global disruptions SOURCE: McKinsey McKinsey & Company | 6 Current trends impacting automotive supply chain Agility for success Cross functional agility to drive an agile organization Implementing agility McKinsey & Company | 7 Volume volatility severely impacts enterprises – Agility critical to manage business cycles Development of volume demand Actual Index – units per year ▪ ▪ ▪ Volume faster than forecast Growth challenge ▪ Back on same levels as before crisis COMMERCIAL VEHICLE MANUFACTURER Forecast How to prepare for the next downturn +70% volume 12-18 months 100% ▪ ▪ 2006 07 SOURCE: McKinsey Agile Operations Volume drop in 4-6 m ▪ Start of financial crisis 08 09 10 5 to 1shift with 4 days of productio n 11 ▪ New financial crisis ? 12 2013 McKinsey & Company | 8 Demand Capacity Agility critical for through-cycle success xx India Actual 1 903 518 Indian auto industry is no exception 559 759 578 427 Preempt ▪ ▪ Reduce variability Build structural agility Detect ▪ ▪ Create real time visibility Define targets and triggers for fast action Respond ▪ ▪ Outline “playbooks” and trigger points Teams with clear decision rights & capabilities to react Capture advantage ▪ ▪ Understand true drivers of change Gain competitive advantage from disruption Capabilities and culture to deal with changes Prioritized uncertainties Fully resourced agility plan Agility built in routine strategic planning & business decisions War room 1 Actual CV sales (trucks & buses) in India from FY 06-07 to FY 11-12 in ‘000 units SOURCE: McKinsey Agile Operations McKinsey & Company | 9 PREEMPT & DETECT – Some companies have developed good practices to cope with unpredictable and rapid changes Relevance for Auto Example ▪ Flexible production Agile supplier development Flexible assets Quick response capabilities SOURCE: McKinsey Agile Operations ▪ 2-phase production to combat seasonality (“Build to stock”; “Near just-in-time” for winter) Allowed for lower inventory levels and less risk throughout the year ▪ ▪ Segmented manufacturing process Implemented demand flow (e.g., at GE, Boeing, Flextronics, etc.) ▪ ▪ Standardized processes across all models Quickened reactions to changes in mix ▪ ▪ Implemented systems and infrastructure Weekly reviews with top 35 global leaders McKinsey & Company | 10 RESPOND & CAPTURE – Agility can differentiate companies that will struggle with volatility from those that profit by it Example downside – Share price declines by >50% within 18 months Example upside – ~25 to 35% savings from RM volatility Mattel share price development1 Raw materials price development 100 80 60 1,500 0 01/07 ▪ ▪ ▪ -58% Feed stock A Feed stock B 1,000 500 0 07/07 01/08 07/08 01/09 07/09 Lead paint discovered in toys; Sourcing: non pre-approved supplier Took long to detect the quality issue 2005 2006 2007 2008 2009 ▪ Identified a substitute feedstock (B) 25% cheaper than the current (A) ▪ Feedstock B also used 10% less volume in manufacturing process Upside for Chemicals company ▪ Saved 25% of costs by switching Downside for Mattel: ▪ Recalled ~3 mn toys, Paid $12 mn settlement; 50% loss in market cap Closer home, lesser than expected sales of Nano and labour unrest at Maruti highlight the need for agility of OEMs and suppliers 1 Indexed: 100% = price on May 1st, 2007 SOURCE: McKinsey Agile Operations, Caijing Magazine, Datastream McKinsey & Company | 11 Current trends impacting automotive supply chain Agility for success Cross functional agility to drive an agile organization Implementing agility McKinsey & Company | 12 Key to build agility across functions Presented today Examples of levers Agile Organization Capital productivity agility Production agility ▪1 Labor flexibility ▪4 Asset footprint ▪2 Ramp up/down capabilities ▪5 Asset flexibility ▪3 Process design flexibility SOURCE: McKinsey Agile Operations Purchasing agility ▪6 ▪7 ▪8 Supplier selection ; develop Make or buy; Contracting strategies Risk transfer Product development agility ▪9 ▪10 Modularizat ion/ standardiza tion/ late differentiati on Diversified R&D funnel Planning agility ▪11 Demand shaping ▪12 Inventory strategy ▪13 End-to-end planning ▪14 ▪15 Forecasting War room McKinsey & Company | 13 Bridging demand forecast volatility and volume flexibility in production planning can avoid lost sales Capacity increase Percent Demand forecast Long-term investment curve Key question ▪ Which flexibility is required for each component – based on volatility in demand and time for capacity increase Short-term investment High Demand volatility 2nd sourcing Escalation Banking/Pre-Production Work organization (labor flexibility) Contracted flexibility, e.g., 10% 2 years prior to production SOURCE: McKinsey Agile Operations EXAMPLE Time Finalization of Produplanning ction Low Lo w High Lead time to capacity adjustment De-stresses the supply chain with removal of uncertainty in capacities and aids in setting up a ‘stable’ supply chain McKinsey & Company | 14 Understanding component level flexibility characteristics are critical to building production agility EXAMPLE Volatility exposure and reaction time Inadequate processes for critical components Volatility exposure index Sensitivity towards mix-shifts 100 10 20 Component A 75 Component B Component C Component K 50 ▪ Flexibility not addressed in supplier selection ▪ Late communication of changes in volume forecasts ▪ No transparency of spare capacities at suppliers ▪ No active capacity management Component D Component G Component F Component E Component J Component H 25 Component I 40 70 0 0 5 10 15 20 25 30 Technical reaction time (months) Significantly impacts the ability of the supply chain to ▪ Respond to changing needs of production ▪ Actively plan for managing risks 1 Time to extend machine-capacity SOURCE: McKinsey Agile Operations McKinsey & Company | 15 Agree / Strongly agree Survey: Organizations are aware of asset capacity and plan for asset agility ~65% of respondents believe decision makers are aware of manufacturing ability Neutral Disagree / Strongly disagree xx Average rating ~65% of respondents believe the new assets are designed for agility N = 22 N = 22 Decision makers are fully aware of the capacities (including limitations) of manufacturing plants based on various scenarios (product mix, demand pattern etc) The new assets that are being planned are designed to improve agility (through standardization, flexibility etc.) in operations 64% 18% 64% 36% 18% 3.7 3.8 1 Rating scale: 1 – Strongly disagree -- 2 Disagree -- 3 Neutral - 4 Agree – 5 Strongly agree) 2 Excludes respondents who did not respond to the question SOURCE: Survey of participants of Automotive Conference, Delhi 2012 McKinsey & Company | 16 Examples Flexible production systems to manage throughput, model diversity and cost Enhanced thruput Improved Model Diversity ▪ Linking technology, ▪ Standardized processes prod. development, across models in the main line and production ▪ Introduction of the “lineless line” – cooperating robots Flexible production sequence ‘Lineless’ line “Mobile Cells” at BMW, Leipzig Characteristics ▪ 1 platform follows the next with no retooling time for setup Characteristics ▪ Low changeover time ▪ Mobile cells can be moved between plants in 3 days Characteristics ▪ Robots and products move in rails ▪ Robots cooperate in defined scope Building flexibility ▪ Mobile cells for plants ▪ Investments in flexible equipment Flexible production systems key to maintain high customer service levels, respond to changing market requirements and reduce lost sales SOURCE: McKinsey Agile operations team, Press clippings; internet search McKinsey & Company | 17 Agree / Strongly agree Survey: There is scope for improvement in supplier management practices ~40% of respondents believe there are gaps in supplier management practices N = 22 There is complete trust based transparent professional supplier management and development process in my organization Neutral Disagree / Strongly disagree xx Average rating ~35% of respondents are not confident of managing supply chain risks N = 22 64% 23% 14% 3.6 There is complete visibility on supplier capacities and constraints (at least for critical products) 59% There is confidence in the organization 64% to overcome supply chain disruptions 18% 32% 23% 5% 3.5 3.5 My organization is aware of the supply chain risks and has clear risk management plans 68% 18% 14% 3.6 1 Rating scale: 1 – Strongly disagree -- 2 Disagree -- 3 Neutral - 4 Agree – 5 Strongly agree) 2 Excludes respondents who did not respond to the question SOURCE: Survey of participants of Automotive Conference, Delhi 2012 McKinsey & Company | 18 Organizations should follow professional supplier development to build purchasing agility Supplier performance Reactive supplier management Supplier monitoring Supplier evaluation Supplier Improvement Professional supplier development Time frame ▪ Typically cost and delivery time accuracy ▪ Criteria defined which A▪ Integrated scorecard with A require action in case parameters tracked of non- fulfillment only ▪ Supplier improvement expected to be done by supplier himself ▪ Selected, single B B▪ Ongoing supplier supplier improvement workshops in workshops improvement process ▪ Task force to solve C C▪ Professional supplier key issues at suppliers support center ▪ No sophisticated D D▪ Temporarily supplier supplier incentives incentives Subsupplier Management SOURCE: McKinsey Agile Operations E▪ Direct negotiation and management of subsupplier McKinsey & Company | 19 Co-locating suppliers help build a agile supply chain Industriepark Smartville, Hambach, France Further examples TNT Magna Eisenmann ▪ ▪ TKA ▪ ▪ Bosch ▪ VDO Sales MCC assembly Dynamit Nobel ▪ ▪ Industriepark Ingolstadt, Audi Uniport Proximity allows for more efficient processes and short distances Especially leveraged for variant parts and JiS delivery SOURCE: McKinsey Agile Operations Carcoustics Delphi Faurecia Rehau Röchling Automotive ▪ ... Frisia Industriepark Industriepark Saarlouis, Ford Mosel, VW ▪ Benteler ▪ Johnson Controls ▪ Lear ▪ Stadco Saarlouis ▪ Saint-Gobain/ ▪ ▪ ▪ ▪ ▪ ▪ Brose Faurecia Tenneco Peguform Sachsentrans ... Sekurit ▪ ... ▪ ▪ ▪ Visibility by co-locating suppliers How will companies respond to disruptions in tier – 2 suppliers? Focus on alternate suppliers even if primary suppliers are in parks? McKinsey & Company | 20 In the face of natural disaster, Chiquita increased its revenue by 4%, while Dole´s revenue fell by 4% Situation In 1998, Hurricane Mitch devastated Honduras ▪ 70-80% of transportation infrastructure washed away ▪ 80% of banana crop destroyed Alternative sourcing key to Chiquita's success Drop in sales for Dole Chiquita increased sales ▪ ▪ ▪ Lost 70% of their supply Revenue fell by 4% as lost supply was not replaced ▪ Increased output from alternative suppliers in unaffected areas Chiquita was able to increase its revenue by 4% Reactivity of 2 banana sellers in supply base clearly separated performance SOURCE: A. J. Schmitt. Using Stochastic Supply Inventory Models to Strategically Mitigate Supply Chain Disruption Risk. Logistics Spectrum, 2008 and EIU "Managing supply-chain risk for reward" Ability of purchasing and supply chain to respond quickly to disruptions and identify alternate options is critical McKinsey & Company | 21 Cost differences drive selective outsourcing, provided the service requirements are met Cost differences… drive outsourcing across the world (per year, tsd EUR, Labor cost) 68 -40% 41 3PL is responsible for ▪ JiS delivery to assembly line ▪ Replenishment of picking stations ▪ Operation of warehouse storing slow moving, low value parts ▪ OEM 3PL1 Complete logistics outsourcing – 3PL is resonsible for physical handling, inspection and replenishment of line 1 Considering additional overhead and required management resources SOURCE: McKinsey Agile Operations, Press clippings McKinsey & Company | 22 Agree / Strongly agree Survey: There are gaps in the process and pace of product development Neutral Disagree / Strongly disagree xx Average rating ~50-60% respondents believe key product dev. processes are in place, Only 30% believe their new product development practice takes the right time N = 21 N = 22 N = 22 Our new products are developed considering standardizations / design for manufacturability There is excellent cross functional coordination accelerating product development Our new product development takes the right amount of time 62% 50% 27% 50% 45% 33% 23% 5% 5% 3.5 3.5 3.0 1 Rating scale: 1 – Strongly disagree -- 2 Disagree -- 3 Neutral - 4 Agree – 5 Strongly agree) 2 Excludes respondents who did not respond to the question SOURCE: Survey of participants of Automotive Conference, Delhi 2012 McKinsey & Company | 23 Platforming used to adapt easily to the changes in demand mix Examples Common platform ▪ Production, design system that can flex to the changes in demand mix FM chassis Adopting modularity ▪ ▪ Increasing speed in current structure Flexible range & volume at low cost Simple, slim, and speedy … we will have more flexibility than ever before..”President Toyota Past Nissan 350Z Murano F E D C B A Today Synergies Infiniti FX F E D C B A 45% specific 25% modular 30% platform F E D C B Synergies 20% specific 60% modular 20% platform Infiniti G35 Future Infiniti M A 50% specific Synergies 50% platform Modular production and common platforms by Indian players (e.g., ‘Yf/YJ’ platform by Maruti; ‘LC’ platform by Hyundai) SOURCE: McKinsey Agile Operations McKinsey & Company | 24 Increasing parallelization is critical for building product development agility, requires new practices to be successful Mktg. PD Mktg. PD Mktg. Mfr. PD Mktg. PD Mfr. Mfr. Mfr. Sequential design Concurrency between functions Concurrency within engineering Maturity-driven engineering Information characteristics ▪ ▪ ▪ ▪ ▪ TTM potential 0 Sequential Push ▪ Predominantly sequential Push ~ 20 to 30% ▪ Predominantly sequential Push ~ 40 to 50% ▪ Constant, bidirectional exchange Pull ~ 50 to 60% Product development agility key to reduce time to market for new products and accelerate value engineering projects SOURCE: McKinsey Agile Operations McKinsey & Company | 25 Agree / Strongly agree Survey: There is a disconnect in the effectiveness of planning process ~50 – 60% respondents believe there are gaps in key planning processes N = 22 There is complete trust and alignment between production, sales and procurement functions Neutral Disagree / Strongly disagree xx Average rating Yet, tend to believe there are no sales losses or wrong inventory pileup N = 22 36% 32% There is a robust Sales & Operations planning (S&OP) process in place 50% The sales loss in my organization is severe 2 41% 10% 30% The levels of 'wrong' FG / WIP inventory is very high 27% 36% 60% 36% 32% 9% 3.1 3.5 2.1 2.8 1 Rating scale: 1 – Strongly disagree -- 2 Disagree -- 3 Neutral - 4 Agree – 5 Strongly agree) 2 Excludes respondents who did not respond to the question SOURCE: Survey of participants of Automotive Conference, Delhi 2012 McKinsey & Company | 26 Demand shaping enables a company to influence customer decisions to smoothen operations Concept and solution ▪ Customer preferences and demand proactively influenced ▪ ▪ Influences customers to choose products in excess supply, by changing default choices on web site, discounting, and promotions Pricing, price promotions, strategic product placement key levers Result ▪ ▪ Example Orders matched to availability Mix of products, volume/timing of orders influenced to linear demand, taking volatility out of supply chain Customers perceive the supplier to be flexible and reliable SOURCE: McKinsey agile operations, Press clippings, internet search Tire manufacturer Smoothens fluctuating demand by discouraging end-of-period promotions Volume adjusted price to Auto suppliers capture runner products and increase asset utilization Helps in optimal utilisation of assets and managing volatility McKinsey & Company | 27 Segmentation can result in substantial service level improvement and inventory reduction DRY GOODS EXAMPLE Segmentation of SKUs by volume and demand variability 1 High vol., low variability: Steady flow Make to order, Low safety stock Volume 1 2 High volume, high variability: Segment forecast accuracy based on predictability A: Predictable: Build to forecast B: Unpredictable: Improve ability to react; Make-to-order 2 3 4 0% 50% 100% 150% 200% 250% Demand variability Dramatic improvement in service levels & inventory ▪ Service levels in high 90s ▪ Lead time reduced to days ▪ Inventory reduced by half 3 Low vol., low variability: Basic replenishment ▪ Make-to-stock with small lots ▪ Minimize dependence on forecast 4 Low vol., high variability: Manage complexity; Stock at semi-finished level, build to order McKinsey & Company | 28 Improved forecasting enables an agile supply chain by helping companies to anticipate variability Concept and solution ▪ Use feedback to optimize forecasting ▪ Manual forecasting focused on select products ▪ In cases of high volatility, use range forecasts on economic benefit Result ▪ ▪ Early detection of changes Example Forecasts are updated in real time with product performance, outside factors (e.g., weather), and live stock levels Use prediction market approach for forecasting Resources released from fire-fighting 1 Prediction market – broad group of experts provide "wisdom of the crowd" in forecast SOURCE: McKinsey agile operations, Press clippings, internet search McKinsey & Company | 29 Planning and collaborating with partners allows end-to-end visibility and increased ability to adapt Concept and solution ▪ Collaboration and visibility allows coordinated and efficient responses ▪ Key enablers are planning capabilities and tuned process execution ▪ Joint "burning platform" helps alignment, Result ▪ Shared understanding in volatile situations ▪ ▪ Reliable planning and scheduling process with visibility and accountability for all partners end-to-end Coordinated efforts between functions SOURCE: McKinsey agile operations, Press clippings, internet search Example Uses a web-based data platform – “retail link” to allow real-time information sharing with suppliers such as item sales by hour DSi2 system provides real-time data across global suppliers and Dell factories for planning and enabling demand scheduling McKinsey & Company | 30 Boeing implemented a Production Integration Center for managing development of its troubled 787 Situation Concept and solution ▪ ▪ ▪ 787 delayed by 2 years Globally dispersed supply base unable to fulfil responsibilities Implemented an operations center to monitor global production among all of Boeing's suppliers, Example Features of center Operation ▪ Inspired by other 24/7 ▪ Central video screen displays centers (NASA, 911) global news, weather, earthquakes, ▪ Access to translators production issues with each supplier, for 28 different ▪ Live video feeds from suppliers languages ▪ Personnel from different functions ▪ Personnel works for a short-term SOURCE: Seattle Post-Intelligencer; McKinsey agile operations McKinsey & Company | 31 Managing inventory placement enables reacting to demand changes both globally and locally Concept and solution ▪ Design network, balancing benefits of centralized and decentralized network ▪ ▪ Define inventory policy Ensure flexibility of inventory levels to be able to react quickly to upturns/downturns (driven by flexibility of production and suppliers) Example ▪ Centralized distribution center replenishes all stores, delivery from center to store takes 24-48 hours ▪ Reacted quickly to reduce inventory levels upon downturn by reducing lot-size, segmentation ▪ One multi-country inbound/ source consolidation center Chemical company Result ▪ Ability to meet customer demands, both locally and globally despite shifts in volumes, product and geographical mix ▪ Ability to react to upturns/downturns effectively SOURCE: McKinsey agile operations, Press clippings, internet search Minimises time to market and respond to changing needs McKinsey & Company | 32 Global consolidation and optimization of regional demand helped VW face increasing need fragmentation Situation Concept and solution ▪ Global consolidation, optimization of regional demand ▪ ▪ Companies acting more globally A Distinct and more and more fragmented customer needs in each country Engineering capacities not suited to manage complexity and a growing product portfolio Transparency current portfolio Regional product pricevolume curve B Consolidate global portfolio Module strategy and roadmap ▪ Consolidation of demand curves ▪ Iterative process to determine level of local adaptation ▪ VW Polo India as locally produced and less equipped car to meet local needs Module Example “Polo India” from VW VW Polo ~12,300 EUR VW Polo India ~7,000 EUR 1 Polo India (released 2009) without airbags, lower interior quality, and partially exchanged components; sourcing target of 70% from local suppliers SOURCE: McKinsey agile operations, Press clippings, internet search McKinsey & Company | 33 Lean fulfilment/replenishment concepts enable a quick response to changes in demand Concept and solution ▪ Frequent planning cycles, steady flow production ▪ ▪ Minimal administrative time delay ▪ Systems, organization, and mindsets support quick changes A "fast track" allows speeding urgent orders through the supply chain when the need arises Result ▪ A fast replenishment structure allows quick response to changes in demand SOURCE: McKinsey agile operations, Press clippings, internet search Example With a frequent replenishment structure, Coca Cola has less than 3 weeks of inventory Synchronization of production with Tesco's requirements minimized stock holdings throughout the chain and led to dramatic service level improvement Different processes for different products allow for dramatic reduction in lead time Helps companies manage costs and reduce non-value adding capital McKinsey & Company | 34 Current trends impacting automotive supply chain Agility for success Cross functional agility to drive an agile organization Implementing agility McKinsey & Company | 35 Agree / Strongly agree Survey: Organizations believe agility is critical, however realize they are under prepared Respondents believe agility in business is critical… Neutral Disagree / Strongly disagree xx Average rating However realize organizations are underprepared today N = 21 N = 22 It is very important to plan, design and build agility (Ability to build the organization for quick response) in business My organization has built / clear plans to build agility across functions 86% 14% Agility is important 4.2 55% 43% 27% 43% 18% 14% 64% 68% 27% 9% 18% 14% 77% 9% 14% Production Capital Product Purchasing Planning asset 2 development 3.5 3.3 3.8 3.7 3.9 1 Rating scale: 1 – Strongly disagree -- 2 Disagree -- 3 Neutral - 4 Agree – 5 Strongly agree) 2 Excludes respondents who did not respond to the question SOURCE: Survey of participants of Automotive Conference, Delhi 2012 McKinsey & Company | 36 Building a holistic agility organization has not been treated as priority because of misconceptions Common misconceptions Our core beliefs Why leaders put off becoming agile Agility is easier than what is thought ▪ I’m not sure I could define agility or its value to my team ▪ Agility has a measurable benefit and it is a strategic game ▪ It will cost too much ▪ Not all agility levers require a cost/benefit trade-off ▪ It will take too long; It is too overwhelming ▪ Start with a short-list of priority uncertainties ▪ Functional improvements is ok ▪ Cross-functional operations key ▪ I just trust my teams on the ground to do the right things ▪ Majority of managers lack agile leadership skills and mindsets ▪ It's all about how quickly you react anyway ▪ Preparation defines the degrees of freedom SOURCE: McKinsey Agile Operations McKinsey & Company | 37 Agility should be built following a four step approach ▪ ▪ ▪ Awareness & assessment Understand exposure to uncertainties Identify, prioritize sources of uncertainty Establish infrastructure to institutionalize agility Design an adaptive management infra-structure SOURCE: McKinsey Agile Operations ▪ Assess current agility in prioritized areas ▪ Identify key strengths and gaps ▪ Identify levers to address uncertainties ▪ Develop contingency plans with defined triggers ▪ Determine key people required 1 Assess current agility level 4 2 Make agile operations stick 3 Determine where and how to build agility “Anticipate what could happen instead of reacting to what has happened” McKinsey & Company | 38