Accounting Principles, Third Canadian Edition

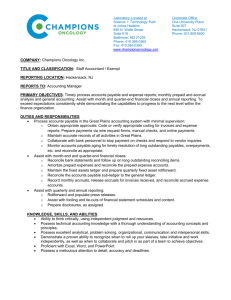

advertisement

Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition Solutions to Chapter 3 Homework BRIEF EXERCISE 3-2 A Co. B Co. Supplies used: $675 + $1,695 - $225 = $2,145 Supplies on hand, May 31, 2008: $640 + $2,825 - x = $2,715 x = $750 BRIEF EXERCISE 3-3 (a) Mar. 2 Cleaning Supplies ................................... Accounts Payable.............................. 3,880 3,880 (b) Cleaning Supplies used = $945 + $3,880 - $980 = $3,845 (c) Dec. 31 Cleaning Supplies Expense ................... Cleaning Supplies ............................. 3,845 3,845 (d) Jan. 1 Mar. 2 Dec. 31 Bal. Cleaning Supplies 945 3,880 Dec. 31 Cleaning Supplies Expense Dec. 31 3,845 3,845 980 BRIEF EXERCISE 3-4 (a) (b) June 1 Prepaid Insurance ..................................... Cash ...................................................... 9,900 9,900 Monthly cost: $9,900 ÷ 12 = $825/month; Number of months expired: June to December—7 months Amount expired in 2007: 7 months x $825 = $5,775 Number of months remaining: January to May—5 months Amount unexpired at December 31: 5 months x $825 = $4,125 Total $9,900 = $5,775 + $4,125 (c) Dec. 31 Insurance Expense .................................... 5,775 Solutions Manual 3-1 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition Prepaid Insurance ................................ 5,775 (d) June 1 Prepaid Insurance 9,900 Dec. 31 Dec. 31 Bal. 5,775 Dec. 31 Insurance Expense 5,775 4,125 BRIEF EXERCISE 3-7 (a) An adjusting entry will be needed because services have been provided in November but will not be invoiced until the first of December. (b) Nov. 30 Accounts Receivable ................................ Service Revenue .................................. 375 375 (c) No, Zieborg will not have to make a journal entry on December 1 when they invoice Crispy because the November 30th adjusting entry already recorded the amount. (d) Dec. 9 Cash............................................................ Accounts Receivable ........................... 375 375 BRIEF EXERCISE 3-8 (a) (b) (c) Dec. 26 Dec. 31 Jan. 2 Salaries Expense ....................................... Cash ...................................................... 5,000 Salaries Expense ....................................... Salaries Payable ................................... 3,000 Salaries Expense ....................................... Salaries Payable ........................................ Cash ...................................................... 2,000 3,000 5,000 3,000 5,000 Solutions Manual 3-2 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition BRIEF EXERCISE 3-9 (a) July 1/07 (b) Dec. 31/07 (c) Dec. 31/08 Vehicles ................................................... 40,000 Cash ................................................. Note Payable ................................... Interest Expense .................................... Interest Payable .............................. ($22,000 x 6% x 6/12) 18,000 22,000 660 660 Interest Expense ($22,000 x 6%) .......... 1,320 Interest Payable ..................................... 660 Note Payable .......................................... 22,000 Cash ................................................ 23,980 EXERCISE 3-3 (a) (b) (c) (d) (e) (f) (g) (h) (i) 3. Accrued expenses 4. Accrued revenues 1. Prepaid expenses 4. Accrued revenues 2. Unearned revenues No entry required 1. Prepaid expenses 3. Accrued expenses 1. Prepaid expenses EXERCISE 3-4 (a) June 1 Sept. 15 Nov. 1 Dec. 1 Various (b) Dec. 31 Prepaid Insurance ..................................... Cash ...................................................... 4,740 Cash............................................................ Unearned Revenue............................... 3,600 Prepaid Rent .............................................. Cash ...................................................... 6,875 Prepaid Cleaning ....................................... Cash ...................................................... 3,150 Cash............................................................ Unearned Gift Certificate Sales........... 1,250 Insurance Expense .................................... 2,765 4,740 3,600 6,875 3,150 1,250 Solutions Manual 3-3 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition Prepaid Insurance ................................ $4,740 x 7/12 = $2,765 31 Unearned Revenue .................................... Revenue ................................................ $3,600 x 3/9 = $1,200 Dec. 31 2,765 1,200 1,200 Rent Expense ............................................. Prepaid Rent ......................................... $6,875 x 2/5 = $2,750 2,750 31 Cleaning Expense...................................... Prepaid Cleaning ....................................... 1,050 31 Unearned Gift Certificate Sales ................ Gift Certificate Sales ............................ $1,250 - $475 = $775 775 2,750 1,050 775 (c) June 1 Dec. 31 Bal. Nov. 1 Dec. 31 Bal. Dec. 1 Dec. 31 Bal. Prepaid Insurance 4,740 Dec. 31 Dec. 31 Insurance Expense 2,765 Dec. 31 Rent Expense 2,750 Dec. 31 Cleaning Expense 1,050 2,765 1,975 Prepaid Rent 6,875 Dec. 31 2,750 4,125 Prepaid Cleaning 3,150 Dec. 31 1,050 2,100 Unearned Revenue Sep. 15 3,600 Revenue Dec. 31 1,200 Solutions Manual 3-4 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Dec. 31 Accounting Principles, Third Canadian Edition 1,200 Dec. 31 Bal. 2,400 Unearned Gift Certificate Sales Various 1,250 Dec. 31 775 Dec. 31 Bal. Gift Certificate Sales Dec. 31 775 475 EXERCISE 3-6 (a) Dec. 31 Utility Expense ........................................... Accounts Payable ................................. 425 425 31 Salaries Expense........................................ 2,375 Salaries Payable ................................... $3,325 x 5/7 = $2,375 (b) Jan. 31 Interest Expense ........................................ Interest Payable .................................... $45,000 x 5% x 1/12 = $188 188 31 Accounts Receivable ................................. Commission Revenue .......................... 920 31 Interest Receivable .................................... Interest Revenue ................................... $6,000 x 6% x 2/12 = $60 60 17 Accounts Payable ...................................... Cash ....................................................... 425 2,375 188 920 60 425 2 Salaries Payable ......................................... 2,375 Salaries Expense........................................ 950 Cash ....................................................... 1 Interest Payable.......................................... Cash ....................................................... 188 5 Cash ............................................................ Accounts Receivable ............................ 920 3,325 188 920 Solutions Manual 3-5 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Feb. Accounting Principles, Third Canadian Edition 1 Cash ............................................................ 6,090 Interest Receivable .............................. Interest Revenue ($6,000 x 6% x 1/12) 30 Note Receivable .................................... 60 6,000 EXERCISE 3-8 1. Mar. 2. 3. 4. 5. 6. 31 Amortization Expense ............................. Accumulated Amortization —Equipment........................................ ($21,600 ÷ 6 x 3/12) 900 31 Unearned Rent Revenue .......................... Rent Revenue ($9,300 × 2/3) .............. 6,200 31 Interest Expense ...................................... Interest Payable .................................. ($20,000 x 6% x 3/12) 300 31 Supplies Expense .................................... Supplies ($2,800 - $850) ..................... 1,950 31 Insurance Expense ($3,600 x 3/10) ......... Prepaid Insurance ............................... 1,080 31 Accounts Receivable ............................... Rent Revenue ...................................... 700 900 6,200 300 1,950 1,080 700 EXERCISE 3-9 Answer (a) Supplies balance = $800 Supplies expense Add: Supplies (1/31/08) Less: Supplies purchased Supplies (01/01/08) Total premium = $4,800 Total premium = Monthly premium x 12 $400 X 12 = $4,800 Purchase date = Aug. 1, 2007 Purchase date: On Jan. 31, there are 6 months coverage remaining ($400 x 6). Thus, the purchase date was 6 months earlier on Aug. 1, 2007. Purchase date On Jan. 31/08, there is $4,880 in ) (b) (c) Calculation $950 700 (850) $800) Solutions Manual 3-6 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition = Jan. 1, 2003 accumulated amortization: $4,880 ÷ $80/month = 61 months Purchase date: 61 months earlier than Jan. 31/08, or 5 years and 1 month. (d) Salaries payable = $1,400 Cash paid Salaries payable (01/31/08) $2,500 800 3,300 1,900 $1,400 Less: Salaries expense Salaries payable (12/31/07) (e) Unearned revenue = $1,050 Service revenue (01/31/08) Unearned revenue (01/31/08) $2,000 750 2,750 1,700 $1,050 Cash received in Jan. Unearned revenue (12/31/07) EXERCISE 3-10 Aug. 31 Accounts Receivable ($9,230 - $8,700) ............ Service Revenue .......................................... 530 31Office Supplies Expense ...................................... Office Supplies ............................................. 1,745 31Insurance Expense ............................................... Prepaid Insurance ........................................ 1,260 31Amortization Expense .......................................... Accumulated Amortization —Office Equipment ...................................... 1,175 31 Salaries Expense ............................................... Salaries Payable ........................................... 1,125 31 Unearned Service Revenue ($1,600 - $900) .................................................... Service Revenue ............................................ 530 1,745 1,260 1,175 1,125 700 700 Solutions Manual 3-7 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 3-11 LIM COMPANY Income Statement Year Ended August 31, 2008 Revenues Service revenue ......................................................................... Expenses Salaries expense ........................................................ $18,125 Office supplies expense ............................................ 1,745 Rent expense.............................................................. 15,000 Insurance expense..................................................... 1,260 Amortization expense ................................................ 1,175 Total expenses...................................................................... Net income ....................................................................................... $46,230 37,305 $ 8,925 LIM COMPANY Statement of Owner's Equity Year Ended August 31, 2008 E. Lim, capital, September 1, 2007 ................................................. Add: Net income ............................................................................ Less: Drawings ............................................................................... E. Lim, capital, August 31, 2008 ..................................................... $25,600 8,925 34,525 10,000 $24,525 Solutions Manual 3-8 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition EXERCISE 3-11 (Continued) LIM COMPANY Balance Sheet August 31, 2008 Assets Cash ................................................................................................. Accounts receivable ....................................................................... Office supplies ................................................................................ Prepaid insurance ........................................................................... Office equipment ............................................................. $14,100 Less: Accumulated amortization .................................. 4,700 Total assets ................................................................................ $10,500 9,230 700 2,520 9,400 $32,350 Liabilities and Owner's Equity Liabilities Accounts payable ...................................................................... Salaries payable ......................................................................... Unearned rent revenue .............................................................. Total liabilities....................................................................... $05,800 1,125 900 7,825 Owner's equity E. Lim, capital ............................................................................. Total liabilities and owner's equity ..................................... 24,525 $32,350 Solutions Manual 3-9 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition *EXERCISE 3-12 (a) Jan. (b) Jan. 2 Insurance Expense .................................. Cash ..................................................... 2,460 10 Supplies Expense .................................... Cash ..................................................... 1,700 15 Cash .......................................................... Service Revenue ................................. 4,200 31 Prepaid Insurance .................................... Insurance Expense ............................. ($2,460 x 11/12) 2,255 31 Supplies .................................................... Supplies Expense ............................... 550 31 Service Revenue ...................................... Unearned Service Revenue................ 2,700 2,460 1,700 4,200 2,255 550 2,700 (c) Insurance Expense Jan. 2 2,460 Jan. 31 Jan. 31 Bal. 205 5,040 Service Revenue Jan. 15 2,700 Jan. 31 Bal. Prepaid Insurance Jan. 31 2,255 Supplies 550 Jan. 1 15 Jan. 31 Bal. Cash 5,000 Jan. 2 4,200 10 2,255 Supplies Expense Jan. 10 1,700 Jan. 31 Jan. 31 Bal. 1,150 2,460 1,700 Jan. 31 Jan. 31 550 4,200 1,500 Unearned Service Revenue Jan. 31 2,700 Solutions Manual 3-10 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-2A 1. Jan. Dec. 2. May Dec. 3. Nov. Dec. 4. Dec. Dec. 5. May Dec. 1 Office Supplies ......................................... Cash ..................................................... 3,100 31 Supplies Expense ($3,100 - $770) ........... Office Supplies.................................... 2,330 1 Prepaid Insurance .................................... Cash ..................................................... 5,040 31 Insurance Expense ($5,040 x 8/12) ........................................... Prepaid Insurance ............................... 15 Cash .......................................................... Unearned Service Revenue................ 31 Unearned Service Revenue ($425 x 2) ................................................... Service Revenue ................................. 15 Prepaid Rent ............................................. Cash ..................................................... 3,100 2,330 5,040 3,360 3,360 1,275 1,275 850 850 4,500 4,500 31 No entry required 1 Equipment ................................................ 30,800 Cash ..................................................... 31 Amortization Expense ............................. Accumulated Amortization— Equipment [$30,800 ÷ 7 x (8/12)]........ 30,800 2,933 2,933 Solutions Manual 3-11 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-4A (a) 1. Prepaid Insurance – before adjustments A2958 – B4564 – 2. ($10,320 x 18/24) Unearned Subscription Revenue – before adjustments Oct 1 Nov 1 Dec 1 (b) 1. $ 5,700 7,740 $13,440 Dec. 31 $16,800 21,120 26,880 $64,800 (350 x $48) (440 x $48) (560 x $48) Insurance Expense .................................. Prepaid Insurance ............................... 8,010 8,010 Prepaid Insurance at December 31, 2007: B4564 $10,320 x 6/24 $2,580 A2958 $ 5,700 x 12/24 2,850 $5,430 Expired insurance and adjustment = $13,440 - $5,430 = $8,010 2. Dec. 31 Unearned Subscription Revenue ............ Rent Subscription Revenue ............... 9,960 9,960 Unearned Subscription Revenue at December 31, 2007: October 350 x $48 x 9/12 = $ 12,600 November 440 x $48 x 10/12 = 17,600 December 560 x $48 x 11/12 = 24,640 $54,840 Earned Revenue and adjustment = $64,800 - $54,840 = $9,960 Solutions Manual 3-12 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-4A (Continued) (b) (Continued) 3. Dec. 31 6 x $625 = 3 x $750 = Total 4. 5. Dec. 31 Dec. Salaries Expense...................................... Salaries Payable ................................. 1,200 1,200 $3,750 2,250 $6,000 x 1/5 = $1,200 Interest Receivable .................................. Interest Revenue ................................. $8,000 x 7.75% x 3/12 = $155 31 Amortization Expense ($128,250 ÷ 30) .......................................... Accumulated Amortization— Building ............................................... 31 Amortization Expense ($165,000 ÷ 40) .......................................... Accumulated Amortization— Building ............................................... 155 155 4,275 4,275 4,125 4,125 Solutions Manual 3-13 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (a) 1. 2. 3. 4. 5. 6. 7. 8. 9. Dec. 31 Accounts Receivable ............................... Service Revenue ................................. 1,750 1,750 31 Insurance Expense ($3,840 × 10/12) ..... 3,200 Prepaid Insurance ............................... 3,200 31 Supplies Expense .................................... Supplies ($2,535 - $570) ..................... 1,965 1,965 31 Amortization Expense— Automobiles ............................................. 15,500 Accumulated Amortization— Automobiles ($62,000 ÷ 4) .................. 31 Amortization Expense—Furniture .......... Accumulated Amortization— Furniture ($16,000 ÷ 10) ...................... 31 Interest Expense ($46,000 x 7% x 3/12)................................ Interest Payable .................................. 15,500 1,600 1,600 805 805 31 Salaries Expense...................................... Salaries Payable ($230 × 3) ................ 690 31 Unearned Revenue................................... Service Revenue ($600 x 2) ................ 1,200 690 1,200 31 No adjustment required Solutions Manual 3-14 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (b) CASH Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 12,165 ACCOUNTS RECEIVABLE Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit Balance 3,200 4,950 1,750 PREPAID INSURANCE Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit 3,200 Balance 3,840 640 PREPAID RENT Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 1,150 Solutions Manual 3-15 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (b) (Continued) SUPPLIES Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit 1,965 Balance 2,535 570 AUTOMOBILES Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 62,000 ACCUMULATED AMORTIZATION—AUTOMOBILES Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit 15,500 Balance 15,500 31,000 OFFICE FURNITURE Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 16,000 Solutions Manual 3-16 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (b) (Continued) ACCUMULATED AMORTIZATION—OFFICE FURNITURE Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit 1,600 Balance 5,600 7,200 NOTES PAYABLE Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 46,000 UNEARNED REVENUE Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit Balance 3,600 2,400 1,200 INTEREST PAYABLE Explanation Date Dec. 31 Ref. J2 Debit Credit 805 Balance 805 Solutions Manual 3-17 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (b) (Continued) SALARIES PAYABLE Explanation Date Dec. 31 Ref. Debit J2 Credit 690 Balance 690 C. OROSCO, CAPITAL Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 56,000 C. OROSCO, DRAWINGS Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 38,400 SERVICE REVENUE Date Dec. 31 31 31 Explanation Ref. Balance J2 J2 Debit Credit 1,750 1,200 Balance 101,605 103,355 104,555 Solutions Manual 3-18 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (b) (Continued) SALARIES EXPENSE Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit Balance 57,500 58,190 690 INTEREST EXPENSE Date Dec. 31 31 Explanation Ref. Balance J2 Debit Credit Balance 2,415 3,220 805 RENT EXPENSE Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 13,800 REPAIR EXPENSE Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 6,000 Solutions Manual 3-19 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (b) (Continued) GAS AND OIL EXPENSE Explanation Date Dec. 31 Balance Ref. Debit Credit Balance 9,300 INSURANCE EXPENSE Explanation Date Dec. 31 Ref. Debit J2 Credit 3,200 Balance 3,200 AMORTIZATION EXPENSE—AUTOMOBILES Explanation Date Dec. 31 Ref. Debit J2 15,500 Credit Balance 15,500 AMORTIZATION EXPENSE—FURNITURE Explanation Date Dec. 31 Ref. Debit J2 Credit 1,600 Balance 1,600 SUPPLIES EXPENSE Explanation Date Dec. 31 Ref. J2 Debit 1,965 Credit Balance 1,965 Solutions Manual 3-20 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-6A (Continued) (c) OROSCO SECURITY SERVICE Adjusted Trial Balance December 31, 2008 Debit Cash ................................................................................ $ 12,165 Accounts receivable ...................................................... 4,950 Prepaid insurance .......................................................... 640 Prepaid rent .................................................................... 1,150 Supplies .......................................................................... 570 Automobiles ................................................................... 62,000 Accumulated amortization—automobiles .................... Office Furniture .............................................................. 16,000 Accumulated amortization—office furniture ................ Notes payable ................................................................. Unearned revenue .......................................................... Interest payable .............................................................. Salaries payable ............................................................. C. Orosco, capital ........................................................... C. Orosco, drawings ...................................................... 38,400 Service revenue .............................................................. Salaries expense ............................................................ 58,190 Interest expense ............................................................. 3,220 Rent expense .................................................................. 13,800 Repair expense ............................................................... 6,000 Gas and oil expense....................................................... 9,300 Insurance expense ......................................................... 3,200 Amortization expense—automobiles ........................... 15,500 Amortization expense—office furniture ....................... 1,600 Supplies expense ........................................................... 1,965 $248,650 Credit $ 31,000 7,200 46,000 2,400 805 690 56,000 104,555 _______ $248,650 Solutions Manual 3-21 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-8A (a) Sept. 30 Accounts Receivable ............................... Commission Revenue ........................ ($7,435 – $6,335) 1,100 30 Supplies Expense .................................... Supplies ............................................... 485 30 Rent Expense ($1,350 - $900) .................. Prepaid Rent........................................ 450 30 Amortization Expense ............................. Accumulated Amortization— Equipment ........................................... 470 30 Interest Expense ...................................... Interest Payable .................................. 60 30 Unearned Revenue ($875 - $550) ............ Commission Revenue ........................ 325 30 Salaries Expense...................................... Salaries Payable ................................. 840 30 Utilities Expense ($820 - $710) ................ Accounts Payable ............................... 110 1,100 485 450 470 60 325 840 110 Solutions Manual 3-22 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-8A (Continued) (b) IRABU CO. Income Statement Quarter Ended September 30, 2008 Revenues Commission revenue ................................................ Expenses Salaries expense ....................................................... Interest expense........................................................ Amortization expense ............................................... Supplies expense...................................................... Utilities expense........................................................ Rent expense............................................................. Total expenses..................................................... Net loss ........................................................................... $15,845 $13,940 60 470 485 820 1,350 17,125 $ (1,280) IRABU CO. Statement of Owner’s Equity Quarter Ended September 30, 2008 Y. Irabu, capital, July 1, 2008 .......................................................... Less: Net loss .............................................................. $1,280 Drawings............................................................ 2,700 Y. Irabu, capital, September 30, 2008 ............................................ $14,000 3,980 $10,020 Solutions Manual 3-23 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-8A (Continued) (b) (Continued) IRABU CO. Balance Sheet September 30, 2008 Assets Cash ................................................................................ Accounts receivable ...................................................... Supplies .......................................................................... Prepaid rent .................................................................... Equipment....................................................................... Less: Accumulated amortization ................................. Total assets ............................................................... $ 3,250 7,435 1,265 1,050 $15,040 6,110 8,930 $21,930 Liabilities and Owner’s Equity Liabilities Notes payable............................................................................. Accounts payable ...................................................................... Interest payable.......................................................................... Unearned rent revenue .............................................................. Salaries payable ......................................................................... Total liabilities....................................................................... $ 6,000 4,460 60 550 840 11,910 Owner’s equity Y. Irabu, capital .......................................................................... Total liabilities and owners’ equity ..................................... 10,020 $21,930 Solutions Manual 3-24 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-8A (Continued) (c) Interest of 6% per year equals a monthly rate of 0.5%; monthly interest is $30 ($6,000 x 0.5%). Since total interest expense is $60, the note has been outstanding two months. (d) The company is not performing well. It incurred a loss for the quarter. In particular the salary expense seems high in relation to the revenue. Another negative indicator is the amount of drawings Yosuke has taken. This further reduces the amount of owner’s equity. The financial position of Irabu appears tenuous. Total cash and accounts receivable ($10,685) are not enough to pay all liabilities outstanding ($11,910). If all accounts receivable are not collected, there may not be adequate cash to repay all liabilities. Solutions Manual 3-25 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-9A (a) 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. May 31 Insurance Expense ($1,872 x 9/12) ......... Prepaid Insurance ............................... 1,404 31 Supplies Expense .................................... Supplies ($525 + $2,405 - $475) ......... 2,455 31 Amortization Expense ($7,635 ÷ 3) ......... Accumulated Amortization— Computer Equipment ......................... 2,545 1,404 2,455 2,545 31 Amortization Expense ($9,640 ÷ 10) . 964 Accumulated Amortization— Furniture .............................................. 31 Unearned Consulting Revenue ............... Consulting Revenue ........................... 31 Interest Receivable ($7,500 × 5.5% × 2/12) .............................. Interest Revenue ................................. 31 Salaries Expense...................................... Salaries Payable ................................. 964 3,650 3,650 69 69 890 890 No entry required. 31 Accounts Receivable ............................... Consulting Revenue ........................... 2,925 31 Telephone Expense ................................. Accounts Payable ............................... 145 2,925 145 Solutions Manual 3-26 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-9A (Continued) (b) MAHADEO CONSULTING CO. Adjusted Trial Balance May 31, 2008 Debit Cash ................................................................................ $ 2,825 Accounts receivable ($2,485 + $2,925) ......................... 5,410 Note receivable ............................................................... 7,500 Interest receivable .......................................................... 69 Supplies ($2,930 - $2,455) .............................................. 475 Prepaid insurance ($1,872 - $1,404) .............................. 468 Computer equipment ..................................................... 7,635 Accumulated amortization— computer equipment ($2,545 + $2,545)....................... Furniture ......................................................................... 9,640 Accumulated amortization—furniture ($964 + $964) ................................................................. Accounts payable ($1,476 + $145) ................................ Salaries payable ............................................................. Unearned consulting revenue ($5,280 - $3,650)........... 1,630 M. Mahadeo, capital ....................................................... M. Mahadeo, drawings ................................................... 66,850 Consulting revenue ($117,350 + $3,650 + $2,925) ........................................ Interest revenue ............................................................. Rent expense .................................................................. 10,120 Salaries expense ($32,950 + $890) ................................ 33,840 Telephone expense ($1,560 + $145) .............................. 1,705 Supplies expense ........................................................... 2,455 Amortization expense ($2,545 + $964) .......................... 3,509 Insurance expense ......................................................... 1,404 $153,905 Credit $ 5,090 1,928 1,621 890 18,752 123,925 69 _______ $153,905 Solutions Manual 3-27 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-9A (Continued) (c) MAHADEO CONSULTING CO. Income Statement Year Ended May 31, 2008 Revenues Consulting revenue .................................................. Interest revenue ........................................................ Total revenue ....................................................... Expenses Rent expense............................................................. Salaries expense ....................................................... Telephone expense................................................... Supplies expense...................................................... Amortization expense ............................................... Insurance expense.................................................... Total expenses..................................................... Net income ...................................................................... $123,925 69 123,994 $10,120 33,840 1,705 2,455 3,509 1,404 53,033 $ 70,961 MAHADEO CONSULTING CO. Statement of Owner's Equity Year Ended May 31, 2008 M. Mahadeo, capital, June 1, 2007 ................................................. Add: Net income ............................................................................ Less: Drawings .............................................................................. M. Mahadeo, capital, May 31, 2008................................................. $18,752 70,961 89,713 66,850 $22,863 Solutions Manual 3-28 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition PROBLEM 3-9A (Continued) (c) (Continued) MAHADEO CONSULTING CO. Balance Sheet May 31, 2008 Assets Cash ................................................................................ Accounts receivable ...................................................... Note receivable ............................................................... Interest receivable .......................................................... Supplies .......................................................................... Prepaid insurance .......................................................... Computer equipment ..................................................... Less: Accumulated amortization ................................. Furniture ......................................................................... Less: Accumulated amortization ................................. Total assets ............................................................... $ 2,825 5,410 7,500 69 475 468 $7,635 5,090 $9,640 1,928 2,545 7,712 $27,004 Liabilities and Owner's Equity Liabilities Accounts payable ...................................................................... Salaries payable ......................................................................... Unearned consulting revenue................................................... Total liabilities....................................................................... Owner's equity M. Mahadeo, capital ................................................................... Total liabilities and owner's equity ..................................... (d) $ 1,621 890 1,630 4,141 22,863 $27,004 Mahadeo Consulting Co. is performing well. Net income is positive and expenses represent only 43% of total revenues. Mohammed Mahadeo has withdrawn cash from the company but the amount does not exceed net income. The financial position of Mahadeo Consulting Co. also appears positive. Total cash and accounts receivable ($8,235) far exceed total liabilities ($4,141). Solutions Manual 3-29 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition *PROBLEM 3-11A (a) 1. 2. 3. 4. 5. 6. 7. Dec. 31 Supplies .................................................... Supplies Expense ............................... 31 Interest Expense ($20,000 × 6% × 2/12) ............................... Interest Payable .................................. 585 585 200 200 31 Prepaid Insurance ($2,220 x 7/12) ........... Insurance Expense ............................. 1,295 31 Graphics Fees Earned ............................. Unearned Consulting Fees ................ 1,600 31 Amortization Expense ($46,500 ÷ 15 x 6/12) ................................. Accumulated Amortization— Equipment ........................................... 1,295 1,600 1,550 1,550 31 Utilities Expense ...................................... Accounts Payable ............................... 225 31 Prepaid Rent ............................................. Rent Expense ...................................... 565 225 565 Solutions Manual 3-30 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition *PROBLEM 3-11A (Continued) (b) ROYAL GRAPHICS COMPANY Adjusted Trial Balance December 31, 2008 Cash ................................................................................ Accounts receivable ..................................................... Supplies .......................................................................... Prepaid insurance .......................................................... Prepaid rent .................................................................... Equipment....................................................................... Accumulated amortization ............................................ Note payable ................................................................... Accounts payable ($11,000 + $225) .............................. Interest payable .............................................................. Unearned graphics fees................................................. J. Bejar, capital ............................................................... J. Bejar, drawings........................................................... Graphic fees earned ($62,400 - $1,600) ........................ Salaries expense ............................................................ Supplies expense ($3,230 - $585).................................. Rent expense ($3,955 - $565) ........................................ Utilities expense ($1,740 + $225) ................................... Amortization expense .................................................... Insurance expense ($2,220 - $1,295)............................. Interest expense ............................................................. Debit $ 7,250 7,450 585 1,295 565 46,500 Credit $ 1,550 20,000 11,225 200 1,600 34,625 17,400 60,800 38,280 2,645 3,390 1,965 1,550 925 200 $130,000 _______ $130,000 Solutions Manual 3-31 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition *PROBLEM 3-11A (Continued) (c) ROYAL GRAPHICS COMPANY Income Statement Six Months Ended December 31, 2008 Revenues Graphic fees earned ................................................. Expenses Salaries expense ....................................................... Supplies expense...................................................... Rent expense............................................................. Utilities expense........................................................ Amortization expense ............................................... Insurance expense.................................................... Interest expense........................................................ Total expenses..................................................... Net Income ...................................................................... $60,800 $38,280 2,645 3,390 1,965 1,550 925 200 48,955 $11,845 ROYAL GRAPHICS COMPANY Statement of Owner's Equity Six Months Ended December 31, 2008 J. Bejar, capital, July 1, 2008 .......................................................... Add: Investment ........................................................................... Net income ........................................................................... Less: Drawings ................................................................................ J. Bejar, capital, December 31, 2008 .............................................. $ 0 34,625 11,845 46,470 17,400 $29,070 Solutions Manual 3-32 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition *PROBLEM 3-11A (Continued) (c) (Continued) ROYAL GRAPHICS COMPANY Balance Sheet December 31, 2008 Assets Cash ................................................................................ Accounts receivable ...................................................... Supplies .......................................................................... Prepaid insurance .......................................................... Prepaid rent .................................................................... Equipment....................................................................... Less: Accumulated amortization ................................. Total assets ............................................................... $ 7,250 7,450 585 1,295 565 $46,500 1,550 44,950 $62,095 Liabilities and Owner's Equity Liabilities Note payable............................................................................... Accounts payable ...................................................................... Interest payable.......................................................................... Unearned consulting fees ......................................................... Total liabilities....................................................................... Owner's equity J. Bejar, capital........................................................................... Total liabilities and owner's equity ..................................... $20,000 11,225 200 1,600 33,025 29,070 $62,095 Solutions Manual 3-33 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited. Weygandt, Kieso, Kimmel, Trenholm, Kinnear Accounting Principles, Third Canadian Edition Solutions Manual 3-34 Chapter 3 Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.