Presentation - IRIS Administrative Support

advertisement

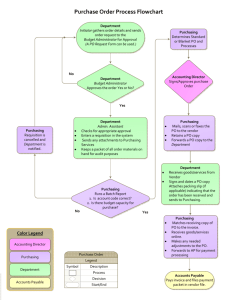

University of Tennessee Finance Business Blueprint 11 Agenda Business Blueprint Executive Summary • • • • • • • • Goal of Business Blueprint Tools Used Enterprise Structure Module Overview Business Fit Issues / Gaps Change Management / Training Concerns Authorizations 2 Business Blueprint Analysis Goals • Determine UT’s business process requirements • Achieve a common understanding of how UT intends to run its business within the framework of SAP R/3 • Deliver a record of results gathered • Move into the next phase with enough information to complete baseline configuration 3 Business Blueprint Analysis Tools • Business Process Questions (by process) – Standard questions regarding UT’s organizational structure, processes and business needs • Detailed Workshops – Meetings with key users to discuss business processes and business needs • Customer Input Templates – high level summary of Processes • Business Process Transaction – Business Process Master List (BPML) 4 Business Blueprint Analysis Activities • Business Blueprint Workshops • Detail Requirement Workshops • Preparation of Business Blueprint Deliverables – – – – – Creation and review of all Q&A questionnaire Creation and review of CI Templates Creation and review of BPMLs Creation and review of RICES Update issue log (which includes the major gaps). 5 Financial Accounting Enterprise Structure – General Ledger Chart of Accts UT As s e ts Liabilitie s Com pany Code UT Fund Balance s Re ve nue s Expenditures 6 Financial Accounting Enterprise Structure - Controlling Company Code UT Cost Center E011024001 Functional Area Instruction Profit Center L011002401 Chemistry Fund E011024001 Business Area Cur Unrest E&G Knoxville Fund Center U011002401 Chemistry 7 Financial Accounting Enterprise Structure – Project Systems Company Code UT Functional Area Research Profit Center L011002401 Chemistry WBS Element B01001024 Fund B01001024 WBS Element R011024010 Fund R011024010 Business Area Cur Rest E&G Knoxville Fund Center U011002401 Chemistry 8 Financial Accounting Enterprise Structure – Procurement Univ of Tennessee UT Company code Central Purch.Org. UT Purch. Organization Plant Storage location Knoxville K Depart. K001... Chattanooga C Martin M Memphis H UTSITullahoma T Depart... C001... Depart... M001... Depart... H001 Depart... T001 9 General Ledger • Chart of Accounts includes general ledger accounts, the equivalent of object codes (expenditures, revenues, assets, liabilities, and fund balances) • Posting of journal entries to the General Ledger (direct and through automatic account assignment from other modules) – Direct postings – journal entry (JV, TV, etc.) – Automatic account assignments – payroll postings 10 Special Purpose Ledger • Balance Sheet and Revenue and Expenditure Reporting by Fund – Automatic cash offset posting – Internal reporting by fund • Balance Sheet and Revenue and Expenditure Reporting by Fund Group and Budget entity – For monthly Treasurer’s Report – For external financial statements 11 Asset Management • Supports tracking and management of fixed assets (equipment, buildings and land) – Leased and owned equipment – Sensitive item tracking – Integration with MM to benefit from automatic capitalization at time of goods/invoice receipt – UT will have new functionality to meet GASB requirements to depreciate their assets July 2001 12 Cash Management • Cash management manages UT’s short term cash flow and Bank Ledger accounting – Evaluate UT cash position – Lockbox cash receipts – Bank statement input and bank reconciliation – Deposit handling and Cashed Check reconciliation – Monitor cash inflows and outflows to ensure on optimum amount of liquidity to meet required payments 13 Controlling • Provides collection of costs for unrestricted accounts – Cost Centers – UT E & I accounts – Profit Centers - UT departments – Cost/Revenue Elements – expenditure and revenue codes – Departmental Planning for cost centers – plan vs actual analysis 14 Funds Management • Provides monitoring and control of budgets for both state and local appropriations as well as sponsored programs – Commitment items – UT object codes – Funds centers – UT organizational units – Funds – UT accounts – Budgeting at the fund level – Funds availability control at the fund level 15 Project Systems • Project accounting (revenue and expenses) for UT restricted funds – Planning (dates, costs at the cost element level) – Overhead calculation (F&A) – Integration with FM (wbs element link to funds), AM (plant funds will require AuC’s) and SD (sponsor billing) 16 Accounts Payable • Single vendor master database ownership by A/P dept – purchasing view updated by purchasing dept • Invoice processing – Processing of purchase order invoices via Logistics Invoice Verification (LIV) – On-line 3 way matching of invoice/PO/goods receipt – Processing of direct vouchers without purchase order • Automatic and manual payment process – Manages payments based on frequency of payment runs & payment terms specified in the vendor master record or invoice • Integration with Travel Management 17 Sales and Distribution • Supports billing of sponsor reimbursable funds – Cost reimbursable (resource related billing) – Schedule billing (example $15,000 each month) – Item billing (example trial testing) – Letter of credit (draw down) – Retainage 18 Accounts Receivable • Single customer master database of sponsored projects shared with Sales and Distribution • Invoice processing for sponsored projects – Integration with Sales and Distribution billing – Supports accounting for manual billing • Application of incoming payments for sponsored projects • Supports dunning for sponsored projects 19 Travel Management • Employee and Guest Travel – Travel Authorizations – Travel Advances – Entry and Approval of Trip Facts – Travel Expense Accounting – posting to GL – Reimbursement through Accounts Payable – Incorporates University fiscal policy 20 Purchasing • Requisitions – Electronic transmission of document to purchasing (eliminates paper document) – Electronic approval process – Ability of department to review existing university contracts on-line in determining requisition source – Assignment of asset at point of requisition 21 Purchasing • Source Lists – Identify and suggest potential sources based on contracts – Identify potential sources for bid lists – Ability to identify sources based on info records and flexible search parameters – Information contained in central data base accessible to all campus purchasing departments 22 Purchasing • Request for Quotation – Generation of bidder list based on information records maintained in SAP such as NIGP codes, recent purchases, etc. – Flexibility in evaluation of quotes received - line item vs totals – Departments can evaluate on-line vs. sending hard copy for review 23 Purchasing • Purchase Orders – Identify and suggest potential sources based on contracts – Identify potential sources for bid lists – Ability to identify sources based on info records and flexible search parameters – Information contained in central data base accessible to all campus purchasing departments 24 Purchasing • Contracts – Available for review and maintenance on-line – Ability to release order directly against contract without requisition – Better accountability of funds spent against contract – Flexible agreement types (i.e. outline, blanket, etc.) – Ability to review all campus contracts across UT 25 Purchasing Matrix Volume/Value Annual activity Doc. Type /Method Low/Low $3M P-Card High/Low or High Note Req . N/A Request for Quotation ($2,000><10,000) Optional >$10,000 Required Purchase Orders Funds Avail. Checking Goods Receipt A/P-or Department N/A N/A N/A N/A Accts. Payable OutlineValue (WK) N/A N/A Release Orders (NB) Yes Yes Depts. N/A Blanket (FO) N/A N/A Accts. Payable Yes Yes Yes Department N/A N/A N/A Department Yes Yes N/A Accts. Payable High/Low Note OutlineValue (WK) N/A Low/High (incl. Assets) Note Purchase Order (NB) Yes High/Low $100M NonPurchase Order N/A Personal Services Purchase Order or External Order Yes Facilities / Construction Purchase Order or External Order Library-Books Out of Scope Yes N/A InsuranceContracts Utilities T-Club Out of Scope 26 Financial Accounting Business Fit In Scope • Financial Accounting – General Ledger – Special Purpose Ledger – Asset Management – Cash Management – Controlling – Funds Management – Project Systems – Accounts Payable • Materials Management – Purchasing • Sales and Distribution – Billing for sponsored projects • Accounts Receivable – A/R for sponsored projects • Travel Management – Travel Expenses 27 Financial Accounting Business Fit Out of Scope • Inventory Management • Real Estate Management (Facilities) • Investment Management • Internal Orders • PS Networks (scheduling, resources, tasks, etc) • General Accounts Receivable (only sponsored receivables in scope) • Purchasing Material Master • Purchasing B-to-B Functionality (in RFP) • Archiving 28 Financial Accounting Issues • Import of Procurement card transactions into R/3 (Issue 8 – functionality deficit) • Funds availability checking (Issue 33 – process design) • Creation of external reports such as CFDA, IPEDs, etc (Issue 68 – functionality deficit) • Data-level security for Finance (Issue 74 – process design) • Support for cost sharing transactions in R/3 (Issue 106 – process design and functionality deficit) • Research and determine FAX software to acquire (Issue 113 - ) • Ability to track source of recoveries of payroll costs (Issue 118, 119 – process design) • Scope of University procurement processes (Issue 133 – project scope) 29 Financial Accounting Issues (cont.) • Effort Certification processing (Issue 137, 155 – functionality deficit and process design) • Financial/technical/equipment reporting to Grant sponsors (Issue 157 – functionality deficit) • Budget transfers for mass salary changes (Issue 162 – functionality deficit) • What will be the commitment item group standard for unrestricted accounts (Issue 166 – process design) • Revenue recognition for restricted projects (Issue 178 – process design) • Accrued annual leave (Issue 186 – process design) • Salary transfer vouchers (STV) (Issue 187 – process design) 30 Financial Accounting Change Management Concerns • • • • • • • • • • Terminology Decentralization of Accounts Payable functions Goods receipt (in some situations) Departmental requisitioning online Travel request and reimbursement decentralized Budgets and planning Departmental entry of service contracts Departmental entry of assets for equipment Workflow Cash management for cash receipts 31 Financial Accounting Authorizations • There will be user authorizations at the following levels: – By fund/fund center/commitment item – By transaction 32