Financing Romanian Agriculture, Robert Rekkers, Agricover Credit IFN

advertisement

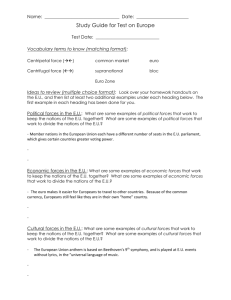

Financing Romanian Agriculture Investment and development options www.agricover.ro How attractive is Romanian agriculture versus Europe ? Agriculture in Netherlands vs. Romania Romania Netherlands GDP Euro 140 billion Euro 600 billion Arable land 9.5 million ha 1.8 million ha Professional farmers 265 000 67 000 Agriculture exports Euro 4 billion Euro 78 billion Arable land prices Euro 2 500 – 5 000 /ha Euro 40 000 /ha (working > 5 ha) Total loans to the agricultural sector 2013 Loans Average Debt / farmer Romania Euro 3.5 billion 1 300 Euro Netherlands Euro 40 billion 600 000 Euro Total agricultural loans in Romania Million RON 75% granted by banks 2012 2013 Aug. 2014 10 613 10 879 11 600 annual growth rate 3% 25% granted by Non-Bank Financial Institutions (NFI) 2 847 3 501 4 006 annual growth rate > 20% *Commercials credit (offered by agribusiness players) is estimated at RON 2.5 – 3 billion per year. What is being financed? 66% Working Capital Needs (Banks, NFI, Commercial Credit) 33% Investment Loans Equipment (NFI) Projects with European grants (Banks) Others, such as arable land acquisitions (Banks, NFI) What investment and development options does a Romanian farmer has? Extension of the agricultur al area Milling bakery Energy (biogas wind) Silos Trade in cereals FNC Development Agricultu ral service delivery Livestock breeding (pigs, cows) Vegetabl e and fruit growing » Defensive » Low risk » Moderate increase in cost efficiency » Liquid fixed assets and an increasing trend in the market value during the next period » Facilitates the densification of land Acquisition of agricultural land ▪ Increases the indebtedness ▪ Investment paid off in the long term ▪ The market becomes extremely competitive, decreasing negotiation power » It may generate a significant profitability in the future » Multiplies the profit centers » Limitation of the specific seasonal character » Using renewable resources » A market with a growth potential in the future » Possible access to non-reimbursable funds Energy (biogas, wind) ▪ High risk ▪ Increase in exposure, significant investments ▪ Low expertise level, it does not depend on the underlying activity ▪ Dependent on tax incentives that are highly uncertain » Defensive » Storage » Immunity » Allows a better capitalization on one’s own production » Possible access to non-reimbursable funds Silos for one’s own needs ▪ Average risk ▪ Increase in exposure, significant investments ▪ Money blocked ▪ Risk of extra capacity ▪ The risk of deterioration of the production stored is taken over » Integrated model » Average profitability » Legal limitations that are to reduce the access to the market of the small producers, generating growth opportunities » A market with an increase potential » Possible access to non-reimbursable funds » The integration of activities related to large crops increases profitability Livestock breeding (pigs, cows) ▪ Average risk ▪ Expenses on initial investments ▪ Liberalization of the milk market in 2015, pressure of imports » Integrated model » Low risk » Average profitability » Market with an increase potential » Possible access to non-reimbursable funds Fruits and vegetables growing ▪ Expenses on initial investments ▪ Pressure on the price by imports Distribution of development options High profitability/ efficiency Services Energy Land Vegetable growing Fruit growing Livestock breeding Silo Inputs Low risk High risk Shops Trade FNC Milling, bakery Low profitability / efficiency In conclusion, Romanian agriculture Has great potential for improving performance Can contribute significantly more to economic development and export growth Is hugely under-financed both in terms of working capital needs and investment loans Will benefit from a significant increase in European funds/subsidies NFI’s are ideally placed to satisfy the farmers needs for credit Specialized loan providers, understanding the farmers business Can provide fast, innovative and flexible credit solutions Better collateral valuation Better collection mechanisms AGRI-FINANCE WHERE AGRICULTURE MEETS FINANCING Thank you !