Salim Hajee

advertisement

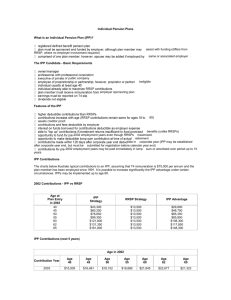

th 4 CIFPS Annual National Conference - 2006 Vancouver May 28 – May 31 Individual Pension Plans (IPPs) Robert G. Camp Salim Hajee INW Financial AGENDA • What is an IPP? • History of IPPs • What are the rules regarding IPPs? • Why would one want an IPP? • Why would one NOT want an IPP? What is an IPP? • Registered Pension Plan (employee/employer relationship) • Defined Benefit, not Defined Contribution (RRSP is DC) • Ancillary Benefits can be added • Who Determines How Much can be Paid into an IPP? What is an IPP? Registered Pension Plan (employee/employer relationship) • Only employees can be members of a Registered Pension Plan • Partners and Proprietors are not Eligible • Registered with both Canada Revenue Agency and the Provincial Authority • Some Provincial Authorities have chosen to ignore IPPs What is an IPP? Registered Pension Plan (employee/employer relationship) Cont’d •Federal Registration gives deductibility to Plan Contributions •Employer contribution NOT a taxable benefit to the Employee •Provincial Rules may force extra reporting and employer commitment What is an IPP? Defined Benefit, not Defined Contribution (RRSP is DC) • Pension Promise is based on Employee Earnings, not on Contributions to the Plan • In an RRSP, Pension will arise from Contributions and Investment Earnings on the Fund • If Investments tank in an IPP, who has responsibility to "make it whole"? • If Investments do well in an IPP, who gets the "surplus"? • If Investments tank in an RRSP, who has responsibility to "make it whole"? • If Investments do well in an RRSP, who gets the "surplus"? What is an IPP? Ancillary Benefits can be added • Post-retirement indexing to CRA limits • Improved Spousal Protection • Early Retirement Provisions • Improved Pre-Retirement Death Benefits What is an IPP? Who Determines How Much can be Paid into an IPP? • An Actuary (FCIA) • Filings with CRA and Provincial Authority must be made History of IPPs • Prior to October, 1968 • Information Circulars 71-4 and 72-13Rx • 1980 Significant Shareholder Plans • The Sedgwick IPP Marketing Scheme • Regulation 8515 (Designated Pension Plans) History of IPPs Prior to October, 1968 •Basically, there were no special rules •If Arnold Chater accepted a Plan for Registration, it was okay •His guideline appeared to be a pension should not exceed 70% of pre-retirement pay •October 1, 1968 saw the definition of a "Significant Shareholder" and restrictions thereon •The "primarily for" restriction History of IPPs Information Circulars 71-4 and 72-13Rx •Codified the federal taxation rules for Registered Pension Plans •Defined Pensionable Service, Earnings, Maximum Pensions, Form of Pension, Retirement Age •IC 72-13R8 still applies for a Pension Plan crediting service prior to 1991 History of IPPs 1980 Significant Shareholder Plans •Someone forgot Mr. Chater's "blue book" •Door opened for about six months and hundreds of plans were established for Significant Shareholders •Door closed December 31, 1980 and restrictions on Plan "improvements" were applied punitively History of IPPs The Sedgwick IPP Marketing Scheme •Highly paid executives and commissioned people possibly through foregoing of bonus •The "flip-flop" of RRSP and AVC •Maximize contributions through "conservative" actuarial assumptions and maximum ancillaries •Extension of IPPs to Partners who were Former Employees History of IPPs Regulation 8515 (Designated Pension Plans) •Applies to Plans with small numbers of participants who are highly compensated •Connected Person rules different from those for "regular" employees •Sets out the actuarial assumptions that are acceptable to CRA for Designated Plans … History of IPPs Regulation 8515 (Designated Pension Plans) Cont’d • Mortality Table 80% of 1983 Group Annuity Mortality Table • Discount Rate 7.5% per annum • Retirement Age Age 65 • Form of Pension 2/3 JLS guaranteed 5 years • Post-retirement indexing 5.5% per annum What are the rules regarding IPPs? • What is a Connected Person? Specified Individual? Designated Plan? • Highest Average Earnings versus Updated Earnings • Maximum Lifetime Pension • Maximum Bridge Benefit • Past Service Pension Adjustment • Funding versus Cost at Retirement What are the rules regarding IPPs? What is a Connected Person? Specified Individual? Designated Plan? •A "connected person" owns (directly or indirectly) 10% or more of the company •Usually measured in conjunction with relatives •A "specified individual" is a connected person earning more than 2.5 times the YMPE •A Designated Plan is one with less than 10 active members What are the rules regarding IPPs? Highest Average Earnings versus Updated Earnings •"Regular" employees can have benefits based on Highest Average Earnings (HAE) •Connected Persons are restricted to benefits based on Updated Earnings •Updated Earnings are based on actual earnings brought forward at the AIW rate •Maximum pension limits rising at about 5.5% per annum, AIW running less than 3% per annum What are the rules regarding IPPs? Maximum Lifetime Pension •For a "regular" employee, 2% times credited service times HAE •Dollar limits finally moved from $1,715 (set in 1974) to $1,722 (in 1990) to $2,111 (in 2006) •For a connected person, the sum of 2% of Updated Earnings for each year of service What are the rules regarding IPPs? Maximum Bridge Benefit •Bridge pension is payable from actual retirement until age 65 (when government benefits start) •Maximum Bridge Benefit is sum of OAS and CPP for a person currently age 65 and eligible for maximum benefits •However, at least ten years of credited service is required for the maximum to be payable •The maximum dollar amount is the lifetime maximum plus 1/35 of CPP What are the rules regarding IPPs? Past Service Pension Adjustment • For each year of service (after 1990) credited today, a PSPA must be computed • If the member is a connected person, a PSPA for 1990 must also be computed even though no benefit for 1990 is credited • The PSPA for a year is the same as the Pension Adjustment (PA) would have been if the member were in the Plan in the year • The PA for 1996 and later years is 9 times the pension earned with a $600 offset What are the rules regarding IPPs? Past Service Pension Adjustment •The PA for 1990 through 1995 is 9 times the pension earned with $1,000 offset •The effect of PA and PSPA is to reduce the RRSP room of the member in the next calendar year •If the member does not have sufficient RRSP room to absorb the PSPA, a "qualifying withdrawal" must be made from RRSP What are the rules regarding IPPs? What are the Funding Levels for 2006 •Assuming a person earning in 2006 in excess of $110,000, new RRSP room for 2007 will be $19,000 •Assuming sufficient earnings and service back to 1991, the PSPA and Qualifying Withdrawal will be $226,100 What are the rules regarding IPPs? What are the Funding Levels for 2006 (Cont’d) Age Accrued Liability 2006 Service Cost 2007 Service Cost 2008 Service Cost 35 238,000 17,100 18,300 19,600 40 262,000 18,700 20,100 21,500 45 287,000 20,600 22,100 23,600 50 316,000 22,600 24,200 25,900 55 347,000 24,800 26,600 28,500 60 381,000 27,300 29,300 31,300 65 418,000 30,000 What are the rules regarding IPPs? What are the Cost Levels for 2006 •Assuming the Plan is being wound up at the beginning of 2006 pension accrual is $29,500: •CRA rules limit the amount of transfer to RRSP?? •Alternatively, can purchase an immediate pension with maximum bridge from an insurance company licensed to transact business in Canada?? What are the rules regarding IPPs? What are the Cost Levels for 2006 CRA rules limit the amount of transfer to RRSP to the following: Age Transfer under 50 265,000 50 277,000 55 307,000 60 339,000 65 366,000 What are the rules regarding IPPs? What are the Cost Levels for 2006 The cost of purchasing an immediate pension with maximum bridge would be approximately: Age Cost 50 539,000 55 594,000 60 619,000 65 542,000 Why would one want an IPP? And When? • Additional Tax Deferral • Creditor Protection • Ability to "Ensure" a Post-Retirement Income Why would one NOT want an IPP? • Cost of the Plan • Investment Restrictions • Conversion of Capital Gains and Dividends into Regularly Taxed Income • Commitment of Employer Business Planning Cycle • Early Career Years • Too busy Growing Business • Money into RRSPs for purposes of tax-deferment, Not ACTIVE Retirement Planning • Middle Career Years • Mature Business • Looking to pass on business/value in tax-effective manner • Money into RRSPs for purposes of tax-deferment, Not ACTIVE Retirement Planning • End Career Years • Phase out of business • Retirement – how much is enough? Retirement Planning • RRSPs • Company Registered Pension Plan • Government Statutory Benefits (CPP + OAS?) IPP – A Possible Solution • Comprised of one (individual) plan member – spouse may participate, provided she is employed by same or associated employer • Complex rules – simple concept • Employer must sponsor and fund (employee contributions permitted) • Registered defined benefit pension plan IPP – A Possible Solution (Cont’d) • Benefit is clearly defined: • Lifetime - 2% of Updated Annual Compensation for each Year of Service with Employer (within annual ITA limits) • Bridge - Within ITA limits payable to age 65 • Spousal Pension on Death - 66 2/3% of member’s lifetime • Indexing - Yes IPP – A Possible Solution (Cont’d) Maximum Annual Benefit Accruals under the ITA 2006 $ 2,111.11 2007 2008 $ 2,222.22 $ 2,333.33 2009 $ 2444.44 2010 $ 2,444.44 * (1 + AIW) Until the next time the ITA is amended Ideal Candidates for an IPP • Owner/manager or senior executives of private • • • • or public corporation Age 41 or older Business must be incorporated T4 earnings of approx. $106,000 in 2006, $112,000 in 2007, etc. (dividend income ineligible) Have an employer that is willing to set one up An IPP is NOT Like an RRSP… The Good (Cont’d) • Annual Contributions in an RRSP depend on earnings only; Annual Contributions to an IPP depend on earnings and AGE – higher the age, higher the annual contribution requirement An IPP is NOT Like an RRSP… The Good • Younger than Age 41 – RRSP More advantageous; • • • • Older than 41 – IPP more advantageous IPP must fund the benefit promise, hence additional funding may be required if shortfall in pension fund (ongoing or member/plan termination); RRSP – no such requirement IPP is creditor-proof; RRSP may be assigned Investment risk transferred to plan sponsor Any money borrowed by Company to fund IPP contributions is tax-deductible to Company, unlike borrowing to make personal RRSP contributions An IPP is NOT Like an RRSP… The Bad • Restrictions on withdrawal of funds as subject to locking-in in most provincial jurisdictions in Canada • No spousal contributions permitted and reduces income-splitting opportunities • Requires a trustee – either self-trusteed (3 individual trustees, at least one at arms-length), corporate trustee or life insurance company An IPP is NOT Like an RRSP… The Ugly • Administration costs: IPPs – set up ~ $3,000 - $5,000, annual $1,000 - $1,500, every 3 years ~ $2,500; RRSPs - $100 for self-administered • Any surplus over permissible ITA limits will be paid to employee as fully taxable lump sum upon termination of employment/IPP, if elect the transfer option An IPP IS Like an RRSP… • Contributions tax deductible: IPP by Company from • • • • • business income; RRSP by taxpayer Investment income accumulates and compounds on a tax-deferred basis Upon death by member, all assets in an IPP may be transferred to spouse and rolled over to an RRSP on a tax-deferred basis, similar to that for an RRSP Investments, if RRSP-eligible are also IPP-eligible Foreign content limits are the same Taxed when amounts withdrawn/paid And, Finally … Thank You Q&A