Cost behaviour & effect of changing activity levels on

advertisement

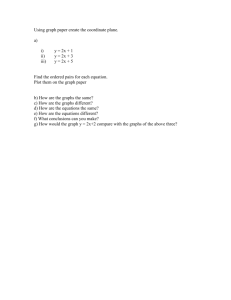

Cost behaviour & effect of changing activity levels on unit costs Objectives: 1. Correctly identify types of cost behaviour 2. Explain the effect of changing activity levels on unit costs 3. Correctly calculate the effect of changing activity levels on unit costs 4. Accurately calculate contribution at different levels of activity 5. Correctly calculate profits or losses at different activity levels 6. Prepare accurate revised forecast profit statements having adjusted either cost or revenue figures Revision of Cost Behaviour INDIVIDUALLY study the graphs on the wall and decide the cost behaviour for each one. List your answers ready to discuss Graphs Activity A Variable Cost Graphs Activity B Fixed Cost Graphs Activity C Fixed Cost Graphs Activity D Semi-variable Cost Graphs Activity E Variable Cost Activity 1 A business produces widgets. Fixed costs are £10000 and Direct materials per widget are £4, Direct labour per widget are £8. There are no semi-variable costs. 12000 240000 480000 10000 22000 22.00 10000 250000 10000 12.50 490000 12.25 Activity 2 Variable In pairs discuss the table and Variable Fixed identify the cost behaviour Semi Variable Fixed If a cost is made up of fixed and variable and the What do we know about fixed and variable costs? total costs go up which cost will have changed? Water (Activity 2) Units Cost Highest 300 160.00 Lowest 100 120.00 200 40.00 so 0.20p Variable Element 100 units total cost for water is £120.00. Deduct the VC of £20.00 (20p per unit) = Fixed cost of £100.00 To check: 200 units total cost for water is £140.00. Deduct the VC of £40 (20p per unit) = Fixed Cost of £100.00 Activity 3 Handout Activity 4 - Turbo Motor Factors 80,000 cars = £325,000 60,000 cars = £247,000 20,000 £78,000 This represents the difference in VARIABLE costs £78,000 ÷ 20,000 = £3.90 per unit Activity 4 - Turbo Motor Factors 80,000 cars = £325,000 Variable Costs 80,000 x £3.90 = £312,000 Fixed Costs £325,000 - £312,000 = £13,000 60,000 cars = £247,000 Variable Costs 60,000 x £3.90 = £234000 Fixed Costs £247000 - £234000 = £13000 Activity 4c: Turbo Motor Factors Variable Cost = £3.90 per unit Fixed Costs = £13,000 65,000 cars Variable Costs 65,000 x £3.90 = £253,500 Fixed Costs = £13,000 Total Costs £266,500 Complete Activity 5 & 6 Relevant Costs ‘A future incremental cash flow arising as a direct consequence of a decision’ ‘Those costs which are changed by a decision’ Sometimes described as avoidable Example: Increase in costs after a decision to increase production Specific Examples? Irrelevant Costs ‘Cost incurred in the past which are irrelevant to any decision being made now – including committed costs. ‘Those costs which are not affected by a decision’ Unavoidable Example: Fixed Costs Specific Examples? Activity 7 In pairs read through the WHOLE question. What are the key words/phrases/numbers? Handout Absorption Costing Revision ‘Method of finding an appropriate amount of overhead per cost unit so the total cost of producing a product or job can be found’ ‘Sharing the overheads between the units made’ Examples of methods of absorption? Machine Hour Labour Hour Marginal Costing ‘Separates Variable and Fixed costs’ Sales revenue less Variable costs = Contribution to Fixed Costs Activity 8 a. Calculate the total cost of making a week’s supply of beef sandwiches Variable cost per sandwich 1.05 X number of sandwiches 240 Total Variable Costs + Fixed costs 252.00 Total Costs 272.00 20.00 Marginal Costing Unit costs only includes Variable Costs (i.e. the cost of increasing production by ONE unit) Variable Costs are Direct costs – Materials/Labour/Expenses What kind of decisions will affect these costs? • • • • • These will change as a result of decisions being made Make or buy? Start/Stop production of a particular product Open/Close function in the business If resources are limited – which products to make Level of activity to break even Marginal Costing – How it works … Costs allocated to a unit are VARIABLE only Selling price minus Variable costs = CONTRIBUTION to fixed cost & profit Activity 6b What is the marginal cost of a beef sandwich? Variable cost per sandwich 1.05 What is her profit for a week if she makes and sells all her sandwiches each week? £2.00 £1.05 £0.95 240 £228.00 20.00 £208.00 Now it’s your turn! Activity 9 Activity 10 Activity 11 Relevant costs of materials On-going purchase of materials for use in production Valuing the use of surplus material is the higher of: Current resale value Value if put to alternative use Homework Complete all remaining activities – checking your answers on the Wiki