L10 financial globalization

advertisement

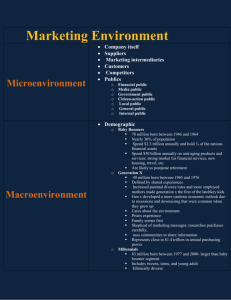

Financial Globalization Current Events • Headline: Currency Trade Reaches $5.3 Trillion a Day Amid Yen Turnover • ~1.5 Trillion/day in 1997 • If we add in stocks, bonds, CDS, speculative investments much, much higher Current Events • Businesses May Be Next Target of Higher Taxes – Corporate earnings are also vulnerable to the strengthening dollar, which reduces the value of revenue from exports and foreign earnings by U.S. multinationals. And exports and foreign earnings of U.S. companies are under pressure, especially in developing countries where growth has slowed. – China’s growth is slowing as it shifts to an economy led by consumer demand and away from exports, which are depressed by weak demand from the U.S. and Europe. China has also vastly overbuilt its infrastructure. Vacant cities and other excess capacity could become considerable problems, particularly for the lenders who financed them. Deceleration in China implies slow growth for the other developing countries that have thrived by exporting commodities and components to the Chinese manufacturing juggernaut. – Meanwhile, the prospective tapering of Federal Reserve asset purchases and the related interest rate increases that have already occurred are causing financial harm to those nations. – Earlier, the likes of Brazil, India, Indonesia and Turkey were almost overwhelmed by inflows of hot money that drove up the value of their currencies and financed their large currentaccount deficits. Now that hot money is rushing out, leaving them with three unsavory choices. They can allow their currencies to slide, which aids exports but also promotes inflation as import prices jump. They can raise interest rates to help retain foreign money, but that threatens growth. Or they can impose capital controls to keep money from leaving, but that discourages future inflows and triggers huge outflows when controls are lifted. Some Basics • Balance of payments – Current account (exchange of real goods and services + remittances) – Capital account (stocks of capital abroad yielding flows of revenue) • Exchange rate regimes – Fixed – Flexible Theories about Economic Stability • Efficient Market Hypothesis (recent ‘Nobel’) – Prices of financial assets based on market fundamentals – Reflect NPV of all future returns – Regulation undesirable – Crisis = ‘correction’ • Financial instability hypothesis – Hedge, speculative, ponzi investments (e.g. housing bubble) – Increasing confidence and risk: Destabilizing stability – Collapse inevitable U.S. Stock (inflation adjusted) S&P Price/Dividend Ratio Financial liberalization Causes of Crisis: conventional view • • • • Leverage Moral Hazard Adverse selection Selling short Causes of Crisis • “Fundamentals” wrong – High current account deficits – Excessive money creation • Bernanke injecting another $trillion? • Vs. $3 trillion drop in M3 – Overvalued exchange rates • Relative to what? – Large deficits/debt Financial Instability Hypothesis Causes of Crisis: EE view • Biophysical limits – Oil production – Resource depletion • Financial liberalization – Money can go where it wants – ‘Hot’ money – Imperfect information • Complex systems – Positive feedback loops and self fulfilling prophecies – Collapse is inevitable outcome of exponential growth Financial contagion • What is contagion? • Speculative flows – 5.3 trillion per day in currency alone, vs. ~$70 Trillion global GNP – Over $1 quadrillion in CDS – What does speculation contribute to economic output? • “Speculators are harmless as bubbles on a steady stream of enterprise. But the position is serious if enterprise becomes a bubble on the whirlpool of speculation. When the capital development of a country becomes the by-product of the activities of a casino, the job is likely to be ill-done.” John Maynard Keynes Examples of Contagion LA debt crisis (1982) ISI and the energy crunch Petro-dollars Reagonomics Capital flight, exchange rate depreciation Switch from ISI to Export promotion, implementation of Washington Consensus • “The lost decade” • • • • • Tequila crisis (1994) • • • • Clinton’s comments Uprising and assassination Political uncertainty Capital flight and devaluation Asian flu (1997) • Real estate bubble • Financial speculation, selling short and devaluation • Impacts of devaluation on debt • Impacts on trade competitors • IMF role: interest rates, taxes, government spending, bailouts Asian flu (1997) • Spread to Russia – Deficits and fixed exchange rate – Fear of collapse caused collapse • Infected other former USSR countries • Spread to US (LTCM) • Spread to Brazil and Argentina Current Crisis • Origins – Dot.com bust real estate boom – Hedge speculative Ponzi • ARMS, falling asset prices, and inability to refinance, asset liquidation, falling asset prices, etc. – Mortgage securities and moral hazard – Exotic derivatives sold, imperfect information, and moral hazard • Rated AAA – Excessive leverage Current Crisis • Origins – Dot.com bust real estate boom – Hedge speculative Ponzi – Exotic derivatives sold and imperfect information • Rated AAA – Financial speculation – From liquidity crisis to liquidity surplus • Biophysical constraints • Contagion Financial Crises and Distribution • Concentrated wealth and speculation • Too big to fail • Growth rates greater than economic growth Response to Crisis • Conventional – – – – Poor countries Rich countries Liberal Conservative • EE – – – – – – Redefining crisis Restricting capital flows Taxation (Tobin, income, throughput, rent) Regulation Replacing horizontal money with vertical money Ecological Restoration