Capital Budgeting

advertisement

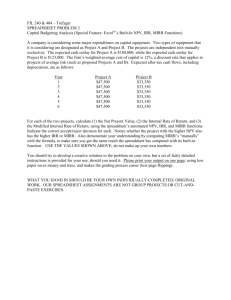

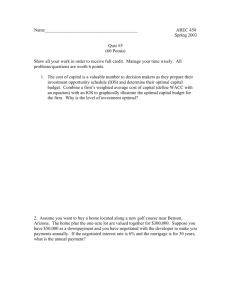

Capital Budgeting Chapter 11 1 Introduction • Planning in advance for capital expenditures. • Process used by companies for making decisions on long term projects. • Importance of capital budgeting for a financial analyst • Principles we’ll study here will be used for valuation of projects or valuation of entire companies. • Capital budgeting – proper planning helps achieve the goal of maximizing shareholder wealth. 2 Capital Budgeting Process • Capital budgeting process comprises of the following steps: – Generating an investment decision – Forecasting cash flow for each project – Scheduling and prioritizing projects – Monitoring and auditing 3 Categories of Capital Budgeting Projects • Replacement Projects – Maintaining the business – Cost reduction • Expansion projects – Requires complex decision making • New products and services – Complex decision making – High uncertainty 4 Important Definitions • Independent Projects – Independent projects basically mean that if analysis reveal that it is profitable to do both projects A and B, we will do both of them. • Mutually Exclusive Projects – A set of projects where only one project can be accepted. Even if analysis reveals it is profitable to do projects A and B we can only do one of them. Example: Warehouse – fleet of forklift, conveyor belt system. • Unlimited Funds vs. Capital Rationing 5 Company’s Investment Decisions • Short term – – – – – T-bills CD’s Bank deposit Shares Other • Long term 6 Why Investment decisions are so important to analyze in the beginning? • Two most important reasons: – The value of investment is very large – Irreversible 7 Tools of Capital Budgeting 1. Payback Period – Simple Payback – Discounted Payback period 2. NPV 3. IRR 4. MIRR 8 1. Payback Period a. • Simple Payback Period Definition: Number of years it takes for project’s cumulative cash flows to recover the cost of the project. The sooner the cost is recovered the better it is. Calculation (Example) • • – Suppose the firm requires cost to be recovered within 3 years. • Formula: • Years before full recovery + unrecovered cost at the start of the year cash flow during full recovery year • • • • Which project we would accept? What if the two projects are mutually exclusive? What if the two projects are independent? What if cash flows are received evenly during the year? Formula: Original investment cash inflows per period Cut-off payback period: It is the pre-determined (desired) length of time for an investment to be recovered. 9 a. Simple Payback Period Advantages 1. 2. 3. 4. Easy to calculate. Easy to comprehend. Easy to analyze. Very good indicator of liquidity of a project. Disadvantages 1. 2. 3. 4. Ignores the principal of TVM. Sets off unrealistic expectations. Does not consider cash inflows after the original investment is recovered. Biased against long-term projects that take longer time periods to become lucrative . 10 b. • Discounted Payback Period Definition: Number of years it takes for project’s cumulative discounted cash flows to recover its costs. or Length of time required to recover original investment from the present value of expected future cash flows. • Calculation (Example) – Suppose the firm requires cost to be recovered within 3 years. • Formula: • Years before full recovery + unrecovered cost at the start of the year cash flow during full recovery year • • • Which project we would accept? What if the two projects are mutually exclusive? What if the two projects are independent? 11 a. Discounted Payback Period Advantages 1. A more realistic measure than simple pay back period. 2. Takes into account the principle of time value of money (PV of cash inflows taken into consideration). Disadvantages 1. Ignores cash flows beyond cut-off point. 12 2. Net Present Value a. • Net Present Value (NPV) Definition: NPV is the present value of cash inflows minus the present value of cash outflows. Characteristics A very important capital budgeting tool. Helps firm assess the level of importance various capital budgeting projects have. • • • – – • Why doing such a thing is important? Capital budgeting projects normally requires expenditures in millions and billions of dollars, before embarking on any such project they want to be reasonably sure that the cash inflows generated from the project will pay off project’s costs within a reasonable amount of time. Firms generally can carry out multiple projects, capital budgeting tools like NPV help firms choose the best among them. 13 2. Net Present Value (contd.) • i. • • ii. Formula: NPV = Present value of cash inflows - Present value of cash outflows Cash outflows: As on today (PV) Cash inflows: Discounted back (To find PV) . • Decision Criteria (3 scenarios): – NPV = Positive (Cash inflows than outflow) => Accept the project. – NPV = Zero (Cash inflows than outflow) => Indifferent – NPV = Negative (Cash inflows than outflow) => Reject the project. 14 2. Net Present Value (contd.) • • • • • • In case of: Independent projects: NPV > 0 (Accept both projects or all within budget) Mutually exclusive projects: Accept the project with highest positive NPV Example: Global Enterprises is considering two projects. Each project requires an initial outlay of $100,000 and provides the following cash flows. The firm requires a required ROR of 10% on both projects. Project A: Cash Outflow = 100,000 Cash Inflows: 1st year = 30,000 • 2nd year = 40,000 3rd year = 50,000 4th year = 60,000 2nd year = 30,000 3rd year = 30,000 4th year = 20,000 Project B: Cash Outflow = 100,000 Cash Inflows: 1st year = 40,000 15 2. Net Present Value (contd.) • Remember: For doing NPV analysis always make a timeline. Advantages 1. 2. 3. 4. Adjusts for the TVM. Provides a straight forward method for controlling risk of competing projects, higher risk cash flows can be discounted at higher costs whereas lower risk cash flows are discounted at lower costs. Tells whether the investment will increase firm’s value. Considers all the cash flows. Disadvantages 1. 2. 3. May not be considered as simple or intuitive as some other methods. Requires an estimate of cost of capital in order to calculate NPV. Expressed in dollar terms, not as a percentage. 16 3. IRR • IRR stands for ‘Internal Rate of Return’. • Concept: – IRR quite simply tells you what is the return on a project. – IRR is the discount rate at which NPV of a project is equal to ‘zero’. – When we say NPV of a project is equal to ‘zero’ we mean PV of cash inflows = PV of cash outflows. • Definition: IRR is the discount rate at which PV of cost is equal to PV of future cash inflows. 17 3. IRR – We stated, “IRR is the discount rate at which NPV of a project is equal to zero”. – Using the NPV formula – In IRR we calculate the discount rate, the ‘r’ at which NPV = 0 18 3. IRR • Decision Criteria • For Independent Projects IF IRR > cost of capital => accept the project IF IRR < cost of capital => reject the project • For Mutually Exclusive Projects Accept the project with highest IRR provided IRR for the project is greater than cost of capital. 19 3. IRR Advantages 1. Considers all cash flows of the project. 2. Considers time value of money. Disadvantages 1. Requires an estimate of cost of capital in order to make a decision. 2. Cannot be used in situations where sign of the cash flows of the project change more than once during project’s life. 20 Class Practice Question 1 21 4. MIRR • • • MIRR stands for ‘Modified Internal Rate of Return’. Definition: MIRR is the discount rate at which the present value of a project’s cost is equal to the PV of its terminal value where the terminal value is found by summing up the future value of the cash inflows, compounded at company’s cost of capital. Formula: PV costs = Terminal Value (1+MIRR)n 22 4. MIRR • Decision Criteria • For Independent Projects IF MIRR > cost of capital => accept the project IF MIRR < cost of capital => reject the project • For Mutually Exclusive Projects Accept the project with highest MIRR provided MIRR for the project is greater than cost of capital. 23 4. MIRR Advantages 1. 2. 3. Considers all cash flows of the project. Considers time value of money. A better capital budgeting tool than IRR as it assumes cash inflows are reinvested at the cost of capital. Disadvantages 1. 2. Requires an estimate of cost of capital in order to make a decision. Cannot be used in situations where sign of the cash flows of the project change more than once during project’s life. 24 Class Practice Question 2 25 Key differences between NPV, IRR and MIRR NPV • Calculation – • • • MIRR IRR • We determine the PV of future cash inflows and then subtract the initial cash outflow from them to obtain NPV. Cost of capital is used as the actual discount rate. • Projects with positive NPV’s are accepted. • NPV assumes cash flows are reinvested at cost of • capital. Calculation – – • We calculate the rate at which NPV is zero ‘or’ simply stated we calculate the rate of return on a project. IRR is the rate at which PV of cost is equal to PV of future cash inflows. IRR is compared with cost of capital to determine if it is feasible to accept the project. Projects with IRR > cost of capital are accepted. IRR assumes cash flows are reinvested at IRR. Calculation – – • • • We calculate the terminal value (TV) by summing up the future value of the cash inflows, compounded at company’s cost of capital then find the PV of the TV. MIRR is the rate at which PV of cost is equal to PV of the TV. MIRR is compared with cost of capital to determine if it is feasible to accept the project. Projects with MIRR > cost of capital are accepted. MIRR assumes cash flows are reinvested at cost of capital. 26 Reinvestment Rate Assumption • In slide no. 26 the last difference points towards an important assumption built into the three capital budgeting tools. – NPV: The NPV technique assumes that cash inflows are reinvested at the cost of capital (i.e. the same rate by which they were discounted). – IRR: The IRR technique assumes that cash inflows are reinvested at IRR. – MIRR: The MIRR technique assumes that cash inflows are reinvested at the cost of capital. 27 Conclusion • MIRR is a superior method to the regular IRR as an indicator of a project’s true rate of return. but, • NPV is better than IRR and MIRR when choosing among competing projects. 28 Conclusion • Independent Projects – For independent projects, NPV, IRR and MIRR all give the same result if NPV says accept, IRR and MIRR also say reject and vice versa. • Mutually Exclusive Projects – For mutually exclusive projects, NPV is the best method to use because it focuses on maximizing shareholder value. 29 Class Practice Question 3 30 Class Practice Question 4 31 Class Practice Question 5 32