Exercise 5.2 (continued)

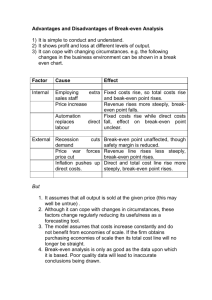

advertisement

5 Cost-Volume-Profit Analysis Exercise 5.1 Basic Problems 1. a. Variable cost b. Fixed cost c. Mixed cost d. Variable cost 3. a. Fixed costs consist of: Cell phone Advertising Sarah’s wages Variable costs consist of: Cleaning supplies Fuel Friend’s wages e. f. g. h. Fixed cost Mixed cost Variable cost Fixed cost Business licence Business liability insurance Car insurance and licence Oil changes Tires Depreciation b. Monthly fixed costs consist of: Cell phone = $80.00/month Advertising = $75.00/month Sarah’s wages = $1500.00/month Business licence = $150/12 = $12.50/month Car insurance and licence = $1500/12 = $125.00/month Business liability insurance = $600/12 = $50.00/month Therefore: Total monthly fixed costs = $80.00 + $75.00 + $1500.00 + $12.50 + $125.00 + $50.00 = $1842.50/month Variable costs are: Cleaning supplies = $10.00/home Friend’s wages = $30.00/home $75.00 Fuel = 10 km $1.50/home 500 km $50.00 Oil changes = 10 km $0.10/home 5000 km $500.00 10 km $0.05/home Tires = 100,000 km $150.00 Depreciation = 10 km $1.50/home 1000 km Therefore: Total variable cost per home = $10.00 + $30.00 + $1.50 + $0.10 + $0.05 + $1.50 = $43.15/home Chapter 5: Cost-Volume-Profit Analysis 121 Exercise 5.1 (continued) Intermediate Problems 5. Last year: X = 580,000 units Total costs were $3,710,000, of which $3,335,000 were variable costs. Since: Then: TC = Total Variable Costs + Total Fixed Costs $3,710,000 = $3,335,000 + FC FC= $3,710,000 – $3,335,000 = $375,000 And: Total Variable Costs = VC (X) $3,335,000 = VC (580,000) VC = $3,335,000/580,000 = $5.75 per unit To produce X = 650,000 units next year, TC = (VC)X + FC TC = $5.75(650,000) + $375,000 TC = $4,112,500 7. Total variable costs to produce 10,000 units was ($50.4 + $93 + $16 + $14.2) million = $173,600,000 Total fixed costs = ($22.2 + 19.2 + $9.6 + $5) million = $56,000,000 To produce 9700 units, 9700 $173,600,000 = $168,392,000 Total variable costs = 10,000 and Total costs = ($56 + $168.392) million = $224,392,000 122 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.2 Basic Problems 1. Given: S = $30; VC = $10; FC = $100,000 per year a. TR = (S)X = $30X TC = (VC)X + FC = $10X + $100,000 To break even, TR = TC Then, $30X = $10X + $100,000 $20X = $100,000 X = 5000 toys per year b. Break-even revenue = (S)X = $30(5000) = $150,000 per year 3. Given: S = $3.20; VC = $1.20; FC = $250 per month a. FC = 12($250) = $3000 per year TR = (S)X = $3.20X TC = (VC)X + FC = $1.20X + $3000 To break even, TR = TC Then, $3.20X = $1.20X + $3000 $2.00X = $3000 X = 1500 jars per year b. If Ingrid sells 3000 jars per year, NI = (S – VC)X – FC = ($3.20 – $1.20)3000 – $3000 = $3000 Chapter 5: Cost-Volume-Profit Analysis 123 Exercise 5.2 (continued) 5.Given: Capacity = 250 units per week S = $20, VC = $12, FC = $1200 per week a. TR = (S)X = $20X TC = (VC)X + FC = $12X + $1200 To break even, TR = TC Therefore, $20X = $12X + $1200 X = 150 units/week b. NI = TR – TC = $20X – $12X – $1200 = $8X – $1200 (i) If X = 120 units/week, then NI = $8(120) – $1200 = –$240 There will be a loss of $240/week. (ii) If X = 250 units/week, then NI = $8(250) – $1200 = $800/week profit. c. If NI = $400/week, then 400 = $8X – $1200 $1600 = $8X X = 200 units/week 124 Fundamentals of Business Mathematics in Canada, 2/e Intermediate Problems 7. Given: S = 10¢ per copy; FC = $300 per month; $5.00 $100.00 + $0.005 = $0.05 per copy 500 5000 a. TR = (S)X = $0.10X TC = (VC)X + FC = $0.05X + $300 To break even, TR = TC Then, $0.10X = $0.05X + $300 $0.05X = $300 X = 6000 copies per month b. If X = 6000 + 1000 = 7000 copies per month. NI = (S – VC)X – FC = ($0.10 $0.05)7000 – $300 = $50 per month The additional 1000 copies add $50 per month profit. VC = $0.015 + 9. Given: FC = $450,000 per year; S = $25; VC = $15. a. At the break-even point, NI = 0 = (S – VC)X – FC 0 = ($25 – $15) X – $450,000 $450,000 X 45,000 units per year $10 As a percentage of capacity, 45,000 units per year is 45,000 100 75%. 60,000 b. Annual revenue at breakeven = 45,000($25) = $1,125,000 per year c. (i) (ii) (iii) NI = (S – VC)X – FC = ($25 – $15)50,000 – $450,000 = $50,000 profit Since VC = $$15 25 = 0.60 of S, NI = TR – TC = $1,000,000 – 0.60($1,000,000) – $450,000 = –$50,000 That is, a $50,000 loss. 90% of capacity represents 0.90 x 60,000 units = 54,000 units TR = $25 x 54,000 units = $1,350,000 NI = TR – TC = $1,350,000 – $15(54,000) – $450,000 = $90,000 That is, a $90,000 profit. d. For NI = –$20,000 = (S – VC)X – FC –$20,000 = ($25 – $15)X –$450,000 $430,000 X 43,000 units per year $10 e. If S and FC are unchanged, but VC increases by $1 to $16, NI = 0 =($25 – $16)X –$450,000 $450,000 X 50,000 units per year at breakeven $9 Therefore, the break-even volume increases by 50,000 – 45,000 = 5000 units and the break-even revenue increases by $25(5000) = $125,000. Chapter 5: Cost-Volume-Profit Analysis 125 $6,000,000 1 of total revenue, $18,000,000 3 FC = $10,000,000 per year $18,000,000 At full capacity, Sales revenue = = $20,000,000 0.90 a. At the break-even point, TR – TC = 0 That is, TR – 31 TR – $10,000,000 = 0 11. Given: Total variable costs are 2 3 TR = $10,000,000 TR = $15,000,000 $15,000,000 $100% = 75% of capacity $20,000,000 b. At 70% of capacity, TR = 0.70($20,000,000) = $14,000,000 NI = TR – TC = $14,000,000 – 31 ($14,000,000) – $10,000,000 = –$666,667 That is, Beta would have a $666,667 loss. which is 126 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.2 (continued) 13. Given: S = $180/tonne, VC = $42 + $24 = $66 per tonne, FC = $400 + $600 + $450 = $1450 per hectare a. To break even, FC $1450 X= = = 12.719 tonnes per hectare $ 180 $66 S VC b. (i) NI = (S – VC)X – FC = ($180 – $66)15 – $1450 = $260 per hectare. (ii) NI = ($180 – $66)10 – $1450 = –$310.00 per hectare. That is, a loss of $310 per hectare. c. If S = $190 per tonne instead of $180 per tonne, $1450 X= = 11.694 tonnes per hectare $190 $66 The break-even tonnage will be 11.694 tonnes per hectare. Advanced Problems 15. Given: S = $270, VC = $220, FC = $1400 for 15 to 36 participants a. To break even, FC $1400 X= = = 28 participants $270 $220 S VC b. If X = 36, then NI = (S – VC)X – FC = ($270 – $220)36 – $1400 = $400 c. If a loss of $400 is incurred, –$400 = ($270 – $220) X – $1400 X = 20 Hence, the minimum number of participants is 20. Chapter 5: Cost-Volume-Profit Analysis 127 Exercise 5.2 (continued) 17. Given: S = $37.50, VC = $13.25, FC = $5600/month FC $5600 a. Last year’s break-even volume = = = 231 units/month $37.50 $13.25 S VC This year, VC = $15, FC = $6000/month. For the break-even volume to remain 231 units/month, FC S – VC = Break - even volume $6000 S – $15 = = $25.97 231 S = $15 + $25.97 = $40.97 b. Last year’s NI = (S – VC)X – FC = ($37.50 – $13.25)300 – $5600 = $1675.00. In order that this year's profit also be $1675/month on sales of 300 units/month, $1675 = 300(S – $15) – $6000 $7675 S= + $15 = $40.58 300 19. Given: NI = –$400,000; TR = $3 million/year at 60% of capacity; Total variable costs = ⅓TR . a. First calculate FC. Since NI = TR – TC, then –$400,000 = $3,000,000 – ⅓($3,000,000) – FC FC = $2,000,000 + $400,000 = $2,400,000 At breakeven, NI = 0 = TR – TC Hence, 0 = TR – ⅓ TR – $2,400,000 ⅔TR = $2,400,000 TR = $3,600,000 Since sales of $3 million/year represented 60% of capacity, $3,000,000 Full capacity = = $5,000,000 0.60 $3,600,000 100%= 72% % of capacity at breakeven = $5,000,000 . b. At 80% capacity, TR = 0.80($5,000,000) = $4,000,000 NI = TR – ⅓ TR – $2,400,000 = $4,000,000 – ⅓($4,000,000) – $2,400,000 = $266,667 c. For NI = $700,000, $700,000 = TR – ⅓TR – $2,400,000 ⅔TR = $3,100,000 TR = $4,650,000 d. One-third of each dollar of sales is consumed by variable costs. Therefore, the increase in NI is $0.67. e. At breakeven, NI = 0 = TR – ⅓ TR – FC ⅔TR = FC TR = 3 2 FC Therefore, if FC increases by $1.00, TR must increase by $1.50 to still break even. 128 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.2 (continued) 21. Given: In the first quarter (Q1), TR = $4,500,000; NI = $900,000; X = 60,000 tires. In the second quarter (Q2), NI = $700,000; X = 50,000 tires. TR $4,500,000 S Since TR = (S)X, then = $75 per tire X 60,000 Also, TR = $75 50,000 = $3,750,000 in Q2. Since NI = (S – VC)X – FC then for Q1, $900,000 = (S – VC)60,000 FC and for Q2, $700,000 = (S – VC)50,000 FC Subtract: $200,000 = (S – VC)10,000 VC = S – $20 = $75 – $20 = $55 per tire Substitute S – VC = $20 into : $700,000 = ($20)50,000 FC Therefore, FC = $1,000,000 $700,000 = $300,000 per quarter Chapter 5: Cost-Volume-Profit Analysis 129 Exercise 5.3 Intermediate Problems 1. Given: S = $2.50 per package; VC = $1.00 per package; FC = $60,000 per month. 150000 TR = (S)X = $2.50X TC = (VC)X + FC = $1.00X + $60,000 X: 20,000 60,000 TR: $50,000 $150,000 TC: $80,000 $120,000 TR,TC ($) 140000 Total Revenue, TR 130000 120000 110000 $7500 Total Cost, TC 100000 90000 a. 40,000 pkgs/month 80000 b. 45,000 pkgs/month 70000 60000 (b) (a) X 50000 20000 25000 30000 35000 40000 45000 50000 55000 60000 Packages per Month 130 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.3 (continued) 3. Given: S = $10 per bag; VC = $7.50 per bag; FC = $100,000 per year. TR = (S)X = $10X TC = (VC)X + FC = $7.5X + $100,000 65,000 X: 20,000 $200,000 $587,500 TR: TC: $250,000 $650,000 a. b. c. d. 40,000 bags/year $50,000 64,000 bags/year 36,000 bags/year 650000 TR,TC ($) 600000 (b) $50,000 profit 550000 Total Revenue, TR 500000 450000 400000 Total Cost, TC 350000 300000 (a) 250000 200000 20000 X 25000 30000 35000 40000 45000 50000 55000 60000 65000 Bags per Year Chapter 5: Cost-Volume-Profit Analysis 131 Exercise 5.3 (continued) 5. Given: S = $0.10 per copy; FC = $300 per month; VC = $0.015 + $5.00 $100.00 +$0.005 = $0.05 per copy 500 5000 TR = (S)X = $0.10X TC = (VC)X + FC = $0.05X + $300 800 4000 $400 $500 650 X: TR: TC: 8000 $800 $700 TR,TC ($) Total Revenue, TR 750 700 (b) $50 profit Total Cost, TC 600 550 a. 6000 copies/month 500 b. $50 per month 450 400 4000 (a) X 4500 5000 5500 6000 6500 7000 7500 Copies per month 132 Fundamentals of Business Mathematics in Canada, 2/e 8000 Exercise 5.4 Basic Problems 1. Given: S = $30; VC = $10; FC = $100,000 per year a. Each toy sold contributes CM = S – VC = $30 – $10 = $20 to the payment of fixed costs. To cover $100,000 of fixed costs (and break even), Toys-4-U needs to sell FC $100,000 per year = 5000 toys per year CM $20 b. Break-even revenue = 5000($30) = $150,000 per year 3. Given: S = $3.20; VC = $1.20; FC = $250 per month a. FC = 12($250) = $3000 per year Each jar sold contributes CM = S – VC = $3.20 – $1.20 = $2.00 to the payment of fixed costs. To cover $3000 of fixed costs (and break even), Ingrid must sell FC $3000 per year = 1500 jars per year CM $2.00 b. If Ingrid sells 3000 jars per year, this sales level is 1500 jars above break-even. Each of these jars contributes CM = $2.00 to profit. Total profit = 1500($2.00) = $3000 5. Given: Capacity = 250 units per week a. S = $20, VC = $12, FC = $1200 per week CM = S – VC = $20 – $12 = $8.00 FC $1200 Break-even volume = = = 150 units per week $8 CM b. (i) At 30 units per week short of breakeven, there will be a loss of X(CM) = 30($8) = $240/week. (ii) At 100 units per week above breakeven, there will be a profit of 100($8) = $800/week. c. For a net income of $400/week, sales must be NI $400 = = 50 units above breakeven $8 CM Hence, sales must be 150 + 50 = 200 units per week. Chapter 5: Cost-Volume-Profit Analysis 133 Intermediate Problems 7. Given: S = 10¢ per copy; FC = $300 per month; $5.00 $100.00 VC = 1.5¢ + + 0.5¢ = 5¢ per copy 500 5000 a. CM = S – VC = 10¢ – 5¢ = 5¢ per copy FC $300 Break-even volume = = = 6000 copies per month $0.05 CM b. Each additional 1000 copies per month will add profit of 1000CM = 1000($0.05) = $50 per month 9. Given: FC = $450,000/year, VC = $15, S = $25 a. CM = S – VC = $25 – $15 = $10 FC $450,000 Break-even volume = = = 45,000 units per year $10 CM 45,000 100% = 75% Break-even volume as a percentage of capacity = 60,000 b. From Part (a), we found that break-even volume = 45,000 units per year. Hence, annual revenue required to break even = 45,000($25) = $1,125,000 c. (i) If sales exceed breakeven by 5000 units, NI = 5000(CM) = 5000($25 – $15) = $50,000 (ii) The break-even revenue is $1,125,000. In this instance, the actual $125,000 revenue is $125,000 below break even, or 5000 units below $25 breakeven. When sales are 5000 units below breakeven, then NI = -5000(CM) = -5000($25 – $15) = -$50,000 = $50,000 loss (iii) The break-even revenue is $1,125,000. In this instance, the actual revenue is 0.90 x 60,000 x $25 = $1,350,000, which is $225,000 above break $225,000 9000 units more than even. At this sales level, the company is selling $25 the breakeven level. The profit will be: NI = 9000(CM) = 9000($25 – $15) = $90,000 d. If the loss is $20,000, sales will be $20,000 $20,000 = = 2000 units below breakeven. $10 CM That is, annual sales will be 45,000 – 2000 = 43,000 units. e. S and FC are unchanged, but VC increases by $1 to $16.00. The CM drops $1 to $9 and $450,000 Break-even volume = = 50,000 units $9 The break-even unit sales increases by 5000 units and the break-even revenue by 5000($25) = $125,000. 134 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.4 (continued) 11. a. Since the budget projects total variable costs of $6,000,000 for total sales of $6,000,000 0.33 or 33.3 cents of $18,000,000, we know that variable costs are $18,000,000 every sales dollar. Since we do not know SP, let us use SP = $1.00. Then VC = $ 0.33 and CM = $1.00 - $ 0.33 =$ 0.66 . $10,000,000 FC 15,000,000 “units” per year. Since we set Break-even volume = = CM $0.66 SP = $1, then this is really $15,000,000 of sales revenue per year. If revenue of $18,000,000 represents 90% of capacity, then 100% Revenue at full capacity = $18,000,00 0 $20,000,00 0 90% $15,000,00 0 100% = 75% of capacity and break-even revenue represents $20,000,00 0 b. At 70% of capacity, Revenue = 0.70($20,000,000) = $14,000,000 In part (a) we determined that variable costs are 33.3 % of every sales dollar. Therefore, in this instance, Total variable costs = $14,000,000 0.33 = $4,666,667 Net income = $14,000,000 – $10,000,000 – $4,666,667 = –$666,667 That is, Beta would lose $666,667. 13. Given: S = $180/tonne, VC = $42 + $24 = $66 per tonne, FC = $400 + $600 + $450 = $1450 per hectare a. CM = S – VC = $180 – $66 = $114 per tonne FC $1450 Break-even yield = = = 12.719 tonnes/hectare $114 CM b. (i) If X = 15 tonnes/hectare (which is 2.281 tonnes/hectare above breakeven), NI = 2.281(CM) = 2.281 ($114) $260 per hectare profit. (ii) If X = 10 tonnes/hectare (which is 2.719 tonnes/hectare below breakeven), the loss will be 2.719($114) $310 per hectare loss. c. If S = $190 per tonne, then CM = $124 per tonne and $1450 per hectare Break-even yield = = 11.694 tonnes/hectare $124 per tonne Chapter 5: Cost-Volume-Profit Analysis 135 Advanced Problems 15. Given: S = $270, VC = $220, FC = $1400 for 15 to 36 participants a. CM = S – VC = $270 – $220 = $50 FC $1400 To break even, X = = = 28 participants $50 CM b. If X = 36 (which is 8 participants above breakeven), then NI = 8(CM) = 8($50) = $400 c. A loss of $400 will be incurred if there are NI $400 = = 8 fewer participants than breakeven $50 CM Hence, the minimum number of participants is 28 – 8 = 20. 17. Given: S = $37.50, VC = $13.25, FC = $5600/month a. Last year's CM = S – VC = $37.50 – $13.25 = $24.25 FC $5600 Last year’s break-even volume = = = 231 units/month $ 24 .25 CM This year, VC = $15, FC = $6000/month. For the break-even volume to still be 231 units/month, $6000 FC CM = = = $25.97 and 231 Break - even volume S = VC + CM = $15 + $25.97 = $40.97 b. Last year’s NI = (CM)X – FC = ($24.25)300 – $5600 = $1675.00. In order that this year's profit also be $1675/month on sales of 300 units/month, $1675 = 300CM – $6000 $7675 CM = = $25.58 300 and S = CM + VC = $25.58 + $15 = $40.58 136 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.4 (continued) 19. Given: NI = –$400,000 on sales of $3 million/year; Utilization = 60% of capacity; Variable costs = 33.3% of sales. a. Variable costs are 33.3% of sales. If we set SP = $1, VC = $0.33 and CM = $1 - $0.33 $0.66. FC = Sales – Variable costs – NI = $3 million – 0.33 ($3 million) – (– $400,000) = $2,400,000 $2,400,000 FC Break-even volume = = = 3,600,000 “units”. Since we set SP = $1, CM $0.66 then the break-even level of revenue is $3,600,000. Since sales of $3 million/year represented 60% of capacity, $3 million 60% of capacity $3.6 million % of capacity at break even % of capacity at breakeven = b. Sales at 80% capacity = 80 60 3.6 3 60% = 72% $3 million = $4,000,000 which is $400,000 above breakeven. If we assume SP = $1, then 80% of capacity represents 400,000 “units” above the break-even level. NI = CM(400,000) = ($0.66)(400,000 $266,667 c. In order that NI = $700,000, $700,000 NI = 3,600,000 + = 4,650,000 CM $0.66 “units”. Since we set SP = $1, sales revenue of $4,650,000 is required to generate a net income of $700,000. Sales volume = Break-even sales volume + d. The CM gives us this figure directly. That is, CM = $ 0.66 means that net income increases by 66.6 ¢ for each $1 of sales (above break even). $1 FC $1.50 more sales to cover it. e. Each $1 of FC requires CM $0.66 Chapter 5: Cost-Volume-Profit Analysis 137 Exercise 5.4 (continued) 21. Given: In the first quarter (Q1), TR = $4,500,000; NI = $900,000; X = 60,000 tires. In the second quarter (Q2), NI = $700,000; X = 50,000 tires. TR $4,500,000 Since TR = (S)X, then S = $75 per tire selling price X 60,000 Also, TR = $75 50,000 = $3,750,000 in Q2. Since NI = (CM)X – FC then for Q1, $900,000 = (CM)60,000 FC and for Q2, $700,000 = (CM)50,000 FC Subtract: $200,000 = (CM)10,000 $200,000 CM = $20 per tire 10,000 Substitute CM = $20 into : $700,000 = ($20)50,000 FC Therefore, FC = $1,000,000 $700,000 = $300,000 per quarter Since then CM = S VC VC = S CM = $75 $20 = $55 per tire Checkpoint Questions (Exercise 5.5) 1. a. False. A fixed cost can, at some point, change. What makes it is a fixed cost, however, is the fact that the cost is changing for a reason other than a change in sales volume. For example, rent is a fixed cost. At the renewal of a rental agreement, the rent may increase. However, rent is still a fixed cost because its total value does not change based on changes in sales. b. False. “Total revenue” is the total dollar value of sales for a given period. “Net income” is the difference between total revenue and total expenses for a given period. c. True d. True e. False. All else being equal, lower fixed costs will result in a lower break-even point. 3. At the break-even point, all fixed costs and all variable costs are covered and NI = 0. Production beyond the break-even point results in additional variable costs. Therefore, only the difference between additional revenue ($1) and additional variable costs [$1 (1 – CR)] contributes to net income. 138 Fundamentals of Business Mathematics in Canada, 2/e Exercise 5.5 Basic Problems 1. Given: S = $25.00, VC = $5.00, FC = $680/month a. CM = S – VC = $25.00 – $5.00 = $20.00 per lawn CR = CM $20.00 100% = 80% x100% = $25.00 S b. Break-even Revenue = FC $680 = = $850 per month 0.80 CR c. Since TR= S(X), and break-even revenue is $850/month, then: $850 = $25(X) $850 X= 34 lawns per month to break even $25 Intermediate Problems 3. a. Step 1: Calculate Beta Inc.’s anticipated contribution rate, CR. Total revenue- Total variablecosts CR = x100% Total revenue CR = $18,000,000 $6,000,000 x100% $18,000,000 CR = 66.6% Step 2: Calculate Beta Inc.’s break-even revenue level of annual revenue. FC $10,000,000 Break-even Revenue = = = $15,000,000 per year CR 0.66 Step 3: Calculate Beta Inc’s capacity and the percentage of capacity represented by break-even sales of $15,000,000 per year Since the forecasted $18,000,000 of sales represents 90% of capacity, then $18,000,000 = 0.90(Capacity) $18,000,000 Capacity = = $20,000,000 of annual revenue 0.90 The break-even level of revenue, $15,000,000 per year, represents $15,000,000 100% 75% of capacity $20,000,000 b. Since Beta’s capacity was calculated to be $20,000,000 of revenue per year, when Beta operates at 70% of capacity, total revenue would be 0.70($20,000,000) = $14,000,000 Chapter 5: Cost-Volume-Profit Analysis 139 In part a, Beta’s break-even level of revenue was calculated to be $15,000,000 per year. Therefore, annual sales of $14,000,000 are $1,000,000 below the break-even level. Since CR is 66.66%, then sales of $1,000,000 below break even will generate a $1,000,000 $0.66 $666,666.67 loss. Exercise 5.5 (continued) Advanced Problems 5. a. Step 1: Calculate Greenwood Corp.’s contribution rate, CR. Total revenue- Total variablecosts CR = x100% Total revenue CR = $1,200,000 $600,000 x100% $1,200,000 CR = 50% Step 2: Calculate Greenwood Corporation’s break-even revenue level of annual revenue. FC $400,000 Break-even Revenue = = = $800,000 per year 0.50 CR b. In the past year TR = $1,200,000, FC = $400,000, and TVC = $600,000. Therefore, net income in the past year was NI = TR – FC – TVC NI = $1,200,000 – $400,000 – $600,000 NI = $200,000 in the past year If sales increase by 15%, the new total revenue will be 1.15($1,200,000) = $1,380,000. This new sales level is $1,380,000 - $800,000 = $580,000 beyond the break-even level of revenue. Since CR = 0.50, 50 cents from every dollar of sales beyond the break-even level contributes toward net income or profit. Therefore, the new level of net income will be $580,000 x 0.50 = $290,000, an increase of $290,000 - $200,000 = $90,000 increase in net income. c. If fixed costs are 10% lower in the year ahead, then FC = 0.90($400,000) = $360,000. Since sales remain unchanged at $1,200,000 and variable costs remain at $600,000, then: NI = TR – FC – TVC NI = $1,200,000 – $360,000 – $600,000 NI = $240,000 Since net income in the past year was $200,000, the reduction in fixed costs in the year ahead would result in a $240,000 - $200,000 = $40,000 increase in net income. 140 Fundamentals of Business Mathematics in Canada, 2/e d. If variable costs are 10% higher in the year ahead, then total variable costs will be 1.1($600,000) = $660,000. Since sales remain unchanged at $1,200,000 and fixed costs remain unchanged at $400,000, then: NI = TR – FC – TVC NI = $1,200,000 – $400,000 – $660,000 NI = $140,000 Since net income in the past year was $200,000, the increase in variable costs in the year ahead would result in a $200,000 – $140,000 = $60,000 reduction in net income. Review Problems Basic Problems 1. a. The amount of sugar used will grow or decline in proportion to sales. Therefore, sugar is a variable cost. b. The cost of weekly newspaper advertisement will not change if sales increase or decrease. Therefore, weekly newspaper advertisement is a fixed cost. c. The cost of the lease for a delivery vehicle will typically be a set amount per month, and will not change if sales increase or decrease. Therefore, lease costs for a delivery vehicle is an example of a fixed cost. d. The number of cake boxes used will grow or decline in proportion to sales. Therefore, cake boxes are a variable cost. 3. Given: S = $40; X = 384; TC= $4848; FC = $3600 per year a. TC = (VC)X + FC $4848 = (VC)384 + $3600 $4848 – $3600 =(VC)384 $1248 VC = = $3.25 per dog 384 b. In a year in which Sabine groomed 500 dogs, TC = (VC)X + FC = $3.25(500)+$3600 = $5225 Chapter 5: Cost-Volume-Profit Analysis 141 Review Problems (continued) 5. Given: S = $180; VC = $110; FC = $1,260,000 per year a. TR = (S)X = $180X TC = (VC)X + FC = $110X + $1,260,000 To break even, TR = TC Then, $180X = $110X + $1,260,000 $70X = $1,260,000 X = 18,000 units b. Break-even sales revenue = (S)X = $180(18,000) = $3,240,000 c. If X = 20,000 units are sold, NI = (S – VC)X – FC = ($180 – $110)20,000 – $1,260,000 = $140,000 That is, the company will have a profit of $140,000. If X = 17,500 units are sold, NI = (S – VC)X – FC = ($180 – $110)17,500 – $1,260,000 = –$35,000 That is, the company will suffer a loss of $35,000. 142 Fundamentals of Business Mathematics in Canada, 2/e Review Problems (continued) 7. Given: S = $155; VC = $65; FC = $18,000 per month a. TR = (S)X = $155X TC = (VC)X + FC = $65X + $18,000 To break even, TR = TC Then, $155X = $65X + $18,000 $90X = $18,000 X = 200 seats per month = 2400 seats per year b. If X = 2000 seats per year, NI = (S – VC)X – FC = ($155 – $65)2000 – 12($18,000) = $180,000 – $216,000 = – $36,000 That is, ChildCare will have a loss of $36,000. Intermediate Problems 9. Given: FC = $45,000 + $7000 + $8000 = $60,000; VC = $8.00 + 0.08($35) = $10.80; S = $35.00 FC $60,000 a. Break-even volume = = = 2479 books $35.00 $10.80 S VC b. NI = (S – VC)X – FC = ($35.00 – $10.80)4800 – $60,000 = $56,160 c. If the price is reduced 10%, S = $35(1 – 0.10) = $31.50 and if sales are 15% higher, X = 4800(1 + 0.15) = 5520 units Note that a reduction in selling price changes VC because the 8% royalty will be a smaller dollar value. At the new S = $31.50, the new VC = $8.00 + 0.08($31.50) = $10.52. Then NI = ($31.50 – $10.52)5520 – $60,000 = $55,809.60 Select the $35 price because (forecast) net income will be larger (by about $350). d. If FC = $65,000 and VC = $11.80, then FC $65,000 Break-even volume = = = 2802 books $35.00 $11.80 S VC That is, the break-even volume would be increased by 2802 – 2479 = 323 books Chapter 5: Cost-Volume-Profit Analysis 143 11. Given: S = $100, FC = $200,000, VC = $60 Forecast X = 8000 units a. CM = S – VC = $100 – $60 = $40 FC $200,000 Break-even volume = = = 5000 units $40 CM b. Volume = Break-even volume + NI $100,000 = 5000 + = 7500 units $40 CM c. If sales are 8000 – 5000 = 3000 units above breakeven, then NI = 3000(CM) = 3000($40) = $120,000 d. (i) (ii) e. (i) f. NI = (CM)X – FC = 8000(CM) – FC For each $1 increase in FC, NI will drop $1. If FC is 5% (or $10,000) higher, NI will be $10,000 lower. If FC is 10% (or $20,000) lower, NI will be $20,000 higher. If VC is 10% (or $6) higher, then CM = S – VC = $100 – $66 = $34, and NI = 8000(CM) – FC = 8000($34) – $200,000 = $72,000 That is, NI will be $120,000 – $72,000 = $48,000 lower. (ii) If VC is 5% (or $3) lower, then CM = $100 – $57 = $43 and NI = 8000($43) – $200,000 = $144,000 That is, NI will be $144,000 – $120,000 = $24,000 higher. Note the “leverage” effect here. That is, (% change in NI) = – 4(% change in VC) (i) If S is 5% (or $5) higher, then CM = $105 – $60 = $45, and NI = 8000($45) – $200,000 = $160,000 That is, NI will be $160,000 – $120,000 = $40,000 higher. (ii) If S is 10% (or $10) lower, then CM = $90 – $60 = $30 and NI = 8000($30) – $200,000 = $40,000 That is, NI will be $120,000 – $40,000 = $80,000 lower. Note the “leverage” effect here. That is, % change in NI = 6. 6 (% change in S) (assuming that the sales volume does not change). g. If X = 8000, VC = 1.1($60) = $66. S = $100, and FC = 0.9($200,000) = $180,000, then CM = $100 – $66 = $34 and NI = 8000($34) – $180,000 = $92,000 That is, NI will be $120,000 – $92,000 = $28,000 lower. 144 Fundamentals of Business Mathematics in Canada, 2/e Advanced Problems 13. Given: S = $10 (= Average revenue per person)). Plan 1: VC = (0.1 + 0.3)S = $4, FC = $15,000 Plan 2: VC = (0.1 + 0.5)S = $6, FC = $10,000 a. CM = S – VC: Break-even point = FC : CM Plan 1 $10 – $4 = $6 $15,000 = 2500 $6 Plan 2 $10 – $6 = $4 $10,000 = 2500 $4 b. (i) At X = 3000, NI: 500($6) = $3000 500($4) = $2000 (ii) At X = 2200, NI: –300($6) = –$1800 (loss of $1800) –300($4) = –$1200 (loss of $1200) c. If attendance surpasses the break-even point, the 30% commission rate generates the higher profit. However, if attendance falls short of the 2500 break-even point, the 30% commission will produce the larger loss. Chapter 5: Cost-Volume-Profit Analysis 145