Team___________________________ Member(s

advertisement

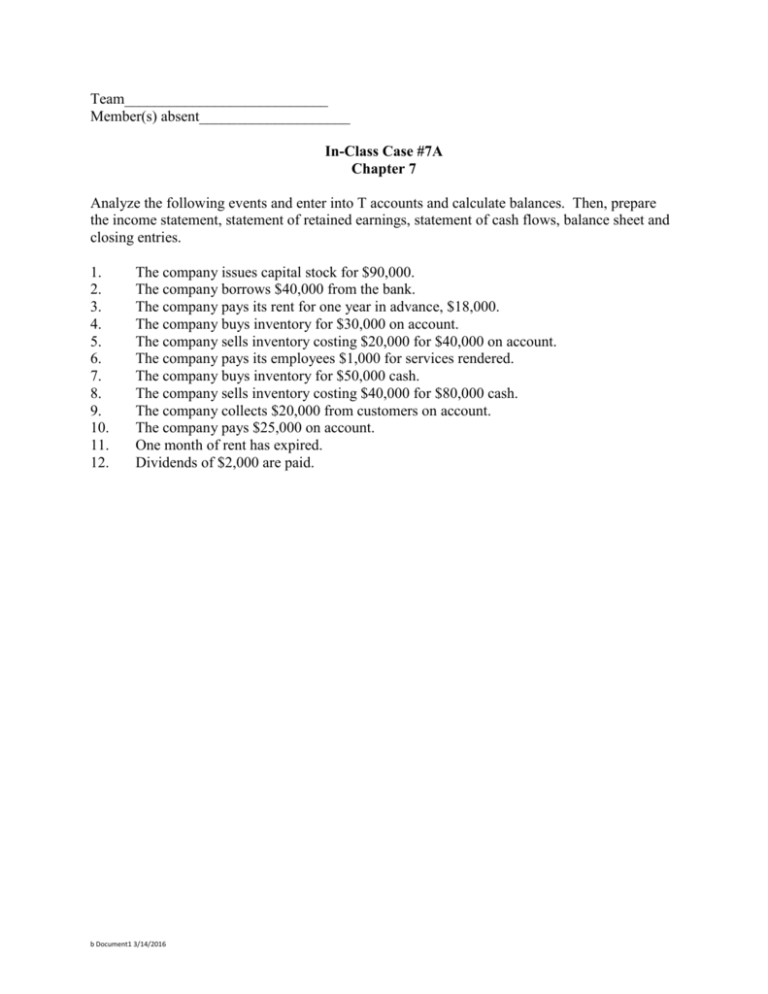

Team___________________________ Member(s) absent____________________ In-Class Case #7A Chapter 7 Analyze the following events and enter into T accounts and calculate balances. Then, prepare the income statement, statement of retained earnings, statement of cash flows, balance sheet and closing entries. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. The company issues capital stock for $90,000. The company borrows $40,000 from the bank. The company pays its rent for one year in advance, $18,000. The company buys inventory for $30,000 on account. The company sells inventory costing $20,000 for $40,000 on account. The company pays its employees $1,000 for services rendered. The company buys inventory for $50,000 cash. The company sells inventory costing $40,000 for $80,000 cash. The company collects $20,000 from customers on account. The company pays $25,000 on account. One month of rent has expired. Dividends of $2,000 are paid. b Document1 3/14/2016 Team ________________________ Member(s) absent ______________ In-Class Case #8A Chapter 8 Jones Company, a manufacturing firm, experienced the following inventory activity during the period: Day 1 Day 5 Day 10 Day 15 Day 18 Day 31 Purchased $9,000 of inventory from Edward Company, terms 2/10, n/30. Paid $500 freight on the purchase from Edward Company. Paid for the inventory purchased from Edward Company. Purchased $14,000 of inventory from Smith Company, terms n/60. Purchased $7,000 of inventory from Doe Company, terms 1/10, n/30 Paid for the purchase from Doe Company. Required: 1. 2. 3. 4. 5. Record these events using the gross price method and the periodic inventory system. Record these events using the gross price method and the perpetual inventory system. Record these events using the net price method and the periodic inventory system. Record these events using the net price method and the perpetual inventory system. Compare the ending inventory resulting under requirement #2 to that of requirement #4. b Document1 3/14/2016