Now!

advertisement

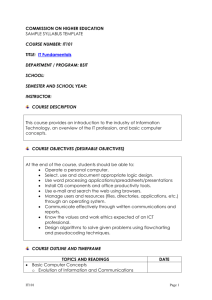

By: Oluseyi Olanrewaju HND, BSc, MBA, MSc, AMNIM, M.IoD, FCCM, FCTI, FCCA, FCA Finance Expert – IS InternetSolutions Limited, Lagos & Executive Director – Risk Free Standard Associates Limited, Lagos Overview of ICT Overview of Financial Reporting Handshake between ICT and Financial Reporting Finance Expert and the Future of Financial Reporting Finance Expert Functions and Fundamental Principles Closing Remarks ICT (information and communications technology - or technologies) is an umbrella term that includes any communication device or application, encompassing: radio, television, cellular phones, computer and network hardware and software, satellite systems and so on, as well as the various services and applications associated with them, such as videoconferencing and distance learning. In our fast-growing global information society, technology has had a profound effect on every aspect of society and each individual's life. Importantly two distinct technologies: information technology (IT) and communications technology (CT) have gradually become integrated to form a new technology – ICT (information communications technology). Coupled with the huge success and popularity of the Internet, society has now indisputably entered the era of ICT. Largely consultative approach to industry regulation; the Nigerian data services market is in the most part self-regulating and most changes to regulation or Nigerian Communications Commission (NCC) intervention is targeted at the mobile market 30MHz of 2.3GHz spectrum currently under public auction with a reserved price of $23m (NGN3.7bn) for ten years (excludes a once off $2.3m universal access licence) was recently awarded; the NCC plans a further auction of 5.4GHz spectrum for broadband penetration in 2014 – this particular spectrum will support an SME play for competitors Technology continues to profoundly affect the way we: Work Collaborate Communicate Play Learn Socialize Succeed in almost every arena CLOUD OFFERINGS - outsourcing BIG DATA Etc. Financial reporting is presenting financial data of a company's operating performance, position and cash flow for an accounting period. Financial statements alongside related information/documents may be contained in various forms mainly for external party use such as in the annual report. It is basically financial information that companies give about their activities, including how they prepare and show it. The International Accounting Standards Committee (IASC), now called IFRS Foundation, formed in 1973, was the first international standards-setting body. It was reorganized in 2001 and became an independent international standard setter, the International Accounting Standards Board (IASB). Since then, the use of international standards has progressed rapidly. As of 2012, the European Union and over 120 other countries either require or permit the use of International Financial Reporting Standards (IFRSs) issued by the IASB. International Financial Reporting Standards were first adopted in 2005 in many countries around the world. A Road map committee was inaugurated on October 22, 2009. The Road Map committee’s report was submitted January 26, 2010. Government took a decision on July 28, 2010 to adopt IFRS effective January 1, 2012 following the approval of the committee report. Financial Reporting Council of Nigeria Act (FRCN Act) was signed into law in 2011. Nigerian Accounting Standard Board Act (NASB Act) was repelled by the new Act FRCN members are now 19 ( 5 members were added to the 14 member under NASB) Monthly, Quarterly and Annual Reports Understand financial performance SOCI, SOFP & SOCF Careful analysis of analysis to guarantee accuracy Creating value as a Finance Expert Make financing, investing and dividend decisions Sustainability Reporting A sustainability report is an organizational report that gives information about economic, environmental, social and governance performance. Sustainability reporting is not just report generation of collected data it is a method to internalize and improve an organization’s commitment to sustainable development in a way that can be demonstrated to both internal and external stakeholders. Organizations must ensure a robust system for sustainability management and reporting with regard to: Transparency Traceability Compliance Integrated Reporting Integrated reporting is a "process that results in communication, most visibly a periodic “integrated report”, about value creation over time. An integrated report is a concise communication about how an organization’s strategy, governance, performance and prospects lead to the creation of value over the short, medium and long term. It means the integrated representation of a company’s performance in terms of both financial and other value relevant information. Integrated Reporting provides greater context for performance data, clarifies how value relevant information fits into operations or a business, and may help embed long-termism into company decision making. While the communications that result from IR will be of benefit to a range of stakeholders, they are principally aimed at providers of financial capital allocation decisions. Over the years, ICT & FR have come to be Siamese twin. Financial Reporting are done predominately using ICT tools. It is obvious that the biggest impact of Information and Communication Technology (ICT) has been made on accounting; and it is the ability of companies to develop and use computerized system to track and record financial transactions properly and accurately. The recording of business transaction manually on ledgers, papers, spread sheets etc has been translated and computerized for quick and easy presentation of individual financial transaction and give report on it. (Granlund & Mouritsen, 2003). ICT adds values to Financial Reporting in the area of Cloud Accounting, Forensic Accounting, Carbon Finance etc. Modern Function Business Partner Traditional Function Diligent Caretaker Commentator ScoreKeeper 14 Today’s Finance Experts are expected to play four diverse and challenging roles. The two traditional roles are steward, preserving the assets of the organisation by minimising risk and getting the books right, and operator, running a tight finance operation that is efficient and effective. It’s increasingly important for Finance Experts to be strategists, helping to shape overall strategy and direction, and catalysts, instilling a financial approach and mind set throughout the organization to help other parts of the business perform better. These varied roles make a Finance Expert’s job more complex than ever. 15 Steward (Traditional) Accounting, control, risk management and asset preservation are the province of the Steward. The Steward must ensure company compliance with financial reporting and control requirements. Information quality and control rationalisation are top-of-mind issues for the Steward. Operator (Traditional) Efficiency and service levels are the primary areas of focus for the Operator. The Operator must dynamically balance cost and service levels in delivering on the finance organization's responsibilities, and adapt finance's operating model as necessary. Talent management, offshoring and shared service decisions are often the key issues to be addressed. Strategist (Modern) The Strategist is a director, focused on defining the future of the company to enhance business performance and shareholder value. 16 Provides a financial perspective on innovation and profitable growth; Leverages this financial perspective to improve risk-awareness, strategic decision-making and performance management integration; Translates the expectations of the capital markets into internal business imperatives. Catalyst (Modern) The Catalyst is an agent for change, focused on establishing a value attitude throughout the organization. Aligns business to identify, evaluate and execute strategies. Serves as a business partner to other decision makers including business unit leaders, the chief information officer, and sales and marketing leaders. 17 In our quest to stay tuned the ever-dynamic changes in the business ecosystem requires for Finance Expert function to be steered by fundamental principles which will continually be shaped to functional fruition. According to the IFAC study, the five principles stated below should be adopted : An active role in senior management. The Finance Expert should be there to support, and at times guide, the CEO. Balance the responsibilities of economic planning and business partnership. Finance Experts are used to taking care of business on the finance end of things. But they should also be invested in their companies’ goals and missions. Act as an integrator and navigator for the organization. Because finance officers usually have a pretty good picture of multiple areas of their companies work, there’s no one better to help steer the ship and provide guidance during inter-departmental projects. Be an effective leader in the finance department. As head of Finance, Finance Experts need to refine their managerial skills to ensure their department is running like a well-oiled machine. Bring professional qualities to the role and organization. As an important member of senior management, Finance Experts should conduct themselves professionally. Finance officers are role models in their companies and should keep that in mind when making decisions and leading. 18 ICT & FR are Siamese twin. No Finance Expert can function and create much more value without adopting ICT ICT is dynamic and brought dynamism into Financial Reporting Finance Expert should be flexible and stay abreast of latest information "It is not the strongest of the species that survives, nor the most intelligent … it is the one that is the most adaptable to change." By Charles Darwin