Private Retail Liquor Stores (1)

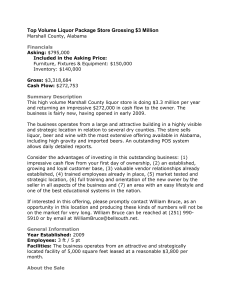

advertisement

STRICTLY PRIVATE AND CONFIDENTIAL ROCKY MOUNTAIN LIQUOR INC (TSXV:RUM) Presentation September 10, 2010 STRICTLY PRIVATE AND CONFIDENTIAL Disclaimer & Forward Looking Statements This presentation has been prepared by the management of Rocky Mountain Liquor Inc. (“RUM” or the “Company”) solely for review by persons who qualify as “accredited investors” under Canadian securities laws. This presentation and its contents are confidential and are not for public distribution. No securities commission or securities regulatory authority has in any way approved or passed upon the merits of an investment in the Company or upon the accuracy or adequacy of this presentation and any representations to the contrary is an offence. This presentation is intended to provide a summary overview of the business of RUM. It has been prepared for informational purposes only and does not purport to be complete. Recipients of this presentation who are considering acquiring securities of the Rocky Mountain Liquor Inc. are reminded that any such purchase or subscription must not be made on the basis of the information contained in this presentation but are referred to the entire body of publicly disclosed information regarding the Company. The information contained herein is qualified entirely by reference to the Company’s publicly disclosed information available at www.sedar.com. There are no representations or warranties made in this presentation by RUM. This presentation, including information incorporated by reference, may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Examples of such statements include: (A) the intention to grow the Business and operations of RUM (as such terms are defined below); and (B) the annualized cash flow using the third quarter EBITDA. Actual results and developments are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this presentation. Such forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to: the ability of RUM to obtain necessary financing; satisfy conditions under the Acquisition Agreement (as defined below); the level of activity in the retail liquor industry in Alberta and the economy generally; and the ability to find suitable acquisition targets. These forward-looking statements should not be relied upon as representing RUM’s views as of any date subsequent to the date of this presentation. Although RUM has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The factors identified above are not intended to represent a complete list of the factors that could affect RUM. 1 STRICTLY PRIVATE AND CONFIDENTIAL Events Exemplify Rocky Mountain Liquor’s Strong Momentum September 21, 2009 Announces significant acquisition for expected purchase price of $2.0 million September 21, 2009 Changes name from Humber Capital Corporation to Rocky Mountain Liquor Inc. December 18, 2009 Announces the acquisition and development of 3 additional stores. Once these additional stores are transitioned, the Company will have 29 liquor stores operating in Alberta January 27, 2010 Announces today that Tracey Bean, Chief Financial Officer of the Corporation, will acquire 1,000,000 shares of Rocky Mountain Liquor Inc. March 1, 2010 Announces 3 separate transactions that may result in 4 additional liquor stores. April 15, 2010 Announces that RUM has signed letter of intent to purchase an additional liquor store. May 20, 2010 RUM completes the construction of a new store in Lac La Biche as announced December 18, 2009 June 4, 2010 Announces today that Tracey Bean, Chief Financial Officer of the Corporation, will acquire 1,000,000 warrants of Rocky Mountain Liquor Inc. June 11, 2010 Announces today that Rocky Mountain Liquor Inc graduates from Tier 2 to Tier 1 on the TSX Venture Exchange. June 25, 2010 Announces today that a group of warrant holders have effected an early conversion of warrants. The result of the early conversion of warrants will provide one million dollars ($1,000,000) of new equity to RUM. July 9, 2010 Announces new facility from Toronto-Dominion Bank that increases Senior Secured Lending commitments from $15.0 million to $25.0 million; The entire amount includes BA based pricing plus a spread ranging from 2.0% to 3.0%. July 9, 2010 RUM completes the construction of a new store in Lethbridge as announced on March 1, 2010 August 11, 2010 RUM completes the purchase of a store in Lethbridge as announced on April 15, 2010, resulting in 32 stores in operation. 2 STRICTLY PRIVATE AND CONFIDENTIAL Active Industry Consolidator • Since the commencement of its business in 2001, Anderson’s has focused on store operations while pursuing an active acquisition strategy within the Alberta market, focusing largely outside of the major urban centres Currently, Anderson’s operates 32 retail liquor stores throughout Alberta, and is in the process of in-filling 2 more stores by the late fall of 2010. • Management believes that through the pursuit of further acquisitions, Anderson’s will continue to benefit from top line growth and increased market share • Going forward the acquisition strategy will continue to contemplate acquisitions in Alberta and management is evaluating opportunities to enter the British Columbia market Anderson’s Retail Liquor Stores Growth(1)(2) 34 26 19 16 16 2006 2007 13 6 3 2001 (1) (2) (3) 7 4 2002 2003 2004 2005 2008 2009 C urre nt (3) Represents liquor store count over calendar years Anderson's acquired an additional liquor store in 2007 but also consolidated two existing stores in Nisku, Alberta; as a result, the total number of retail liquor stores remained consistent from 2006 to 2007 despite the 2007 acquisition The 34 stores include 2 additional stores, which are in development process and are expected to be ready in the late fall of 2010 3 STRICTLY PRIVATE AND CONFIDENTIAL Rocky Mountain Liquor Inc. Overview • Formerly a CPC, Humber Capital Corp. (“Humber”) completed its Qualifying Transaction of Anderson’s Liquor Inc. (“Anderson’s”) in December 2008 • Humber (name since changed to Rocky Mountain Liquor Inc) owns 100% of Andersons, headquartered in Edmonton Alberta, which owns and operates private liquor stores in that province • Since the amalgamation, the Company has continued to build upon Anderson’s previously established momentum, with a number of acquisitions and new store developments. Andersons currently operates 32 stores and has announced the development of 2 new stores, which if completed will bring total retail stores to 34. RUM – Market Valuation Current Price 52 Week High 52 Week Low % of 52 Week High $0.390 $0.590 $0.190 66.1% Shares Outs. (Basic) Shares Outs. (FD)(1) Market Cap (Basic) Adj. Net Debt(1) Enterprise Value 54.5 63.0 $21.3 $12.5 $33.8 • Management believes current economic uncertainty is mitigated for the business, since retail liquor provides an attractive substitute for consumers’ discretionary spending (1) (2) Adjusted for closed acquisitions announced December 18, 2009, including $0.8 million 8.25% convertible debenture issuance Based on a ‘basic’ basis 4 STRICTLY PRIVATE AND CONFIDENTIAL Founding Executives & Board of Directors • The Company’s management team includes its founders, while its Board of Directors includes several members who are prominent owner/operators within the consumer retail sector Management Team Peter J. Byrne, President, CEO Mr. Byrne is the President, Chief Executive Officer and co-founder of Anderson’s and previously has been Chief Executive Officer and Chairman of the Board of Channel Drugs Limited, a private company that owned and operated a PharmaCare franchise until its sale in 2004. Mr. Byrne also acts as a Director of the Company. Allison Byrne, COO Ms. Byrne is the Executive Vice President of Operations and Finance of Anderson’s and prior to joining Anderson’s, she worked at Deloitte & Touche LLP from September 2002 until March 2007, receiving her Chartered Accountant designation in 2005. Ms. Byrne is Chair of the Alberta Liquor Store Association. Tracey Bean, CFO Mr. Bean is a Certified Management Accountant and holds a Masters in Business Administration degree from Dalhousie University. Previously Mr. Bean was employed by The Toronto-Dominion Bank for 15 years and was most recently the Associate Vice President Credit, Commercial National Accounts. Board of Directors Frank J. Coleman, Chairman Mr. Coleman is the President and Chief Executive Officer of the Coleman Group of Companies, a retail food, home furnishings and clothing company based in Newfoundland and Labrador. Mr. Coleman is also a trustee of The Northwest Company Income Fund and former director of Fishery Products International. Robert Normandeau Mr. Normandeau is President and Chief Operating Officer of Clarke Inc., an activist investment company based in Halifax, Nova Scotia and serves as a trustee of Cinram International Income Fund and as a director of Shermag Inc. 5 STRICTLY PRIVATE AND CONFIDENTIAL Highlights • Since completion of its December 2008 Qualifying Transaction of Anderson’s, the Company will have grown over 89% by number of stores. • The share price increased 95% since the IPO in 2008. • Strategy to continue to act as an active industry consolidator - and is an identifiable operator by many potential acquisition targets • Announced increased Senior Lending commitments from ~$15.0 million to ~$25.0 million; Expected to support further accretive acquisition opportunities • Strong operator and superior network support with a proven track record • Operates within a recession-resistant industry, as management believes retail liquor provides a substitute for consumers’ discretionary spending • Management team consists of Company founders and Board possesses significant experience in the consumer retail sector and retains significant ownership in RUM • Alberta and British Columbia private liquor retail markets are extremely stable and provide great potential for consolidation 6 STRICTLY PRIVATE AND CONFIDENTIAL Anderson’s Liquor Inc. 7 STRICTLY PRIVATE AND CONFIDENTIAL Anderson’s Liquor Inc. - Overview • Anderson's is an operator of 32 retail liquor stores located in Alberta, the only province in Canada that has a fully privatized retail distribution system for adult beverages • Anderson’s retail stores provide a complete range of products including: beer, spirits, wine and ready to drink liquor products, as well as ancillary items such as juice, ice, pop and giftware • Anderson's has focused on in-store operations, while successfully integrating multiple store acquisitions into their framework and processes, which has created significant revenue growth, while maintaining healthy operating performance Revenue Profile (C$MM)(1) $35.0 $32.72 $30.0 $25.0 $21.25 $20.0 $17.01 $15.0 $17.85 $13.60 $10.0 $6.90 $5.0 $4.70 $0.0 2004 (1) 2005 2006 2007 2008 2009 2 nd Qtr Note – Historical fiscal year-end is July 31; Reporting fiscal year-end has been changed to December 31 8 STRICTLY PRIVATE AND CONFIDENTIAL Anderson’s Liquor Inc. – EBITDA TREND EBITDA Profile (C$MM) $2.5 $2.1 $2.0 $ 1. 6 $ 1. 6 $1.5 $ 1. 1 $1.0 $0.6 $0.5 $0.4 $0.0 2004 2005 2006 2007 2008 2009 9 A t h a b a s c a 2 B e a u m o n t 1 C a l g a r y 1 C l a r e s h o l m STRICTLY PRIVATE AND CONFIDENTIAL Anderson’s Liquor Inc. – Locations Locations Alberta Head Office - Edmonton Distribution Center - Wetaskiwin Retail locations Athabasca Beaumont Calgary Claresholm Cochrane Devon Didsbury Drayton Valley Edmonton Fort MacLeod Fort McMurray Gibbons Lac La Biche Leduc Lethbridge Millet Morinville Nisku Rocky Mountain House St. Paul Sylvan Lake Wetaskiwin 2 1 1 1 1 3 1 1 1 1 1 1 1 1 2 1 2 1 2 2 3 2 32 10 STRICTLY PRIVATE AND CONFIDENTIAL Detailed Acquisition Criteria • Company expects to continue to pursue further acquisitions in order to benefit top line growth and increase market share • Company has previously and plans on continuing to maintain a specific acquisition strategy that will continue to focus on rural markets, with less competitive pressures, where the Company can be leaders in the markets it operates within • In addition to this, management ensures acquisitions meet several basic criteria as detailed below: Attractive location Meaningful size Store model is easily transitioned onto the existing store network Target is available at a price that is accretive to shareholders 11 STRICTLY PRIVATE AND CONFIDENTIAL Strong Operator & Superior Network Support • The retail store system is supported by Anderson’s enterprise fulfillment center located in Wetaskiwin, Alberta Strategically located with proximity to several main highways in Alberta Enables Anderson’s to break down bundled inventory in order to better meet the demands of individual stores, as well as take advantage of pricing opportunities on a limited time offer basis As the Company continues to grow, greater storage capacity is available through an agreement with its current landlord that would allow Anderson’s to significantly expand its warehouse • Pursuant to the Company’s acquisition strategy, increased scale of operations will allow Anderson’s to reduce overall costs of management, realize operational and administrative efficiencies, facilitate increased use of limited time discount offerings, and spread corporate cost over a larger store system • Anderson’s network is managed by a flat management structure that is a key to the Company’s efficient coverage of the network President & CEO Peter J. Byrne IT Manager Jerry Sheets Regional Managers Store Managers Programmer Purchasing Manager Jennifer Hunting COO Allison Byrne Distribution Manager Fulfilment Centre Staff CFO Tracey Bean Human Resources Joanne Leduc Accounts Payable Controller Sarah Stelmack Order Processing Accountant Retail Staff 12 STRICTLY PRIVATE AND CONFIDENTIAL Industry Overview 13 STRICTLY PRIVATE AND CONFIDENTIAL Alberta Liquor Industry • Alberta became the first, and remains the only, province in Canada to fully privatize its retail liquor industry • The privatization program was designed to ensure that small, independent retailers and large format retailers could compete on an equal basis • Alberta Gaming and Liquor Commission receives a flat mark-up on the wholesale price charged to licensees • Retailers maintain full discretion on retail pricing • The industry has demonstrated substantial growth across all areas including: Number of private retail stores, value of liquor sales and volume of liquor sales 300 280 $1.6 260 $1.4 240 2009 2008 200 2007 $1.0 2006 220 2005 $1.2 2004 Current 2009 2008 2007 2006 2005 2004 2003 2002 2001 320 Sales V olume $1.8 2003 800 340 $2.0 2002 863 Sales CAGR = 6.0% 2000 1027 600 (1) $2.2 1999 910 826 950 1193 1998 1,000 994 1122 Sales ($ Billions) Total Stores 1056 1098 Volume (Millions of Litres) Total Stores 1,200 Alberta Liquor Sales and Volume(1) 2001 Private Retail Liquor Stores(1) Source - Government of Alberta, Alberta Gaming and Liquor Commission 14 STRICTLY PRIVATE AND CONFIDENTIAL Alberta Liquor Industry – Highly Fragmented • Since privatization, the Alberta liquor stores industry has seen significant acquisition activity • Despite heavy acquisition activity, the liquor industry in Alberta remains fragmented, as the majority of liquor stores in Alberta are operated by private retailers who operate as single-store owners or chains of fewer than five stores not under a major flagship Retail locations in Alberta Liquor Stores Income Fund(1)(2) 174 Other Major 'Banner' Stores(3) 88 Anderson's 32 Non-'Banner' Stores • Liquor Stores Income Fund (“LIQ”) has historically been the most active purchaser within the Alberta market Alberta Private Retail Liquor Stores(4) • It is widely believed LIQ will not be focused on significantly further acquiring within Alberta and future growth initiatives will come from the U.S. and through greenfield development RUM’s Est. Suitable Opportunities (1) (2) (3) (4) 899 1,193 400 LIQ 2009 Annual report LIQ operates a total of 174 retail stores in Alberta Major Banner stores include: Real Canadian Liquor Stores (Loblaws), Western Cellars (Sobeys), Calgary Co-Op and Safeway AGLC as at June 2010; does not include general merchandise liquor stores 15 STRICTLY PRIVATE AND CONFIDENTIAL British Columbia Liquor Industry • British Columbia has a partially privatized retail liquor industry, with both government and privately owned and operated retail liquor stores • At present, though, the British Columbia Liquor Distribution Branch (the “BCLDB”) sells a substantial amount of its entire product to privately-owned retail liquor stores at a discount of 16% from the listed retail price • In addition, suppliers, including the BCLDB, decrease the wholesale prices of certain products from time-to-time pursuant to limited time offers • The BC industry has also demonstrated substantial growth across all areas including: number of private retail stores compared with Government owned stores; value of liquor sales; and volume of liquor sales Private Retail Liquor Stores(1) 541 600 592 631 654 674 670 431 327 200 221 220 212 209 201 199 197 197 2003 2004 2005 2006 2007 2008 2009 2010 0 (1) Sales ($ Billions) Total Stores 800 $3.2 $3.0 $2.8 $2.6 $2.4 $2.2 $2.0 $1.8 $1.6 $1.4 Sales CAGR = 6.9% Sales V olume 400 380 360 340 320 300 280 Volume (Millions of Litres) Private Sec tor BCLDB stores 1,000 400 BC Liquor Sales and Volume(1) 2002 2003 2004 2005 2006 2007 2008 2009 2010 Source – British Columbia Liquor Distribution Branch 16 STRICTLY PRIVATE AND CONFIDENTIAL Questions 17