RBI

advertisement

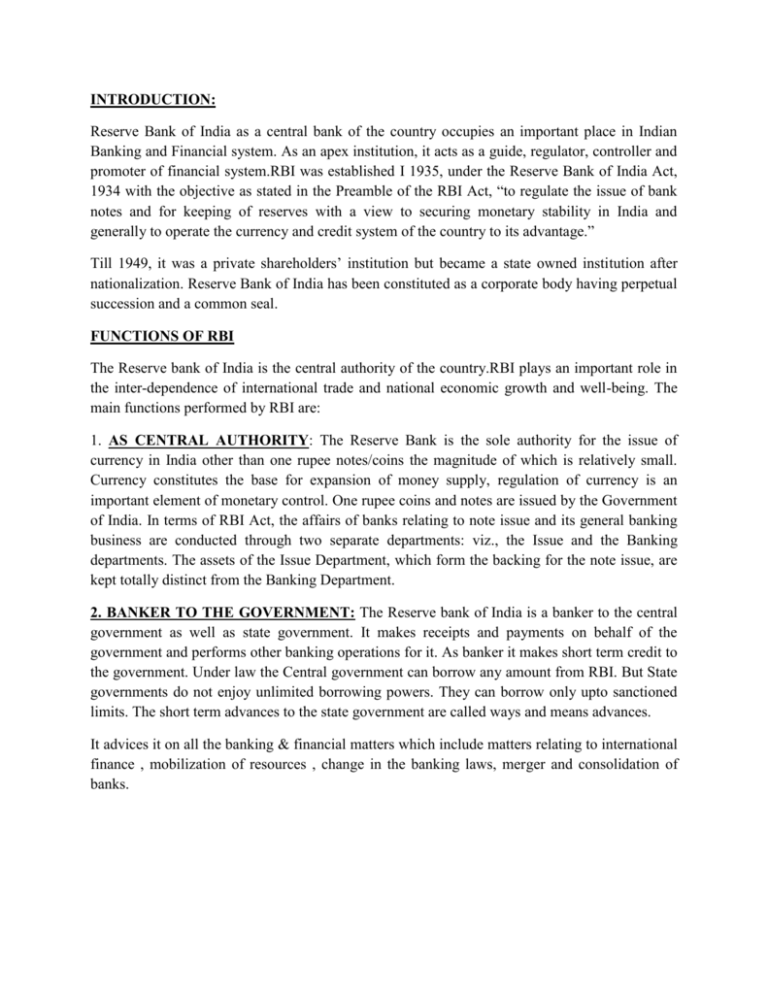

INTRODUCTION: Reserve Bank of India as a central bank of the country occupies an important place in Indian Banking and Financial system. As an apex institution, it acts as a guide, regulator, controller and promoter of financial system.RBI was established I 1935, under the Reserve Bank of India Act, 1934 with the objective as stated in the Preamble of the RBI Act, “to regulate the issue of bank notes and for keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country to its advantage.” Till 1949, it was a private shareholders’ institution but became a state owned institution after nationalization. Reserve Bank of India has been constituted as a corporate body having perpetual succession and a common seal. FUNCTIONS OF RBI The Reserve bank of India is the central authority of the country.RBI plays an important role in the inter-dependence of international trade and national economic growth and well-being. The main functions performed by RBI are: 1. AS CENTRAL AUTHORITY: The Reserve Bank is the sole authority for the issue of currency in India other than one rupee notes/coins the magnitude of which is relatively small. Currency constitutes the base for expansion of money supply, regulation of currency is an important element of monetary control. One rupee coins and notes are issued by the Government of India. In terms of RBI Act, the affairs of banks relating to note issue and its general banking business are conducted through two separate departments: viz., the Issue and the Banking departments. The assets of the Issue Department, which form the backing for the note issue, are kept totally distinct from the Banking Department. 2. BANKER TO THE GOVERNMENT: The Reserve bank of India is a banker to the central government as well as state government. It makes receipts and payments on behalf of the government and performs other banking operations for it. As banker it makes short term credit to the government. Under law the Central government can borrow any amount from RBI. But State governments do not enjoy unlimited borrowing powers. They can borrow only upto sanctioned limits. The short term advances to the state government are called ways and means advances. It advices it on all the banking & financial matters which include matters relating to international finance , mobilization of resources , change in the banking laws, merger and consolidation of banks. 3. ADVISOR TO THE GOVERNMENT: Like all the central banks, the Reserve bank acts as advisor to the government not only on the banking and financial matters but also on a wide range of economic issues those in the flied of planning an resource mobilization. It has of course a special responsibility in respect of the financial policies and measures concerning new loan, agricultural finance, co-operative organization, industrial finance and legislation affecting banking and credit. The bank has also the render advice to government on various matters of international finance. 4. BANKERS’ BANK: The Reserve Bank of India acts as a bank for commercial banks. In this capacity it holds their cash reserves, lends them funds for short terms and provides economical and expeditious central clearing and remittance facilities. Thus it performs all banking operations for them. The RBI rediscounts the bills of the commercial banks. It provides leadership, guidance and guidance in regulating their practices. The centralization of cash reserves with RBI is a source of strength for the system and can be employed most effectively during the periods of seasonal strain and financial crisis. It is for this reason that it is called “Reserve Bank”. As Banker’s bank the RBI can implement its monetary policy more effectively. 5. LENDER OF THE LAST RESORT: It is lender of the last resort for the scheduled commercial banks in India .It provides credit to these banks through rediscounting facility. It is called lender of the last resort as normally the banks are expected to meet there requirements from sources other than the Reserve Bank of India .Commercial banks can approach RBI if they are not able to meet their funds requirements from any other source. That is why it is called lender of last resort. 6. SUPERVISION OF BANKS: The Reserve Bank’s responsibilities include, in addition to the traditional central banking functions, the development of an adequate and sound banking system for catering to the needs of the trade, commerce, industry and agriculture. Under the reserve Bank of India Act, 1934 and the Banking (Companies) Regulation Act, 1949, The Bank has been vested with extensive powers of supervision and control over commercial and co-operative banks. The Bank’s powers extend to calling of information from and giving directions. The Banks send their periodic reports to the Reserve Bank of India. The RBI conducts periodic inspection of the banks. The regulation and control are required for the proper growth of sound banking. 7. CONTROLLER OF MONEY SUPPLY AND CREDIT: One of the most important functions of the Reserve Bank of India is to control the Money supply and credit in the economy. This becomes all the more important as India is following the managed paper currency system which has inherent inflationary tendency. The RBI has to control the money supply and credit in such a way as to ensure the reasonable achievements of all the objectives of credit control e.g price stability, economic growth etc. for performing this function, it has various techniques of credit control available with it. It has wide powers to influence the volume of money supply directly or indirectly. 8. FOREIGN EXCHANGE CONTROL AND MANAGEMENT: The Reserve Bank of India is the custodian of country’s foreign exchange reserves. It manages the exchange control. The purpose of the control is to regulate the demand for foreign exchange according to available supplies, which is very important in the view of foreign exchange reserves. 9. MONETARY DATA AND PUBLICATIONS: The Reserve Bank of India is the main source of monetary data and also of the data relating to banking. The data is very important for framing the economic policies and banking policies. The bank collects and publishes the data regularly through weekly statements, monthly bulletins, annual report, report on trend and progress of banking in India etc. the availability of this data is very useful to all those who are interested in the various aspects of the Indian economy. 10. BANKING OMBUDSMAN SCHEME: With a view to providing an expeditious and inexpensive forum to bank customers for resolution of their grievances regarding banking services, the RBI introduced the banking Ombudsman scheme way back in 1995. The scheme was revised in 2002 and then in 2006 to cover several new areas of customer complaints. Under the revised scheme, the complainants can file their complaints in any form, including online and can also appeal to the RBI against the awards and other decisions of the Banking Ombudsman. 11. PROMOTIONAL FUNCTIONS: In addition to the usual central banking functions, the Reserve Bank of India has been performing variety of promotional functions. Its promotional functions and activities have been mainly directed towards building up and strengthening up financial infrastructure and filling the institutional gap by setting up new financial institutions; and by ensuring the allocation of credit in the socially desired directions. Its promotional activities are: (a) Promotion of commercial banking: Under the powers vested in it under the RBI Act, 1934 and the Banking Regulation Act, 1949, it has taken number of steps from time to time for the growth of commercial banks and putting the Indian banking system on sound footing. (b) Promotion of co-operative banking: In India’s rural based economy, co-operative banks have an important role to play. The credit for expansion of co-operative banking goes to the Reserve bank of India, which is directly or indirectly source of funds for these co-operative banks. (c) Promotion of agriculture and rural credit: In the Reserve Bank of India Act itself, it is recognized that it has special responsibility for providing institutional credit to agriculture and allied activities. A major step in this direction was setting up of the Agriculture Refinance and development corporation. Nationalization of banks gave further push to institutional credit in rural areas. Establishing Regional Rural Banks and inclusion of agriculture in the priority sector are other major steps. Another development in this direction was the establishing of the National Bank for Agriculture and rural development (NABARD) in 1982, which took over the Agriculture Refinance and development corporation. (d) Promotion of industrial finance: The commercial bank can take care of the working capital requirements of the industrial units. However, industrial growth cannot take place in the absence of medium to long term finance. Moreover, small scale industries need special attention. Setting up of IDBI, IFCI, SIDBI etc. are notable steps in this direction.