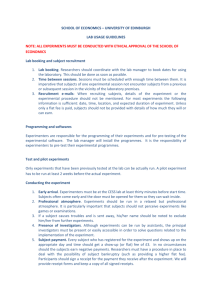

Introduction

Contracts

EECE 295

Estimating

• Estimating takes place at proposal time, and includes an estimate of:

– Time phased cost:

• Direct labor

• Direct material

– Overhead, G & A

– The sum of cost and G&A equals your cost through G&A

• The above defines your “breakeven point”

• Please note that this is based on your cost estimate, not what you end up spending on a project

– Actual cost can vary significantly from the estimate

Contract Negotiations

• A final iteration of contract cost and fee is accomplished at a negotiation after the contract award

• The idea is to define the “cost” and the “fee” for the entire project

• The “price” of the contract equals cost plus fee

• There are a variety of incentives available based on the type of contract

• Cost reimbursable

• Fixed price

• Time and Material

Direct Material and Labor

• The term “Direct” implies that both the labor hours expended and the material utilized is incorporated into the deliverable product

• Direct Material and Labor do not include the cost of the contractor’s facilities, rent, utilities, etc.

– Included in the “Overhead” that is applied to the cost of

Direct Material and Labor

• The cost of direct material and labor does include employee benefits, the cost of buyer labor to procure material, etc.

Typical Overhead Items

• Direct Labor would include:

– Vacation pay

– Sick pay

– Insurance

– FICA

• Direct Material would include

– Cost of shipping

– Buyers to purchase the material and their overhead

How are Overhead Rates Calculated?

• An accounting methodology that conforms to the Federal

Accounting Standards Board (FASB) for government contracts, and generally acceptable accounting practices for commercial companies

• The approach may vary from Company to Company

• Overhead does not include “Wheat Tax” or the cost of nondirect labor

– Supervisors, department heads, executives, etc.

– Also referred to as “Indirect” cost

• Overhead does include the “Cost of Doing Business”

Overhead Rate Calculation Example

Methods for Apportioning Overhead

Application of O/H, G & A, and Profit

Definition of a Contract

• A “bilateral” agreement between two business entities to do something in the future for

“Consideration”

– Giving party is the “Customer” (or Buyer, or Client)

– Receiving party is the “Contractor” (or Seller)

• The contractor can subcontract work to other companies and individuals

– However, the contractor is still responsible for contract performance

• Governed by the Uniform Commercial Code

Contractual Relationships

• Interactions between business entities are based on

Common Law

• Ultimately, contracts are administered by the

Federal and State Government if a dispute arises

– Court of Claims

• Settlement of Contract Disputes

– Court of Patent Appeals

• Settlement of Intellectual Property Disputes

Consideration

• Consideration is provided to the contractor upon successful completion of the contract terms

• Consider the following scenario:

– Contractor builds a building, pays for all labor, subcontractors, and material suppliers

– Contractor delivers the finished building with a perfect title.

– Owner gives the contractor money as consideration

• All contracts and changes to contracts have consideration

• Consideration can take forms other than money, such as schedule relief, technical performance relief, etc.

Requirements for the Creation of a

Contract

• In order to establish a contract, a mutual understanding as to what each business entity will give and receive in return must be defined

– Consideration, ie. cost and fee

– Deliverable items and data

– Technical performance of deliverables

– Schedule

– Tasks (work) to be performed

• If you don’t have all of the above items defined, you do not have an executable contract

Requirements for the Creation of a

Contract (cont’d)

• The contractor makes an offer to the customer (Proposal)

– Can be a written or verbal offer, or an offer created by other acts of communication by responsible officers of the seller

• Fax, email?

– Contractor defines the period within which the proposal will be honored

• Customer enters into negotiations by issuing a letter of acceptance

• The offer must be revoked in writing if something happens that requires withdrawal of the offer prior to expiration

– The offer defines all cost, schedule, and technical requirements

• Factfinding then takes place with the customer team

• Negotiations are then held to clarify items in the proposal, and to state the customer’s perception of the “should cost”

Requirements for the Creation of a

Contract (cont’d)

• The customer then counteroffers to the seller to converge differences in understanding

– This can take multiple iterations

• Customer then generates a “Best and Final Offer,” or

BAFO

• This is then either accepted by the performer (seller) or the seller “takes a hike”

• If the offer is accepted, a contract is generated which incorporates all of the final changes, and everyone signs it

– The signators must be able to legally obligate the business

– Typically, signators would be officers of the company with a delegated signature authority greater than the value of the contract

• This could be many $100 Million

Requirements for the Creation of a

Contract (cont’d)

• Upon everyone’s signature, the project starts

– The seller is “under contract” to perform in accordance with the final negotiated document

Contract Changes

• Things happen during the course of the project that change either the amount of work ($$$$), or the schedule

• A formal change process is incorporated into all contracts

– Unilateral Change

• Imposed by the Customer on the Contractor without concurrance

– Constructive Change

• Failure by the Customer to meet contractual requirement, ie. “Breach of Contract”

– Bilateral Change

• Mutually agreed to change between the Customer and Contractor

• Unilateral and Constructive Changes generally result in a

“Dispute”

Disputes and Breaches

• Unilateral changes are typically not acceptable to

Contractor

– Consideration is insufficient

• Need more money to do the additional work

– Impossible to perform to changed schedule, performance, etc.

• Breach of contract occurs when the Customer or

Contractor fail to meet the requirements of the contract

– Failure to provide Customer Furnished Equipment, Facilities, etc.

Dispute Resolution

• Negotiations are required by all parties to resolve dispute

• Contract letters and supporting documentation are very important in order to document the situation and position of both parties

– Getting ready to go to trial

– Lawyers get involved

– Generally very unproductive and expensive

– Not worth the effort for less than $10K on a large job

• Disputes must eventually adjudicated by the Court of

Claims, which requires a legal trial

Termination

• Contract Termination is possible under certain prenegotiated conditions

– “Termination for Convenience of the Government”

• Termination is also possible for failure to meet Contract requirements

– Cost, Schedule, or Technical Performance

– Termination for “Cause”

– Termination for Default

• Termination clauses are always included as a part of the original Contract

Termination (cont’d)

• Termination for cause allows the customer to re-procure the item at the expense of the original contractor!

– This is extremely serious and can bankrupt a company

• Termination for convenience requires a “Termination

Proposal,” which is then negotiated like a new contract

– Material purchased is packaged and turned over to the customer

– Subcontracts must also be terminated

– Costs associated with early termination of employees are included

• Layoff notification, etc.

Contract Concepts

• Different contract types are available

• The contract type selected must be based upon a mutual understanding of the risk of success of the project

– If the customer is incorrect with regard to their perception of risk, than there should be no bidders on the contract

– Success is defined as the achievement of all contract objectives

Cost, Schedule, Performance

– Improper utilization of a contract type can, and does frequently result in project failure

• All contracts provide a concept of “Profit” or “Fee”

– Related to consideration

– Generally, the fee equals funds left over at contract completion, and after closeout

Contract Concepts (cont’d)

– Residual materials or equipment are not included in the final profit

• Sold as surplus and credited to overhead

• Delivered to Customer

– Profit percentage varies with the type of contract, ie. cost reimbursable or fixed price

The residual funds can be negative!!

Types of Contracts

• Fixed Price

• Cost Reimburseable

• Time and Material

Fixed Price Contracts

• Highest risk to Seller. Used for low risk procurements.

• Three Types

– Fixed Fee (FFP)

– Incentive Fee (FPIF)

– Fixed Price with Redertimination (FPR)

Firm Fixed Price Contracts (FFP)

• Fixed profit, no ceiling price

• Exceptions

– Constructive Changes

– Unilateral Changes

• Definition of “Change” subject to interpretation

– Generally used as negotiating tool

– Customer has upper hand by withholding of funds

• Can overrun! Can also have costs disallowed.

Fixed Price Incentive Fee (FPIF)

• Lower Risk to Seller, fee determined by targets

• Ceiling Price

• Cost/Profit Sharing

– Incentive Curve

• 30/70 Share for Underrunns

• 70/30 Share for Overruns

• Still subject to Changes Clause

• Can receive minimal or no profit and overrun!

• Customer can also disallow costs.

Fixed Price with Redetermination (FPR)

• Two types: Prospective and Retroactive

• Prospective FPR negotiates prices to be paid in a prospective period

– Similar to two FFP arrangements negotiated at stated times during contract performance period

• Retroactive FPR provides for adjusting price after performance

– Essentially like FPIF

• Maximizes Project Managers attention on happines of

Customer

Cost Reimbursable Contracts

• Lower Risk to Seller than Fixed Price Contracts

• Used for higher risk procurements

– Uncertainty of performance goals, etc.

• Three Types

– Fixed Fee (CPFF)

– Incentive Fee (CPIF)

– Award Fee (CPAF)

Cost Plus Fixed Fee (CPFF)

• Fixed profit, no renegotiation of contract allowed

• No ceiling price

• Exceptions

– Constructive Changes

– Unilateral Changes

• Definition of “Change” subject to interpretation

– Generally used as negotiating tool

– Customer has upper hand by withholding of funds

• All “Costs” are paid

– Subject to interpretation as to “Allowable” cost

Cost Plus Fixed Fee (cont’d)

• If project overruns at cost, no increase in fee

(lower profit margin)

• If project underruns at cost, higher profit margin achieved

• Can overrun, but will always make a profit

Cost Plus Incentive Fee (CPIF)

• Lower Risk to Seller

• Established Targets (Cost, Schedule, Performance)

• Cost/Profit Sharing

– Incentive Curve

• 30/70 Share for Underrunns

• 70/30 Share for Overruns

• Still subject to Changes Clause

• Can overrun and still make a profit subject to the

Incentive Curve

Cost Plus Award Fee (CPAF)

• Fee determined by Customer via award criteria

– No rules regarding Award Criteria

• Typical targets established

– “Responsiveness to Customer”

– Cost/Schedule Controls, etc.

• Completely dependent on “Grade” of Customer.

• Can receive $0 profit, but will always be reimbursed for costs

• Maximizes Project Manager’s attention on happiness of

Customer

Time and Material Contracts

• Lowest risk to Seller. Generally used for studies with indeterminate outcome, or support, operational or maintenance contracts.

• Not to Exceed Contract for labor and material

• Task orders from Customer are negotiated with

Seller

– Defines effort for small tasks

– Minimizes any cost uncertainty

Cost/Fee Examples

• FFP

• FPIF

• CPFF

• CPIF

Note: In the following slides, the “price” to the customer equals the sum of the profit and cost.

Firm Fixed Price (FFP)

Fixed Price Incentive Firm Target (FPIF)

Cost Plus Fixed Fee (CPFF)

Cost Plus Incentive Fee (CPIF)

Elements of a Contract

• Contract Form

• Schedule

• Statement of Work (SOW)

– Deliverables

– Contract Data Requirements

– Contract Data Requirements List

– Specifications

Contract Form

• Document which provides all “contractual” details

– Type of Contract

– Total Cost

– Deliverables/Services and Prices

– Packaging and Marking

– Inspection and Acceptance

– Contract Clauses and Administration Data

– List of Documents, Exhibits

– Representations and Certifications

Contract Form (cont’d)

• Technically, Schedule and SOW are part of

Contract

– Generally referenced in body of Contract Form

• No Schedule or Technical Information. Cost only!

Schedule

• Time phased tasks and deliverables which are detailed in SOW, Supplies List, and CDRL

• Generally identical to the proposed schedule, with modifications resulting from negotiations

• No Cost or Technical Information. Schedule only!

Statement of Work

• Details all tasks and activities to be accomplished on

Contract

• References the following documents

– Contract Data Requirements

– Contract Data Requirements List (CDRL)

– Deliverable Items

– Specifications

• Defines all design activities, documentation, etc.

• No Cost or Schedule Information. Technical Only!

Other Topics of Interest

• Government Acquisition Regulations

– DARS/FARS

• Government Contracting vs. Commercial

Contracting

• Estimating/Scheduling Methodology

• Work Planning

• Specification Development and System

Engineering