Macy's

advertisement

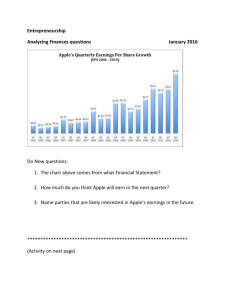

MACY’S Strategic management case study Andrea Baril, Marie-Michele Lachance, Ashley Cleary, Sylvia LaBrie Overview Company Overview History of Macy’s Growth 2009 Events and Issues Existing Mission and Vision statement New Mission and Vision Statement SWOT Analysis External Assessment CPM EFE Positioning Map Internal Assessment Organizational chart Financial ratios IFE Matrix Strategy Formulation SWOT Matrix Grand Strategy Matrix BCG Space Matrix Data Space Matrix IE Matrix Matrix Analysis QSPM Matrix Strategic Plan for the Future Objectives Strategies Implementation Issues EPS/EBIT Projected Financials Evaluation Balanced Scorecard Key Future Ratios History Rowland Hussey Macy Macy’s Thanksgiving Parade 1932 Growth • 1859 Macy's first-year sales were approximately $85,000 with an advertising budget of $2,800. • 1902 Macy's moves to Herald Square in New York City. • 1923 May Company acquire a department store company in Los Angeles, adding to its growing regional coverage in Akron and Cleveland, OH, and St. Louis. • 1930 Bloomingdale's joins Federated. First-year sales for Federated were $112 million. • 1996 Bloomingdale's opens its first California stores with four locations - three in the Los Angeles area and one in Palo Alto.www.macys.com is launched. • 2005 Federated begins operating nationwide under two store nameplates - Macy's and Bloomingdale's - as all regional department store names are converted to the Macy's brand. Macy's launches a new customer loyalty program, with escalating benefits for its largest customers, as it issues new credit cards for about 14 million accounts. Federated acquires The May Department Stores Company. The acquisition creates a stronger, more resourceful company with more stores nationwide. • 2008 Macy's began piloting a new localization initiative called “My Macy's” in 20 local markets as it consolidated three divisions - Macy's North into Macy's East, Macy's Northwest into Macy's West, and Macy's Midwest into Macy's South (creating a new Macy's Central division). The company celebrated Macy's 150th birthday on October 28. • 2010 Bloomingdale's opens in Dubai, the company's first international presence. Macy's ends the year with more than 1.2 million Facebook friends. 2009 • Macy’s operates 850 Stores in 45 states. • Laid off 7,000 employees, which is roughly 175,000 workers. • Cut their dividends by more than half. • Target customer is “older parents or working older couples who are college educated and earn more than $82,570”. • Has been in business for 151 years Existing Vision Our vision is to operate Macy's and Bloomingdale's as dynamic national brands while focusing on the customer offering in each store location. Existing Mission Our goal is to be a retailer with the ability to see opportunity on the horizon and have a clear path for capitalizing on it. To do so, we are moving faster than ever before, employing more technology and concentrating our resources on those elements most important to our core customers. New Mission and Vision Proposed Vision • Macy’s brings distinctive national brands to its customers while still offering them an affordable luxury. Proposed Mission • At Macy’s we focus on our customers needs by offering a wide range of products from clothing to furniture. We expect our employees to remain professional by following our code of conduct, which in turn demonstrates our strong value as a company. We see our firm as constantly innovating to expand our online market worldwide which will help maintain our growth and profitability to our shareholders. Our purpose as a company is to contribute to charitable organizations and remain socially responsible towards the communities we operate in. SWOT San Francisco, CA Strengths • Strong brand equity • Strong advertising • Economies of scale • Ethical, socially responsible, and sustainable company with strong value • Structured Code of conduct for all the company’s vendor • Healthy portfolio • Innovating company • Bloomingdales a subsidiary of Macy’s appeals to upscale customer to upscale customers while Macy’s offers “affordable luxury” items. • Large piece of the market share SWOT Weaknesses • Macy as a declining net profit • Downturn in economy for in store shopping • Lack of diversification in the merchandise • Weak merchandise departments such as mattresses, furniture, and handbags causing firm money loss • Macy’s most profitable brand (Liz Claiborne) even experiencing sale loss. • Not being able to find the middle ground between WalMart’s low prices, and Bloomingdales high prices while maintaining reputation. • Macy’s has to overcome the client’s perception of the impersonality of national brand SWOT Opportunities Threats • • • • • • • • Open new stores to boost revenues in the medium term There is a growth trough overseas operation There is a growth of sales in the online retail spending Many smaller stores are looking to be bought out because of the recession Merchandise such as apparel, cosmetics, and children’s clothing are experiencing fastest growth Robotic machines to help sales such as IPods and IPads Opportunities to buy out smaller brands because of its size • • • • • The economic recession in the United States The increase of the minimum wages in the United States Intense competition in the retail stores such as Dillard’s, JC Penney, and Saks Lower price competition Numerous employee layoff A change in customers has occurred over the past year, but Macy’s has not changes to satisfy customers. External Audit Arlington, VA CPM Macy's Critical Success factors 1. Advertising 2. Financial Position 3. Store locations 4. Market Share 5. Price Competitiveness 6. Product Quality 7. Technology 8. Customer loyalty 9. Merchandise Variety 10. Customer Service Totals Dillard's Nordstorm Weights Rating Weighted Score Rating Weighted Score Rating Weighted Score 0.0 to 1.0 1 to 4 1 to 4 1 to 4 0 0 0 0.12 4 0.48 3 0.36 3 0.36 0.1 3 0.3 2 0.2 2 0.2 0.1 4 0.4 3 0.3 2 0.2 0.1 4 0.4 3 0.3 2 0.2 0.12 3 0.36 2 0.24 2 0.24 0.11 4 0.44 4 0.44 4 0.44 0.08 3 0.24 3 0.24 3 0.24 0.1 2 0.2 2 0.2 3 0.3 0.09 4 0.36 3 0.27 3 0.27 0.08 3 0.24 3 0.24 3 0.24 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 3.42 2.79 2.69 EFE Key External Factors Opportunities Open new stores to boost revenues in the medium term There is a growth through overseas operation There is a growth of sales in the online retail spending Many smaller stores are looking to be bought out because of the recession Merchandise such as apparel, cosmetics, and children's clothing are experiencing fastest growth Robotic machines to help sales such as Ipods and Ipads Opportunities to buy out smaller brands because of its size Threats The economic recession in the United States The increase of the minimum wages in the United States Intense competition in the retail stores such as Dillard's JC Penney, and Saks Lower price competition Numerous employee layoff A change in customers has occurred over the past year, but May's has not changed to satisfy Totals Weights 0.0 to 1.0 Rating 1 to 4 Weighted Score 0.05 0.07 0.13 2 2 4 0.1 0.14 0.52 0.1 2 0.2 0.11 0.04 2 1 0.22 0.04 0.03 2 0.1 0.06 2 2 0.06 0 0.2 0.12 0.07 0.08 0.1 3 2 3 0.21 0.16 0.3 0.06 1 2 0.12 2.39 Positioning Map Strong Online Retail JC Penny Macy’s Nordstorm Dillard’s Low cost High cost Weak Online Retail Internal Audit Organizational Chart CEO Bloomingdales Labor Relations Communications & External Administration Directors CFO Human Ressources & Diversity Property Development Finance Marketing Merchandise Planning Risk & Financial Services TAX Control Merchandising Private Brand Stores Macys.com Merchandising & Private Brand Macy's Florida Division Stores Stores International Retail Development Legal & Secretary Diversity & Legal Assistant Secretary My Macy’s Financial Trends Financial Trends (IN MILLIONS) Month Sales # of Stores Februrary March April 1st Quarter May June July 2nd Quarter August September October 3rd Quarter November December January 4th Quarter Total $1,577 1.931 1.691 $5.199 $1.744 2.044 1.376 $5.164 $1.542 2,042 1,693 $5.277 $2.174 4.422 1.253 $7.849 $23,489 847 848 848 848 848 848 851 852 854 854 854 850 % Change Comp-Store Sales (8.5)% (9.2)% (9.1)% (9.0)% (9.1)% (8.9)% (10.7)% (9.5)% (8.1)% (2.3)% (0.8)% (3.6)% (6.1)% 1.0% 3.4% (0.8)% (5.3)% Remarks: The 4th Quarter was the one where they made more sales. They closed 4 stores during that period, which seemed to helped raised the percentage change in company store sales. IFE Key Internal Factors Weights Rating 0.0 to 1.0 1, 2, 3 or 4 Internal Strengths Weighted Score 3 or 4 Strong brand equity 0.09 4 0.36 Strong advertising 0.08 4 0.32 Economies of scale 0.06 4 0.24 Ethical, socially responsible, and sustainable company with strong value 0.07 4 0.28 Structured Code of conduct for all the company's vendor 0.08 4 0.32 Healthy portfolio 0.05 3 0.15 Innovating company 0.05 4 0.2 Bloomingdales a subsidiary of Macy's appeals to upscale customers while Macy's offers "affordable luxury" items. 0.03 4 0.12 Large piece of the market share 0.04 3 0.12 0 Internal Weaknesses Macy's has a declining net profit 1 or 2 0.1 1 0.1 Downturn in economy for in store shopping 0.08 1 0.08 Lack of diversification in the merchandise 0.06 2 0.12 Weak merchandise departments such as mattresses, furniture, and handbags causing the firm's monetary loss 0.05 2 0.1 Macy's most profitable brand (Liz Claiborne) is even experiencing some sale loss 0.05 2 0.1 Macy's has not been able to find a middle ground between Wal-Mart's low prices, and Bloomingdales high prices while maintaining a reputation 0.07 1 0.07 Macy's has to overcome the client's perception of impersonality of national brand. (it is not true that one size fits all) 0.04 2 0.08 0 0 0 0 Totals 1 2.76 Strategic Formulation SWOT Matrix (S1,O1) Open stores in new locations not already near. (O2,S1) Open stores internationally (O3, S8) Combine different stores websites to each other so they are easier to go between (W2, O3) Develop online programs that offer incentives when you shop online. (O5, W4) Cut out the departments that are not performing to focus on those that are growing (S2, T6) Advertise to different groups to expand (T4, W4) Cut out more high priced goods to customer basis (S1, T3) Use the strong Macy's brand promote the lower priced goods in stores (W6, T4) to target the same group of customers as other Instead of carrying all high end brands, bring in retail stores (S7, T1) Use company innovations to more reasonably priced goods for all consumers expand into worldwide markets to boost revenues Grand Strategy Matrix Rapid Market Growth Quadrant I Quadrant II Strong Competitive Position Weak Competitive Position 1. 2. 3. Quadrant III Slow Market Growth Quadrant IV Related Diversification Unrelated Diversification Joint Ventures Space Matrix Data Financial Strength <FS> Environmental Stability <ES> Liquidity Cash Flow Inventory Turnover Earnings per Share Price earnings ratio Technological Changes Rate of inflation Price range of competing products Barriers of entry into market Risk involved with business 4.0 4.0 3.0 1.0 2.0 Competitive Advantage <CA> Industry Strength <IS> Market Share -1.0 Product Quality -2.0 Customer Loyalty -3.0 Product Lifecycle -2.0 Control over suppliers and distributors -3.0 Profit Potential 4.0 Growth Potential 3.0 Financial Stability 2.0 Ease of entry into market 4.0 Productivity 3.0 -3.0 -4.0 -4.0 -1.0 -5.0 Y Coordinate = -.6 X Coordinate = .8 Space Matrix IE Matrix Hold and maintain market penetration And product development The IFE Total Weighted scores Strong 3.0 Average 2.0 to 4.0 to 2.99 High 3.0 to 4.0 The EFE Medium 2.0 to 2.99 Total Weighted Scores Low 1.0 to 1.99 MACY'S Weak 1.0 to 1.99 Matrix Analysis Summary Alternative Strategies IE SPACE GRAND Count Forward Integration x x 2 Backward Integration x x 2 Horizontal Integration x x 2 x x 3 x x 2 x x 3 x 2 Market Penetration x Market Development Product Development Related Diversification x Unrelated Diversification 1 Horizontal Diversification 1 Joint Venture 0 Retrenchment 0 Divesture 0 Liquidation 0 QSPM Macy's Key factors External Opportunities: Open new stores to boost revenues in the medium term There is a growth through overseas operation There is a growth of sales in the online retail spending Many smaller stores are looking to be bought out because of the recession Merchandise such as apparel, cosmetics, and children's clothing are experiencing fastest growth Robotic machines to help sales such as Ipods, and Ipads Opportunities to buy out smaller brands because of its size Threats: The economic recession in the United States The increase of the minimum wages in the United States Intense competition in the retail stores such as Dillard's, JC Penney, and Saks Lower price competition Numerous employee layoff A change in customers have occurred over the past year, but Macy's has not change to satisfy more customers total should be 1.0 Open stores in new locations, in International expansionUnited States Weight AS TAS AS TAS 1 to 4 1 to 4 0.05 0.07 0.13 0.1 0.11 0.04 0.03 4 4 4 1 1 4 1 0.2 0.28 0.52 0.1 0.11 0 0.03 2 1 4 2 2 0.2 0 0.26 0.1 0.44 0.08 0.06 0.1 0.06 0.07 0.08 0.1 0.06 4 1 3 3 1 2 0.4 0.06 0.21 0.24 0.1 0.12 1 1 3 3 1 2 0.1 0.06 0.21 0.24 0.1 0.12 Focus marketing successful AS 1 to 4 3 4 2 2 1 3 3 3 on TAS 0 0 0.39 0 0.44 0.08 0.06 0 0 0.1 0 0.21 0.24 0 0.18 1 Internal Strengths Strong brand equity Strong advertising Economies of scale Ethical, socially responsible, and sustainable company with strong value Structured Code of conduct for all the company's vendor Healthy portfolio Innovating company Bloomingdales a subsidiary of Macy's appeals to upscale customers while Macy's offers "affordable luxury" items. Large piece of the market share 1 to 4 1 to 4 0.09 0.08 0.06 0.07 0.08 0.05 0.05 0.03 0.04 4 4 4 3 3 3 4 2 3 Weaknesses Macy's has a declining net profit Downturn in economy for in store shopping Lack of diversification in the merchandise Weak merchandise departments such as mattresses, furniture, and handbags causing the firm's monetary loss Macy's most profitable brand (Liz Claiborne) is even experiencing some sale loss Macy's has not been able to find a middle ground between Wal-Mart's low prices, and Bloomingdales high prices while maintaining a reputation Macy's has to overcome the client's perception of impersonality of national brand. (it is not true that one size fits all) total should be 1.0 0.1 0.08 0.06 0.05 0.05 0.07 0.04 1 1 1 2 2 0 0.36 0.32 0.24 0.21 0.24 0.15 0.2 0.06 0.12 0 0 0.1 0 0.06 0.1 0.1 0 0 4.63 1 to 4 4 4 4 3 3 3 4 3 4 0.36 0.32 0.24 0.21 0.24 0.15 0.2 0.09 0.16 4 3 4 3 3 3 3 3 3 1 1 1 2 2 2 2 0.1 0.08 0.06 0.1 0.1 0.14 0.08 1 1 1 4 1 4.6 1 0 0.36 0.24 0.24 0.21 0.24 0.15 0.15 0.09 0.12 0 0 0.1 0.08 0.06 0.2 0.05 0 0.04 4.03 Recommendations • Reconsider inventory- unsuccessful departments such as furniture, mattresses, and handbags would be the first to cut out. • Focus on growth of the successful merchandise to meet customers needs. • Connect Macys.com with Bloomingdales.com to give customers the accessibility to visit both sites easily. • Advertise online shopping more intensely to help potential growth. Implementation EPS/EBIT Common Stock Financing Recession Normal Boom EBIT Interest $ $ Macy's EPS/EBIT (In millions with 25% difference for sales) Debt Financing Recession Normal Boom 2,010.00 $ 2,680.00 $ 3,350.00 $ - $ - $ - $ 2,010.00 $ 2,680.00 $ 1.28 $ 1.28 $ Combination(70% debt 30% stock) Recession Normal Boom 3,350.00 $ 2,010.00 $ 2,680.00 $ 3,350.00 1.28 $ 0.90 $ 0.90 $ 0.90 EBT $ 2,010.00 $ 2,680.00 $ 3,350.00 $ 2,008.72 $ 2,678.72 $ Taxes $ 884.40 $ 1,179.20 $ 1,474.00 $ 883.84 $ 1,178.64 $ EAT $ 1,125.60 $ 1,500.80 $ 1,876.00 $ 1,124.88 $ 1,500.08 $ # of Shares $ 422.00 $ 422.00 $ 422.00 $ 420.10 $ 420.10 $ 420.10 $ 421.00 $ 421.00 $ 421.00 EPS $ 2.67 $ 3.56 $ 4.45 $ 2.68 $ 3.57 $ 4.46 $ 2.67 $ 3.56 $ 4.45 Tax Rate 0.44 3,348.72 $ 2,009.10 $ 2,679.10 $ 3,349.10 1,473.44 $ 884.01 $ 1,178.81 $ 1,473.61 1,875.28 $ 1,125.10 $ 1,500.30 $ 1,875.50 16.76 stock price on 12/31/2009 need 1909308 stocks to sell outstanding shares 420.1 $ 422,009,308.00 954,654.00 421,054,654.00 Projected Financials • Assumptions -Borrow 32 million over 8 years at 4% interest -Cut out 60% of inventory -Generate 600 million additional income. Projected Income statement Macy's Consolidated Statement of Operations Operations Net Sales Cost of Sales Inventory Valuation adjustments Gross Margin Selling, general and administrative expenses Division consolidation costs and store closing related costs Asset impairment charges Goodwill impairment charges May integration costs Gains on asle of accounts receivable Operating income (loss) Interest expense Interest income Income (loss) from continuing operations before income taxes Federal, state and local income tax benefit (expense) Income (loss) from continuing operations Discontinued operations, net of income taxes Net income 2009 $ 23,489.00 $ (13,973.00) $ $ 9,516.00 $ (8,062.00) $ (276.00) $ (115.00) $ $ $ $ 1,063.00 $ (562.00) $ 6.00 $ 507.00 $ (157.00) $ 350.00 $ $ 350.00 Projected 2010 $ 24,089.00 $600 million growth $ (14,329.90) % of sales $ $ 9,759.10 $ (8,062.00) $ (276.00) $ (115.00) $ $ $ $ 1,306.10 $ (562.00) $ 6.00 $ 750.10 $ (157.00) $ 593.10 $ $ 593.10 Projected Balance Sheet Macy's Balance Sheet in millions ASSETS 2009 2010 projected Comments Current assets Cash and equivalents Accounts and notes receivable Merchandise inventories Supplies and prepaid expense Total current assets $1,385.0 $360.0 $4,769.0 Increase in cash from decrease in $1,567.0 inventory $450.0 More accounts receivable $1,907.6 Decrease by 60% $226.0 $226.0 $6,740.0 $4,150.6 $719.0 $719.0 $3,743.0 $3,743.0 $501.0 $501.0 $4,963.0 $4,963.0 Other assets Other intangible assets - net Goodwill Other assets Total other assets Property and equipment Property and equipment, at cost $10,442.0 $13,063.4 Property valuation increase Total assets $22,145.0 $22,177.0 Projected Balance Sheet LIABILITIES AND SHAREHOLDERS’ EQUITY Current liabilities Short-term debt Merchandise accounts payable Account payable and accrued liabilities Income taxes Deferred income taxes Total current liabilities Long-term debt Other long-term liabilities Deferred income taxes Shareholders’ equity Common stock, 420.8 and 420.1 shares outstanding Additional paid-in capital Accumulated equity Treasury stock Accumulated other comprehensive income Total shareholders’ equity Total liabilities and shareholders’ equity $966.0 $1,282.0 $2,628.0 $28.0 $222.0 $5,126.0 $8,733.0 $2,521.0 $1,119.0 $966.0 $1,282.0 $2,628.0 $28.0 $222.0 $5,126.0 $8,765.0 $32 million loan $2,521.0 $1,119.0 $5.0 $5,663.0 $2,008.0 ($2,544.0) $5.0 $5,663.0 $2,008.0 ($2,544.0) ($486.0) $4,646.0 ($486.0) $4,646.0 $22,145.0 $22,177.0 Evaluation Balanced Scorecard Area of Objectives Measure of Target Customers 1. Improve Brand Identity Company Report 2. Respond to costumer demand for Costumer survey results and change Company report Managers/Employees 1. Employee Satisfaction Employee survey Store inspection and web 2. Quality training costumer survey Community/ Social Responsibility New products made with organic materials. Volume 1. Eco-Friendly company of recyclable materials improvement Volunteerism 2. Ethical Employees Charitable giving Operations/Processes 1. Innovation 2. Store image 3. Worldwide expansion Financial 1. Company Growth 2. Reduce Debt Number of new merchandise, products Numbers of Macy’s store who have remodeled Numbers of store opened in different country Increase Profit Decrease of expenses Time Expectation Primary Responsibility Yearly Marketing Department Yearly Marketing Department Yearly Human Resources Yearly Chief Operating Officer Quarterly Chief Operating Officer Biannually Human Resources Biannually Yearly COO Marketing Department Product development team Store Planning, Construction and Design Yearly Chief Operating Officer Quarterly Quarterly Chief Financial Officer Chief Financial Officer Projected Ratio Liquidity ratios Current Quick Leverage ratios Debt to total assets Debt to equity Long-term debt to equity Times-interest-earned ratio Activity ratios Fixed Assets Turnover Total Assets Turnover Inventory Turnover Profitability ratios Gross profit margin Operating profit margin Net profit margin Return on assets Return on equity Price-earnings ratio EPS Growth ratios Sales Growth % Net Income Growth % Earnings per share Growth % Macy's 2009 Projected 2010 1.31 0.38 0.81 0.44 0.79 3.77 1.88 1.91 0.79 3.77 1.89 2.35 2.25 1.06 4.93 1.84 1.09 12.68 0.41 0.045 0.015 0.016 0.075 20.19 0.83 0.41 0.054 0.025 0.027 0.13 17.94 1.41 -5.97% 14.72% 14.73% 3% 41% 41.13% M Update Stock Price History Macy’s Video http://video.foxbusiness.com/v/1113195521001/keeping-themacys-brand-fresh-in-a-tough-economy/ Questions Sources • • • • • • • • • • • • "Macy's Inc. History." Macy's Inc.. Sanger and Eby, Web. 7 Apr 2012. <http://www.macysinc.com/AboutUs/History/default.asp&xgt;. "Organizational Chart, Macy’s." The Official Board. March 6, 2012. Web. 7 Apr 2012. <http://www.theofficialboard.com/org-chart/macy-s>. "Macy’s." Company-Statements-Slogans. Web. 7 Apr 2012. <http://www.company-statements-slogans.info/list-ofcompanies-m/macys.htm>. Hart, Carly. "Macy’s 2009 Reorganization Means 7,000 Layoffs." Yahoo Voices. Web. 7 Apr 2012. <http://voices.yahoo.com/macys-2009-reorganization-means-7000-layoffs-2604039.html>. "Macy." Yahoo Finance. April 5, 2012. Web. 7 Apr 2012. <"Macy." Yahoo Finance. April 5, 2012. Web. 7 Apr 2012. http://finance.yahoo.com/echarts?s=M Interactive "FDO: Munich Stock Chart- Macy’s." Bloomberg. April 5, 2012. Web. 7 Apr 2012. <http://www.bloomberg.com/quote/FDO:GR/chart>. "Financial Ratios for Macy’s." Barchart. April 5, 2012. Web. 7 Apr 2012. <http://www04.aws.barchart.com/profile.php?sym=M&view=ratios>. "Social Responsibility." Macy’s Inc. 2012. Web. 7 Apr 2012. <http://www.macysinc.com/aboutus/sustainability/>. “Maps." Macy’s Inc. 2012. Web. 7 Apr 2012. <http://www.macysinc.com/Macys/maps.asp&xgt;. "Macy’s Fact Book 2011." Macy’s Inc. April 2, 2011. Web. 7 Apr 2012. <http://www.macysinc.com/Investors/vote/2011_fact_book.pdf>. David, Fred. Strategic Management Concepts and Cases. 13th ed.,. Upper Saddle River: Prentice Hall, 2007. Print. Supman, Jacqueline. "Case Study: Macy’s Private Label." Merchandise Strategies. Web. 4 Apr. 2012. <jacquelinesupman.com/downloads/jsupman