Chapter 10

Accounting

Exposure

Overview of Translation

• Accounting exposure, also called translation

exposure, arises because financial statements of

foreign subsidiaries – which are stated in

foreign currency – must be restated in the

parent’s reporting currency for the firm to

prepare consolidated financial statements.

• The accounting process of translation, involves

converting these foreign subsidiaries financial

statements into US dollar-denominated

statements.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-2

Overview of Translation

• Translation exposure is the potential for an

increase or decrease in the parent’s net worth

and reported net income caused by a change in

exchange rates since the last translation.

• While the main purpose of translation is to

prepare consolidated statements, management

uses translated statements to assess

performance (facilitation of comparisons across

many geographically distributed subsidiaries).

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-3

Overview of Translation

• Translation in principle is simple:

– Foreign currency financial statements must be

restated in the parent company’s reporting currency

– If the same exchange rate were used to remeasure

each and every line item on the individual statement

(I/S and B/S), there would be no imbalances

resulting from the remeasurement

– What if a different exchange rate were used for

different line items on an individual statement (I/S

and B/S)?

– An imbalance would reslult

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-4

Overview of Translation

• Why would we use a different exchange

rate in remeasuring different line items?

– Translation principles in many countries are

often a complex compromise between

historical and current market valuation

– Historical exchange rates can be used for

certain equity accounts, fixed assets, and

inventory items, while current exchange

rates can be used for current assets, current

liabilities, income, and expense items.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-5

Overview of Translation

• Most countries today specify the translation method

used by a foreign subsidiary based on the subsidiary’s

business operations (subsidiary characterization).

• For example, a foreign subsidiary’s business can be

categorized as either an integrated foreign entity or a

self-sustaining foreign entity.

• An integrated foreign entity is one that operates as an

extension of the parent, with cash flows and business

lines that are highly interrelated.

• A self-sustaining foreign entity is one that operates in

the local economic environment independent of the

parent company.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-6

Overview of Translation

• A foreign subsidiary’s functional currency is

the currency of the primary economic

environment in which the subsidiary operates

and in which it generates cash flows.

• In other words, it is the dominant currency

used by that foreign subsidiary in its day-today operations.

• The US, requires that the functional currency

of the foreign subsidiary be determined based

on the nature and purpose of the subsidiary.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-7

Overview of Translation

• Two basic methods for the translation of foreign

subsidiary financial statements are employed

worldwide:

– The current rate method

– The temporal method

• Regardless of which method is employed, a translation

method must not only designate at what exchange rate

individual balance sheet and income statement items

are remeasured, but also designate where any

imbalance is to be recorded (current income or an

equity reserve account).

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-8

Overview of Translation

• The current rate method is the most prevalent

in the world today.

– Assets and liabilities are translated at the current

rate of exchange

– Income statement items are translated at the

exchange rate on the dates they were recorded or an

appropriately weighted average rate for the period

– Dividends (distributions) are translated at the rate in

effect on the date of payment

– Common stock and paid-in capital accounts are

translated at historical rates

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-9

Overview of Translation

• Gains or losses caused by translation adjustments are not

included in the calculation of consolidated net income.

• Rather, translation gains or losses are reported separately

and accumulated in a separate equity reserve account (on

the B/S) with a title such as cumulative translation

adjustment (CTA).

• The biggest advantage of the current rate method is that the

gain or loss on translation does not pass through the

income statement but goes directly to a reserve account

(reducing variability of reported earnings).

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-10

Overview of Translation

• Under the temporal method, specific assets are

translated at exchange rates consistent with the

timing of the item’s creation.

• This method assumes that a number of

individual line item assets such as inventory

and net plant and equipment are restated

regularly to reflect market value.

• Gains or losses resulting from remeasurement

are carried directly to current consolidated

income, and not to equity reserves (increased

variability of consolidated earnings).

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-11

Overview of Translation

• If these items were not restated but were instead carried

at historical cost, the temporal method becomes the

monetary/nonmonetary method of translation.

– Monetary assets and liabilities are translated at current

exchange rates

– Nonmonetary assets and liabilities are translated at

historical rates

– Income statement items are translated at the average

exchange rate for the period

– Dividends (distributions) are translated at the exchange

rate on the date of payment

– Equity items are translated at historical rates

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-12

Overview of Translation

• The US differentiates foreign subsidiaries on the basis of

functional currency, not subsidiary characterization.

– If the financial statements of the foreign subsidiary are

maintained in US dollars, translation is not required

– If the statements are maintained in the local currency, and

the local currency is the functional currency, they are

translated by the current rate method

– If the statements are maintained in local currency, and the

US dollar is the functional currency, they are remeasured by

the temporal method

– If the statements are in local currency and neither the local

currency or the US dollar is the functional currency, the

statements must first be remeasured into the functional

currency by the temporal method, and then translated into

US dollars by the current rate method

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-13

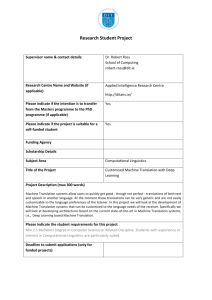

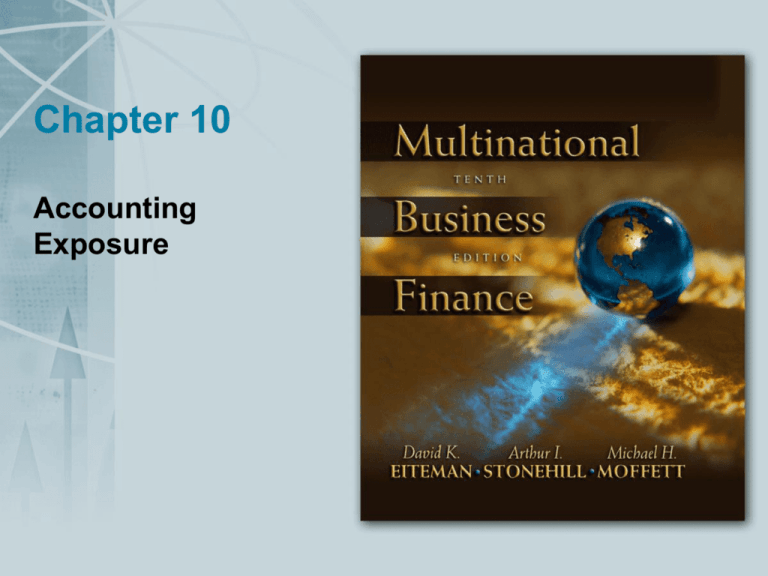

Exhibit 10.2 Procedure Flow Chart for United States

Translation Practices

Purpose: Foreign currency financial statements must be translated into U.S. dollars

If the financial statements of the foreign subsidiary

are expressed in a foreign currency, the following

determinations need to be made.

Is the local currency the

functional currency?

Yes

No

Is the dollar the

functional currency?

Remeasure from foreign

currency to functional

(temporal method)

and translate to dollars

(current rate method)

Translated to dollars

(current rate method)

No

Yes

Remeasure to dollars

(temporal method)

* The term “remeasure” means to translate, as to change the unit of measure, from a foreign

currency to the functional currency.

10-14

Overview of Translation

• Many of the world’s largest industrial countries –

as well as the relatively newly formed

International Accounting Standards Committee

(IASC) follow the same basic translation

procedure:

– A foreign subsidiary is an integrated foreign entity

or a self-sustaining foreign entity

– Integrated foreign entities are typically remeasured

using the temporal method

– Self-sustaining foreign entities are translated at the

current rate method, also termed the closing-rate

method.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-15

Managing Translation Exposure

• The main technique to minimize translation exposure is

called a balance sheet hedge.

• A balance sheet hedge requires an equal amount of

exposed foreign currency assets and liabilities on a

firm’s consolidated balance sheet.

• If this can be achieved for each foreign currency, net

translation exposure will be zero.

• If a firm translates by the temporal method, a zero net

exposed position is called monetary balance.

• Complete monetary balance cannot be achieved under

the current rate method.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-16

Managing Translation Exposure

• The cost of a balance sheet hedge

depends on relative borrowing costs.

• These hedges are a compromise in which

the denomination of balance sheet

accounts is altered, perhaps at a cost in

terms of interest expense or operating

efficiency, to achieve some degree of

foreign exchange protection.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-17

Managing Translation Exposure

• If a firm’s subsidiary is using the local currency as the

functional currency, the following circumstances could

justify when to use a balance sheet hedge:

– The foreign subsidiary is about to be liquidated, so that

the value of its CTA would be realized

– The firm has debt covenants or bank agreements that

state the firm’s debt/equity ratios will be maintained

within specific limits

– Management is evaluated on the basis of certain income

statement and balance sheet measures that are affected

by translation losses or gains

– The foreign subsidiary is operating in a

hyperinflationary environment

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-18

Managing Translation Exposure

• Management will find it almost impossible to offset both

translation and transaction exposure at the same time.

• As a general matter, firms seeking to reduce both types of

exposure usually reduce transaction exposure first.

• Taxes complicate the decision to seek protection against

transaction or translation exposure.

• Transaction losses are considered “realized” and are

deductible from pre-tax income while translation losses are

only “paper” losses and are not deductible from pre-tax

income.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-19

Evaluation of Performance

• An MNE must be able to set specific financial

goal, monitor progress by all units of the

enterprise towards those goals, and evaluate

results.

• An MNE must be able to measure the

performance of each of its subsidiaries on a

consistent basis, and managers of subsidiaries

must be given unambiguous objectives against

which they will be judged.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-20

Evaluation of Performance

• The MNE must determine for itself the proper

balance between three operating financial

objectives:

– Maximization of consolidated after-tax income

– Minimization of the firm’s effective global tax

burden

– Correct positioning of the firm’s income, cash

flows, and available funds

• These goals are frequently inconsistent.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-21

Evaluation of Performance

• Managers of foreign subsidiaries must be able

to run their own operations efficiently

according to achievable objectives.

• All firms expand and modify their domestic

profitability measures when applying them to

foreign subsidiaries.

• In addition, some firms establish foreign

subsidiaries for objectives not related to normal

corporate profit-oriented goals.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-22

Evaluation of Performance

• There are four purposes of an internal

evaluation system:

– To ensure adequate profitability

– To have an early warning system if

something is wrong

– To have a basis for allocating resources

– To evaluate individual managers

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-23

Evaluation of Performance

• International financial evaluation of foreign

subsidiaries is both unique and difficult.

• Use of one foreign exchange translation

method, in an attempt to measure results in the

home currency, will present a different measure

of success or of compliance with

predetermined goals than use of some other

translation method.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-24

Evaluation of Performance

• The results of any control system must be

judged against distortions of performance

caused by widely differing national

business environments.

• International measurement systems are

distorted by decisions to benefit the

world system (MNE) at the expense of a

specific local subsidiary.

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-25

Evaluation of Performance

• The impact of exchange rate movements on the

measured performance of foreign subsidiaries

is one of the single largest dilemmas facing

management of the MNE.

• The evaluation of the performance of an MNE

subsidiary involves three different evaluation

dimensions:

– Management evaluation

– Subsidiary evaluation

– Strategic evaluation

Copyright © 2004 Pearson Addison-Wesley. All rights reserved.

10-26