In enabling comparisons to be made it was important that

advertisement

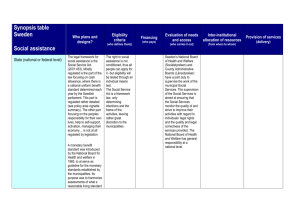

MUNICIPAL FINANCIAL VIABILITY Municipal Managers Network 28 February 2011 Overview • • • • State of municipal finances presented to 2009 Budget Forum 2010 Budget Forum submissions − Review of the LG Fiscal Framework − Understanding Outstanding Municipal Debtors − Local Business Tax 2011 Division of Revenue Act Other matters of interest Objective • The outcome of this session is to confirm the challenges, provide evidence and guide the process for resolution of these issues State of Municipal Finances Background • SALGA developed own database containing data on municipal AFS, AO, service delivery and economic profiles, information on CFOs. • Analysis of 2007 and 2008 financial performance and service delivery presented to the 2009 Budget Forum focused on the following criteria: Criteria Service Delivery Finances Financial Management Basis of Assessment Settlement characteristics Extent of backlogs for key services Identification of whether additional financial resources are required Sufficiency of own revenue sources Sufficiency of government grants Efficiency of expenditure Key financial ratios Audit report findings Capacitation assessment State of Municipal Finances Background In enabling comparisons to be made it was important that certain common classifications had to be made and utilised Municipal Sub-categories Included Typical Attributes S1 A (metros) and aspirant metros Dominated by a large urban (city) centre S2 Secondary cities, large regional town Larger and smaller towns typically and small towns surrounded by commercial farm land S3 Mostly rural with no significant urban Mostly tradition rural areas, with little centre formal urban economy S4 Districts which are not water services The districts for the S1s authorities metropolitan), S2 and S3s S5 C2 districts which are water services The districts for the S3s authorities Cat. (non The above categorisation was used commonly throughout the exercise and was also used the emphasis the differentiation between the municipalities and provinces State of Municipal Finances Service Delivery Settlement characteristics have a significant impact on municipal finances Municipalities that have a small number of households but the formal urban component is relatively small face viability challenges Conversely municipalities with high number of rural households and/or informal settlements tend to have high levels of poverty and high backlogs of services Service delivery challenges have a significant impact on municipal finances Rural municipalities have limited revenue raising opportunities because of the level of backlogs. Unable to generate revenue from the rendering of services Lack of densification in a rural environment impacts on economies of scale in delivering services It is unlikely that backlogs can be eliminated in the short-term with finances available to municipalities State of Municipal Finances Finances (1) Expenditure efficiencies Spending profiles of rural municipalities not easily ascertained from annual financial statements. High, other categories Roles and functions of rural municipalities and districts not clear Expenditure likely to come under increased pressure with high input costs post 2008, eg. Water and electricity costs Revenue self sufficiency and government grants Rural municipalities and district municipalities receive substantial government grants (in respect of districts, replacement of RSC levies) Metros, aspirant metros and secondary cities have balanced revenue mixes State of Municipal Finances Finances (2) Outcomes of revenue self sufficiency and grants Criteria Average rates revenue per household Large and aspirant metropolitan cities Secondary Rural cities, large municipalities regional and peri-urban towns R2 612 R1 160 R128 District municipalities for the periurban municipalities Not applicable District municipalities for the rural municipalities Not applicable Average revenue selfsufficiency 84% 75% 28% 31% 20% Government grants to total operating revenue 21% 25% 68% 62% 79% Operating revenue per household R14 349 R7 743 R2 017 Not applicable Not applicable Operating expenditure per household R13 034 R7 060 R2 014 Not applicable Not applicable State of Municipal Finances Financial Management Financial ratios characteristics Generally financial position is strong 18 municipalities technically insolvent Significant financial variances in the rural municipalities Borrowing levels generally low but secondary cities and rural municipalities have the potential to borrow (assessment done on an individual basis) to supplement capital financing Generally cash flow strong Financial management issues National issues to take into account: Depth of audit reporting – recommend improvements to assist better understanding of underlying causes GRAP accounting standards simplification – particularly around fair valuing and complex issues Better understanding of the linkage between financial viability and audit qualifications Municipalities to consider leadership, local SCOPA and governance 2010 Budget Forum Background SALGA made submissions to the Budget Forum with the objective of engaging national and provincial stakeholders on the following areas: – The Review of the LG Fiscal Framework • • • • • • • Need for differentiation between municipalities The Expenditure assignment of LG The Revenue assignment of LG LG’s share of nationally raised revenue (Vertical Division of Revenue) The Local Government Equitable Share Infrastructure Funding and Borrowing Conditional Grants to LG – Understanding Outstanding Municipal Debtors • Nature and extent of debt owed to municipalities • Why debt has grown over the last 6 years? • What proportion of the debt is realistically recoverable? – Local Business Tax • Work-in-progress towards application to Minister of Finance LG Fiscal Framework Review (1) Differentiation • A commonly accepted categorization of municipalities should be developed and be used to review roles and functions of certain categories of municipalities, in amending the Local Government Equitable Share formula and in targeting certain conditional grants. Expenditure Assignment • • • • • Finalisation of the Provincial and Local Government Policy review, initiated by COGTA in July 2007, restructuring of the electricity distribution industry. Housing accreditation. Funding arrangements for the National Land Transport Act. The local government fiscal review should ensure that issues around unfunded mandates are resolved. Some unfunded mandates have already been costed (such as library services in the Western Cape and Ethekwini). Others should still be quantified. FFC research currently. Studies should be conducted into the accurate long term costs of municipal service delivery, which can vary substantially across municipalities in different service delivery contexts. LG Fiscal Framework Review (2) Disparity in Fiscal Capacity - GVA (2004) Classification Metros Secondary cities Rural municipalities Average GVA per capita 39,686 22,854 4,184 Average rates revenue per household 2,612 1,189 157 Revenue Assignment • • • • Ways should be explored to extend the general fuel level sharing approach across more municipalities beyond just the metros, exploring the viability of also utilising other bases such as transfer duties Implementation of a Local Business Tax should be expedited. Replacement of RSC levy replacement grant for district municipalities by a suitable revenueraising instrument Implementation of good practice municipal taxes and surcharges LG Fiscal Framework Review (3) Vertical Division of Revenue Division of nationally raised revenue, 2007/08 - 2013/14 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 Outcome Revised Medium-term estimates R million estimates Division of revenue between spheres National departments 242 580 289 236 345 366 359 120 380 154 408 439 439 049 Provinces 207 504 246 836 293 164 323 080 357 929 380 450 404 251 Local Government 38 482 45 487 51 537 61 152 70 171 77 029 82 317 Total 488 566 581 559 690 067 743 352 808 254 865 918 925 617 Percentage share National departments 49.7% 49.7% 50.0% 48.3% 47.0% 47.2% 47.4% Provinces 42.5% 42.4% 42.5% 43.5% 44.3% 43.9% 43.7% Local Government 7.9% 7.8% 7.5% 8.2% 8.7% 8.9% 8.9% • • There should be a systematic review of baselines to ensure that: – revenue allocations to local government as a whole are congruent with its full range of developmental and service delivery responsibilities – and the vertical share of local government meets the increasing demand for municipal services This should be coupled with efforts to build the capacity of weaker municipalities to spend efficiently and effectively LG Fiscal Framework Review (4) Local Government Equitable Share • Increase institutional capacity support to smaller and mainly rural municipalities • Activate the development component of the LGES formula should be reviewed • The Basic Services component needs to be expanded to include other services • Review the poverty line that is currently at R800 total monthly household income Infrastructure funding and borrowing • The extent of rehabilitation backlogs should be quantified. • Funding should be set aside for refurbishment and upgrade of existing infrastructure. • Own-revenue sources (e.g. Local Business Tax) is essential to allow borrowing Conditional Grants • There is no reporting on non-financial achievements and limited awareness of grants • SALGA concerned that review of grant baselines are not informed by proper research. The FFC has made various important recommendations to government in 2010. • Capacity development programs should be aligned to each stage of the developmental transition of municipalities – more effective use and to be more consultative LG Fiscal Framework Review (5) SALGA recommendations to the Budget Forum: • Supports the rapid implementation of a more comprehensive review of all the elements of the municipal fiscal framework over the medium term. • Brings speedily to closure a number of protracted national processes – – – – Policy review Electricity distribution restructuring (post EDI dissolution) Single public service Housing accreditation of municipalities and the funding of the new Land Transport Act • Appoints an independent commission to arrive at long term solutions, ensuring maximum stakeholder participation and transparency Understanding Municipal Debtors (1) • The objective of this submission to the Budget Forum was to present to the Minister of finance the complexity of municipal debt and proposals to address it • The submission covered the following: 1. Nature and extent of debt owed to municipalities What is the composition of the debt? Why has debt grown from approx R30bn to R56bn over 6 years? What portion of debt is realistically recoverable? 2. Proposals to address Challenges How to contain the growth in Debtors What can National Treasury and other stakeholders do 3. Concluding comments Issues to be agreed between SALGA & National Treasury for action Understanding Municipal Debtors (2) Composition of debt - Debtor’s by Income Source Revenue Source 2005 2010 R % R % Water Tariffs 7 658 506 26 15 634 639 28 Electricity Tariffs 3 378 774 12 7 956 664 14 Rates (Property Rates) 6 781 355 23 12 026 853 21 Sewerage / Sanitation Tariffs 1 344 497 5 3 957 851 7 Refuse Removal Tariffs 1 749 875 6 3 612 737 6 Housing (Rental Income) 986 365 3 1 096 094 2 RSC Levies 377 016 1 137 237 0 6 719 936 23 100 11 972 952 21 100 Other Total by Revenue Source 28 996 324 56 395 025 Understanding Municipal Debtors (3) Composition of Debt - Debtors Profile by Customer Type Debtors Profiles 2005 2010 R % R % 600 995 2 3 002 355 5 3 099 456 11 6 583 555 12 Households 12 517 870 45 31 688 354 56 Other 11 481 080 41 15 120 761 27 Total 27 699 402 100 56 395 025 100 Government Business Understanding Municipal Debtors (3) Nature and Extent of debt owed to municipalities • Focus on metros and secondary cities will address 75% of total debt and medium and small towns should also get some focused attention (proportionally) • Household and Other debt customer types require more focus • Water, Other and property rates are the income sources that require most focus • Insufficient detailed data and non-uniformity of data parameters leaves gaps in analysis of debt • Interest component is complex and unclear • Inconsistent reporting (some only report from 120 days or less) • Most municipalities (using IAS 36/39) recognise revenue for indigents and FBS – resulting in this increasing debtors provisions (non implementation of Grap 9) Understanding Municipal Debtors (5) Different accounting treatments for indigents (fbs) Debtors Provision Net debtors RXXXX -(RXX) RXXX Increases debtors’ balances outstanding as provision ignored Rates and services rendered on credit Only where there is an indigent consumer Not impaired – revenue and debtor recognised in full Impact on debtors – debtors’ high but provision for bad debts also high IAS 36/39: Recognise revenue/debtors at transactional value. Impair through a provision Don’t recognise the revenue as it is not probable that Municipality will receive revenue (GRAP 9) Impact on debtors – no debtor recognised Understanding Municipal Debtors (4) Government Property Rates Accounts Property Municipal Billing System Department of Public works Line Department National Provincial National Provincial Understanding Municipal Debtors (6) Why has debt grown from R30-R56bn over 6 years? 1. 100% collection rate not possible because services provided to the poor and other practicalities (eg. national policies of providing services to all, business liquidations). Debtors’ balances will grow annually as a result 2. Challenges to data integrity and incorrect billing remains a problems 3. Accounting treatment and reporting not uniform … treatment of equitable share – reported debt may be growing 4. Balance sheet impact of debt – manifests ito surpluses but not realisable as cash therefore contributing to cash flow crisis (paper surplus) 5. Insufficient and insignificant bad debt write-off 6. Interest on debt is growing – adding interest to irrecoverable balances merely increases the amount outstanding Understanding Municipal Debtors (7) Recommendations to Budget Forum 1. That the Budget Forum mandates NT to: a) Include revenue recognition in the Budget Reforms b) Use Net Debtors (instead of Gross) for reporting purposes because the financial effect is more realistic. (R56bn vs R33bn) c) Implement GRAP 9 (revenue recognition on services to the poor as well as raising interest) to ensure that revenue that will not be recovered is not recognized at all d) Encourage implementation of accounting standards on debtors’ impairments e) Provide guidelines to outline writing off irrecoverable debt 2. That the Budget Forum encourage support be given to municipalities for better debtors’ and customer profiling 3. That NT and Public Works establish a task team to simplify billing and payments for government-owned properties (government debt) and update asset registers. 2010 Budget Forum Local Business Tax • SALGA submitted a proposal to introduce a local business tax as a second general tax revenue source for local governments to the Budget Forum in October 2009. • Several Metro Councils in partnership with SALGA have initiated a project to prepare formal applications in terms of the Municipal Fiscal Powers & Functions Act (2007) (MFPFA) to introduce a local business tax for economic infrastructure and services. • SALGA presented work-in-progress on the application to the 2010 Budget Forum. • It is envisaged that a formal application will be submitted to the Minister of Finance later this year. 2011 DoRA Transfers to LG (1) • LG’s share of nationally raised revenue increased slightly to 8.7% from 8.2% in 2010/11. • Tight fiscus reduced growth in LGES to 8.3% p.a. over 2011 MTEF (9.3%, 2008 MTEF) − Concern as bulk prices and number of indigents have increased − However, smaller municipalities receive more for institutional capacity • Infrastructure transfers increase 9.7% p.a. over 2011 MTEF (8%, 2008 MTEF) - Higher growth in infrastructure transfers than LGES imply more pressure on repairs and maintenance - Faster growth mainly result of Urban Settlements Development Grant (Housing + MIG (Cities) allocations) - Other Concerns: Neighbourhood Development Grant reduction - poses challenges to some cities that have already planned certain projects; Electricity Demand-side Management Grant reaches final year in 2011/12 and SALGA will work together with DoE to motivate for extension An unallocated Municipal Disaster Grant is a new grant to make funding immediately available following disasters. It will be administered by the National Disaster Management Centre in CoGTA The Rural Transport and Infrastructure Grant has been increased to improve data collection on the condition of rural roads to inform better planning and delivery of projects 2011 DoRA Transfers to LG Other matters of interest SALGA are involved in other areas in municipal finance, including: • Accounting Standards – Assess cost and capacity for compliance (esp Grap 17) - lobby for differentiated accounting standards • Budget Weeks – SALGA workshops on financial management and sharing of good practices on revenue management and audit improvements • Councillor Training – develop targeted training for Mayors, MMC: Finance, MPACs and ordinary councillors. • Municipal Property Rates Act Amendment – Develop a position paper and engage the parliamentary processes • Budgeting and payment of audit fees – Municipalities urged to cost audit fees with approved audit plan and if amount exceeds 1% to expenditure apply to NT • Policy and Legislation review – – Credit control and debt management policies MFMA review – future focus Audit Outcomes 2008/09 (1) 2008/09 2007/2008 2006/2007 2005/2006 2004/2005 UNQUALIFIED 39% 33% 19% 18% 23% QUALIFIED 17% 19% 25% 22% 27% DISCLAIMER 29% 33% 39% 45% 41% 3% 4% 9% 9% 6% 13% 12% 8% 6% 4% 100% 100% 100% 100% 100% ADVERSE AUDIT NOT FINALISED • Overall improvement in audit outcomes, however: – Disclaimers and Adverse opinions have decline from 41% to 29% and 6% to 3% respectively. – While there is improvement there remain a high number of unqualified audits with matters of emphasis. – Audits outcomes however do not address: The adequacy of the funding of the municipal budget; The allocative efficiency of the municipality’s spending priorities; The quality of the municipality’s revenue management capabilities; The effectiveness of municipal spending; and The sustainability of the municipality’s capital budget and debt burden. Audit Outcomes 2008/09 (3) • SALGA will support further improvements in line with AG recommendations: – Encourage training of Councillors and senior municipal officials to establish adequate leadership and oversight; – Assist with establishment of effective governance arrangements through support of MPACs and DAFFs; – Continuous engagement with national stakeholders to make available appropriate financial resources, personnel and systems for municipalities to improve audit outcomes. FFC Research 2010 LG projects: • • • • • • Measuring the efficiency of local government expenditures: an FDH analysis of a sample of South African municipalities Estimating the factors that influence municipal expenditures Municipal consumer debt in South Africa Estimating the economic and fiscal costs of inappropriate land use patterns Climate change and environmental sustainability in urban areas Budget and spending performance of local government Possible 2011 projects: • • • • • • • Estimating municipal fiscal capacity Gender dynamics in local government Environmental sustainability in rural areas Exploring service delivery options and strategies for local government Deriving cost functions to inform subsidies in the LGES formula Assessing the human capital constraints in local government Developing indices to assess municipal budgets