Where is Your Organization?

advertisement

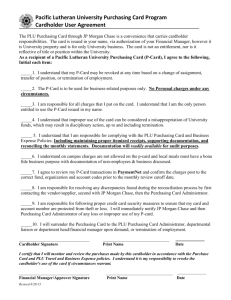

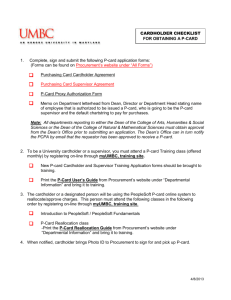

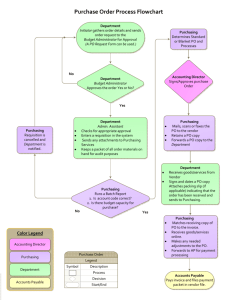

Purchasing Card Best Practices: Program Expansion & Controls Julie Krause, Vice President Commercial Cards Sales Manager M&T Bank May 12, 2010 Purchasing Cards – Where is Your Organization? Do you have a Purchasing Card program? – – – – Is it as successful as you’d like it to be? Have you re-evaluated your program recently? Do you have a plan for future growth of your program? Are you using controls & tools to protect your organization from fraud/misuse? Are you considering implementing a P-Card program? – Interested in improving your bottom line by reducing costs? – Interested in improving working capital? Are you just here for the great food and credits? 2 Why use Purchasing Cards? Not Important Source: Aberdeen Group survey of 297 enterprises between March and July 2007. 3 Extremely Important Why Use Purchasing Cards? Process and Transaction Cost Savings Many different stats are reported, but directionally they all point to lower processing costs for P-Card. Average cost of P-Card process is $22 per transaction (versus $89 for traditional PO process)1 Source: 4 P-Card processing costs 40% - 50% lower than paperbased checks2 1. RPMG Research, Purchasing Card Benchmarking Report, 2006. 2. Aberdeen Group, Impact of Payment Automation on Bottom Line Savings, 2009 Why Use Purchasing Cards? Process and Transaction Cost Savings Stick with it! Process savings from P-cards tends to grow over time 5 Source: Aberdeen Group “Global Commercial Payment Cards”, April 2007. Why Use Purchasing Cards? Enhanced Funds Availability P-Cards can improve your working capital Payment to Card Issuers is generally due monthly – opportunity to gain float by managing the timing of vendor payments Many organizations are relying on a strategy of extending Days Payable Outstanding (DPO) by using P-Cards to pay vendors with non-negotiated terms 6 Why Use Purchasing Cards? Revenue Sharing Opportunities For larger Purchasing Card programs, Issuers may be willing to “share” in their revenue (Interchange paid from the Merchants) in the form of a rebate Card Issuers want your P-Card program to be a success as it is mutually beneficial and may work with you to help you grow your card spend 7 Growing Your P-Card Program Review and Modify First Before you make a plan for growth, evaluate your current program: Did you meet your original objectives? If not, why? Are the key stake-holders (Purchasing, Accounts Payable, etc.) on-board with the program or do you need to revisit buy-in? Are the appropriate levels of controls in place? Benchmark your program against traits of “High Performing” programs 8 Best Practices: Traits of “High Performing” Programs Program has specific, measurable goals and objectives There is executive-level support for the program Program Administrator has the skills necessary for the position Policies and procedures are understandable, well-documented & updated regularly Training is performed regularly for all individuals involved “Agreements” are used with Cardholders & Program Administrators 9 Best Practices: Traits of “High Performing” Programs There is a separation of duties (Program Administrator & Audit) Program is not under-controlled or over-controlled A cross-functional team (purchasing, accounting, IT, etc.) is established to review program Program is reviewed frequently to uncover areas needing improvement and opportunities for growth Issues are resolved before program is expanded Very limited manual processes 10 Best Practices: Establishing Internal Card Controls Concern Employees will misuse Commercial cards •Purchasing card misuse accounts for a mere 0.025% of purchasing card spend, which is the equivalent of $250 for every $1,000,000 of purchasing card spend1 Facts •Corporate card misuse currently accounts for less than 0.01% of T&E spend or less than $100 for every $1,000,000 spent2 •Card programs can be data management tools that can assist in the detection of misuse 1 RPMG 2 RPMG 11 Research Group, 2007 Purchasing Card Benchmark Survey Report Research Group, 2006 Corporate Travel Card Benchmark Survey Results Best Practices: Establishing Internal Card Controls Prevent and Detect Fraud & Misuse Communicate “use” expectations to card holders Establish a healthy balance of MCC restrictions Establish an internal audit procedure • Audit representative samples • Audit transactions within 60-90 days • Review span of control – who generates audit reports and who reviews them • Communicate audit findings to card program participants to increases awareness of oversight Report any suspicious transactions to your issuer urgently 12 Lessons Learned: P-Card Implementation Top Challenges Source: Aberdeen Group, November 2008 13 Growing Your P-Card Program Conduct a Payables Transaction Review Step 1: Before you embark on a plan to grow your PCard program, determine your potential Analyze your current vendor database Identify current cardaccepting vendors Set realistic short-term and longterm vendor acceptance targets Develop a plan to solicit vendor acceptance ** Many Card Issuers will work with you on this process 14 Growing Your P-Card Program Gather Internal Support Step 2: Establish a P-Card team including appropriate stakeholders from across your organization •Senior Management •Accounts Payable •Finance •Purchasing •Internal Audit •Legal 15 All are crucial to the success of growing a successful P-Card program Growing Your P-Card Program Set Realistic and Informed Targets Step 3: Use the data from your vendor analysis and your own knowledge of your suppliers to set “electronic conversion” goals Use the knowledge that your Card Issuer and your own A/P and Purchasing departments have to categorize suppliers by their willingness to accept P-Cards from you: • Do you have negotiation leverage? • Do you already have very favorable terms? • Is the supplier looking for you to pay sooner? 16 Growing Your P-Card Program Train Your Staff to Grow Card Spend Step 4: Anticipate Supplier push-back and proactively educate your staff on the benefits of card acceptance Process Efficiency Reduce internal processing and transaction costs by eliminating paper-based processes such as creating invoices and processing checks Working Capital Management Payments are received sooner and more consistent than check payments Credit Risk and Loss Reduction Eliminate possible collection costs, credit risk, and losses related to nonpayment from check acceptance Customer Acquisition and Retention Provide a valued service and potentially gain increased business with existing customers and a competitive advantage with new customers 17 Growing Your P-Card Program Develop a P-Card Payment Policy Step 5: Continue to grow your program by building the acceptance of P-Cards into your payment terms whenever appropriate 18 One-off spend needs RFP’s New Vendors Vendor Consolidation “Preferred” supplier contract terms Growing Your P-Card Program Monitor Performance to Goals Step 6: Track P-Card Spend at regular intervals to monitor performance to original goals. Hold your team and your organization accountable to the goals they established Track and internally report conversion success monthly Identify and address any issues Communicate successes within the organization 19 Growing Your P-Card Program Looking Forward Keep open communications with your Card Issuer • Stay abreast of new technology developments • Work jointly to combat card fraud • Inquire as to how they can help you to grow your program and to automate your payables Benchmark your organization against Best Practices - always look to refine and improve your processes 20