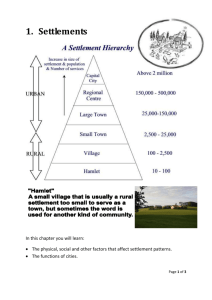

Real-time gross settlement system

advertisement

国际结算理论与实务 (Theories and Practices of International Settlements ) 主讲人:李颖 山东大学经济学院金融系 联系方式:grace.liying@163.com Reference books 《国际结算》第四版,苏宗祥,2009,中国 金融出版社; 《国际结算》,秦定,2010,清华大学出版 社; 《国际结算:理论·实务·案例》,蒋琴,2007,清 华大学出版社。 Exercises in class (20%) Examination Final tests In English(80%) International Settlement Chapter1: Introduction On Fundamentals In International Settlements Overview Chapter2: Banks’ Clearing System In international Settlements International Settlement Chapter3: Financial Instruments used in International Settlements Core part Chapter4: Mercantile documents used In International Settlements Chapter5: International Settlement Methods International Settlement Chapter6: L/G and Stand-by L/C extension Chapter7: Financing methods In International Settlements. Chapter8: Bank Letters in International Settlement Chapter 1 Introduction on Fundamentals in International Settlements Definition International payments or international settlements are financial activities conducted among different countries in which payments are effected or funds are transferred from one country to another in order to settle accounts, debts, etc., emerged in the course of political, economic or cultural contacts among them. spot payment—— payment between different cities—— international payment. International Settlement International trade: visible trade and invisible trade contents Financial transactions Payment between governments International Settlement Objectives safe quick convenient Characteristics of evolution: cash settlement to transfer settlement and transaction of documents; Banks became the center in the international settlement at the end of 18th century; From payments under simple price terms to payments under more complex price terms; Chapter 1 Introductions on Fundamentals in International Settlements computerization SFNB,1996, USA; Entrium Direct Bankers,1990,1998 International Settlement Mail: Letter, registered letter, express delivery letter Communication means Cable or Telex Network: SWIFT Chapter 1 Introductions on Fundamentals in International Settlements SWIFT: society for worldwide interbank financial telecommunications, a computerized international telecommunications system that, through standardized formatted messages, rapidly processes and transmits financial transactions and information among its members around the world. Chapter 1 Introductions on Fundamentals in International Settlements – Services provided by SWIFT: FIN (Financial Application) IFT (Interbank File Transfer) Procedures of message flow: – – – An appropriate SWIFT message type is selected, prepared, addressed and released by the sender to the SWIFT network via the bank’s SWIFT interface; The message is then sent to the sender’s local SWIFT Regional Processor; Chapter 1 Introductions on Fundamentals in International Settlements – – – The input Regional Processor forwards the SWIFT message to a Slice Processor; If the message is properly formatted, it is sent to the Receiver’s local SWIFT Regional Processor; The output Regional Processor then sends the message to the receiver. Chapter 1 Introductions on Fundamentals in International Settlements – Types of messages: 10 types Characteristics of SWIFT: Quick and cheap; Secure and reliable; Standardized forms. Signatures – – Credit instruments Mercantile documents Chapter 1 Introductions on Fundamentals in International Settlements Classification methods of settlement 基于商业信用的结算(Settlement on commercial credit)——汇款 (Remittance),对应着预付货款(payment in advance) 和赊销(open account,O/A) ;托收(Collection ) 基于银行信用的结算(Settlement on bank credit)——信用证(letter of credit, L/C ) ;银行保函( bank guarantee ) Chapter 1 Introductions on Fundamentals in International Settlements payment in advance: provides greatest security for the seller and greatest risk for the buyer; requires that the buyer have a high level of confidence in the ability and willingness of the seller to deliver the goods as ordered. open account, O/A,provides the least risk for the buyer and the greatest risk for the seller. Chapter 2 Banks’ Clearing System In International Settlements 1. Reasons for the establishment of banks’ clearing system objective reasons subjective reasons 2. components (1) global business web system branches correspondent bank: a bank having direct connection or friendly service relations with another bank. Chapter 2 Banks’ Clearing System In International Settlements Bank letter: a sample Agency agreements: a sample control documents: Ⅰ lists of specimen of authorized signatures: for authentication of the messages, letters, remittances, letters of credit, etc. Ⅱ telegraphic test keys: code arrangements that enable the banks to receive cables from other banks to verify the authenticity of cables or telexes. Ⅲ SWIFT authentic key: for authenticating messages transmitted through SWIFT; Ⅳ terms and conditions. Chapter 2 Banks’ Clearing System In International Settlements Services provided by correspondents: Collecting checks, drafts, and other credit instruments; Making loan or investments as agents for their customer banks; Making credit investigation of firms that borrow in the open market; Providing banks with foreign exchange facilities, including commercial and traveler’s checks; Providing banks with funds/loans in case of need. Chapter 2 Banks’ Clearing System In International Settlements (2) global foreign exchange transferring system nostro account: due from account, the foreign currency account of a major bank with the foreign banks abroad to facilitate international payments and settlements. Vostro account: due to account, the account held by a bank on behalf of a correspondent bank. Chapter 2 Banks’ Clearing System In International Settlements From the point of view of a Chinese bank, a nostro account is our bank’s account in the book of an overseas bank denominated in foreign currency; and a vostro account is an overseas bank’s account with our bank denominated in RMB. Chapter 2 Banks’ Clearing System In International Settlements Ⅰ funds transferring system in China Intra-city transfer between different banks; Intra-bank transfer between different cities; Inter-bank transfers between different cities. Ⅱ USD foreign exchange system: – FEDWIRE: a fund transfer system operated nationwide in the USA by the Federal Reserve System to transfer funds from one financial institution to another with an account balance held with the Fed. Chapter 2 Banks’ Clearing System In International Settlements Real-time gross settlement system: usually operated by central banks, in which each payment order is settled immediately upon its entry into the system in its entire (gross) amount. Chapter 2 Banks’ Clearing System In International Settlements Procedures of Fed Wire: A payer gives an instruction to a bank in which the payer has an available balance; The paying bank passes instructions on to the Fed to move value from the bank’s reserve balance account to the reserve balance account of another bank in which the payee has an account; Chapter 2 Banks’ Clearing System In International Settlements The Fed credits the reserve account of the payee’s bank and debits the reserve account of the payer’s bank. The Fed Wire provides a confirmation number to the payer so that the transaction can be traced; When a bank receives an incoming wire, the receiving firm is given notification that value has been received. Chapter 2 Banks’ Clearing System In International Settlements – CHIPS( Clearing House Interbank Payment System): a netting system operated by the New York Clearing House Association. A netting payment system: payment orders debiting the accounts of participants are collected for a certain time period, and then at the end of that time the net position is calculated and cleared for each participant on the basis of the payment orders sent and received. Chapter 2 Banks’ Clearing System In International Settlements Advantages of netting payment system: lower liquidity requirement that banks need in order to settle payments of a specific value (only the difference between the value of an individual bank’s incoming and outgoing payments is settled by transferring funds) ; netting systems are more efficient from the point of view of the communications and processing capacity employed. Chapter 2 Banks’ Clearing System In International Settlements Disadvantages of netting payment system: These systems expose participants to a settlement risk, as they are implicitly giving each other unsecured credit on the basis of payments that are not immediately settled in final terms. Components of CHIPS: Chips participation (CP) and chips universal identifier (CH) Chapter 2 Banks’ Clearing System In International Settlements Procedures of CHIPS (P299): member banks send instructions to CHIPS regarding transfers that they wish to make to other banks in New York City; At the end of the business day CHIPS reports to the Federal Reserve Bank of New York the net amounts to debit and credit at each of CP. Chapter 2 Banks’ Clearing System In International Settlements Euro foreign exchange system TARGET: Trans-Europe Automated Real-time Gross – Ⅲ Settlement Express Transfer System, a real-time gross settlement system for the Euro, which is composed of 15 national RTGS systems, the ECB payment mechanism and interlinking. National Real-time Gross Settlement, RTGS: Belgium (ELLIPS), Germany (ELS), Greece (HERMES), Spain (SLBE), France (TBF), Ireland (IRIS), Italy (BIREL), Luxembourg (LIPS), Netherlands (TOP), Austria (ARTIS), Portugal (SPGT), Finland (BOF); UK (CHAPS), Denmark (DEBES), Sweden (RIX). Chapter 2 Banks’ Clearing System In International Settlements – EPM ( European Central Bank Payment Mechanism) Purposes of TARGET: – to provide the payment procedures necessary for implementing the ECB’s single monetary policy; – to promote sound and efficient payment mechanisms in euro。 Chapter 2 Banks’ Clearing System In International Settlements – Foreign exchange accounts with domestic institutions Foreign exchange accounts for current account transactions (1) foreign exchange working capital of domestic entities in executing overseas construction and other services contracts; (2) foreign exchange overseas receipts and payments to be made by domestic entities on behalf of clients involved in overseas business; Chapter 2 Banks’ Clearing System In International Settlements (3) project funds of enterprises with exportimport license in business of export of jumbo electronic equipment with total project funds reaching a specified sum and duration, or advanced and progress payments for projects under international bid; (4) foreign exchange within an amount verified by SAFE that is received by international travel agencies and prepared by foreign travel agencies; Chapter 2 Banks’ Clearing System In International Settlements (5) foreign exchange of foreignfunded enterprises within a balance ceiling verified by SAFE; (6) foreign exchange expenses of foreign establishments remitted from abroad. Chapter 2 Banks’ Clearing System In International Settlements – foreign exchange account for capital account transactions (1) external borrowing by domestic entities and foreign exchange loans of domestic Chinese-funded financial institutions; (2) foreign exchange of domestic entities for repayment of principal of domestic and external foreign exchange liabilities; Chapter 2 Banks’ Clearing System In International Settlements (3) foreign exchange of domestic entities from stock issuance; (4) capital paid in foreign exchange by Chinese investors of foreign-funded enterprises; (5) foreign exchange remitted by overseas entities or individuals for establishing a foreign-funded enterprise. Chapter 2 Banks’ Clearing System In International Settlements – – The transactions on foreign exchange owned by individuals: (1) Foreign exchange owned by individuals can be held, deposited in banks or sold to the designated foreign exchange banks. (2) Foreign exchange for private trip abroad may be purchased up to an limit. Individuals must apply to SAFE for the purchase of foreign exchange exceeding the limit and present to the customs office valid documents for carrying foreign exchange exceeding a limit.