Banking Services

advertisement

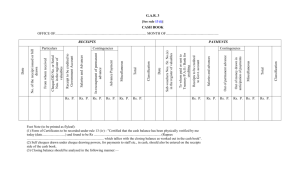

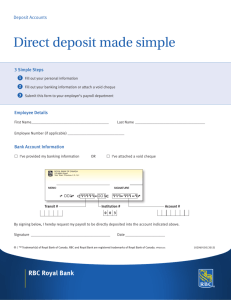

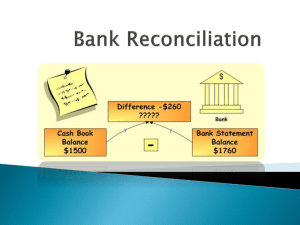

Life Transitions 1. 2. 3. 4. 5. 6. Opportunity Cost Errors Make the most of our money Plan for the future Financial Plan Build our credit rating Banking Basics Services Types of Accounts and Managing your Account Other ◦ ◦ ◦ ◦ Types of financial institutions Terminology Types of services, charges, and accounts How to open an account ◦ ◦ ◦ ◦ Ways of banking Deposit Services Cards Loans ◦ ◦ ◦ ◦ Chequing and Saving Interest Bank Statement maintaining such accounts ◦ Consumer Tips ◦ High Cost Financial Services Financial Institution ◦ Is an organization that provides banking or other financial services for customers. Banking ◦ Refers to the deposit, loan and similar services that these financial institutions offer. There are many types of financial institutions ◦ Banks, credit unions, caisses populaires and trust companies. Banks and trust companies are owned by investors, credit unions and caisees populaires are owned by their members. Account ◦ An arrangement with a financial institution to let you deposit, transfer and withdraw money, subject to terms that are defined in the account agreement. ◦ Two main types of accounts: savings and chequing Account Agreement ◦ An agreement that lists your rights and responsibilities and the financial instruction's rights and responsibilities regarding the account. Transaction ◦ Any business done through your account (deposit, cash withdrawal, cheque or bank charge) Direct deposit Automatic payments Automatic teller machines (ATMs) Point-of-sale transactions Store-value cards Internet/Cyberbanking ◦ Earnings or government payments automatically deposited into bank accounts. ◦ Utility companies, loan payments, and other businesses use an automatic payment system with bills paid through withdrawal from a bank account. ◦ Allow customers to obtain cash and conduct banking transactions. ◦ Acceptance of ATM/debit cards at retail stores and restaurants for payment of goods and services. ◦ Prepaid cards for telephone service, transit fares, store prepaid cards (starbucks, chapters, etc.) ◦ Online services – cyber branches allow customers to check balances, pay bills, transfer funds, compare savings plans and apply for loans on the internet. http://www.youtube.com/watch?v=txOt6gftB e4 Two pieces of ID. Some chequing accounts have a monthly fee of $4 or less. Rights: Responsibilities: ◦ When you open a deposit account, you have a right to see the complete account agreement, any interest paid and how it is calculated; any charges on the account, hold policy on cheques (how long they will hold it before they give you access), and what to do if you have a complaint. ◦ Any changes to account must be given in writing. ◦ Right to cash a cheque issued form the Govt of Canada for free at any bank. ◦ Read and understand the terms of your account agreement ◦ Check your account statement regularly and report anything ◦ Keep your accounts documents, passwords and PINS secure Main ones: ◦ ◦ ◦ ◦ Ways to do banking Deposit services Card services Loans How you bank In Person By Phone Internet/Mobile Device ATM Advantages Disadvantages When to use Deposit your money to keep it safe until you need it. Deposits in most financial institutions are guaranteed up to a certain amount ◦ Deposit Insurance - Canadian Banks are one of the best for regulations, in the bank fails, and unable to pay, your money to a certain amount is insured – double check Interest ◦ Savings – higher rates, may be charged for withdraws ◦ Chequing – low or no interest at all ◦ http://www.tdcanadatrust.com/document/PDF/accounts/td ct-accounts-int-calc.pdf Deposit a cheque – will hold onto the money for a few days, then transfer money and ensure it is there. Fees associated with accounts. You can use it in two main ways: You can make deposits, withdraw cash, pay bills, transfer money from one account to another and view your account at your financial institution's automated teller machine (or ATM, also called an automated banking machine or ABM). You can also use it to withdraw cash from another financial institution's ATM (fees $1 - $8). You can pay for purchases at a store or other merchant that offers debit card payment services. You can also ask the merchant to take out more than you need for the purchase and give you the extra cash back. When you use the merchant's card reader, the bank sends money from your account to the merchant's to pay for what you bought. PIN!!! ◦ Usually necessary, keep it confidential The Canadian Code of Practice for Consumer Debit Card Services is a voluntary code that outlines the responsibilities of consumers and the financial industry. It helps to protect you when you use debit card services in Canada. Under the code, it is your responsibility to use a secure personal identification number (PIN) and to keep it secure. ◦ ◦ ◦ ◦ Choose a PIN that is hard to guess. Don't tell it to anyone, and if you write it down, keep it separate from your debit card. Check your account statements frequently. If your card is lost, stolen or stuck in an ATM, or if there has been a transaction you did not authorize, immediately report it to your financial institution. For more information about keeping your PIN and debit card safe, see the Fraud Protection module. If you are a victim of debit card fraud, it is usually up to the financial institution to show that you are responsible for the charge, and not the other way around. Financial institutions will usually cover any losses if you have taken the appropriate steps to protect your card and your PIN. Mortgages: Lines of credit: Credit cards: ◦ Loans, usually for buying a home or property, in which the lender can take possession of the property if you default on your mortgage payments. Your property is a security or guarantee for the loan. Buying used cars – check the bank for a lien on the car you want to buy. ◦ An arrangement that lets you borrow money when you need it (up to a limit) and pay it back when you are able, provided that each month you pay a minimum amount established by the financial institution. Student line of credit is a good tool for post-secondary students. ◦ An arrangement under which a financial institution pays a seller for purchases you make, and you pay the institution back. You pay interest if you don't pay the entire amount on time. (This is different from a debit card: with a debit card, the financial institution takes money directly from your account to pay the seller. With a credit card, the financial institution uses its money to pay the seller, and you later pay it back.) When buying moveable forms of property, most people don’t check to see if there are any liens registered against it. Buying the item anyway means they may be purchasing the previous owner's legal obligations as well. If the old debt stays unpaid, a creditor or secured party may seize the property out from under you! Source: http://www.isc.ca/SPPR/Pages/SearchLiens.aspx To take out a loan from a financial institution, you fill out an application that lets the institution judge whether you are able to pay it back on time, based on criteria that it has defined. If it agrees to lend you money, you have to pay it back with added interest. Usually you have to make a payment every week, every two weeks or every month according to what your loan agreement specifies. Financial institutions in Canada offer a wide variety of deposit accounts. To match your needs to the services they offer, they need to know a bit about you and how you expect to use a banking account. For example, they need to know: Required balance; monthly fees, interest earned, cost of printing cheques, and charges for other fees and services if you are a member of a special group, such as students, youth or seniors (they may charge lower fees for some groups) the minimum balance you will have in the account each month (they may not charge regular fees if you keep a minimum amount in the account) the number of transactions you expect to do in a month (sometimes it's cheaper to pay for each transaction, sometimes it's better to pay a flat monthly fee) if you need any special services on a regular basis, such as: ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ certified cheques money orders and bank drafts stop payments travellers' cheques personalized cheques overdraft protection cheque returns safety deposit box access to bank machines that are not owned by your financial institution email money transfers. Financial institutions usually calculate the amount of interest to pay each month. Some calculate the amount daily and pay the amount into your account at the end of the month. Some calculate it on the lowest amount you had in the account over the month. If they calculate it daily, you'll save a little faster. Interest on Accounts – TD Canada Trust Cheques – What you need to know! ◦ How to write them. Even with online and card payments – there is still 1 billion cheques that get processed a year. Cheque – agreement b/w two people NSF –non-sufficient funds Post-dated cheques (cashed early/what is it) Cheque cashed by a different individual (countersigned cheques); endorsed cheques Stop Payment Fraudulent cheques Bank Reconciliation Source: http://www.cba.ca/en/consumer-information/40-banking-basics/584-cheques-what-you-need-to-know •Online or monthly statement that is mailed to you. •TD •Infinity Account $14.95 •Overdraft Fee $4 •Statement Fee $2 •Cheques •$39.95 for 100 Cheques (TD) •$20 for 100 at ASAP Cheques The difference between the two records on a given date may arise because of the following; ◦ ◦ ◦ ◦ Cheques drawn but not yet presented to the bank Cheques received but not yet deposited in the bank Interest credited and not recorded in the organization's books Bank charges debited but not recorded in the organization's books. Financial institutions help you manage your money with basic services, and they can also help you meet your financial goals with more advanced services. Most can offer you financial advice to help you save, and they can also help you invest your money. 1. 2. 3. For many people, the hardest part about saving is simply not spending money when they have it. When there is money in your account, it's tempting to spend it on things you want today—whether on small things like an afternoon coffee, or more expensive things like a new music player. When you transfer money out of your chequing account into your savings account, it's easier to keep it for long-term spending needs, like buying a home or paying for an education. Your financial institution can set up an automatic transfer so that you put money into your savings account or an investment account every month. Your savings will grow, and you won't have to choose between saving and spending. Watch how many transactions you make. Use the cheapest method of do your banking. Get only the records you really need. Watch your account balance. Ask for special fees based on your age. Pawn shops charge very high interest for loans based on the value of tangible assets (such as jewellery or other valuable items) Rent-to-own programs offer an opportunity to obtain home entertainment systems or appliances for a small weekly fee. However, the amount paid for the item usually far exceeds the cost if the item were bought on credit/cash. Cheque-cashing outlets charge high fees (2-3%) just to cash a paycheque or government cheque. ($1000 cheque, they could charge 3% fee ($30) plus a $3 service fee, for a total charge of $33 – EXPENSIVE) Rapid-refund tax services provide “instant refunds” when you pay to have your federal tax return prepared. However, this “instant refund” is a loan with interest rates as high as 120%. Banking Services ◦ Complete the bank services sheet ◦ Complete the chequing account sheet Chequing Account ◦ Keeping a running balance ◦ Reading a bank statement ◦ Reconciling an account Banking and Fraud Saving Credit and Debit Investing Income Tax Career Independent Living UNITS Tracking/Banking Action Plan Expense Christmas Project Budget Assignment Banking Assignment ASSIGNMENTS You can ask for lower fees. Contact your financial institution and discuss lowering or waiving some of your fees. ◦ Make sure your account is in good order. Be ready to say how many years you've been a good customer, what accounts you have at the institution and what charges you pay. ◦ Ask for something specific. Explain that you want a specific fee waived and why. ◦ The first person you talk to may not be able to help you. Ask to speak to a supervisor if necessary. ◦ Explain your position, but make sure your request is reasonable. Review your accounts with a representative once a year or if there is a major change in your finances. Ask the representative to suggest ways to reduce your fees. You may be able to get the institution to reduce some or all of your banking fees if you take out a mortgage or line of credit at the institution. Banking Selector Tool ◦ http://www.fcacacfc.gc.ca/eng/resources/toolCalculator/banking/banki ngPackage/BanStep1-eng.asp Cheque Activities ◦ http://www.enchantedlearning.com/economics/checks/ MODULE 27 Describe how to open a checking account, balance a checkbook, and apply for a loan. ◦ http://voc.ed.psu.edu/projects/caps/27CAPS.html