Savings and Banking

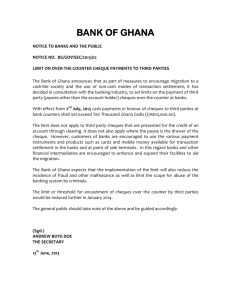

advertisement

Savings and Banking Life Transitions 30 Objectives: Explore reasons for saving and basic forms of savings available Calculate interest to compare saving outcomes Realistic savings targets Bank statements and bank services Identify theft, secure record keeping, and establish a personal recordkeeping system The City Story What is Sienna saving for? How did she manage to reach her savings target? How did Sienna’s savings grow? What did the characters need to know at the start of the story? What did they learn at the end? What do you want to know about saving money? Discussion: Reasons for saving, personal goals, family goals … Main reasons why people include savings in their budget. Why Save Money? To buy a big item or pay for a big bill that’s coming To have emergency funds To build funds to invest Options: Where do you put your money to save? Putting Your Money To Work When you save, your money can earn interest A savings account is a simple form of investment Lending money to the bank, safe, low risk, low interest, term deposit – bank keeps it longer, GIC – longer = higher interest Interest depends on time and risk Current interest rates? Funny Money: Building Long Term Wealth https://www.youtube.com/watch?v=23zghpS9034 Choices Save or spend? If I save it, what’s my best savings choice? When do I need it? Soon, or after a time? Can I put this money to work for me until them? Ways to Save 1. Reduce spending on “wants” Coffee, food, luxury items Pop $2.00 (3 a week $288) 2. Pay yourself first Save the first 10% of income after deductions 3. Put your savings to work 4. More Mutual Funds Stocks Bonds Investments – earn money in the form of interest Saving Account: a deposit account that’s secure but accessible and pays a small amount of interest Investments Guaranteed Investment Certificate (GIC) a deposit for a fixed period of time that pays a set (or sometimes variable) interest rate. Term deposits are very similar http://solvingthemoneypuzzle.com/2013/04/08/should-my-next-investment-bea-market-growth-gic/ Canada Savings Bond A loan to the Government of Canada at a guaranteed interest rate (that may change from year to year) Risk and Return Money earns income at different rates The one key factor in determining whether money earns a high income or a low income is the amount of risk. High risk vs Low risk Expected Return - is what you hope for. You could lose, to. Savings Add Up Simple Interest Is paid only on the initial deposit Compound Interest Is paid on the initial deposit and on any interest that has been earned, so your money grows more rapidly Interest compounding means that starting long-term savings while young creates a big advantage. Financial institutions pay different rates of interest so it’s a good idea to compare the rates that different financial institution will pay to get the most interest on your savings. Simple Interest $1000 at 5% simple interest earns $50 every year. Compound Interest $1000 at 5% compound interest earns $50 in the first year $50 in the second year (total $1100) $52.50 in the second year ($1102.50) $50 in the third year ($1150) $55.13 in the third year ($1157.63) $50 in the fourth year ($1200) $57.88 in the fourth year ($1215.51) Calculators Simple: http://www.moneychimp.com/features/simple_interest_calculator.htm Compound: http://www.moneychimp.com/calculator/compound_interest_calculator.htm http://www.bankofcanada.ca/rates/related/investment-calculator/ Journal Assignment: Pick a realistic amount of money you could invest as a principal amount. Then pick an amount of money you would be willing to invest on a monthly basis. How long would you like to keep this investment going? Do you want simple or compound? Lets go with 4% interest rate. Journal – print out Spender vs Saver https://www.youtube.com/watch?v=3pLp-NZfbso Practice – use an online calculator Joe Saver Knows the value of compound interest. 19 years old – invests $3000 each year, at 8% for 9 years. He manages this for nine years, then at age 28 he starts a family and spends all of his income supporting his family. He puts no additional money in for the next 37 years. How much does he have at 65? Jim Spender Likes to travel and party, so he spends all of his money for a while. Turns 28 and decides he had better start to save. He puts $3000 a year into the same long-term investment earning % annual compound interest. He continues to save $3000 a year for the next 37 years until he retires at ag65, and then checks to see what his savings amount to? Rule of 72 The Rule of 72 is an easy way to calculate approximately how long it takes for your savings to double at a compound interest rate. Divide 72 by the interest rate to find out the number of years it will take to double the amount saved. Divide 72 by the number of years of saving to find out the interest rate needed to double the amount saved. Ex: 72/5% = 14.4 years to double Ex: 72/10 – 7.2% interest needed to double Banking Services Life Transitions Why should we pay attention? 1. Opportunity Cost 2. Errors 3. Make the most of our money 4. Plan for the future 5. Financial Plan 6. Build our credit rating Video: Banking Tips Banking Basics Financial Institution Is an organization that provides banking or other financial services for customers. Banking Refers to the deposit, loan and similar services that these financial institutions offer. There are many types of financial institutions Banks, credit unions, caisses populaires and trust companies. Banks and trust companies are owned by investors, credit unions and caisees populaires are owned by their members. Tap and Go Concerns http://www.youtube.com/watch?v=txOt6gftBe4 How to open an account? Two pieces of ID. Some chequing accounts have a monthly fee of $4 or less. Rights: When you open a deposit account, you have a right to see the complete account agreement, any interest paid and how it is calculated; any charges on the account, hold policy on cheques (how long they will hold it before they give you access), and what to do if you have a complaint. Any changes to account must be given in writing. Right to cash a cheque issued form the Govt of Canada for free at any bank. Responsibilities: Read and understand the terms of your account agreement Check your account statement regularly and report anything Keep your accounts documents, passwords and PINS secure Ways of doing banking? Brainstorm Deposit your money to keep it safe until you need it. Deposit Services Deposits in most financial institutions are guaranteed up to a certain amount Deposit Insurance - Canadian Banks are one of the best for regulations, in the bank fails, and unable to pay, your money to a certain amount is insured – double check Interest Savings – higher rates, may be charged for withdraws Chequing – low or no interest at all http://www.tdcanadatrust.com/document/PDF/accounts/tdct-accountsint-calc.pdf Deposit a cheque – will hold onto the money for a few days, then transfer money and ensure it is there. Fees associated with accounts. When selecting a chequing account, consider… Financial institutions in Canada offer a wide variety of deposit accounts. To match your needs to the services they offer, they need to know a bit about you and how you expect to use a banking account. For example, they need to know: Required balance; monthly fees, interest earned, cost of printing cheques, and charges for other fees and services if you are a member of a special group, such as students, youth or seniors Accounts (they may charge lower fees for some groups) the minimum balance you will have in the account each month (they may not charge regular fees if you keep a minimum amount in the account) the number of transactions you expect to do in a month (sometimes it's cheaper to pay for each transaction, sometimes it's better to pay a flat monthly fee) if you need any special services on a regular basis, such as: certified cheques money orders and bank drafts stop payments travellers' cheques personalized cheques overdraft protection cheque returns safety deposit box access to bank machines that are not owned by your financial institution email money transfers. Chequing and Savings Interest Financial institutions usually calculate the amount of interest to pay each month. Some calculate the amount daily and pay the amount into your account at the end of the month. Some calculate it on the lowest amount you had in the account over the month. If they calculate it daily, you'll save a little faster. Interest on Accounts – TD Canada Trust Managing your Chequing Account Cheques – What you need to know! How to write them. Even with online and card payments – there is still 1 billion cheques that get processed a year. Cheque – agreement b/w two people NSF –non-sufficient funds Post-dated cheques (cashed early/what is it) • Cheque cashed by a different individual (counter-signed cheques); endorsed cheques • Stop Payment • Fraudulent cheques • Bank Reconciliation Source: http://www.cba.ca/en/consumer-information/40-banking-basics/584cheques-what-you-need-to-know Sample Cheque Cheque Book Register Bank Statement •Online or monthly statement that is mailed to you. •TD •Infinity Account $14.95 •Overdraft Fee $4 •Statement Fee $2 •Cheques •$39.95 for 100 Cheques (TD) •$20 for 100 at ASAP Cheques Bank Reconciliation The difference between the two records on a given date may arise because of the following; Cheques drawn but not yet presented to the bank Cheques received but not yet deposited in the bank Interest credited and not recorded in the organization's books Bank charges debited but not recorded in the organization's books. Assignments: Banking Services Complete the bank services sheet Complete the chequing account sheet Chequing Account Keeping a running balance Reading a bank statement Reconciling an account