Financial Market Know how

advertisement

Financial Market Know how

1

This session will help you understand

• The component and Structure of financial market.

• The working of the equity as an asset class.

• The working of the Fixed Income Securities.

• The working of mutual fund products.

• Economic Environment and indicators.

• How to recommend a investment portfolio.

2

Financial Markets

Organizations that facilitate the trade in financial products. i.e. Stock exchanges

facilitate the trade in stocks, bonds and warrants

3

Types of financial markets

The financial markets can be divided into different categories:

– Capital Market

• Stock markets, which provide financing through the issuance of

shares and enable the subsequent trading.

• Bond markets, which provide financing through the issuance of

Bonds, and enable the subsequent trading.

– Money markets, which provide short term debt financing and

investment.

– Derivatives markets, which provide instruments for the management of

financial risk.

– Foreign exchange markets, which facilitate the trading of foreign

exchange.

– Commodity markets, which facilitate the trading of commodities.

4

Capital Market

• The capital market is the market for securities, where companies and

governments can raise long-term funds.

• The capital market includes the stock market and the bond market.

• Financial regulators oversee the capital markets to ensure that investors

are protected against fraud.

• The capital markets consist of primary markets and secondary markets.

– Primary markets: Newly formed (issued) securities are bought or sold.

– Secondary markets allow investors to sell securities that they hold or

buy existing securities.

5

Primary Market

• It deals with the issuance of new securities. Companies, governments or

public sector institutions can obtain funding through the sale of a new stock

or bond issue.

• In the case of a new stock issue, this sale is an initial public offering (IPO).

• Features Of Primary Market are:

– Market for new long term capital.

– Securities are sold for the first time.

– Issued by the company directly to investors

• Methods of issuing securities in the Primary Market

– Initial Public Offer;

– Rights Issue (For existing Companies); and

– Preferential Issue.

6

Secondary Market

• It is the market for trading of securities that

have already been issued in an initial offering

• Once a newly issued stock is listed on a stock

exchange, investors and speculators can easily

trade on the exchange

• A stock exchange is an organization which

provides facilities for stock brokers and traders,

to trade company stocks and other securities.

7

Equity

8

Understanding Equity

Equity is the form of shares of common stock. As a unit

of ownership, common stock typically carries voting

rights that can be exercised in company decisions

9

Ordinary shares - Equities

• Part Owners of Company

– Voting

– receive annual report and accounts

– entitlement to residual assets in case of winding

up

• No Actual Ownership of Company Assets

10

Preference shares

• Fixed Dividend

• Priority for dividend

• Priority on liquidation of company

11

Terminology

12

EPS: Earning per Share

• Earning per share: PAT/ No of equity share

• PAT: Profit after tax of the company

It denote the how much the company has earned on per

share.

Particulars

ABC Co Ltd XYZ Co Ltd

No of shares

100

300

PAT( Last 4 quarters)

600

900

EPS

6

3

13

P/E Ratio

• Market price / number of shares outstanding

• P/E could be either trailing or forward,

depending on the type of earnings used in the

denominator.

Particulars

ABC Co Ltd

XYZ Co Ltd

Price

100

200

EPS (Earning per share)

5

20

P/E Computation

(100/5)

(200/20)

P/E Ratio

20

10

14

Dividend Yield

•

•

•

•

Dividend is declared on the face value of the share.

The market price and face value of the share differs

Divided yield: Dividend/ price

In case of a dividend paying company, there is a cut off

day – till the cut off day the price is CUM-dividend and

after that EX-dividend.

ABC Co Ltd

XYZ Co Ltd

Current Market price (Rs)

500

350

Dividend per share

20

5

Dividend yield

4

1.43

High D/Y paying

Company

Low D/Y paying

Company

15

Market capitalization

• It gives the idea as how big the company.

Price x No. of share

Where,

Price: Market price

No of share: No of fully diluted share

Example

Current Price

No of share (Cr)

Market Capitalization

Market cap

XYZ Co Ltd

ABC Co Ltd

200

230

10000

2000

200 x 10000

230 x 2000

2000000

460000

Large Cap

16

Small Cap

Index

• A broad-base index represents the performance

of a whole stock market — and by proxy, reflects

investor sentiment on the state of the economy.

– Meaning – represents the value of a set of stocks;

relative in value

– Importance

•

•

•

•

Barometer for market behavior

Benchmark portfolio performance

Underlying in derivative instruments like index futures

Passive fund management (index funds)

17

Index: Sensex

• Short form of the BSE-Sensitive Index

• Is a "Market Capitalization-Weighted" index of 30 stocks

representing a sample of large, well-established and

financially sound companies.

• Base period of SENSEX is 1978-79. Actual total market

value of the stocks in the Index during the base period is

equal to an indexed value of 100.

Calculation:

• Divide the total market capitalization of 30 companies in

the Index by the Index Divisor. The Divisor is the only link

to the original base period value of the SENSEX.

18

Types of equity research

• Fundamental analysis – Future earnings and

risk profile considered ( whether to buy or

not)

• Technical analysis – Study of historic data on

the company’s share price movements and

volume (To find timing)

19

Valuations

• Valuation - process of determining the fair value of a financial asset.

• Also referred to as ‘valuing’ or ‘pricing’.

• The fundamental principle of valuation - value is equal to present value of

expected cash flows.

• Valuations of financial assets involve the following three steps:

Step 1: Estimate the expected cash flows

Step 2: Determine the appropriate interest rate that should be used to

discount the cash flows.

Step 3: Calculate the present value of expected cash flows found in

Step 1, using the interest rate or interest rate determined in Step 2.

20

Equity Valuation

• The valuation of equity share is more difficult.

• The difficulties arise because of two factors

first the rate of dividend on equity share is not

known also the payment of equity dividend is

discretionary.

21

Valuation Process

• There are two general approaches to the valuation

process

– Top- Down (three step) Approach

– Bottom Up/ Stock Picking Approach

• Three step approach believe that the economy/ market

and the industry effect have a significant impact on the

total returns for the individual stock.

• The stock picking contend that it is possible to find

stocks that are undervalued relative to their market

price and these will provide superior returns regardless

of the market and industry outlook.

22

The Bulls

A bull market is when everything in the economy is great, people are finding

jobs, gross domestic product (GDP) is growing, and stocks are rising.

Picking stocks during a bull market is easier because everything is going up.

Bull markets cannot last forever though, and sometimes they can lead to

dangerous situations if stocks become overvalued.

If a person is optimistic and believes that stocks will go up, he or she is called

a "bull" and is said to have a "bullish outlook".

23

The Bears

A bear market is when the economy is bad, recession is looming and stock

prices are falling.

Bear markets make it tough for investors to pick profitable stocks.

One solution to this is to make money when stocks are falling using a

technique called short selling.

Another strategy is to wait on the sidelines until you feel that the bear market

is nearing its end, only starting to buy in anticipation of a bull market.

If a person is pessimistic, believing that stocks are going to drop, he or she is

called a "bear" and said to have a "bearish outlook".

24

Risk consideration

Investment Risk: It is the total risk of the

investment in stock which is measured by

Standard deviation. It can be separated into

systematic risk (non diversifiable risk) Plus

Unsystematic Risk (Diversifiable Risk)

A) Systematic Risk: It includes risks that affect the entire market e.g. market

risk, interest rate risk. Systematic risk cannot be eliminated through diversification

because it affects the entire market. Beta is a measure by which systematic risk is

determined.

B) Unsystematic risk: It is unique to a single business or industry, such as

operations and methods of financing. Unlike systematic risk, unsystematic risk can be

eliminated through diversification.

25

Beta

• Beta is a measure of the systematic risk of a

security that cannot be avoided through

diversification.

• Beta is a relative measure of risk-the risk of an

individual stock relative to the market portfolio of

all stocks.

• If the stock has a beta of 1, the implication is that

the stock moves exactly with the market.

• A beta of 1.2 is 20 percent riskier than the market

and 0.8 is 20 percent less risky than the market.

26

Return Computation

• Total return or Holding period return: The period

during which the investment is held by the investor is known as holding

period and the return generated on that investment is called as holding

period return during that period.

• Compounded Annual Growth Rate (CAGR): The

year-over-year growth rate of an investment over a specified period of

time.

27

CAGR Computation

• Suppose you invested Rs. 10,000 in a portfolio on Jan 1, 2005. Let's say by

Jan 1, 2006, your portfolio had grown to Rs. 13,000, then Rs. 14,000 by

2007, and finally ended up at Rs. 19,500 by 2008.

Your CAGR would be the ratio of your ending value to beginning value (Rs.

19,500 / Rs. 10,000 = 1.95) raised to the power of 1/3 (since 1/# of years =

1/3), then subtracting 1 from the resulting number:

1.95 raised to 1/3 power = 1.2493. (This could be written as 1.95^0.3333).

1.2493 - 1 = 0.2493

• Another way of writing 0.2493 is 24.93%.

Thus, your CAGR for your three-year investment is equal to 24.93%,

representing the smoothed annualized gain you earned over your

investment time horizon.

28

Risk Adjusted Return

• A higher return by itself is not necessarily

indicative of superior performance.

• Alternately, a lower return is not indicative of

inferior performance.

• There are composite equity portfolio measures

that combine risk and return to give quantifiable

risk-adjusted numbers.

• The most important and widely used measures of

performance are:

– The Sharpe Measure

– The Treynor Measure

29

The Treynor Measure

• Relative measure of the risk adjusted

performance of a portfolio based on the

market risk (i.e. the systematic risk).

• Treynor Index (Ti) = (Ri - Rf)/Bi.

• Where, Rp represents return on portfolio, Rf is

risk free rate of return and Bi is beta of the

portfolio.

30

The Sharpe Measure

• Relative measure of risk adjusted performance of a

portfolio based on total risk (systematic risk +

nonsystematic risk).

• Standard deviation is used as the measure for the total risk.

In comparing, bigger is better

Sharpe Index (SI) = (Rp - Rf)/SD

• Where, SD is standard deviation of the fund, Rp is the

portfolio rate of return and Rf is the risk free rate of return.

31

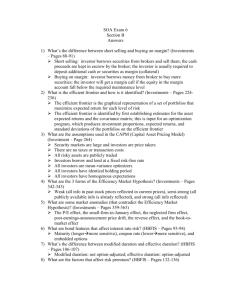

Long Term Investors Get Rewarded

PERFORMANCE OF BSE SENSITIVITY INDEX

#

YEAR END

SENSEX

Rolling 1

Yr Growth

Rolling 3

Rolling 5

Rolling 7

Yr Growth Yr Growth Yr Growth

High Risk

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

Mar-79

100

Mar-80

128.57

Mar-81

173.44

Mar-82

217.71

Mar-83

211.51

Mar-84

245.33

Mar-85

353.86

Mar-86

574.11

Mar-87

510.36

Mar-88

398.37

Mar-89

713.6

Mar-90

781.05

Mar-91

1167.97

Mar-92

4285

Mar-93

2280.52

Mar-94

3778.99

Mar-95

3260.96

Mar-96

3366.61

Mar-97

3360.89

Mar-98

3892.75

Mar-99

3739.96

Mar-00

5001.28

1-Mar

3604.38

2-Mar

3469

3-Mar

3049

4-Mar

5528

5-Mar

6492.82

6-Mar

11279.96

7-Mar

13072.1

8-Mar

15644.44

Probability of Loss

Investment Success

28.57%

34.90%

25.52%

-2.85%

15.99%

44.24%

62.24%

-11.10%

-21.94%

79.13%

9.45%

49.54%

266.88%

-46.78%

65.71%

-13.71%

3.24%

-0.17%

15.82%

-3.92%

33.73%

-27.93%

-3.76%

-12.11%

81.31%

85.14%

57.17%

15.89%

19.68%

29-Oct

66%

29.58%

18.05%

12.24%

17.56%

39.45%

27.66%

4.02%

7.51%

15.22%

43.12%

81.66%

42.88%

47.85%

-8.70%

13.85%

-3.83%

6.08%

3.57%

14.15%

-2.53%

-2.48%

-15.21%

15.32%

23.24%

54.66%

33.23%

34.06%

27-May

81%

Rolling 10

Yr Growth

Rolling 15

Yr Growth

Medium Risk

19.64%

22.43%

27.03%

18.57%

13.48%

23.79%

17.15%

15.25%

52.97%

41.73%

39.54%

33.07%

23.55%

-4.74%

11.28%

-0.21%

8.92%

1.37%

0.64%

-4.77%

8.13%

5.36%

25.63%

30.39%

38.69%

25-Mar

88%

28.33%

21.76%

12.60%

18.47%

20.50%

24.96%

42.76%

21.76%

33.08%

35.02%

24.79%

23.16%

18.75%

-1.92%

11.86%

-0.67%

0.89%

-1.41%

7.37%

10.34%

17.08%

14.71%

23.33%

23-Mar

87%

Rolling 20

Yr Growth

Safe

21.70%

19.76%

21.00%

34.68%

26.82%

31.43%

24.85%

19.33%

20.72%

25.59%

18.01%

20.39%

11.92%

-2.09%

2.95%

3.88%

2.64%

12.09%

14.19%

17.77%

20-Jan

95%

27.37%

24.04%

21.84%

20.00%

21.41%

19.90%

19.30%

13.02%

13.63%

14.53%

14.62%

15.16%

16.32%

7.72%

13.70%

0/15

100%

19.85%

20.09%

16.38%

14.85%

14.27%

16.85%

15.66%

16.06%

17.60%

20.14%

0/10

100%

32

Fixed Income Securities

33

Introduction to Bonds

A financial obligation to pay a specified sum of money at specified future

date- Fixed Income Investment

34

Basic Features

• Term to Maturity: The number of years the debt is outstanding.

• Par Value: The agreed repayment amount to the bondholder at or by

maturity date.

• Coupon Rate (Nominal Rate): The interest rate that the issuer agrees to

pay each year.

• Zero Coupon Bond: Bonds that are not contracted to make periodic

coupon payment.

35

Floating Rate Securities

• Coupon rate need not be fixed over the bond’s life.

• Floating rate securities - coupon payments reset periodically according to

some reference rate.

• Calculated as

– Coupon rate = reference rate x Quoted margin

• Quoted margin: additional amount that the issuer agrees to pay above the

reference rate.

Coupon rate = 1 month MIBOR +Quoted Basis point

36

Classification of Bonds

Market

Segment

Issuer

Instruments

Government

Securities

Central Government

Zero Coupon Bonds, Coupon Bearing Bonds, Treasury Bills,

STRIPS

State Governments

Coupon Bearing Bonds.

Government Agencies /

Statutory Bodies

Govt. Guaranteed Bonds, Debentures

Public Sector Units

PSU Bonds, Debentures, Commercial Paper

Public Sector

Bonds

Private Sector

Bonds

Corporate

Debentures, Bonds, Commercial Paper, Floating Rate

Bonds, Zero Coupon Bonds, Inter-Corporate Deposits

Banks

Certificates of Deposits, Debentures, Bonds

Financial Institutions

Certificates of Deposits, Bonds

37

Risk associated with Fixed Income Securities

• Interest rate risk: Inverse Relationship between Interest or Yield and bond

price.

• Following relationship will hold:

– Price of a bond = par if coupon rate = yield.

– Price of a bond can be < par (sell at discount) or > par (sell at a

premium) if the coupon rate is different from yield.

• Maturity Effect: All other factors constant, the longer maturity, greater the

price sensitivity to interest rates changes.

38

Risk associated with Fixed Income Securities

• Reinvestment risk: Risk of reinvestment of interest income or principal

repayments at lower rates in a declining rate environment.

• Credit risk: An investor who lends funds by purchasing a bond issue is

exposed to credit risk.

• There are two types of credit risk:

– Default Risk: Risk that the issuer will not meet the obligation of timely

payment of interest & principle.

– Downgrade Risk: Risk that one or more of the rating agencies will

reduce the credit rating of an issue or issuer.

39

What is a credit rating ?

•

•

•

•

•

Rating organizations evaluate credit worthiness of an issuer .

Evaluation on ability to pay back debt.

The rating is an alphanumeric code representing creditworthiness.

The highest credit rating - AAA & lowest - D (for default).

Short-term instruments* rating symbol - "P" (varies depending on the

rating agency).

• In India, we have 4 rating agencies:

CRISIL

ICRA

CARE

Fitch

*of less than one year

40

Credit Rating

• An important tool used to gauge the default risk of an issue - credit ratings

by rating companies.

Agency

Moody’s/ ICRA

S & Ps/ CRISIL

Description

Highest Quality

Aaa

AAA

Gilt edge, prime, Maximum

safety

High Quality

Aa

AA

High Grade, High Credit

quality

Upper Medium

A

A

Upper Medium Grade

Medium

Baa

BBB

Lower Medium Grade

Somewhat Speculative

Ba

BB

Low grade, Speculative

Speculative

B

B

Highly Speculative

Highly Speculative

Caa

CCC

Substantial risk, in poor

standing

Most Speculative

Ca

CC

May be in default, very

speculative

Imminent Default

C

C

Extremely speculative

Default

D

D

Default

41

Risk associated with Fixed Income Securities

• Inflation Risk/Purchasing power risk: Risk of decline in the real value of the

security due to inflation.

• Liquidity Risk: Liquidity risk is the risk that the investor will have to sell a

bond below its expected value.

42

Relationship between

parameters

• The relationship between coupon rate, yield, price and par value are as

follows:

– Coupon rate = Yield required by market, therefore price = par value

– Coupon rate < Yield required by market, therefore price < par value

(discount)

– Coupon rate > Yield required by market, therefore price > par value

(premium)

43

Yield Measures

• Investor should value bonds in terms of Yields and in not rupee terms.

• For fixed income instruments, returns can be from :

• Coupon interest payment

• Capital gain on sale or maturity

• Reinvestment of interim cash flow.

• Current Yield: relates coupon interest to bond’s market price.

• Same as dividend yield to stocks.

• Computed as follows

• Current yield= Annual coupon / market price

44

Yield to Maturity

• The Yield to maturity is interest rate that will make the present value of

the cash flow equal to price plus accrued interest. It is also known as IRR

of bond.

• It takes in to account all three sources of return.

• The most widely used bond yield figure as it indicates the fully

compounded rate of return promised to an investor who buys the bond at

prevailing prices, if two assumptions hold true.

• The first assumption is that the investor holds the bond to

maturity.

• Investors reinvest all the interim cash flows at the computed YTM

rate.

45

Debt Markets

• Capital Markets comprise of :

– Equities Market &

– Debt Markets.

• The Debt Market - where fixed income securities of various types and

features are issued and traded.

• Fixed income securities can be issued by:

– Central and State Governments,

– Public Bodies,

– Statutory corporations and corporate bodies.

46

Indian Debt Markets

• Indian Debt Markets - one of the largest in Asia today.

• Government Securities (G-Secs) market - the oldest & largest component

of Indian Debt Market in terms of capitalization, outstanding securities &

trading volumes.

• G-Secs- Benchmark for determining level of interest rates in the country

are the yields on government securities , referred to as the risk-free rate

of return.

• The Indian Debt Market structure was a wholesale market with

participation largely restricted to the Banks, Institutions and the Primary

Dealers.

• The Retail Debt Market in India has been created recently.

47

Segments in the secondary debt

market

• The segments in the secondary debt market based on the characteristics

of the investors and the structure of the market are:

– Wholesale Debt Market - investors are mostly Banks, Financial

Institutions, the RBI, Primary Dealers, Insurance companies, MFs,

Corporates and FIIs.

– Retail Debt Market involving participation by individual investors,

provident funds, pension funds, private trusts, NBFCs and other legal

entities in addition to the wholesale investor classes

48

Money Market Instruments

• Money markets - markets for debt instruments with maturity up to one

year.

• Money markets allow banks to manage their liquidity as well as provide

central bank a means to implement monetary policy.

• The most active part of the money market - call money market (i.e. market

for overnight and term money between banks and institutions) and the

market for repo transactions.

• The former is in the form of loans and the latter are sale and buyback

agreements - both are obviously not traded.

• The main traded instruments are Commercial Papers (CPs), Certificates of

Deposit (CDs) and Treasury Bills (T-Bills).

49

Commercial Paper

• A Commercial Paper is a short term unsecured promissory note issued by

the raiser of debt to the investor.

• In India; corporate & Financial Institutions (FIs) can issue these notes.

• Generally companies with very good ratings are active in the CP market,

though RBI permits a minimum credit rating of Crisil-P2.

• Tenure of CPs - anything between 15 days to one year, the most popular

duration being 90 days.

• Companies use CPs to save interest costs.

50

Certificates of Deposit

• Issued by banks in denominations of Rs.5 lakhs & have maturity ranging

from 30 days to 3 years.

• Banks are allowed to issue CDs with a maturity of less than one year

• Financial institutions are allowed to issue CDs with a maturity of at least

one year.

51

Treasury Bills (T-Bills)

• T- Bills: instruments issued by RBI at a discount to face value

• Form an integral part of the money market.

• In India treasury bills are issued in four different maturities—14 days, 90

days, 182 days and 364 days.

• Apart from these, certain other short-term instruments are also popular

with investors.

• These include short-term corporate debentures, bills of exchange and

promissory notes.

52

Mutual Fund

53

Introduction

• It is a pool of money, collected from investors, and is

invested according to certain investment objectives

• The ownership of the fund is thus joint or mutual, the fund

belongs to all investors.

• A mutual funds business is to invest the funds thus

collected, according to the wishes of the investors who

created the pool

• e.g. money market mutual fund seeks investors to invest

predominantly in Money Market Instruments

54

Important characteristics

• The ownership is in the hands of the investors

who have pooled in their funds.

• It is managed by a team of investment

professionals and other service providers.

• The pool of funds is invested in a portfolio of

marketable investments.

• The investors share is denominated by ‘units’

whose value is called as Net Asset Value (NAV)

which changes everyday.

• The investment portfolio is created according to

the stated investment objectives of the fund.

55

Advantages & Disadvantages

Advantage:

• Portfolio diversification

• Professional Management

• Reduction in Risk

• Reduction in Transaction costs

• Liquidity

• Convenience and Flexibility

• Safety – Well regulated by SEBI

Disadvantage:

• No control over the costs. Regulators limit the expenses of Mutual Funds. Fees

are paid as percentage of the value of investment.

• No tailor made portfolios.

• Managing a portfolio of funds. (Investor has to hold a portfolio for funds for

different objectives)

56

Type of mutual Fund: By Structure

Open Ended Fund:

Investors can buy and sell units of the fund, at NAV related prices, at any time,

directly from the fund.

Open ended scheme are offered for sale at a pre- specified price, say Rs. 10, in

the initial offer period. After a pre-specified period say 30 days, the fund is

declared open for further sales and repurchases

Investors receive account statements of their holdings,

The number of outstanding units goes up and down

The unit capital is not fixed but variable.

57

Type of mutual Fund: By Structure

Closed Ended fund:

• A closed -end fund is open for sale to investors for a

specified period, after which further sales are closed.

• Any further transactions happen in the secondary

market where closed-end funds are listed.

• The price at which the units are sold or redeemed

depends on the market prices, which are

fundamentally linked to the NAV.

58

Types of Funds - By Investment Objective

Equity

Debt

Equity Funds

Index Funds

Sector Funds

Fixed Income

Funds

GILT Funds

Money Market

Money Market

Mutual Funds

Balanced Funds

59

Gilt Funds

• Invests only in securities that are issued by the Government and therefore

do not carry any credit risk.

• Government papers are called as dated securities also.

• It invests in both long-term and short-term paper.

• Ideal for institutional investors who have to invest in Govt. Securities.

• Enables retail Participation

60

ELSS (Equity Linked Saving Scheme)

•

•

•

•

•

•

•

3 year lock in period

Minimum investment of 90% in equity markets at all times

So ELSS investment automatically leads to investment in equity shares.

Open or closed ended.

Eligible under Section 80 C

Dividends are tax free.

Benefit of Long term Capital gain taxation.

61

Fixed Term Plan Series

• FTPs are closed ended in nature.

• AMC issues a fixed number of units for each

series only once and closes the issue after an

initial offering period.

• Fixed Term plan are usually for shorter term – less

than a year.

• They are not listed on a stock exchange.

• FTP series are likely to be an Income scheme.

• Good alternate of Bank deposits/ corporate

deposits.

62

Money Market Mutual Fund

• Money funds provide investors with current income and are managed to

maintain a stable share price.

• Because of their stability, money funds are often used for cash reserves or

money that might be needed right away.

• Money funds typically invest in short-term, high-quality, fixed-income

securities, such as T-Bills, CDs and CPs

• Income from money funds is generally determined by short-term interest

rates.

63

How does a Mutual Fund work?

AMC

Savings

Investments

Trust

Units

Returns

Unit holders

Registrar

SEBI

Trust

Custodian

AMC

64

Loads

• Load is charged to investor when the investor buys or redeems units. It is

primarily used to meet the expenses related to sale and distribution of

units

• Load charged on sale of units is entry load. It increases the price above the

NAV for new investor.

• Load charged on redemption is exit load. It reduces price.

• Maximum Entry load or Exit load is 7%.( For Open ended Funds)

• Max. Entry or Exit load for closed ended funds is 5%

• CDSC is an exit load that varies with holding period.

• Load is an amount which is recovered from the investor.

65

Net Assets Value

• The net assets represent the market value of assets

which belong to the investors, on a given date.

• Net assets are calculated as:

Market value of investments

Plus(+) current assets and other assets

Plus(+) accrued income

Less(-) current liabilities and other liabilities

Less(-) accrued expenses

66

NAV Computation

• Unit capital of a MF scheme is Rs.20 million.

The market value of investments is Rs. 55

million. The number of units is 1 million. The

NAV is

– Rs. 20

– Rs. 75

– Rs.55

– Not possible to say

67

Fund Management

68

Active fund management

Fund manager tends to look at specific attributes in selecting stocks.

Active fund manager believes, that his ability to buy right stock at the right

time, can translate into superior performance for his portfolio.

What are the basic active equity fund management style?

Growth Investment style – Objective is capital appreciation, look for companies

that are expected to give above average earnings growth, The shares are more

risky and thus expected to offer higher returns over a long investment horizons.

Relatively higher P/E ratio and have lower dividend yield

Value Investment Style – Look for companies that are currently undervalued but

whose worth will be recognized eventually.

69

Passive fund management

• Fund manager believes, that holding a well diversified

portfolio is the cost efficient way ,to better returns, he

would tend to mimic the market index.

• It requires limited research and monitoring costs and is

therefore cheaper.

• Fund manager may choose to mimic a index, or a

subset of the index or choose a basket of shares from

multiple indices.

• A passive fund manager has to rebalance his portfolio

every time changes are made in the index.

70

Performance Measurement

• Returns comes form dividend or capital gains.

• Rate of Return =(Income Earned/Amount invested)x100

• Simple total return=

{NAV(end) – NAV ( begin)}+ Dividend paid x100

NAV at beginning

• Rule of 72 is a thumb rule used in finding doubling period.

If Rate = 12%, then money will double in 72/12 = 6 years.

• CAGR

• While comparing funds performance with peer group

funds, size and composition of the portfolios should be

comparable.

71

Investment Plans

• Broadly 2 options- Growth option and

Dividend Option

• Automatic Reinvestment Plans– Benefit of

Power of Compounding.

• Systematic Investment Plans – For regular

investment

• Systematic Withdrawal Plan – For regular

income ( it is not similar to MIP)

• Systematic Transfer Plan

72

Wealth cycle for investors

Stage

Accumulation stage

Transition Stage

Reaping Stage

Financial needs

Investment preferences

Investing for long term identifed

Growth options and long term

financial goals

products.High risk appetite

Near term needs for funds as

Liquid and medium term investments.

pre-specified needs draw closer

Lower risk appetite

Higher liquidity requirements

Liquid and medium term investments.

Preference for income and debt

products

Inter Generational

Long term investment of

inheritance

Ability to take risk and invest for the

long term

transfer

Sudden wealth surge

Low liquidity needs.

Medium to long term

Wealth preservation.

Preference for low risk products

73

Financial Planning Strategies

•

Power of Compounding

•

Buy and hold

•

Rupee cost averaging:

– A fixed amount is invested at regular intervals

– More units are bought when prices are low and fewer units are bought

when prices are high. Over a period of time, the average purchase price of

investor is lower than average NAV.

– Its disadvantage : Does not indicate when to sell or switch.

74

Economic Environment and Indicators

75

Importance of Economic and Business

Environment

• Significant implications on the investment

recommendation.

• Recommendations depend on a number of

assumptions about the future performance of the

economy.

• Financial advisors should always keep a track of

economic environment to make reasonable

assumptions.

• A thorough understanding of economic environment

helps in reviewing the existing financial situation.

76

Gross Domestic Product

• There are three ways to derive GDP:

– The sum of all expenditures,

– The sum of all incomes, and

– The sum of all value added by business

77

ECONOMIC FACTORS: GNP & GDP

This is the value of output of goods and services

produced by Indian companies, regardless of whether

the production is inside or outside the India

Gross National

Product (GNP)

The value of output of goods and services produced

in the country, regardless of whether businesses are

owned and operated by Indians or foreigners.

Gross Domestic

Product (GDP)

Gross National

Product (GNP)

=

Gross Domestic

Product (GDP)

-

profits on

foreign owned

businesses

+

profits on

Indian owned

businesses

outside India

78

GDP

GDP is the measure of total value of final goods and services produced in the

domestic economy each year. The following is often used

GDP=

C+I+G+

(X- M)

C = personal consumption spending on goods and services

I = Private sector fixed capital expenditure

G = Government expenditure

(X-M)= Net of export receipts (X) and import payments (M)

The relationship highlights actual rupee expenditure for goods and services produced

in the economy for measuring GDP.

This equation includes all key players involved in the economy – consumers /

households, business (private sector) and government.

For living standards to rise in India, GDP must grow at a faster rate than the

79

population. This way, there is greater quantity of goods and services per person.

Example

The following information is available for an economy.

Consumption (C) = Rs 3000

Private Investment (I) = Rs 500

Government Expenditure (G) = Rs 2000

Exports (E) = Rs 1000

Imports = Rs 1500

Calculate the GDP for the economy?

Answer:

GDP = 3000 + 500 + 2000 + (1000-1500)

= 5500 – 500

= 5000

80

Inflation

•

A situation of rising prices. Inflation refers to a persistent rise in prices. Simply put, it

is a situation of too much money and too few goods.

•

The most popular measure of inflation in India is change in the Whole Price Index

(WPI) over a period of time.

•

The WPI is an index measure of the wholesale prices of a selected basket of goods

and services in the economy. The WPI is expressed as a percentage with reference to

some base year, according to a formula

•

WPI= (aggregate price for current year/aggregate price for the base year)* 100

•

An alternative measure is consumer price Index, which is concerned with the

consumer market for goods and services.

81

Monetary Policy

• Monetary policy is the process by which the

central bank of a country controls the supply

of money, cost of money or rate of interest.

• The Reserve Bank of India (RBI) controls and

influences the economy by means of

monetary and credit policy.

82

Some Monetary Policy terms

•

Bank Rate

– Bank rate is the minimum rate at which the central bank provides loans to the

commercial banks. It is also called the discount rate.

– Usually, an increase in bank rate results in commercial banks increasing their

lending rates. Changes in bank rate affect credit creation by banks through

altering the cost of credit.

– Bank Rate is at 6.0 per cent.

•

Cash Reserve Ratio

– All commercial banks are required to keep a certain amount of its deposits in

cash with RBI. This percentage is called the cash reserve ratio.

– It is cash as a percentage of demand and time liabilities that bank maimtain

with RBI

– Cash reserve ratio (CRR) of scheduled banks increased to 8.25 per cent with

effect from the fortnight beginning May 24, 2008.

83

Some Monetary Policy terms

• Open Market Operations

– An important instrument of credit control, the Reserve Bank of India

purchases and sells securities in open market operations.

– In times of inflation, RBI sells securities to mop up the excess money in

the market. Similarly, to increase the supply of money, RBI purchases

securities.

• Statutory Liquidity Ratio

– Banks in India are required to maintain 25 per cent of their deposits in

government securities and certain approved securities.

– These are collectively known as SLR securities.

84